Huma

Founded Year

2011Stage

Series D | AliveTotal Raised

$367.6MValuation

$0000Last Raised

$80M | 8 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+54 points in the past 30 days

About Huma

Huma is a healthcare AI company that provides digital health solutions for care and research. The company offers services including remote patient monitoring, hospital-at-home programs, virtual wards, and decentralized clinical trials. Huma's technology is used by hospitals and clinics globally and is integrated into clinical trials. Huma was formerly known as Medopad. It was founded in 2011 and is based in London, England.

Loading...

Huma's Product Videos

ESPs containing Huma

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

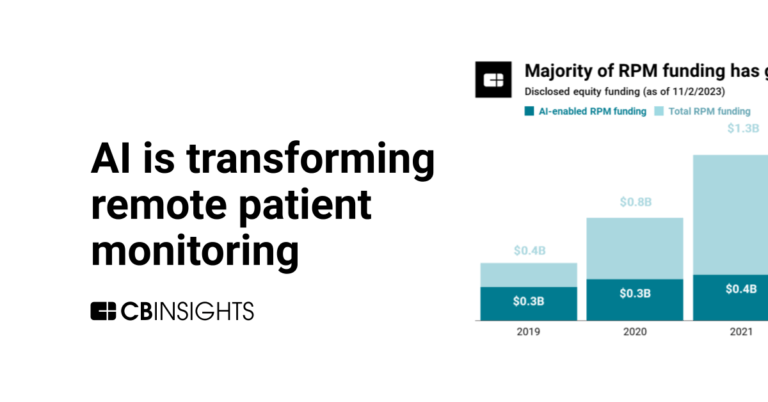

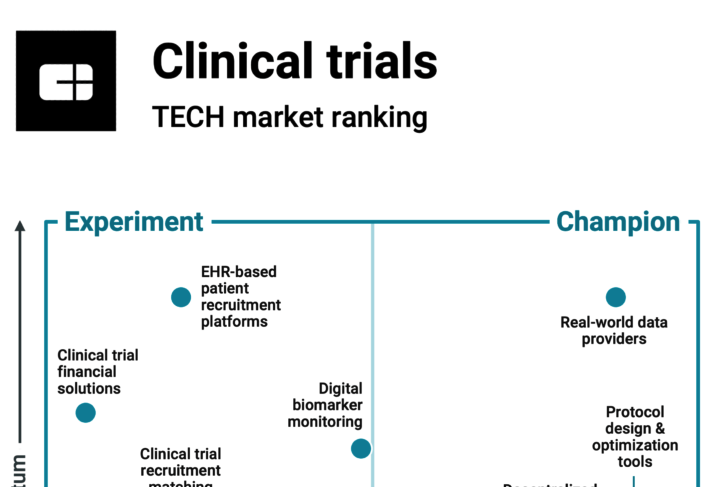

The digital biomarker monitoring market provides technology solutions that capture and analyze digital health data to assess and predict health outcomes. Utilizing devices and software that integrate into patients’ daily lives, these solutions monitor various physiological and behavioral indicators that serve as biomarkers for health conditions. This market includes mobile apps that track activity…

Huma named as Leader among 15 other companies, including Oura, Whoop, and AliveCor.

Huma's Products & Differentiators

Software as a Medical Device, Companion Apps

Huma’s enterprise-level regulated platform gathers real-world evidence, reduces readmission rates, and builds stronger, longer-term relationships with care providers and customers. Huma’s regulated, scalable platform enables the continuous collection of high-quality patient data across a wide range of therapeutic areas and care pathways, reducing readmissions. Support across 60 countries, our clinically-proven platform can effectively optimise global MedTech and Pharma deployments and extend data collection across diverse patient populations. Huma’s highly configurable platform offers the flexibility needed to demonstrate device efficacy and support regulatory submissions through near real-time data capture at both an individual and population level.

Loading...

Research containing Huma

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Huma in 13 CB Insights research briefs, most recently on Oct 17, 2024.

