Komodo Health

Founded Year

2014Stage

Unattributed | AliveTotal Raised

$515MLast Raised

$200M | 2 yrs agoAbout Komodo Health

Komodo Health specializes in healthcare analytics and operates within the healthcare technology sector. The company offers a platform that provides insights by analyzing a range of healthcare data, aiming to improve patient care and reduce disease burden. Komodo Health primarily serves life sciences companies, healthcare practitioners, payers, and patient advocacy groups with its suite of software applications designed to deliver value in healthcare through data-driven insights. It was founded in 2014 and is based in San Francisco, California.

Loading...

ESPs containing Komodo Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The healthcare price transparency platforms market provides clear and accessible information about the costs of medical procedures, treatments, and services. They empower patients and healthcare consumers to make informed decisions regarding their healthcare choices, promoting transparency and cost-efficiency. Through user-friendly interfaces and tools, these platforms allow individuals to compare…

Komodo Health named as Leader among 7 other companies, including Solv, Turquoise Health, and Amino.

Loading...

Research containing Komodo Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Komodo Health in 4 CB Insights research briefs, most recently on Aug 9, 2023.

Aug 1, 2023

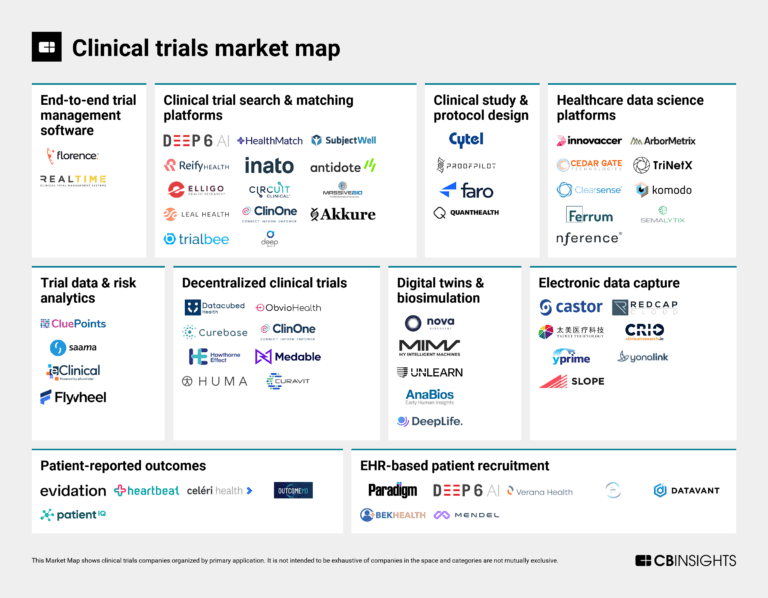

The clinical trials market map

Jan 24, 2023 report

State of Digital Health 2022 ReportExpert Collections containing Komodo Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Komodo Health is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

Conference Exhibitors

5,302 items

Digital Health 50

300 items

The winners of the second annual CB Insights Digital Health 150.

Digital Health

11,313 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

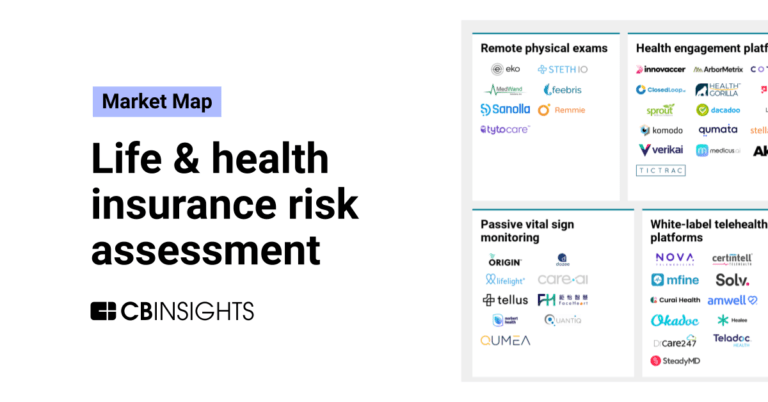

Precision Medicine Tech Market Map

160 items

This CB Insights Tech Market Map highlights 160 precision medicine companies that are addressing 9 distinct technology priorities that pharmaceutical companies and healthcare providers face.

