K Health

Founded Year

2016Stage

Series F - II | AliveTotal Raised

$387MValuation

$0000Last Raised

$50M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-64 points in the past 30 days

About K Health

K Health provides virtual primary care, medical weight management, urgent care, and mental health services through a mobile app and partnerships with health systems and insurers. Its services are designed to provide data-driven and accessible medical consultations and treatments without insurance. K Health was formerly known as Kang Health. The company was founded in 2016 and is based in New York, New York.

Loading...

ESPs containing K Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The hybrid primary & specialty care market aims to provide patients with a combination of virtual and in-person healthcare services. This market addresses the challenges of affordable and accessible healthcare and the demand for personalized care. The market includes vendors that offer unique value propositions such as virtual primary care, mental health, and in-person care all via one seamless ap…

K Health named as Highflier among 6 other companies, including Amwell, One Medical, and Strive Health.

Loading...

Research containing K Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned K Health in 3 CB Insights research briefs, most recently on Jun 6, 2023.

Oct 14, 2022

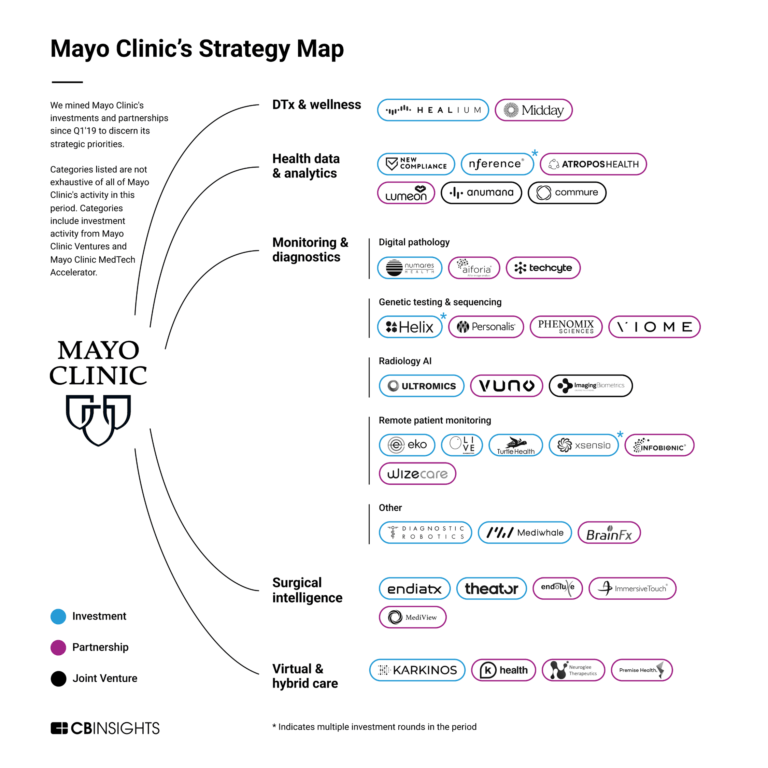

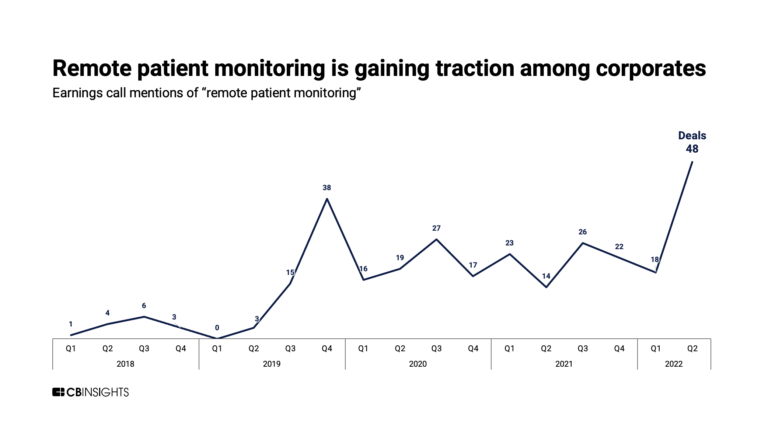

How is Mayo Clinic using AI to improve patient care?

Feb 16, 2022

The 130+ AI startups reinventing healthcareExpert Collections containing K Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

K Health is included in 4 Expert Collections, including Digital Health 50.

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,255 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Artificial Intelligence

7,212 items

K Health Patents

K Health has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/11/2019 | 11/7/2023 | Medical terminology, Health informatics, Machine learning, Electronic health records, Classification algorithms | Grant |

Application Date | 12/11/2019 |

|---|---|

Grant Date | 11/7/2023 |

Title | |

Related Topics | Medical terminology, Health informatics, Machine learning, Electronic health records, Classification algorithms |

