MoonPay

Founded Year

2018Stage

Series A - IV | AliveTotal Raised

$558MLast Raised

$1.5M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About MoonPay

MoonPay is a company providing a platform for buying, selling, and swapping cryptocurrencies. Its services include an interface for digital asset transactions, a wallet service, and support for viewing digital collectibles and NFTs. MoonPay serves individuals and businesses looking to engage with cryptocurrencies and Web3 technologies. It was founded in 2018 and is based in Dover, Delaware.

Loading...

ESPs containing MoonPay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

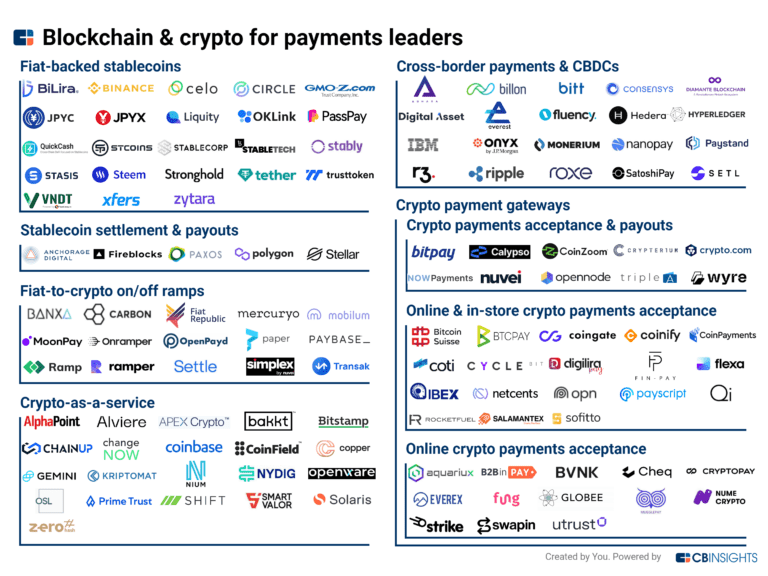

The fiat-to-crypto on/off ramps market aims to make it easier for people to buy and sell cryptocurrencies using fiat currency. This market allows users to seamlessly convert their traditional currency into digital assets, providing access to the world of cryptocurrencies. The market is driven by the increasing adoption of cryptocurrencies and the need for more efficient and user-friendly ways to a…

MoonPay named as Leader among 15 other companies, including Transak, Mercuryo.io, and Banxa.

Loading...

Research containing MoonPay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MoonPay in 7 CB Insights research briefs, most recently on May 31, 2023.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Mar 1, 2022 report

The Blockchain 50: The top blockchain companies of 2022Expert Collections containing MoonPay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MoonPay is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Blockchain

14,114 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

50 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest MoonPay News

Jan 20, 2025

Recent acquisitions by MoonPay, Chainalysis and Banking Circle point to potential acceleration in M&A activity as sector seeks strategic growth The fintech sector has entered 2025 with a flurry of strategic acquisitions, suggesting a shift towards consolidation as established players seek to enhance their technological capabilities and geographic reach. The announcement of three recent deals, including MoonPay's acquisition of Helio and Chainalysis 's purchase of Alterya. This comes after FinTech Magazine reported on Banking Circle's move to acquire Australian Settlements Limited (ASL) , highlighting how established players are leveraging M&A to accelerate market entry and capability expansion in new regions. Moonpay MoonPay's acquisition of Solana-based payment processor Helio demonstrates the growing appetite for specialised technology capabilities in the payments sector. The deal brings Helio's sophisticated ecosystem into MoonPay's portfolio, including integration capabilities with major platforms such as Discord, WooCommerce and Shopify through its widely-adopted Solana Pay plugin. With more than 6,000 merchants and US$1.5bn in transaction volume, Helio's developer API enables marketplaces and apps to create bespoke on-chain checkout flows with high transaction success rates. “This acquisition is an important step in advancing our vision for the future of payments,” says Ivan Soto-Wright, MoonPay's Co-founder and CEO. “With MoonPay and Helio combined, we now offer the most comprehensive product for on-chain payments.” AI and Compliance Shape Deal Flow Chainalysis Elsewhere, the Chainalysis acquisition of Alterya represents a strategic consolidation in the blockchain analytics space, combining Chainalysis's position as a pivotal player in blockchain data analysis with Alterya's sophisticated AI-driven fraud detection methods. “Joining forces with Chainalysis represents a pivotal step in our journey to revolutionise fraud detection and secure the digital economy” Alex Turner, Alterya's Co-founder and CEO Alterya has built its reputation working closely with prominent cryptocurrency exchanges and fintech firms, monitoring activities across both crypto and fiat platforms to protect end users from increasingly sophisticated financial scams. The deal addresses the growing challenge of sophisticated fraud tactics, particularly those leveraging generative AI to create authentic-seeming fake identities and content. Alterya's proven track record in reducing fraud instances by up to 60% for its clients highlights the potential impact of the acquisition on the broader financial ecosystem. The integration is expected to enhance Chainalysis's real-time fraud detection capabilities, crucial for the dynamic nature of cryptocurrency transactions. “Joining forces with Chainalysis represents a pivotal step in our journey to revolutionise fraud detection and secure the digital economy,” says Alex Turner, Alterya's Co-founder and CEO. Market Expansion and Funding Activity Fintech funding: Increased activity The surge in M&A activity comes against a backdrop of renewed funding activity in specific market segments. While sector funding remains below the peaks of 2021, the parallel rise in both strategic acquisitions and targeted investment rounds suggests a more measured approach to market growth. This is evidenced by Sygnum's US$58m strategic growth round achieving unicorn status, and LemFi securing US$53m to support its European expansion. The simultaneous increase in both M&A deals and strategic funding points to a maturing fintech sector where companies are pursuing multi-faceted growth strategies. While acquisitions like MoonPay's and Chainalysis's focus on enhancing technological capabilities, funding rounds are increasingly supporting specific growth initiatives, particularly geographic expansion and product development. This trend suggests a shift from the previous emphasis on rapid scaling to a more strategic approach combining organic growth with targeted acquisitions. Explore the latest edition of FinTech Magazine and be part of the conversation at our global conference series, FinTech LIVE . Discover all our upcoming events and secure your tickets today. FinTech Magazine is a BizClik brand