Komodo Health Patents

Komodo Health has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/8/2019 | 2/27/2024 | Cardinal numbers, Set theory, Data modeling, Infinity, Networks | Grant |

Application Date | 5/8/2019 |

|---|---|

Grant Date | 2/27/2024 |

Title | |

Related Topics | Cardinal numbers, Set theory, Data modeling, Infinity, Networks |

Status | Grant |

Latest Komodo Health News

Jan 21, 2025

| MarketsandMarkets™ News provided by Share this article Share toX DELRAY BEACH, Fla., Jan. 21, 2025 /PRNewswire/ -- Despite the economic uncertainties, healthcare analytics companies have demonstrated strong resilience throughout 2024. The global healthcare analytics industry market size is estimated to grow from USD 44.8 billion in 2024 to USD 133.1 billion by 2029, at a Y-o-Y increase of 24.3%. Continued enhancements in analytics platform, mergers, and acquisitions (M&A), partnerships, commercialization of new product lines, and strategic collaborations are contributing to the sustained growth of the market. Browse in-depth TOC on "Healthcare Analytics Industry Outlook" 10 - Tables 70 - Pages The Global Healthcare Analytics Outlook for 2025 provides a comprehensive overview of the critical trends that shaped the sector in 2024. It offers a comparative analysis of growth rates and valuations across key segments in healthcare analytics for 2024, highlights significant trends to monitor in 2024, and features industry best practices and success stories. As healthcare providers navigate challenges such as workforce shortages, adoption of digital automation solutions, generative AI, and increased M&A, consolidation, and partnerships, healthcare analytics must stay ahead of emerging trends that will define success in 2024. The report concludes with key recommendations and growth opportunities for 2025. Some of the key developments witnessed by the Healthcare Analytics industry in 2024: Accelerating AI Integration Across Healthcare for Improved Efficiency and Care. - In May 2024, BrightInsight & Google Cloud have expanded their partnership to integrate Google's Gemini models and Vertex AI into BrightInsight's Disease Management Solution, enhancing patient apps, accelerating R&D, and providing actionable insights from patient data for better outcomes. Surge in Standardization Efforts for Healthcare Data Formats and Interoperability. Standardization and interoperability are key to breaking points in healthcare data. - For example, in May 2024, World Economic Forum & Capgemini launching a global Digital Healthcare Transformation Community to foster health data collaboration, promote interoperability, and support universal health coverage through data sharing initiatives. Increased Integration of Genomic Data with Analytics Platforms for Better Insights. - In May 2024, SOPHiA GENETICS is collaborating with Microsoft and NVIDIA to develop a streamlined, scalable whole genome sequencing (WGS) analytical solution. Hosted on Microsoft Azure and powered by NVIDIA Parabricks, this new application aims to provide fully analyzed whole genome insights within the same day. The solution enhances clinical research, drug discovery, and diagnosis, benefiting patients with cancer and rare genetic disorders. The prominent Healthcare analytics players include Optum, Inc. (US), Oracle (US), Merative (US), SAS Institute Inc. (US), Veradigm LLC (US), McKesson Corporation (US), Wipro (India), CVS Health (US), IQVIA (US), CitiusTech Inc. (US), Inovalon (US), MedeAnalytics, Inc. (US), Cotiviti, Inc. (US), ExlService Holdings, Inc. (US), Health Catalyst (US), Apixio, Inc. (US), Komodo Health, Inc. (US), Aetion, Inc. (US), HealthEC, LLC (US), among others. In 2024, industry leaders strived to maintain their competitive leadership positions with product launches, technological advancements, and strategic deals. In 2025, key players will continue investments in research and development (R&D) and focus on AI-based unique offerings. The Healthcare Future Growth Anchored in Analytic solutions. The growth of the healthcare analytics market is being driven by the increasing demand for data-driven decision-making to improve patient outcomes, enhance operational efficiency, and reduce costs. Other factors include the increasing adoption of EHRs, the integration of advanced technologies such as AI, machine learning, and predictive analytics, and the shift toward value-based care models. Increasing healthcare cost and the necessity to manage huge amounts of data, such as patient records, clinical data, and claims information, are driving organizations to use analytics for better insights. Apart from this, regulatory mandates about data transparency and population health management are promoting analytics solutions. Innovations in real-time analytics, interoperability, and personalized care add further strength to the growth of the market. Further, the increasing prevalence of chronic diseases and the aged population point to the significance of analytics in healthcare planning and resource optimization. Some of the other key trends that the healthcare analytics industry is likely to witness in 2025: The integration of AI is transforming healthcare analytics by enabling advanced data-driven insights, streamlining processes, and enhancing patient care. Below are most anticipated growth areas to look out for in 2025: Real-Time Predictive Insights Will Revolutionize Decision-Making Across Healthcare: In March 2024, Komodo Health launched MapView, a no-code analytics tool within its MapLab platform, to accelerate patient cohort analysis and provide real-time insights, improving efficiency for life sciences professionals. By enhancing accessibility and efficiency, MapView empowers life sciences professionals to make data-driven decisions more effectively, setting a new standard for innovation in healthcare analytics. AI Will Transform Personalized Care and Operational Efficiency: In May 2024, Wipro and CBR at IISc are collaborating to develop AI-powered technology aimed at precision health. The goal is to create a personal care engine using AI, ML, and big data analytics to manage cardiovascular disease and neurodegenerative disorders, supporting long-term health and wellbeing. The solution will be tested via a digital app-based trial. Behavioral Health Data Integration Will Become Central to Holistic Patient Care: In July 2024, Holmusk and Veradigm announced a milestone in their strategic collaboration. By using Veradigm Network EHR data, Holmusk enriched millions of patient profiles with analyzable, structured data. The data provides insights into disorder progression and patient journeys, enabling better assessment of treatment effectiveness and disorder management in mental health through the NeuroBlu Data platform. Wearable Technology Analytics Will Drive Preventive and Personalized Healthcare: Evidation launched MigraineSmart, a health engagement program on the Evidation app for tracking and understanding migraine symptoms. It includes symptom tracking, personalized insights, rewards for engagement, and opt-in research opportunities, helping individuals better manage their migraines while generating data for researchers. Related Reports: About MarketsandMarkets™: MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. Contact:

Komodo Health Frequently Asked Questions (FAQ)

When was Komodo Health founded?

Komodo Health was founded in 2014.

Where is Komodo Health's headquarters?

Komodo Health's headquarters is located at 257 Park Avenue South, New York.

What is Komodo Health's latest funding round?

Komodo Health's latest funding round is Unattributed.

How much did Komodo Health raise?

Komodo Health raised a total of $515M.

Who are the investors of Komodo Health?

Investors of Komodo Health include Coatue, Dragoneer Investment Group, RevTech Labs Capital, Andreessen Horowitz, Tiger Global Management and 10 more.

Who are Komodo Health's competitors?

Competitors of Komodo Health include Innovaccer, Datavant, Courier Health, TriNetX, Apixio and 7 more.

Loading...

Compare Komodo Health to Competitors

Inovalon provides healthcare software and analytics solutions. It offers a cloud-based platform that connects users with national-scale connectivity, primary source data access, and analytics for clinical outcomes and healthcare economics. The company serves payers, providers, pharmacies, and life sciences organizations within the healthcare sector. Inovalon was formerly known as MedAssurant. It was founded in 1998 and is based in Bowie, Maryland.

Datavant specializes in data connectivity and logistics for the healthcare sector. The company offers services including real-world data connectivity and data transformation to facilitate the secure and compliant movement of health information. It serves health plans, healthcare providers, life sciences, and government entities by providing solutions for improved healthcare data management. The company was founded in 2017 and is based in Phoenix, Arizona.

VisiQuate specializes in revenue cycle management and analytics within the healthcare sector. It offers a suite of services that enable healthcare organizations to analyze complex data, optimize revenue cycle outcomes, and improve operational performance through AI and machine learning, advanced analytics, and intelligent process automation. VisiQuate's solutions cater primarily to healthcare providers looking to enhance their financial and operational efficiency. It was founded in 2009 and is based in Santa Rosa, California.

Innovaccer is a healthcare technology company that provides a platform for data activation and analytics in value-based care. The platform integrates and analyzes healthcare data for clinical, financial, operational, and experiential outcomes. Innovaccer's solutions serve providers, payers, the public sector, and life sciences. It was founded in 2014 and is based in San Francisco, California.

Panda Health specializes in connecting healthcare organizations with digital health solutions, focusing on the healthcare technology sector. The company offers a digital health intelligence platform that supports hospitals in making informed decisions by providing technology evaluations, market intelligence, and advisory services. It serves the healthcare industry, including hospitals and digital health partners. It was founded in 2020 and is based in Atlanta, Georgia.

Medical Brain provides a clinical decision support platform focused on healthcare technology. It offers a monitoring system for patients, aggregates and analyzes patient data, and provides insights to both patients and healthcare providers. The platform includes clinical practice modules for various medical conditions, assisting in pre-operative optimization, post-operative recovery, chronic disease management, and preventive care. It was founded in 2017 and is based in New York, New York.

Loading...