Instacart

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.861BDate of IPO

9/19/2023Market Cap

11.68BStock Price

45.99Revenue

$0000About Instacart

Instacart (CART) is a grocery technology company that operates an online marketplace for grocery delivery and pickup services. The company provides a platform where customers can order groceries, alcohol, and home essentials from various retailers and have them delivered or prepared for curbside pickup by personal shoppers. Instacart's services cater to individual consumers and businesses, offering technology products to fulfill orders and provide digital advertising services. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Instacart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Instacart named as Leader among 15 other companies, including Amazon, DoorDash, and Deliveroo.

Loading...

Research containing Instacart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Instacart in 21 CB Insights research briefs, most recently on Jan 25, 2024.

Jan 4, 2024 report

State of Venture 2023 Report

Nov 21, 2023

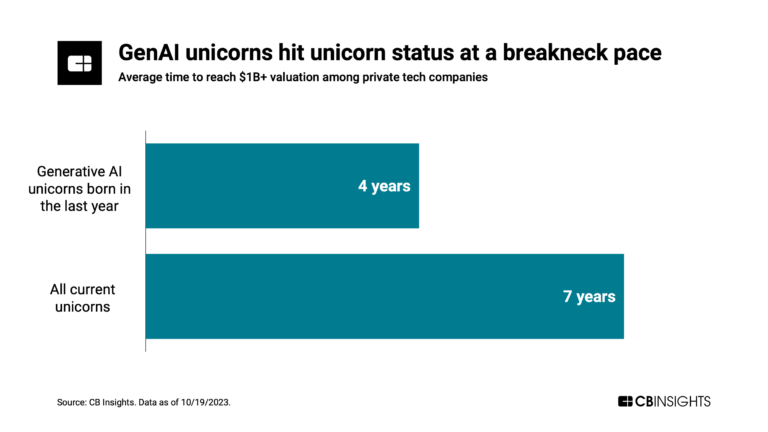

Has the global unicorn club reached its peak?

Nov 20, 2023 report

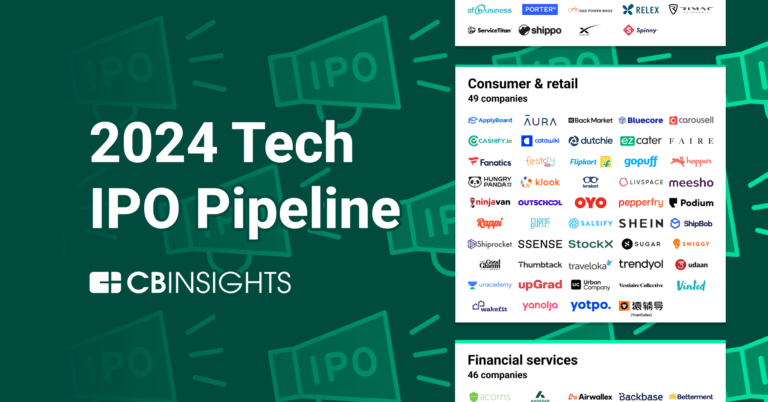

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 ReportExpert Collections containing Instacart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Instacart is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,726 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

