M1

Founded Year

2015Stage

Series E | AliveTotal Raised

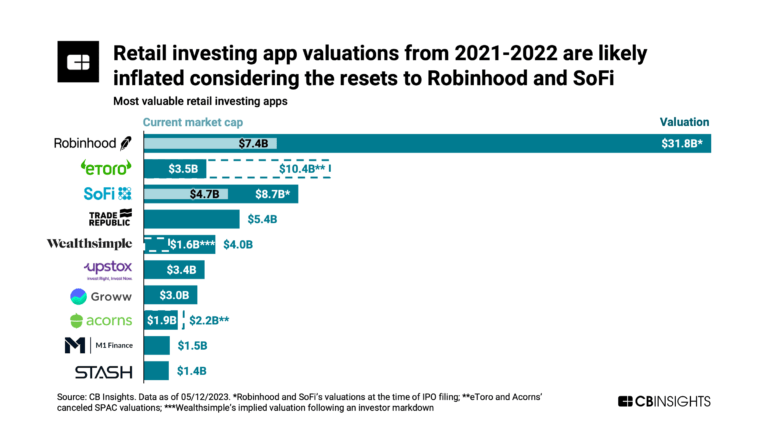

$328.17MValuation

$0000Last Raised

$150M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-58 points in the past 30 days

About M1

M1 is a fintech company that provides personal finance and wealth management services. The company offers a range of financial products, including cash accounts, investing platforms, brokerage services, and loan options. M1 serves individuals who are looking to manage and save for their personal finance needs. It was founded in 2015 and is based in Chicago, Illinois.

Loading...

M1's Product Videos

ESPs containing M1

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

M1 named as Challenger among 15 other companies, including SoFi, Monzo, and MoneyLion.

M1's Products & Differentiators

Individual Brokerage Account

An individual brokerage account is a type of investment account that allows individuals to buy and sell securities, through a brokerage firm, and manage their own investments.

Loading...

Research containing M1

Get data-driven expert analysis from the CB Insights Intelligence Unit.

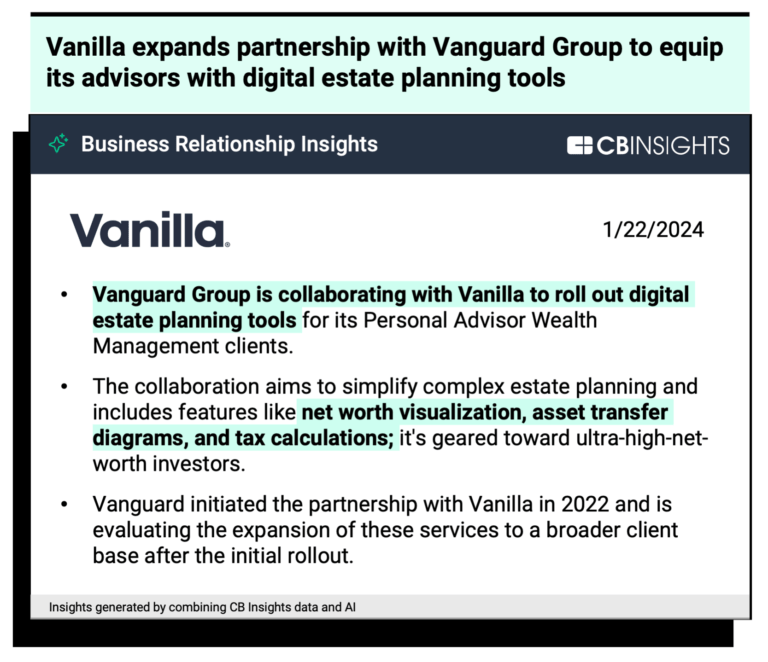

CB Insights Intelligence Analysts have mentioned M1 in 4 CB Insights research briefs, most recently on Aug 30, 2024.

Aug 30, 2024

The financial planning market map

Expert Collections containing M1

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

M1 is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Wealth Tech

2,335 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,059 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest M1 News

Jan 22, 2025

CoolGeek takes the classic CD player and turns it on its side. The player is mounted inside of a picture frame, and its circuitry and mechanism are visible while playing discs. It has both Bluetooth and 3.5mm audio outputs and runs on a rechargeable 18650 Lithium battery. Stand it up, hold it in your lap, or mount it on the wall. When you buy through links on our site, we may earn an affiliate commission . As an Amazon Associate I earn from qualifying purchases. Crowdfunded projects pose a degree of risk for buyers, so be sure to do your research before paying your hard-earned money. More Awesome Stuff

M1 Frequently Asked Questions (FAQ)

When was M1 founded?

M1 was founded in 2015.

Where is M1's headquarters?

M1's headquarters is located at 200 North LaSalle Street, Chicago.

What is M1's latest funding round?

M1's latest funding round is Series E.

How much did M1 raise?

M1 raised a total of $328.17M.

Who are the investors of M1?

Investors of M1 include SoftBank, Clocktower Technology Ventures, Left Lane, Coatue, Chicago Ventures and 4 more.

Who are M1's competitors?

Competitors of M1 include MoneyLion, Public, December., Monzo, Webull and 7 more.

What products does M1 offer?

M1's products include Individual Brokerage Account and 4 more.

Loading...

Compare M1 to Competitors

ONE serves as a financial technology company that provides banking services through a digital platform. The company offers services including debit rewards, credit score monitoring, credit building loans, and savings accounts. ONE serves individuals looking to manage finances. ONE was formerly known as Even. It was founded in 2022 and is based in New York, New York.

Varo is a digital bank that focuses on providing premium banking services through a mobile app. The company offers access to high-yield savings accounts, quicker access to funds, and automatic saving tools without the need for physical branches. Varo serves customers seeking convenient and modern banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Wizest is an advanced investing app designed to make stock market investing accessible to everyone, regardless of their experience level. The platform allows users to replicate the investment portfolios of financial experts with a simple click, providing a user-friendly interface for building and managing investments. Wizest primarily serves individuals looking to enter the stock market with guidance from seasoned investors. It was founded in 2019 and is based in Cleveland, Ohio.

Wealthfront is a financial services company that focuses on automated investing and wealth building for individuals. The company offers a range of services, including savings accounts, investment in US Treasury bonds, and diversified portfolio management using automated technology. Wealthfront's products are designed to cater to both seasoned and novice investors, aiming to simplify the investment process and maximize returns over the long term. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Betterment operates as a digital investment advisor that focuses on automated investing and savings services within the financial technology sector. The company offers a range of products, including automated portfolio management and tax-advantaged retirement accounts that aid personal finance management for individuals. Betterment provides diversified investment portfolios, tax loss harvesting, and financial planning tools to help clients achieve their financial goals. It was founded in 2008 and is based in New York, New York.

Chime is a financial technology company. The company offers banking services such as checking and savings accounts, credit building, and fee-free overdrafts, all aimed at making financial management easy and accessible for everyday people. Its primary customer base includes everyday Americans who are not well-served by traditional banks. The company was founded in 2012 and is based in San Francisco, California.

Loading...