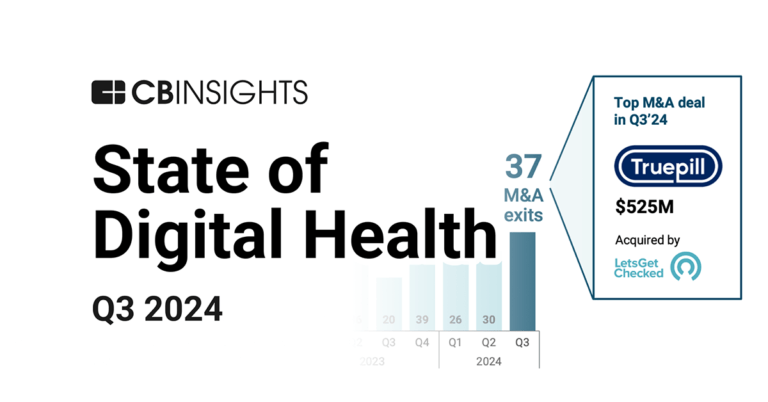

Oct 17, 2024 report

State of Digital Health Q3’24 Report

Aug 21, 2024

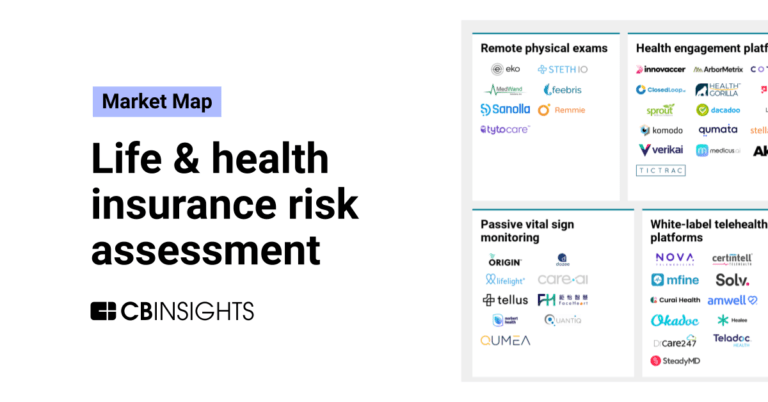

The clinical trials tech market map

Aug 15, 2023

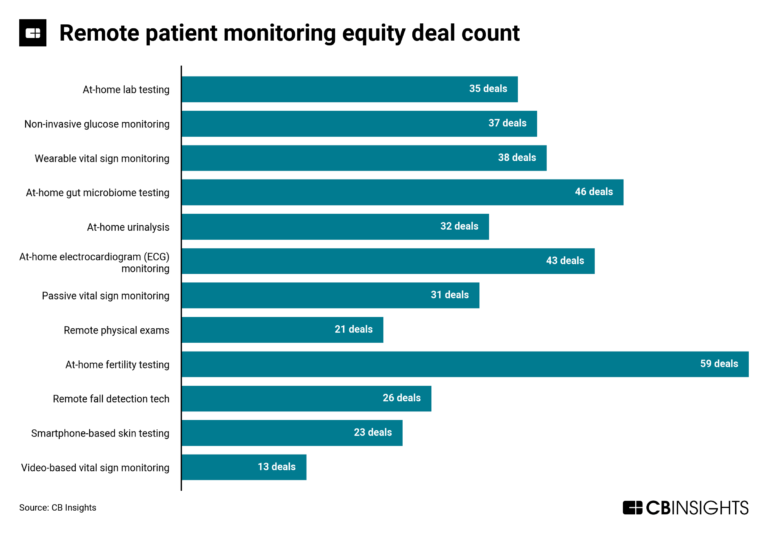

The remote patient monitoring market map

Aug 10, 2023

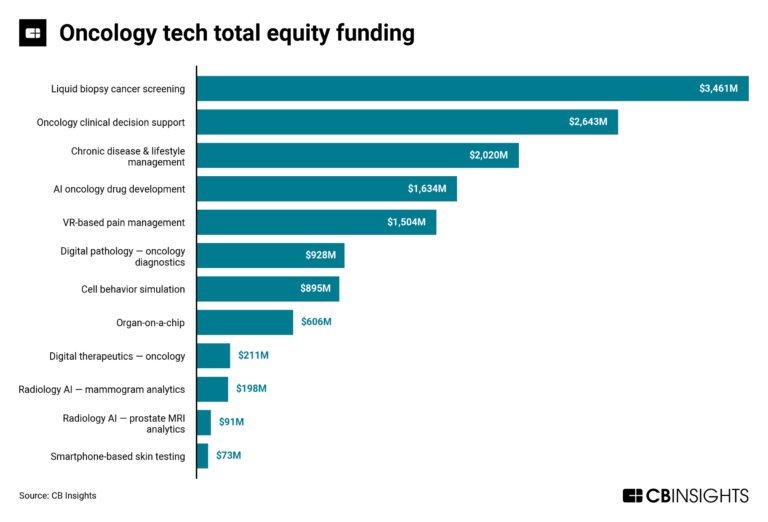

The oncology tech market mapExpert Collections containing Huma

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Huma is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

AI 100

100 items

Artificial Intelligence

9,504 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Value-Based Care & Population Health

1,068 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,328 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Huma Patents

Huma has filed 7 patents.

The 3 most popular patent topics include:

- smartwatches

- autosomal recessive disorders

- bodyweight exercise

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/6/2019 | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension | Application |

Application Date | 2/6/2019 |

|---|---|

Grant Date | |

Title | |

Related Topics | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension |

Status | Application |

Latest Huma News

Feb 14, 2025

Berg Insight says 14.7 million Europeans used connected care solutions in 2024 Date: The figure refers to users of telecare and telehealth solutions in the EU27+3 countries. Until 2028, Berg Insight forecasts that the number of connected care users will grow at a compound annual growth rate (CAGR) of 11.8 percent to reach 23.0 million. Telecare is the largest and most mature segment of the connected care market with a total of 9.7 million users at the end of 2024. The market for telehealth solutions is entering a growth phase with an estimated total of 6.6 million users in the EU 27+3 countries at the end of 2024. Berg Insight expects that telecare will be the largest segment of the connected care market throughout the forecast period reaching 13.1 million users in 2028. Telehealth will follow with 12.5 million users at the end of the forecast period. There is an overlap between the market segments as telecare users can also be equipped with telehealth systems. The telecare equipment market in Europe is highly consolidated. The three major players – Tunstall, Legrand and TeleAlarm – hold leading positions in nearly all markets and together account for about 60 percent of the telecare unit sales in the region. Additional vendors include Careium, Chiptech and