Investments

967Portfolio Exits

116Funds

16Partners & Customers

3About Mitsubishi UFJ Capital

Mitsubishi UFJ Capital or MUCAP is a venture capital firm within the Mitsubishi UFJ Financial Group. It is a commercial financial institution that specializes in healthcare, electronics, and high-technology investments. It supports companies in their pre-seed and pre-series A stages with growth capital investments, and aims to partner with the companies until initial public offering (IPO), mergers and acquisitions (M&A), and other exit strategies. It was founded in 1974 and is based in Tokyo, Japan.

Research containing Mitsubishi UFJ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mitsubishi UFJ Capital in 2 CB Insights research briefs, most recently on Jan 4, 2024.

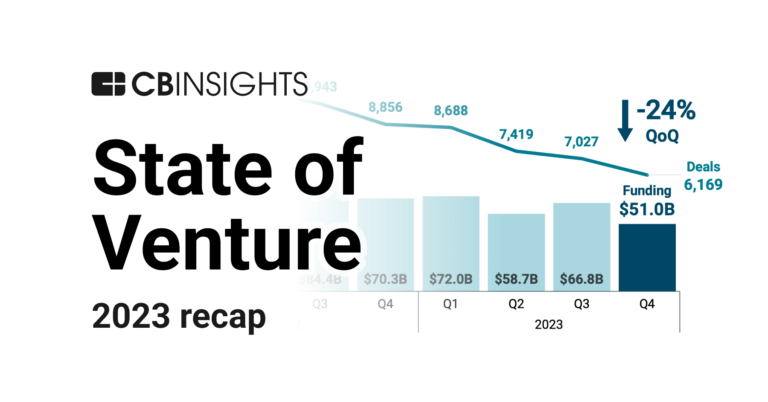

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest Mitsubishi UFJ Capital News

Jan 27, 2025

Image Credit : Power Diamond Systems Power Diamond Systems (PDS), which conducts research and development of next-generation power devices and high-frequency devices, announced on the 17th that it has raised approximately 100 million yen in a second close of its Series A round through third-party allocation of shares to a fund managed by Mitsubishi UFJ Capital. In the same round conducted last November, JIC Venture Growth Investments, Waseda University Ventures, QB Capital, and Mizuho Capital participated in the investment. As such, it is considered the most promising candidate for next-generation power semiconductors and high-frequency semiconductors following SiC, GaN, and gallium oxide (Ga2O3). Furthermore, they are also considering applications in harsh environments such as space, leveraging its radiation resistance and high-temperature operation capabilities. In terms of applications, power devices are expected to enable energy savings and miniaturization of existing systems in renewable energy fields such as solar and wind power generation, and next-generation mobility (electric aircraft, eVTOL, electric vessels) including electric vehicles. For high-frequency devices, applications are anticipated in 5G/6G mobile phone base stations, various radar systems, next-generation wireless power transfer, and next-generation satellite systems. The company’s technical distinction lies in its world-first development of vertical diamond MOSFETs. In addition to conventional lateral structures, they are developing vertical structures to achieve high current and high voltage resistance, better utilizing the physical characteristics of diamond semiconductors. They have also developed normally-off technology, a crucial requirement for power electronics applications. While diamond semiconductor devices using hydrogen-terminated structures are basically normally-on (transistor is on at 0V gate voltage), the company has established normally-off technology using silicon oxide termination structures to meet fail-safe requirements. The raised funds will be allocated to development investment in diamond semiconductor devices and modules, strengthening organizational structure, and building cooperation and partnership frameworks with domestic and international partners. The company was founded in August 2022 by Tatsuya Fujishima, who has extensive experience in power semiconductor development, based at the Waseda University Entrepreneurship Center, utilizing diamond semiconductor technology long led by Professor Kawarada of Waseda University.

Mitsubishi UFJ Capital Investments

967 Investments

Mitsubishi UFJ Capital has made 967 investments. Their latest investment was in Infobox as part of their Series A on January 21, 2025.

Mitsubishi UFJ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

1/21/2025 | Series A | Infobox | No | ANRI, Dentsu Ventures, GREE Ventures, Masato Morishima, X&KSK Fund, and XTech Ventures | 2 | |

1/17/2025 | Seed VC - IV | Power Diamond Systems | No | 2 | ||

12/24/2024 | Series A | MJOLNIR SPACEWORKS | Yes | 2 | ||

12/11/2024 | Seed VC | |||||

12/9/2024 | Series B |

Date | 1/21/2025 | 1/17/2025 | 12/24/2024 | 12/11/2024 | 12/9/2024 |

|---|---|---|---|---|---|

Round | Series A | Seed VC - IV | Series A | Seed VC | Series B |

Company | Infobox | Power Diamond Systems | MJOLNIR SPACEWORKS | ||

Amount | |||||

New? | No | No | Yes | ||

Co-Investors | ANRI, Dentsu Ventures, GREE Ventures, Masato Morishima, X&KSK Fund, and XTech Ventures | ||||

