Kavak

Founded Year

2016Stage

Line of Credit - II | AliveTotal Raised

$3.102BLast Raised

$704M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-64 points in the past 30 days

About Kavak

Kavak specializes in the buying, selling, and financing of pre-owned cars within the automotive industry. The company provides a platform for customers to purchase certified and guaranteed vehicles, offer vehicle inspection services, and facilitate car financing and after-sales support. Kavak primarily serves individuals looking for a reliable and convenient way to buy or sell used cars. It was founded in 2016 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Kavak

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kavak in 3 CB Insights research briefs, most recently on Mar 30, 2022.

Mar 30, 2022

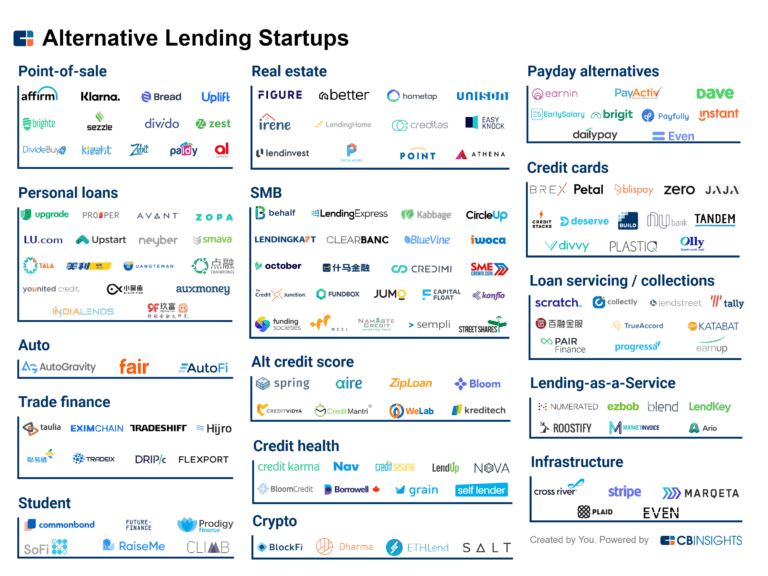

140+ startups shaping the digital lending space

Expert Collections containing Kavak

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kavak is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,142 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,257 items

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Auto Commerce

700 items

Companies involved in the rental, selling, trading, or purchasing of cars, RVs, trucks, and fleets, including auto financing companies, vehicle auction services, online classified advertising companies with a focus on auto, and dealership software platforms.