Status | Grant |

Latest K Health News

Dec 19, 2024

In Collaboration with K Health - Thursday, December 19th, 2024 The right patient at the right time with the right provider Healthcare AI today is focused on alleviating administrative burdens, including solving documentation challenges for clinicians and managing revenue cycle complexity for operators. These are important use cases, helping to reduce the $4.5 trillion spent annually on American healthcare. However, they do not address the care delivery moment itself—nor the biggest challenge in healthcare: the supply and demand imbalance. American healthcare is moving further from economic equilibrium every day. Patient demand is growing more complex, driven by an aging population and rising chronic disease rates. Meanwhile, the clinician shortage continues to deepen, leaving the healthcare system unprepared to meet this growing demand. AI’s greatest impact on access, cost, and quality will come from integrating intelligent systems into workflows at the point of care. This integration has the potential to transform interactions between providers and patients, enabling healthcare systems to create delivery models rooted in abundance rather than scarcity. The future of healthcare is unlikely to include significantly more providers. Instead, it will feature care models that leverage AI Agents to optimize core "jobs to be done." This approach will create equilibrium, ensuring the right patient is seen at the right time by the right provider. How AI can impact patient demand Access barriers often prevent patient demand from connecting with the appropriate supply. Patients face limited knowledge about where to start their care journey, fragmented pathways, and insufficient provider availability. These challenges are exacerbated by the complexity of a healthcare system fragmented by silos. AI has the potential to eliminate these barriers through personalized navigation and scalable patient engagement. A foundational element of these tools is their reliance on a patient’s comprehensive medical history. For example, a headache in a 30-year-old woman could signal flu symptoms, side effects from oncology treatment, or a sports-related injury—each of which requires a different care pathway. An AI Agent anchored in a patient’s electronic medical record (EMR) integrate broader medical histories with current complaints to create a nuanced understanding of demand. This ensures patients are routed to the appropriate provider. AI also enables proactive engagement with patients, going beyond reactive care. AI Agents can deliver personalized health information, conduct automated outreach to close care gaps, and monitor chronic conditions for escalation when necessary. These agents will increase continuity of care and drive quality improvements by encouraging behavior changes and timely interventions. How AI can augment provider supply On the supply side, the shortage of clinicians is severe and trending towards catastrophe. Building on challenges with retention and burnout, clinicians often lack the technology and information at the point of care that could amplify their capacity. This leads to mismatches in supply and demand—for instance, cardiologists managing hypertensive patients with well-controlled blood pressure—while limiting the tools available to provide efficient care. AI can transform this dynamic by augmenting the “jobs to be done” for clinicians and integrating seamlessly into their workflows. As a historian, AI synthesizes patient data from diverse sources, including EMRs, to provide a personalized, context-rich investigation of each patient’s needs. These insights are delivered to clinicians at the point of care, enabling them to focus on complex problem-solving and patient education. This approach enhances productivity while also improving care quality, thanks to consistent, comprehensive data availability for diagnosis and treatment. These benefits are already being realized by K Health, a clinical AI company partnering with leading health systems such as Cedars-Sinai and Hackensack Meridian Health. Using K Health’s platform, primary care providers receive AI-collected insights at the point of care, streamlining workflows and enhancing care delivery. This delivery model, which embeds Virtualists using K’s AI tools into existing primary care teams, has the potential to expand access and panel size while maintaining high quality standards.

K Health Frequently Asked Questions (FAQ)

When was K Health founded?

K Health was founded in 2016.

Where is K Health's headquarters?

K Health's headquarters is located at 387 Park Avenue South, New York.

What is K Health's latest funding round?

K Health's latest funding round is Series F - II.

How much did K Health raise?

K Health raised a total of $387M.

Who are the investors of K Health?

Investors of K Health include Mangrove Capital Partners, Atreides Management, Valor Equity Partners, Claure Group, Pablo Legorreta and 21 more.

Who are K Health's competitors?

Competitors of K Health include Maven, Eden Health, 98point6 Technologies, Kompa Saude, Ada Health and 7 more.

Loading...

Compare K Health to Competitors

98point6 Technologies specializes in digital health solutions and focuses on telehealth and healthcare technology. The company offers a virtual care platform that provides asynchronous and real-time telehealth services, designed to streamline administrative tasks for clinicians and enhance patient-provider interactions. Their platform serves the healthcare industry by increasing provider efficiency and patient satisfaction through technology that supports various care modalities. 98point6 Technologies was formerly known as 98point6. It was founded in 2017 and is based in Seattle, Washington. 98point6 Technologies operates as a subsidiary of Transcarent.

DoctorBox is a digital health platform operating in the healthcare industry. The company offers an application that centralizes all important health data, providing various digital services for diagnostics, pharmaceuticals, and therapy. It primarily serves individuals seeking to manage their daily health. It was founded in 2016 and is based in Berlin, Germany.

CirrusMD operates in the virtual primary care space and provides guidance within the healthcare sector. The company has a physician-first model that enables access to healthcare services and technology for integrated care. CirrusMD serves employers, health plans, and benefits consultants, offering solutions with the goal of enhancing health outcomes and lowering healthcare expenses. It was founded in 2012 and is based in Denver, Colorado.

Firefly Health offers integrated healthcare services and employer-sponsored health plans within the healthcare sector. The company provides a primary and specialty care approach, allowing members to access a team of health professionals and coordination of care. Firefly Health serves individuals and businesses seeking healthcare solutions. It was founded in 2016 and is based in Watertown, Massachusetts.

Biloba focuses on providing medical assistance, specifically in the pediatric sector. It offers an on-demand application that connects parents to a pediatric team without the need for an appointment, facilitating instant messaging communication and providing prescriptions if necessary. Biloba primarily serves the healthcare industry, with a specific focus on pediatric care. It was founded in 2018 and is based in Paris, France.

Included Health operates as a healthcare company. The company provides a range of services, including guidance on healthcare benefits and insurance, virtual primary and urgent care, behavioral health services, and specialist-matched expertise for new diagnoses. It primarily caters to employers, health plans, consultants, and labor and trust members. It was formerly known as Grand Rounds Health. It was founded in 2011 and is based in San Francisco, California.

Loading...