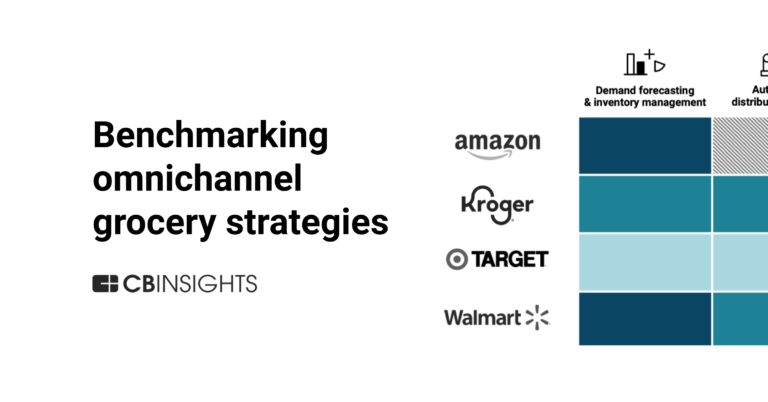

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Tech IPO Pipeline

568 items

Food & Meal Delivery

1,595 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Conference Exhibitors

5,302 items

Latest Instacart News

Jan 27, 2025

ROAS vs. incrementality: Scrutiny around ad spend grows in booming retail media space Ivy Liu For all the dollars advertisers have been shoveling into retail media networks, marketers are starting to scrutinize the industry’s latest shiny object a bit harder. The pitch of RMNs was their first-party data and the potential to truly track sales. Marketers, however, are still looking for the retailers to make good on that promise. This year, expect more emphasis on measurement with advertisers prioritizing incrementality metrics as opposed to return on ad spend, or ROAS, which has traditionally been the gold standard to help marketers determine which campaigns and ads are working (and which aren’t). “Retailers can report incremental sales with greater accuracy than any other media company,” Christine Foster, vp product strategy and media operations for Kroger Precision Marketing at 84.51°, said in an email response to Digiday. “We know exactly what the baseline organic sales should be in any category we sell.” And that’s what advertisers say they want in on, especially as retail media networks act more as media companies, rolling out off-site ad opportunities to reposition themselves from performance marketing channels to one-stop ad shops. “The retail media networks are claiming enormous credit for driving sales, but they’re missing this really important aspect: Would that sale have happened regardless of the ad?” questioned Matt Voda, CEO of OptiMine, a marketing analytics company. Some retailers have already started building out tools and measurement capabilities in hopes to better compete for ad dollars amongst 200-plus retail media networks. Earlier this month, Kroger Precision Marketing (KPM), the grocery chain’s retail media arm, announced new capabilities, bringing incremental sales reporting to self-service programmatic campaigns. Similarly, Albertsons Media Collective, retail media arm for Albertsons Companies food and drug retailer, announced the launch of an API, enabling advertisers to integrate Albertsons campaign performance data into their own measurement models for analysis. And while there’s still the issue of lagging standardization for the retail media space, Instacart, Criteo and other retail media network players received Media Rating Council (MRC) accreditation last year, pointing to its push to ensure the accuracy of its metrics. Retail media was the fastest growing ad channel last year, expected to account for nearly a quarter of total media ad spend by 2028, per eMarketer. That growth is expected to cool ever so slightly this year, according to the market research company. It’s a trend that could continue as marketers start to pick apart metrics like ROAS, looking for more granular level insights to determine campaign effectiveness. Historically, ROAS has been a go-to calculation, “Put money in, get money out. It’s an easy go-to,” said Cindy Meltzer, vp of research and analytics at Dagger ad agency. Incrementality, on the other hand, is more hands on keyboards, testing and experimenting to get a complete picture of ad spend impact, she added. For some Dagger clients, that looks like pausing and restarting media spend to compare sales within certain period of time or segment. Meanwhile, digital marketing agency Wpromote is leveraging proprietary incrementality and measurement tools in platform for off-platform retail media, and leveraging third-party partner solutions for on-platform media incrementality testing. Going back to the standardization issue, some retailers, like Amazon and Walmart, share insights, but marketers question how accurate that incrementality is because “they always take 100% attribution for sales,” said Ashley Karim-Kincey, svp of media at Dagger. In the retailers’ defense, experts in the space say retail media is still in its infancy in comparison to other channels like social or video. Last January, the Interactive Advertising Bureau (IAB) and Media Rating Council (MRC) finalized retail media measurement standards, to which retailers like Instacart and others have aligned themselves with. Those standards set a framework for audience measurement and metrics, best practices when measuring incrementality as well as reporting and transparency. Still, the pivot from ROAS to incrementality is just the tip of the iceberg in a landscape where there are still “tensions within the marketplace” and “a lot of work that still needs to be done,” according to Jeffrey Bustos, svp of retail media analytics at Merkle. Marketers want the data to prove retail media is all it’s hyped up to be and retailers want to stand out in a crowded marketplace, leveraging granular insights to do so. Retail media networks are, as Bustos puts it, “the first ecosystem in which the outcome and the ad happens in the same ecosystem.” Meaning, the ad shows up in the same place where the buying decision happens, making it even more crucial to tie ad spend back to sales. “Incrementality is definitely a huge priority for brands,” he said, “because you’re within an environment where retailers are grading their own homework and this helps brands prove out their performance.”