MoonPay Frequently Asked Questions (FAQ)

When was MoonPay founded?

MoonPay was founded in 2018.

Where is MoonPay's headquarters?

MoonPay's headquarters is located at 8 The Green, Dover.

What is MoonPay's latest funding round?

MoonPay's latest funding round is Series A - IV.

How much did MoonPay raise?

MoonPay raised a total of $558M.

Who are the investors of MoonPay?

Investors of MoonPay include K2 Global, Ashton Kutcher, Calvin Broadus Jr., Aubrey Drake Graham, Paris Hilton and 23 more.

Who are MoonPay's competitors?

Competitors of MoonPay include Banxa, Kima, Deblock, Depasifya, Transak and 7 more.

Loading...

Compare MoonPay to Competitors

Transak is a global web3 infrastructure services provider specializing in fiat-to-crypto payment gateway solutions. The company offers a developer integration toolkit that enables users to buy and sell cryptocurrencies using various payment methods while ensuring compliance with local regulations. It was founded in 2019 and is based in New York, New York.

Ramp focuses on providing Web3 financial infrastructure within the cryptocurrency sector. It offers non-custodial services that enable users to buy and sell cryptocurrencies, facilitating the exchange between fiat currency and digital assets. Ramp's infrastructure supports businesses by integrating crypto onboarding tools, ensuring compliance, and providing a seamless user experience for transactions. It was founded in 2018 and is based in London, United Kingdom.

Mercuryo.io is a fintech platform that provides financial services for the web3 and fintech sectors. The company offers services including fiat-to-crypto exchanges, cryptocurrency on-ramps and off-ramps, and custody services aimed at supporting transactions within the decentralized ecosystem. Mercuryo serves sectors that require integration of traditional finance with Web3 technologies, such as decentralized applications (dApps), custodial wallets, exchanges, NFT platforms, and neobanks. It was founded in 2018 and is based in Tallinn, Estonia.

TransFi develops a payment platform for the purchase of digital assets and nonfungible tokens (NFTs). The company's main service involves providing fiat-to-crypto ramps, allowing users to easily buy and sell cryptocurrency using their local currency and banking or e-wallet services. It was founded in 2022 and is based in Tampa, Florida.

Guardarian specializes in virtual currency services within the financial sector, offering a platform for fiat-to-crypto and crypto-to-fiat transactions. The company provides a suite of products including cryptocurrency onramp and off-ramp services, exchanges tailored for businesses, and integration solutions for partners through APIs and customizable widgets. Guardarian primarily serves businesses looking for B2B exchange and crypto payment solutions. It was founded in 2018 and is based in Tallinn, Estonia.

Onmeta allows to accept payment in any fiat currency and send the funds directly to the wallet. It offers a platform to provide payment solutions to apps to accelerate the adoption of blockchain technology. The company was founded in 2022 and is based in Bengaluru, India.

Loading...