Investments

409Portfolio Exits

43Funds

3Partners & Customers

4About M12

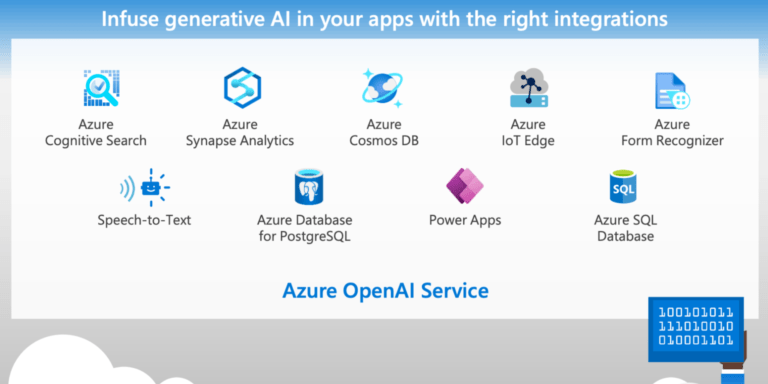

M12 is a corporate venture fund for Microsoft. The firm seeks to invest in companies operating in cloud infrastructure, artificial intelligence, cybersecurity, developer tools, vertical SaaS, web3, and gaming. M12 uses its deep expertise and extensive platform to help early-stage companies in those key thesis areas accelerate growth and build strategic partnerships. The firm was founded in 2016 and is based in Redmond, Washington.

Expert Collections containing M12

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find M12 in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing M12

Get data-driven expert analysis from the CB Insights Intelligence Unit.

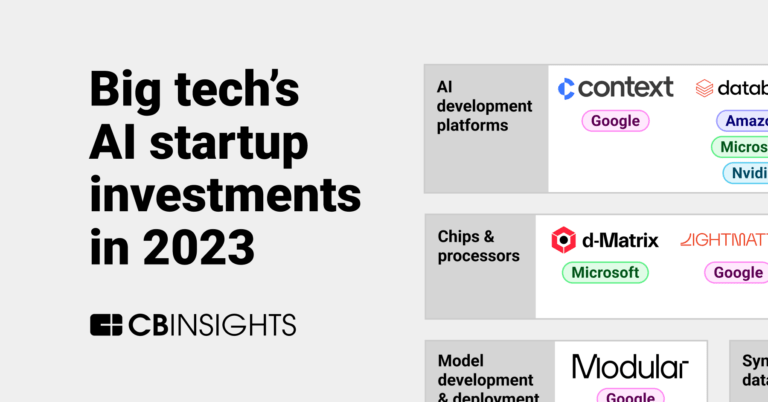

CB Insights Intelligence Analysts have mentioned M12 in 9 CB Insights research briefs, most recently on Jan 30, 2025.

