KuCoin

Founded Year

2017Stage

Corporate Minority | AliveTotal Raised

$180MLast Raised

$10M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-21 points in the past 30 days

About KuCoin

KuCoin offers a global cryptocurrency exchange platform that offers a wide range of services in the digital asset industry. The company provides a platform for trading various cryptocurrencies, including spot and futures trading, as well as staking and lending services. KuCoin serves a diverse customer base, including retail and institutional investors in the cryptocurrency market. It was founded in 2017 and is based in Mahe, Seychelles.

Loading...

ESPs containing KuCoin

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The centralized crypto exchanges market refers to a segment of the cryptocurrency industry that involves trading digital assets through a centralized platform. These exchanges are owned and operated by a central authority, which manages the exchange's infrastructure, order book, and user funds. Centralized exchanges typically charge fees for trading, deposits, and withdrawals, and require users to…

KuCoin named as Leader among 15 other companies, including Coinbase, Binance, and HTX.

Loading...

Research containing KuCoin

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned KuCoin in 7 CB Insights research briefs, most recently on Oct 20, 2022.

Oct 20, 2022

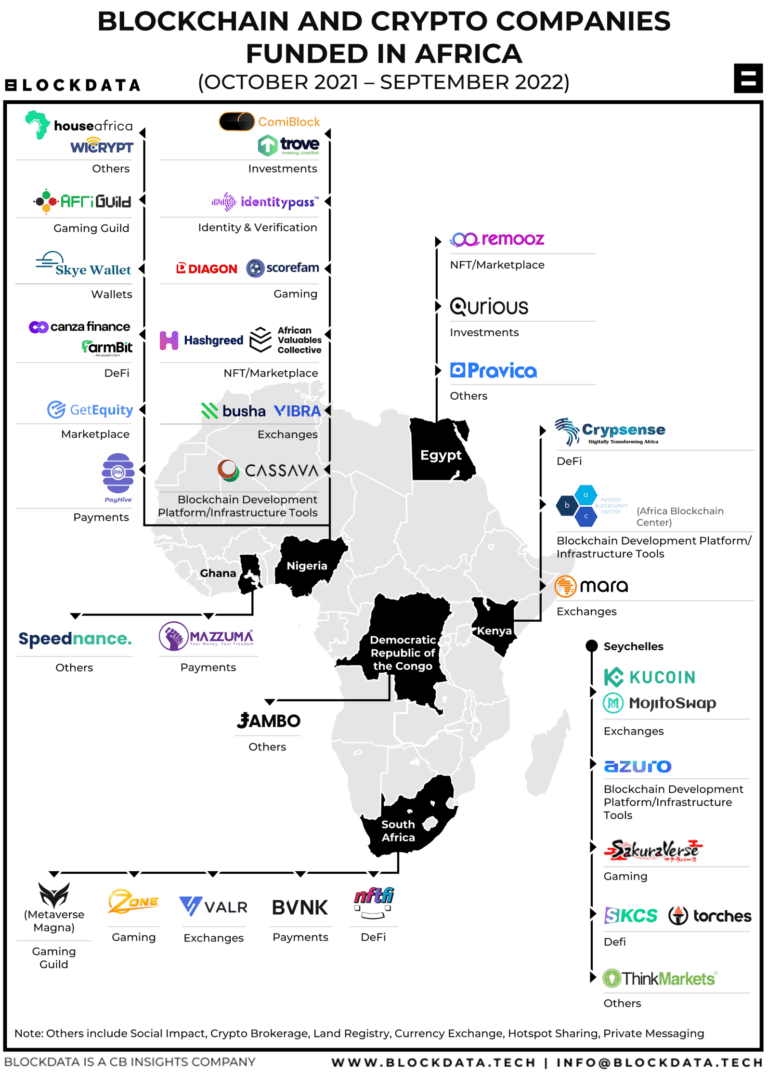

30+ blockchain and crypto companies based in Africa

Jul 19, 2022 report

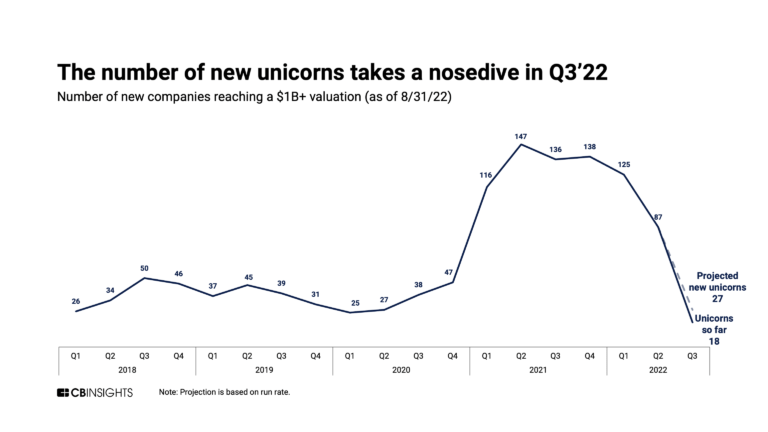

State of Fintech Q2’22 Report

Jul 12, 2022 report

State of Venture Q2’22 Report

Expert Collections containing KuCoin

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

KuCoin is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Blockchain

9,276 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest KuCoin News

Jan 13, 2025

Crypto markets exhibited stability over the weekend as Bitcoin prices consolidated around $94,000 Copied Crypto Price Today: The cryptocurrency market on January 13, 2025, has shown a mixed bag of trends with major cryptocurrencies like Bitcoin and Ethereum experiencing slight declines, while altcoins like XRP and Solana reflect varied performances. The weekend saw relatively stable market conditions, with Bitcoin hovering around the $94k mark but lacking significant trading volume. Despite the stability, the broader market sentiment remains cautious, influenced by macroeconomic factors and upcoming political developments. Weekend Market Recap Crypto markets exhibited stability over the weekend as Bitcoin prices consolidated around $94,000. The trading volume remained muted, indicating a lack of decisive momentum among traders. XRP attempted to display strength during the period, inching closer to the $2.6 resistance level. However, it failed to breach this crucial barrier, which would have been necessary for further upward momentum. The slight downturn in the market is being attributed to stronger-than-expected economic data in the United States. December’s employment figures showed a surprising addition of 256,000 jobs, far exceeding the estimated 167,000. This robust data has led to speculation that the Federal Reserve might pause the anticipated rate cuts in 2025, adding to the cautious sentiment in the crypto market. Bitcoin (BTC): Stable Yet Subdued Bitcoin (BTC) , the largest cryptocurrency by market capitalization, is currently trading at $94,249.27, representing a daily decline of 0.36% and a weekly drop of 5.41%. The lack of significant volume over the weekend suggests a phase of consolidation, with traders adopting a wait-and-see approach. Despite the downturn, Bitcoin continues to anchor the crypto market with a strong market presence and sustained interest from institutional investors. The recent employment data and its potential implications for Federal Reserve policy have added to the cautious outlook, with Bitcoin reflecting broader market hesitation. Ethereum (ETH): Struggling Amid Broader Market Concerns Ethereum (ETH) is trading at $3,222.73, marking a daily decline of 1.80% and a sharper weekly drop of 12.56%. Ethereum, often considered the backbone of decentralized finance and NFTs, continues to face downward pressure. The muted trading activity over the weekend further highlights the market's subdued state. XRP: Attempts to Show Strength Amid Resistance XRP , trading at $2.51, experienced a 1.45% decline over the past 24 hours. Despite this, XRP stands out with a rare weekly gain of 4.11%. Over the weekend, XRP attempted to breach the $2.6 resistance level but failed to sustain the upward momentum. Breaking this barrier is considered crucial for initiating a stronger rally. Solana (SOL): Modest Decline with Stability Solana (SOL) , currently trading at $184.53, has seen a 1.34% decline in the last 24 hours and a weekly drop of 14.58%. Despite these losses, Solana’s performance reflects relative stability compared to other altcoins. Its high-speed blockchain capabilities and growing ecosystem support its long-term value. Shiba Inu (SHIB): High Volatility in Meme-Based Asset Shiba Inu (SHIB) is trading at $0.00002119, reflecting a daily decline of 3.33% and a weekly loss of 12.33%. The speculative nature of SHIB continues to result in high volatility, with recent price action pointing to reduced retail participation. Macroeconomic Impact: The Fed and Economic Data The stronger-than-expected U.S. jobs data for December has added a layer of complexity to the crypto market’s outlook. The addition of 256,000 jobs, far exceeding the anticipated 167,000, has sparked speculation that the Federal Reserve might halt its anticipated rate cuts in 2025. This development has introduced uncertainty into the market, with traders reassessing their strategies in light of potential monetary policy changes. The anticipation of Federal Reserve policy decisions continues to play a significant role in shaping market sentiment, influencing both institutional and retail participation in cryptocurrencies. Political Developments: Trump’s Inauguration and Market Implications The market is also abuzz with anticipation as Donald Trump prepares for his inauguration on January 20, 2025. Trump has outlined an ambitious agenda for his first day in office, including potential reforms in the cryptocurrency sector and new import tariffs targeting key trading partners. These proposed changes have generated excitement among investors, signaling a potential shift towards deregulation and innovation in the financial landscape. The prospect of a more crypto-friendly regulatory environment has led to increased speculative interest, though the specifics of Trump’s plans remain unclear. Markets are closely