Nium

Founded Year

2014Stage

Series E | AliveTotal Raised

$314.1MValuation

$0000Last Raised

$50M | 9 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+83 points in the past 30 days

About Nium

Nium specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. Nium primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. Nium was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Loading...

Nium's Product Videos

ESPs containing Nium

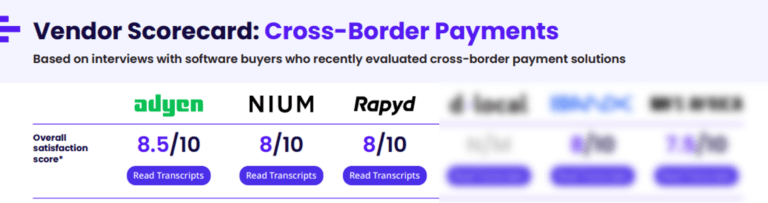

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

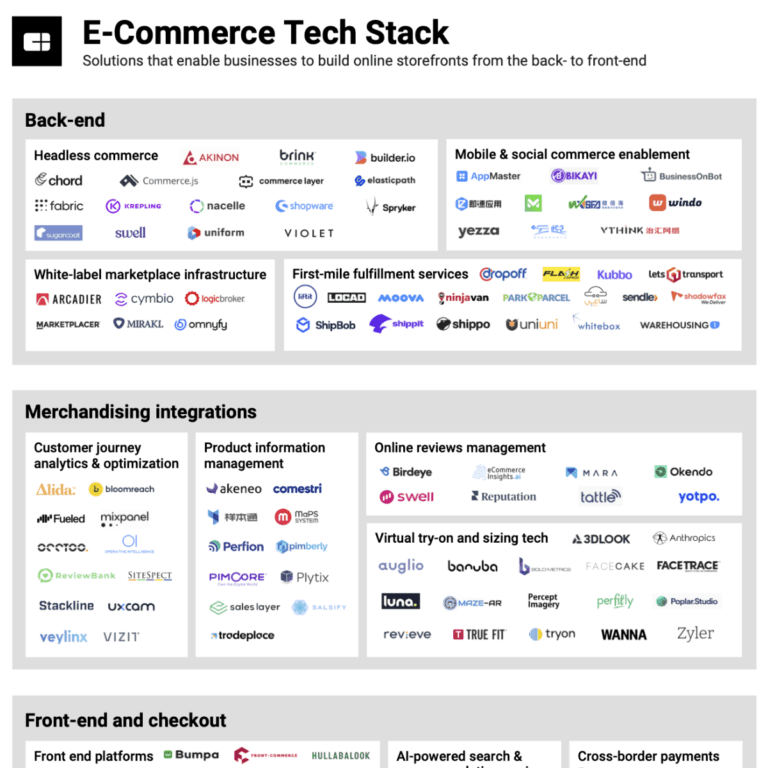

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

Nium named as Leader among 15 other companies, including FIS, Checkout.com, and Thunes.

Nium's Products & Differentiators

Payout

The most advanced means to send money around the world and deliver to bank accounts/proxy methods, cards, e-wallets. Pay employees or build functionality that delights customers from anywhere in the world – all with a single API based solution. With access to 190+ countries, and over 100 currencies Nium’s scale allows limitless growth.

Loading...

Research containing Nium

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Nium in 12 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

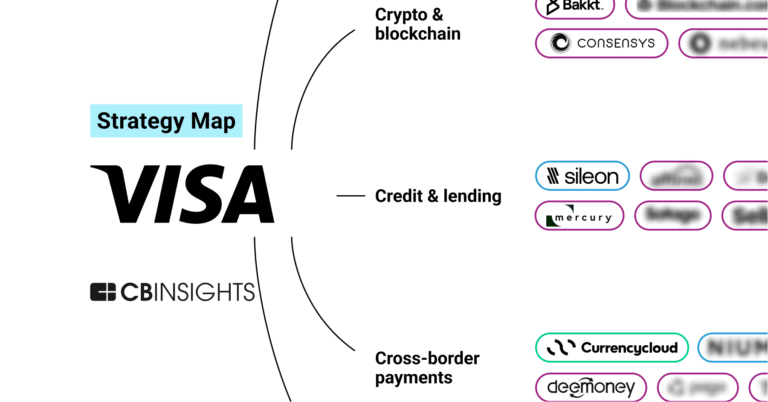

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Nium

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Nium is included in 10 Expert Collections, including HR Tech.