Chubb. Chiptech has its operations in the UK market, meanwhile Careium is a leading market player in the Nordic region and has also presence in the UK. Companies such as Telecom Design, Essence Group, 9Solutions, Oysta Technology (Access Group) and Everon are also key telecare equipment vendors. Enovation, Skyresponse and Azur Soft are the leading providers of telecare monitoring software solutions. Additional significant vendors active in Europe are Tellu, Yorbl, Urmet, Navigil, SmartLife Care, Libify, SmartWatcher, Just Checking and Vivago. The telehealth market evolves quickly and many new start-ups as well as well-established solution providers from adjacent industries are active on the market. Examples include Huma, Luscii (Omron Healthcare), Dignio, Comarch, eDevice and SHL Telemedicine. The European connected care industry faces major changes that will reshape the competitive environment for solution vendors and service providers during the coming years. The ongoing digitalisation of telephone networks in Europe requires replacements of PSTN-based telecare systems. At the same time, the digitalisation enables new types of solutions that can advance the delivery of care to the next level. This includes next-generation telecare systems with new functions as well as integrated solutions that enable a combined delivery of telecare and telehealth services. “Care providers have started to offer proactive and predictive services where user data is continuously analysed so that caregivers can act quickly on any abnormalities. Such solutions rely on data not only from telecare devices, but also from other sources such as smart home sensors, healthcare records and connected medical devices”, said Vatsala Raina, IoT Analyst at Berg Insight. Another trend worth noting is that artificial intelligence (AI) is put into use in modern healthcare practices, driving improvements in clinical efficiency, patient engagement and care coordination. “AI-powered diagnostic tools are making a tangible impact on early detection and chronic disease management. Radiology departments use image-recognition software to identify early-stage tumours or signs of cardiovascular disease with high accuracy, allowing providers to initiate treatment sooner. In chronic disease management, AI-powered remote monitoring platforms can analyse trends in a patient’s heart rate, blood pressure or glucose levels. These systems send automated alerts to care teams, enabling timely interventions and potentially preventing hospital readmissions”, concluded Mrs. Raina.