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

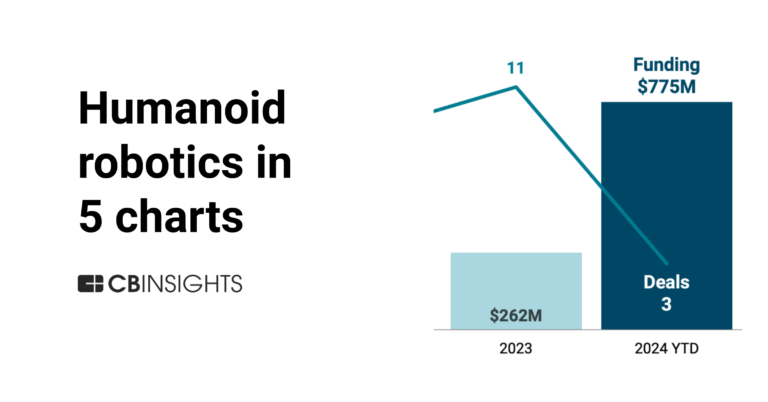

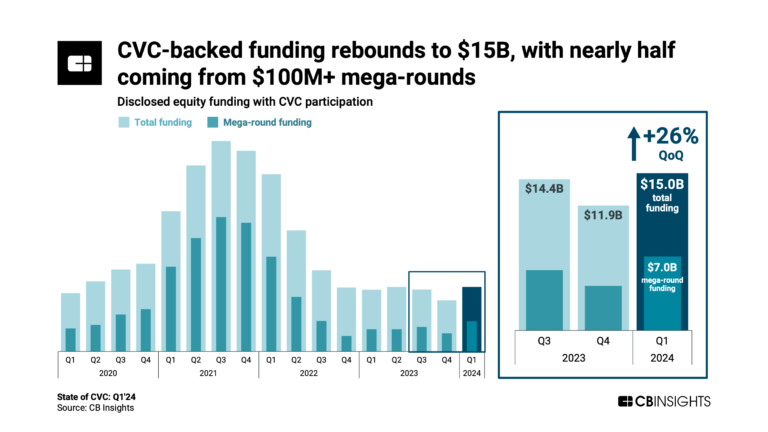

May 16, 2024 report

State of CVC Q1’24 Report

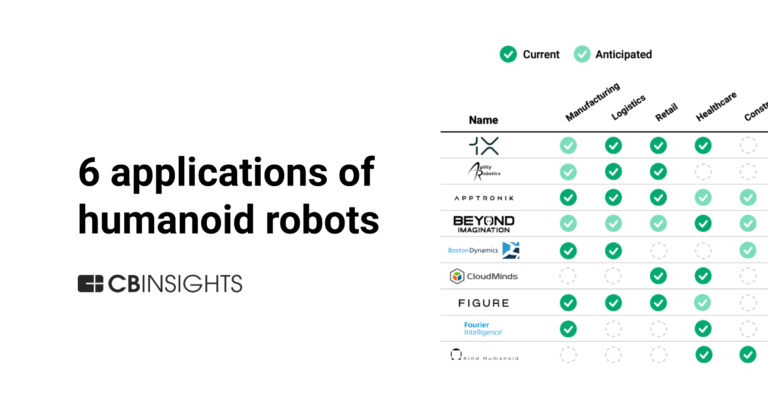

Mar 26, 2024

6 applications of humanoid robots across industries

Feb 5, 2024

6 cybersecurity markets gaining momentum in 2024

Latest M12 News

Feb 12, 2025

Feb 12, 2025 • Fernando Moncada Rivera The next step in AI is creating agents that can run multi-step tasks for us, from sales outreach to diary management. This is how investors at Microsoft's M12 are thinking about the opportunity. The next step in the generative AI goldrush is the creation of AI agents that can perform complex, multi-step tasks without human prompting — and corporate investors are rushing to invest in the startups creating these. Microsoft’s CVC unit, M12, has backed startups like Inworld, which is looking at agents in gaming, while DTCP – the venture unit backed by Deutsche Telekom – invested in Cognigny, a developer voice AI agent for customer service, to name a few. Corporate interest in these tools is high. Late last year, media and information conglomerate Thomson Reuters acquired Materia, a developer of agentic AI for tax and accounting purposes, which had been a portfolio company of its corporate VC unit, Thomson Reuters Ventures. Register for free to access our database showing all the recent startup funding rounds backed by corporate investors. AI agents are a natural extension of large language models, which have been getting bigger, with far more training parameters, larger context windows – the amount of information they can absorb in a prompt – and are becoming multi-modal, able to work across multiple types of media. The next step is programmes capable of handling complex, high-level tasks without human supervision, able to carry out multiple steps without additional prompting. AI agents in daily life Agents are not too different from having your computer running in the background, according to Michael Stewart, managing partner at M12, Microsoft’s CVC unit. “A very simplistic way to think about it is, if you view the work with a computer as giving it instructions during a certain active period of time, and the work continues, do you really need to be monitoring each step all the time?” he says. Work is already hot in the space, with some early startups generating revenue in the low tens of millions. But this is just the initial phase. The breadth of their use cases could be as wide as any other AI application. A classic example of an AI use case is in sales outreach. Unlike the typical robotic process automation we see today, which typically involves things like creating a hit list of prospects from an existing data set and sending off initial emails, an agentic system may source fresh prospects, issue follow-ups and back-and-forths with customers, bringing in a human only when necessary. The use parameters and their effectiveness would vary from company to company. They could be managed by account executives, and some companies are also playing around with operational dashboard to manage “fleets” of agents. “There’s a million little time savers you can think of, and none of these are really super hard to code, and they’re not super hard to imagine.” Michael Stewart, M12 As they evolve to more complex use cases – another classic one being that of booking travel – more considerations come into play. How much autonomy should these systems have? How empowered should they be? They can search for the best travel packs, but should they be allowed to execute the financial transaction to pay for them? These will require evolution in the legal framework – there is currently no standard by which AI systems can use financial credentials, and businesses are understandably careful about letting them have that kind of access because of security or compliance risks. Stewart says AI agents could easily take over a range of mundane tasks in people’s daily lives, from filing expenses to arranging meetings and reacting to changes in your calendar. “There’s a million little time savers you can think of, and none of these are really super hard to code, and they’re not super hard to imagine. This would be something that you would get used to very fast and quickly notice if it was gone,” he says. The user experience, the exact way that you would interact with them, are not altogether clear yet. Would it be an app on your phone? A device you wear? “I have a feeling this is just phase one. The next phase is really hard to see. How will people catch onto this? How will people start to notice it? That’s one of the things that’s really, really tough to judge until it’s happening.” End of the enterprise software business model? Many of the tasks an agent may be asked to do – generating content or analysing data of some kind – would not require constant uptime or dedicated servers, making the actual demand more sporadic. It doesn’t necessarily lend itself to the subscription-based revenues that make software-as-a-service popular. SaaS is good for revenue predictability, capital efficiency, initial customer lock-in and other reasons, but AI agents are something that will likely be used as and when needed. READ MORE

