MoneyView

Founded Year

2014Stage

Series E - II | AliveTotal Raised

$185.45MValuation

$0000Last Raised

$4.65M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+87 points in the past 30 days

About MoneyView

MoneyView is a digital lending platform that specializes in providing personalized financial products and services. The company offers instant personal loans without collateral, credit tracking services, and tools for managing personal finances. MoneyView caters to individuals seeking quick financial solutions with minimal documentation and flexible repayment options. It was founded in 2014 and is based in Bengaluru, India.

Loading...

MoneyView's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

MoneyView's Products & Differentiators

Money View Loans

An instant personal loan app that helps provide customised personal loans in just a few minutes. The App uses data & external factors like bureau/liabilities to provide the max loan amount, tenure & ROI- All this with a 100% online, easy application process. The customers can find their eligibility in less than 2 minutes & proceed with the application.

Loading...

Research containing MoneyView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

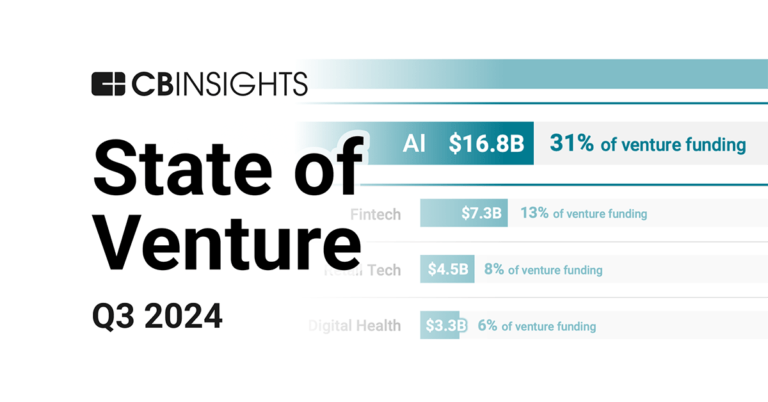

CB Insights Intelligence Analysts have mentioned MoneyView in 2 CB Insights research briefs, most recently on Oct 3, 2024.

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing MoneyView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MoneyView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest MoneyView News

Dec 12, 2024

Discover 6 innovative startups that achieved unicorn status in 2024, crossing the $1 billion valuation milestone with unique strategies. Thursday December 12, 2024 , 5 min Read In the fast-paced world of startups, achieving a $1 billion valuation is a coveted milestone, signifying not just financial success but also market impact and visionary leadership. These companies, often called "unicorns," represent the epitome of innovation and ambition in the business landscape. In 2024, a select group of startups broke through this barrier, showcasing their ability to disrupt industries, address pressing global challenges, and capture the imagination of investors and customers alike. From tech pioneers revolutionising how we live and work to sustainable enterprises reshaping industries with eco-friendly practices, the new unicorns of 2024 embody the diversity and dynamism of the entrepreneurial ecosystem. Each of these companies has a unique story to tell—stories of persistence, creativity, and strategic thinking that propelled them to this remarkable achievement. In this article, we’ll delve into the journeys of six standout startups that earned their unicorn stripes this year. We’ll explore what sets them apart, their key innovations, and how they’ve positioned themselves as leaders in their respective markets. Whether you’re an aspiring entrepreneur, an investor, or simply curious about the trends shaping the future, these stories are sure to inspire and inform. Indian startups that entered the unicorn club in 2024 The year 2024 has been a remarkable one for the Indian startup ecosystem, with six innovative companies crossing the coveted $1 billion valuation mark. From electric vehicles to AI, fintech, and ride-hailing, these startups represent a diverse range of industries. Let’s dive into their inspiring journeys and milestones. 1. Ather Energy Ather Energy , a Bengaluru-based electric two-wheeler manufacturer, became a unicorn in August 2024 after raising ₹600 crore ($71 million) from the National Investment and Infrastructure Fund (NIIF). This funding round valued the company at $1.3 billion. Founded in 2013 by Tarun Mehta and Swapnil Jain, Ather Energy has been a pioneer in India’s EV space. It not only manufactures electric scooters but also operates its charging infrastructure and engages in power storage and distribution services. The company has raised $630 million to date and counts InnoVen Capital and Stride Ventures among its investors. Eyeing a public listing at a valuation of $2 billion, Ather filed its draft red herring prospectus (DRHP) with SEBI in September 2024. However, the road to profitability remains challenging. In FY24, its revenue dipped slightly to ₹1,753.8 crore, while net losses widened by 22% to ₹1,059.7 crore. Despite these hurdles, Ather remains a formidable competitor to Ola Electric, TVS Motor, and Hero MotorCorp. 2. Krutrim In January 2024, Krutrim , founded by Bhavish Aggarwal, became India’s first AI unicorn. The startup raised $50 million in a funding round led by Z47, achieving a $1 billion valuation within a year of its founding. Krutrim specialises in developing large language models (LLMs) and is working on creating India’s first homegrown AI chips for general computing and Edge applications. The startup has raised $74 million so far, including $24 million in debt funding. Competing with global giants like OpenAI and Google, as well as domestic players like SarvamAI, Krutrim is a trailblazer in India’s burgeoning AI ecosystem. 3. Moneyview Lending tech startup Moneyview entered the unicorn club in September 2024, raising $4.6 million from Accel India and Nexus Ventures at a $1.2 billion valuation. Founded in 2014 by Puneet Agarwal and Sanjay Aggarwal, Moneyview offers personal loans, financial management solutions, and credit tracking services. The startup has raised $188.3 million to date from investors like Tiger Global and Ribbit Capital. Moneyview reported a 75% increase in operating revenue to ₹1,012.01 crore in FY24, with a modest 5.2% rise in net profit to ₹171.15 crore. Competing with Flexiloans and Fibe, the startup is carving a niche in India’s fintech landscape. 4. Perfios In March 2024, fintech SaaS company Perfios raised $80 million from Teachers’ Venture Growth (TVG), propelling its valuation beyond $1 billion. Founded in 2008 by VR Govindarajan and Debasish Chakraborty, Perfios offers data aggregation and analytics solutions for over 1,000 financial institutions across 18 countries. The startup turned profitable in FY23, reporting a net profit of ₹7.8 crore and tripling its operating revenue to ₹406.8 crore. It is now preparing for a $500 million IPO and exploring opportunities in the U.S. market. 5. Rapido Ride-hailing startup Rapido joined the unicorn club in July 2024 after raising $120 million from WestBridge Capital, achieving a valuation of over $1 billion. Founded in 2015 by Rishikesh SR, Pavan Guntupalli, and Aravind Sanka, Rapido operates in the bike taxi, auto transportation, and cab segments. The startup has raised $625.75 million to date and significantly reduced its losses, trimming net losses by over 45% in FY24. Competing with Ola, Uber, and BluSmart, Rapido continues to expand its market share with innovative services like peer-to-peer delivery via Rapido Local. 6. RateGain The only listed company to enter the unicorn club in 2024, RateGain provides SaaS solutions for the travel and hospitality industries. Founded in 2004 by Bhanu Chopra, RateGain serves over 3,200 customers across 100 countries. Its profitability and robust growth in tech stocks propelled RateGain’s valuation beyond $1 billion. The company’s operating revenue surged 18% to ₹277.2 crore in Q2 FY25, with a 74% rise in profit after tax to ₹52.2 crore. The Indian startup ecosystem continues to thrive, with these six companies setting benchmarks in their respective industries. From electric vehicles to AI and fintech, their stories are a testament to innovation, resilience, and ambition. As they chart their next phases of growth, these unicorns are inspiring the next generation of entrepreneurs. ADVERTISEMENT