Huma Frequently Asked Questions (FAQ)

When was Huma founded?

Huma was founded in 2011.

Where is Huma's headquarters?

Huma's headquarters is located at 21-24 Millbank, London.

What is Huma's latest funding round?

Huma's latest funding round is Series D.

How much did Huma raise?

Huma raised a total of $367.6M.

Who are the investors of Huma?

Investors of Huma include Leaps by Bayer, Hitachi Ventures, AstraZeneca, HAT, SBRI Healthcare and 17 more.

Who are Huma's competitors?

Competitors of Huma include Albert Health, Biofourmis, Aktivo Labs, Doccla, Feel Therapeutics and 7 more.

What products does Huma offer?

Huma's products include Software as a Medical Device, Companion Apps and 3 more.

Who are Huma's customers?

Customers of Huma include UCB, AstraZeneca, Bayer, Tamer and NHS.

Loading...

Compare Huma to Competitors

Doccla is a virtual hospital that specializes in the healthcare technology sector. The company offers remote patient monitoring services, utilizing medical IoT devices to monitor patients outside of traditional hospital settings, and integrates with electronic health records to streamline patient data management. Doccla primarily serves the healthcare industry, providing solutions to hospitals, clinics, and other medical institutions. It was founded in 2019 and is based in London, United Kingdom.

Evidation focuses on harnessing real-world health data to measure and improve health outcomes. The company offers a digital health measurement and engagement platform that utilizes data science and machine learning to provide health guidance, treatments, and tools. Evidation primarily serves life sciences companies, government bodies, and academic institutions. It was founded in 2012 and is based in San Mateo, California.

BrightInsight specializes in providing a digital health platform for the biopharmaceutical and medtech sectors. The company offers solutions such as disease management, Software as a Medical Device (SaMD), and data analytics services to enhance patient care and ensure regulatory compliance. BrightInsight primarily serves life sciences companies, offering them the technology to develop, launch, and scale digital health solutions. BrightInsight was formerly known as Flex Digital Health. It was founded in 2017 and is based in San Jose, California.

Validic is a technology company specializing in health IoT platforms and EHR-integrated solutions for personalized remote patient care. The company offers a comprehensive ecosystem of connected health devices and apps, alongside an EHR-embedded application designed to make personal health data meaningful and actionable for clinicians and patients. Validic primarily serves the healthcare industry, including health systems, providers, payers, wellness companies, pharmaceuticals, health IT companies, and manufacturers of apps and devices. Validic was formerly known as Motivation Science. It was founded in 2010 and is based in Durham, North Carolina.

PhysIQ specializes in remote patient monitoring and data analytics within the healthcare and life sciences sectors. The company offers a platform that leverages artificial intelligence and wearable biosensors to continuously monitor patients and provide personalized medical insights, aiming to improve patient outcomes and assist in clinical trials. PhysIQ primarily serves healthcare providers and life sciences companies, offering solutions for virtual care, hospital-at-home models, and decentralized clinical research. PhysIQ was formerly known as VGBio. It was founded in 2005 and is based in Chicago, Illinois.

ObvioHealth provides digital health solutions within the clinical trial industry. The company has a platform and mobile application allows for remote monitoring and participation in clinical trials, focusing on data collection and participant engagement. ObvioHealth's services are relevant to the healthcare sector, especially in trial management. It was founded in 2017 and is based in New York, New York.

Loading...