HR Tech

5,785 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,258 items

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

849 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Nium News

Dec 17, 2024

Multiplier Taps Industry Leaders from Nium and Paycor to Accelerate Growth Share: NEW YORK, Dec. 17, 2024 /PRNewswire/ -- Multiplier , a leading global employment platform, announced today the appointments of Pratik Gandhi as Managing Director and Chief Operating Officer (MD & COO) and Matt Carr as Chief Revenue Officer (CRO), two key hires that will help fuel the company's next phase of growth. These new leadership positions come at a crucial time as Multiplier scales its business, reaffirming its dedication to offering effective worldwide employment solutions. In a time when companies face challenges in hiring talent amid ongoing layoffs, many are expanding their search globally and prioritizing flexibility to tap into a broader talent pool . This shift makes Multiplier's commitment to transforming global employment solutions even more critical as the company enhances its operations to help businesses easily access and manage top talent from anywhere in the world. Pratik Gandhi's extensive experience in scaling operations, especially from his time as Co-founder and COO of Nium, will help optimize Multiplier's internal processes to support rapid growth. With over 25 years of leadership experience across industries like fintech, banking, and consulting, he brings valuable expertise in managing global finance, operations, and customer service teams "I am excited to join Multiplier at such a pivotal time," said Pratik Gandhi, MD and Chief Operating Officer of Multiplier. "As businesses look to go global, the market opportunity is truly immense and what Multiplier has achieved in such a short duration is spectacular. I look forward to building on this success and empowering companies to expand globally." Meanwhile, Matt Carr's proven track record in revenue growth, developed through senior roles at Paycor where he led transformative initiatives and achieved year-over-year growth of up to 62%, will be key to expanding Multiplier's revenue efforts. With his expertise in the HR tech space, Matt will lead initiatives to expand the company's market presence, positioning Multiplier for significant success in the years ahead. "I've watched Multiplier's impressive growth over the last four years, and I'm excited about what's ahead," said Matt Carr, Chief Revenue Officer at Multiplier. "With the HR tech space rapidly evolving, Multiplier is well-positioned to capture a larger share of the market. I'm confident that our Employer of Record (EOR) and Global Payroll platforms will keep us at the forefront of delivering an exceptional experience." Together, Pratik and Matt bring extensive expertise that will help Multiplier drive expansion, solidifying its position as a key player in the global employment solutions market. "Multiplier is at a pivotal stage in our journey to revolutionize global employment, and strong leadership is the key to our next phase of growth," said Sagar Khatri, CEO of Multiplier. "Pratik's operational expertise and Matt's proven success in driving revenue will accelerate our mission to help businesses access global talent effortlessly. I am thrilled to welcome them to our leadership team as we continue building the future of work." With these hires, Multiplier is well-positioned to continue revolutionizing the way businesses manage global teams, freelancers, and paying teams across borders in 2025. You can find the press kit here . About Multiplier Multiplier is a global employment platform for HR leaders and professionals who need an easy, fast, and cost-effective way to onboard, pay, and manage the best global talent across 150+ countries. Through best-in-class global payroll, EOR and compliance technology, person-to-person support, and hyper-local employee benefits, Multiplier empowers its customers to connect with the best talent and build a world of limitless opportunity. Source: Multiplier

Nium Frequently Asked Questions (FAQ)

When was Nium founded?

Nium was founded in 2014.

What is Nium's latest funding round?

Nium's latest funding round is Series E.

How much did Nium raise?

Nium raised a total of $314.1M.

Who are the investors of Nium?

Investors of Nium include NewView Capital, Bond, Tribe Capital, Moore Capital Management, Global Founders Capital and 23 more.

Who are Nium's competitors?

Competitors of Nium include Klasha, TerraPay, Tranglo, Merchantrade, TransferGo and 7 more.

What products does Nium offer?

Nium's products include Payout and 2 more.

Who are Nium's customers?

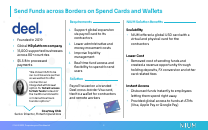

Customers of Nium include Kasikorn Bank, Deel and eTraveli Group.

Loading...

Compare Nium to Competitors

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

Stripe provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Rapyd is a fintech company. It specializes in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors, including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, United Kingdom.

MoneyGram operates as a financial services company. The company offers services such as sending money to various locations worldwide, depositing money into bank accounts, and transferring funds to mobile wallets. It primarily serves individuals who need to send or receive money internationally. MoneyGram was formerly known as Integrated Payment Systems, It was founded in 2003 and is based in Minneapolis, Minnesota.

Checkout.com allows companies to accept payments around the world through one application program interface. It facilitates an integrated payment processing platform allowing the processing of payments in real-time, sending payouts, issuing, processing, and managing card payments. It also offers fraud prevention and secure authentication. The company was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

Loading...