M12 Investments

409 Investments

M12 has made 409 investments. Their latest investment was in Arize as part of their Series C on February 20, 2025.

M12 Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/20/2025 | Series C | Arize | $70M | Yes | 2 | |

2/6/2025 | Series A | Edera | $15M | Yes | 5 | |

1/28/2025 | Series B | VEIR | $75M | Yes | Breakthrough Energy, Congruent Ventures, Dara Holdings, Engine Ventures, Fine Structure Ventures, Galvanize, Munich Re Ventures, National Grid Partners, Piva Capital, SiteGround, Tyche Partners, and VXI Capital | 2 |

1/24/2025 | Series A | |||||

1/9/2025 | Series F |

Date | 2/20/2025 | 2/6/2025 | 1/28/2025 | 1/24/2025 | 1/9/2025 |

|---|---|---|---|---|---|

Round | Series C | Series A | Series B | Series A | Series F |

Company | Arize | Edera | VEIR | ||

Amount | $70M | $15M | $75M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Breakthrough Energy, Congruent Ventures, Dara Holdings, Engine Ventures, Fine Structure Ventures, Galvanize, Munich Re Ventures, National Grid Partners, Piva Capital, SiteGround, Tyche Partners, and VXI Capital | ||||

Sources | 2 | 5 | 2 |

M12 Portfolio Exits

43 Portfolio Exits

M12 has 43 portfolio exits. Their latest portfolio exit was Oosto on January 20, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

1/20/2025 | Acquired | 4 | |||

11/13/2024 | Acquired | 3 | |||

11/13/2024 | Acquired | 4 | |||

Date | 1/20/2025 | 11/13/2024 | 11/13/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 | 3 | 4 |

M12 Fund History

3 Fund Histories

M12 has 3 funds, including Microsoft Ventures AI Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Microsoft Ventures AI Fund | 1 | ||||

M12 Europe Fund | |||||

GitHub Fund |

Closing Date | |||

|---|---|---|---|

Fund | Microsoft Ventures AI Fund | M12 Europe Fund | GitHub Fund |

Fund Type | |||

Status | |||

Amount | |||

Sources | 1 |

M12 Partners & Customers

4 Partners and customers

M12 has 4 strategic partners and customers. M12 recently partnered with Incentive on April 4, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

4/21/2015 | Vendor | United States | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | 1 | |

11/3/2013 | Partner | ||||

Partner | |||||

Partner |

Date | 4/21/2015 | 11/3/2013 | ||

|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner |

Business Partner | ||||

Country | United States | |||

News Snippet | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | |||

Sources | 1 |

M12 Team

16 Team Members

M12 has 16 team members, including current Chief Operating Officer, Oriona Spaulding.

Name | Work History | Title | Status |

|---|---|---|---|

Oriona Spaulding | Chief Operating Officer | Current | |

Name | Oriona Spaulding | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Operating Officer | ||||

Status | Current |

Loading...