Sources | 2 | 2 | 2 |

Mitsubishi UFJ Capital Portfolio Exits

116 Portfolio Exits

Mitsubishi UFJ Capital has 116 portfolio exits. Their latest portfolio exit was AppBrew on November 14, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/14/2024 | Acquired | 2 | |||

11/12/2024 | Corporate Majority | 1 | |||

10/28/2024 | IPO | Public | 2 | ||

Date | 11/14/2024 | 11/12/2024 | 10/28/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Corporate Majority | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 2 | 1 | 2 |

Mitsubishi UFJ Capital Fund History

16 Fund Histories

Mitsubishi UFJ Capital has 16 funds, including Mitsubishi UFJ Life Science II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/20/2019 | Mitsubishi UFJ Life Science II | Multi-Stage Venture Capital | Closed | $91.32M | 1 |

2/20/2019 | Mitsubishi UFJ Capital VII | Multi-Stage Venture Capital | Closed | $136.98M | 1 |

2/20/2017 | Mitsubishi UFJ Capital VI | Multi-Stage Venture Capital | Closed | $88.37M | 1 |

2/20/2017 | Mitsubishi UFJ Life Science I | ||||

11/30/2015 | Mitsubishi UFJ Venture Fund II |

Closing Date | 2/20/2019 | 2/20/2019 | 2/20/2017 | 2/20/2017 | 11/30/2015 |

|---|---|---|---|---|---|

Fund | Mitsubishi UFJ Life Science II | Mitsubishi UFJ Capital VII | Mitsubishi UFJ Capital VI | Mitsubishi UFJ Life Science I | Mitsubishi UFJ Venture Fund II |

Fund Type | Multi-Stage Venture Capital | Multi-Stage Venture Capital | Multi-Stage Venture Capital | ||

Status | Closed | Closed | Closed | ||

Amount | $91.32M | $136.98M | $88.37M | ||

Sources | 1 | 1 | 1 |

Mitsubishi UFJ Capital Partners & Customers

3 Partners and customers

Mitsubishi UFJ Capital has 3 strategic partners and customers. Mitsubishi UFJ Capital recently partnered with Coinbase on August 8, 2021.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

8/19/2021 | Partner | United States | MUFG Partners With Coinbase To Allow 40 Million Customers To Buy Bitcoin In Japan Today , Coinbase announced that it is launching in Japan through a new partnership with one of the largest banks in the country , Mitsubishi UFJ Financial Group . | 1 | |

1/10/2019 | Partner | ||||

1/23/2015 | Vendor |

Date | 8/19/2021 | 1/10/2019 | 1/23/2015 |

|---|---|---|---|

Type | Partner | Partner | Vendor |

Business Partner | |||

Country | United States | ||

News Snippet | MUFG Partners With Coinbase To Allow 40 Million Customers To Buy Bitcoin In Japan Today , Coinbase announced that it is launching in Japan through a new partnership with one of the largest banks in the country , Mitsubishi UFJ Financial Group . | ||

Sources | 1 |

Mitsubishi UFJ Capital Team

10 Team Members

Mitsubishi UFJ Capital has 10 team members, including current President, Kei Andoh.

Name | Work History | Title | Status |

|---|---|---|---|

Kei Andoh | President | Current | |

Name | Kei Andoh | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | President | ||||

Status | Current |

Compare Mitsubishi UFJ Capital to Competitors

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

Inclusion Japan is a venture capital firm that invests in startups and provides consultancy services to large enterprises. The company collaborates with startups and offers consultancy to enterprises for business development. It was founded in 2011 and is based in Tokyo, Japan.

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

31VENTURES is the corporate venture capital arm ("Venture Co-creation Department") of Mitsui Fudosan, engaging in the seed stage to Series A investments. Its primary investment focus is real estate, IoT, security, energy and green tech, sharing economy, fin-tech, e-commerce, robotics, and life sciences. The company was founded in 2015 and is based in Tokyo, Japan.

Samurai Incubate operates as a venture capital firm. The company primarily invests in early-stage startups and provides growth support, including assistance with development plans, human resources, and fundraising strategies. It also offers incubation services for companies related to personal computers, mobile media, and software as a service (SaaS), as well as for executive, management, marketing, sales, and human resource departments. It was founded in 2008 and is based in Tokyo, Japan.

TSUCREA is a professional group focused on startup support and business incubation within the entrepreneurial ecosystem. The company offers mentorship to entrepreneurs, operates accelerator programs, and contributes to the creation of successful startups for a better future. TSUCREA collaborates with entrepreneurs to foster innovation in society and enhance the global 'startup quality' through shared growth experiences. It is based in Tokyo, Japan.

Loading...