MoneyView Frequently Asked Questions (FAQ)

When was MoneyView founded?

MoneyView was founded in 2014.

Where is MoneyView's headquarters?

MoneyView's headquarters is located at 3rd Floor, Survey No. 17, 1A, Outer Ring Road, Bengaluru.

What is MoneyView's latest funding round?

MoneyView's latest funding round is Series E - II.

How much did MoneyView raise?

MoneyView raised a total of $185.45M.

Who are the investors of MoneyView?

Investors of MoneyView include Accel, Nexus Ventures, Tiger Global Management, Evolvence India, Rockstone Ventures and 8 more.

Who are MoneyView's competitors?

Competitors of MoneyView include axio and 6 more.

What products does MoneyView offer?

MoneyView's products include Money View Loans and 2 more.

Loading...

Compare MoneyView to Competitors

Simpl is a checkout network that specializes in providing a seamless online commerce experience for shoppers and enterprises within the digital payments industry. The company offers consumer payment solutions such as 1-tap checkout, pay after delivery, and interest-free installment payments, designed to simplify and secure the online shopping process. Simpl primarily serves the e-commerce industry by enabling merchants to offer these payment options to their customers. Simpl was formerly known as Get Simpl. It was founded in 2015 and is based in Bengaluru, India.

BharatPe provides financial services. It offers merchant discount rate (MDR) services and allows merchants to sign up and start receiving the funds in their respective bank accounts. It serves offline retailers and businesses. The company was founded in 2018 and is based in Gurgaon, India.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

CreditNinja is a fintech company. The company operates in the financial services industry. The company primarily offers online personal loans, providing financial solutions for unexpected expenses, particularly for individuals with less-than-perfect credit. It provides loans that are quick to access, with an easy online application process and potential same-day funding. It was founded in 2018 and is based in Chicago, Illinois.

Haraka operates as a blockchain-based financial services provider specializing in decentralized lending. The company offers low-cost loans using social reputation as collateral, aiming to create a more accessible credit system. Its services are primarily utilized by micro-entrepreneurs and individuals in need of capital who lack traditional credit scores. The company was founded in 2024 and is based in Paris, France.

Tarya Holding Group is reshaping banking through its truly one of a kind and modular financial platform. Fusing technology, virtual bank operator (VBO) based business models and regulation, to add value throughout the customer's distribution chain, creating a ripple effect that generates growth cycles for the business itself, its customers and its partners. Through Tarya’s full-suite Financial Platform as a Service (F-PaaS) companies can leverage their data assets to provide end-to-end financial services otherwise traditionally outsourced.

Loading...