Fintech

13,559 items

Excludes US-based companies

Latest Kavak News

Nov 14, 2024

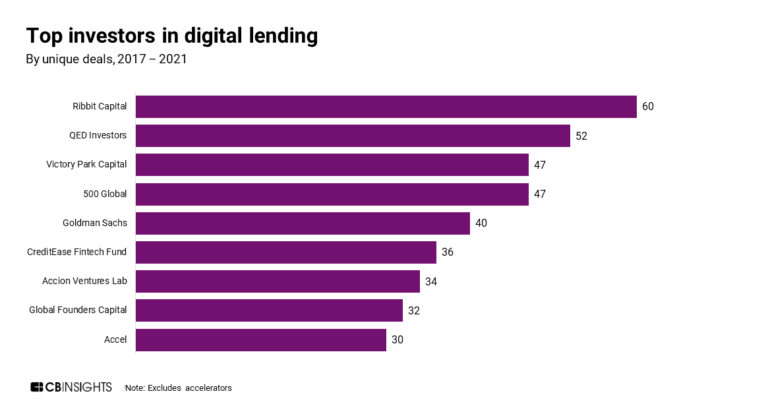

Finnovista 15 July 2020Finnovista Is the health emergency an opportunity or a challenge for Fintech? What are the major financial risks in the lending and finance industries in the face of the new reality? Who are going to be the leaders in the emerging Fintech ecosystem after the pandemic? These and other topics were discussed in a major virtual event on 7th July. What’s next? Shaping the future of Fintech in Latin America, organized by Quona Capital , QED Investors , Kaszek Ventures and Finnovista , and moderated by Andrés Fontao , Co-Founder & Managing Partner of Finnovista , analyzed the future of financial services together three major Latin American VCs and their portfolio companies. Jonathan Whittle , Partner of Quona Capital , who moderated the first part of the webinar and David Arana , Founder & CEO of Konfio , a lending platform for small and medium enterprises in Mexico, presented the current state of SME’s in Mexico and their road to recovery in the face of the new reality. Arana talked about the Konfio experience in the new reality. “As many Fintechs started as digital-first companies, we had one true advantage in understanding and segment out our databases according to different types of data which, in our case, it’s pretty much real-time data”. Thanks to that, he highlighted that they determined three main sectors: companies that have financial problems because their economic model is under a lot of pressure; a second group focused on companies that “aren’t doing so badly or so well but due to uncertainty they are not taking any risks”, and the last group in those that the crisis has helped them to have more growth and more users. This caused several financial institutions to begin offering different types of assistance, which demonstrated the speed of action of Fintech. According to Arana at first, consumers required physical contact and now they are looking for a digital contact experience. “We found that being digital and being Fintech are really helping because the spirit of execution”, so he said that this is an opportunity for Fintech to reinvent themselves and look for new partners. Finally, Arana explained that companies were finding a new opportunity to accelerate their plans and finding their weaknesses based on the needs of their customers, so this is a perfect scenario to collaborate. The second panel was moderated by Lauren Connolley Morton , Partner at QED Investors , who interviewed Ann William , COO of Creditas , and Sergio Furio , Founder & CEO of Creditas . Creditas is the Brazil’s leading Fintech for secured lending company. Furio highlighted how Fintech has evolved positively during these uncertain times, based on Creditas experience with its customers who have been applying for credit. He pointed out their three main cases: 50% of their customers are using their resources to finance their businesses (cash flow, employee payments, equipment purchases, business expansion, payroll payments and lease payments); 30% of their clients are dedicating these credits to pay off credit card debt and personal loans, and the remaining segment uses the loans to pay off personal satisfactions (travel, clothing and luxury). Furio said that now customers are looking for experiences and not only the solution for their problems, that’s the boom of digital platforms like Mercado Libre and Amazon, which have served as inspiration for his business model. “It’s all about user experiences”, he added. To conclude, Creditas stressed out that diversity is a priority issue in their organization and it makes them stronger. In the last panel, Carlos Garcia Ottati , Founder & CEO of Kavak , talked with Nicolas Szekasy , Co-Founder & Managing Partner of Kaszek Ventures . Kavak is a platform for buying, selling and reconditioning cars, which they describe as an application that supports you from the moment you buy to the sale of your first car. Otatti highlighted that the market of buying and selling cars in Mexico amounts “70 million cars that are exchanged each year, and part of this percentage occurs in the informal market”. This situation has encouraged a lack of price knowledge in used cars as well as the legal background. “When you are about to ask for funding, you need to know 3 things: 1) understand your funding capabilities and cost, 2) your customer acquisition costs and 3) if people are going to pay you or not”, concluded Ottati.

Kavak Frequently Asked Questions (FAQ)

When was Kavak founded?

Kavak was founded in 2016.

Where is Kavak's headquarters?

Kavak's headquarters is located at Carretera Amomolulco - Capulhuac, No. 1 Col. El Panteon, Mexico City.

What is Kavak's latest funding round?

Kavak's latest funding round is Line of Credit - II.

How much did Kavak raise?

Kavak raised a total of $3.102B.

Who are the investors of Kavak?

Investors of Kavak include HSBC, Santander Bank, Goldman Sachs, Wollef, SoftBank Latin America Fund and 19 more.

Who are Kavak's competitors?

Competitors of Kavak include VavaCars and 4 more.

Loading...

Compare Kavak to Competitors

Cinch is a company that operates in the automotive industry, focusing on online car services. The company offers a platform for buying and selling cars, providing home delivery, part exchange, and car finance services. Additionally, Cinch provides car care services, including a 90-day warranty, breakdown assistance, and optional lifetime warranty and servicing. It was founded in 2018 and is based in Hook, United Kingdom.

Carsome provides an e-commerce platform and specializes in the online buying and selling of used cars. The company offers a comprehensive service that includes car inspection, valuation, an online bidding portal for dealers, and logistics support, ensuring a seamless selling experience for customers. It was founded in 2015 and is based in Petaling Jaya, Malaysia.

Spinny is a full-stack used car trading platform that specializes in offering thoroughly inspected second-hand cars. The company provides a transparent and seamless car buying and selling experience, featuring a rigorous 200-point quality check and a 5-day money-back guarantee for all vehicles. Spinny also offers additional services such as car financing, a one-year comprehensive warranty, and buyback options to enhance customer satisfaction. It was founded in 2015 and is based in Gurugram, India.

SheerDrive offers a digital used-car platform to optimize the consumer buying experience. It offers a B2B multibrand exchange platform, remarketing solutions, vehicle scan, pricing algorithm, vehicle part review and grading dashboard, and more. The company was founded in 2019 and is based in Mumbai, India.

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Bnext operates as a financial technology company that offers a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Loading...