monitoring developments, with the potential for significant price action in the coming weeks. Biggest Gainers and Losers Among the gainers, KuCoin Token (KCS) leads with a 3.52% increase, trading at $11.26, reflecting growing interest in exchange-linked tokens. Raydium (RAY) also posted a modest gain of 0.97%, trading at $4.54. On the other hand, Virtuals Protocol (VIRTUAL) is among the biggest losers, experiencing a sharp decline of 10.96%, trading at $2.63. Other notable decliners include Ethena (ENA) and Ondo (ONDO), with respective drops of 8.49% and 8.13%. These corrections highlight the risks associated with lower-cap tokens, especially in uncertain market conditions. Market Sentiment: A Cautious Outlook The cryptocurrency market remains in a phase of consolidation, with participants exhibiting caution amid macroeconomic and political developments. Bitcoin and Ethereum continue to anchor the market, but the lack of substantial trading volume reflects hesitancy among traders. Altcoins display a mixed performance, with some showing resilience while others face sharper corrections. The anticipation of Trump’s policies, combined with uncertainties around Federal Reserve actions, has created a complex backdrop for the market. While optimism exists regarding potential deregulation and innovation, the near-term outlook remains uncertain. The crypto market on January 13, 2025, reflects a combination of stability and downward movement, shaped by macroeconomic data and political anticipation. Bitcoin and Ethereum lead the market with relative stability, while altcoins like XRP attempt to show strength amidst resistance. The strong U.S. jobs data and Trump’s upcoming inauguration have introduced a new layer of complexity to the market, influencing sentiment and shaping investor strategies. As markets prepare for potential changes in the regulatory landscape, traders are expected to remain vigilant, assessing the impact of these developments on crypto assets. The coming weeks may bring increased volatility as the market reacts to political and economic shifts. Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

KuCoin Frequently Asked Questions (FAQ)

When was KuCoin founded?

KuCoin was founded in 2017.

Where is KuCoin's headquarters?

KuCoin's headquarters is located at Mahe.

What is KuCoin's latest funding round?

KuCoin's latest funding round is Corporate Minority.

How much did KuCoin raise?

KuCoin raised a total of $180M.

Who are the investors of KuCoin?

Investors of KuCoin include Susquehanna International Group, IDG Capital, MPC, Circle Ventures, Jump Crypto and 3 more.

Who are KuCoin's competitors?

Competitors of KuCoin include BurjX and 5 more.

Loading...

Compare KuCoin to Competitors

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

HitBTC is a cryptocurrency exchange platform with a focus on providing advanced trading options. The platform offers markets for trading various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and many others, using a technology-driven trading terminal. It caters to both individual and institutional traders by providing a secure, responsive, and feature-rich trading environment. It is based in New Territories, Hong Kong.

eToro offers a social investment platform that operates in the financial services industry. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

Loading...