Instacart Frequently Asked Questions (FAQ)

When was Instacart founded?

Instacart was founded in 2012.

Where is Instacart's headquarters?

Instacart's headquarters is located at 50 Beale Street, San Francisco.

What is Instacart's latest funding round?

Instacart's latest funding round is IPO.

How much did Instacart raise?

Instacart raised a total of $2.861B.

Who are the investors of Instacart?

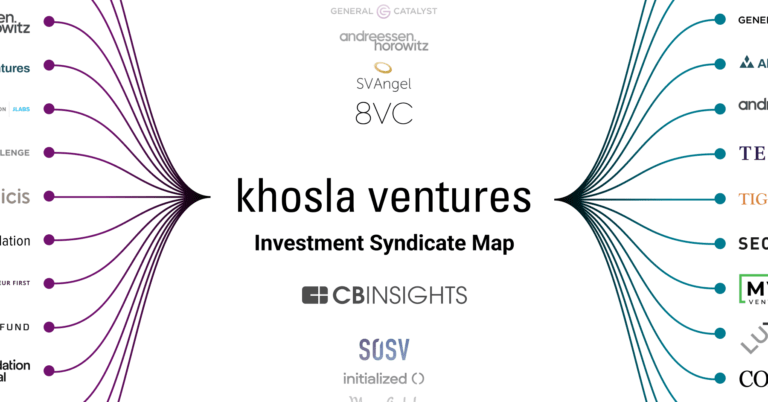

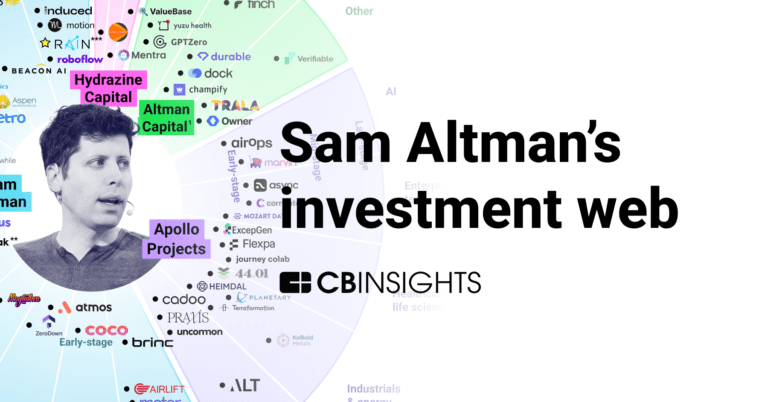

Investors of Instacart include PepsiCo, Sequoia Capital, Andreessen Horowitz, D1 Capital Partners, T. Rowe Price and 32 more.

Who are Instacart's competitors?

Competitors of Instacart include Roadie, Ninja Van, Glovo, Picnic, Good Eggs and 7 more.

Loading...

Compare Instacart to Competitors

Glovo provides delivery services across various sectors. The company offers a platform for users to order food, groceries, and other items from local businesses and have them delivered. It serves the electronic commerce industry with a focus on food delivery and retail items. The company was founded in 2015 and is based in Barcelona, Spain. In December 2021, Delivery Hero acquired a majority stake in Glovo values the company at $2.6B.

Shadowfax is a logistics platform that operates in the hyperlocal, on-demand delivery sector. The company provides a range of services, including delivery, retail deliveries, and e-commerce solutions such as forward and reverse shipments. It primarily serves sectors such as e-commerce, food, pharma, and groceries. It was founded in 2015 and is based in Bengaluru, India.

Roadie provides logistics management and crowdsourced delivery solutions within the logistics and transportation industry. The company offers local same-day delivery, delivery from warehouse with in-house sortation, oversized delivery, and returns services. Its services are utilized in various sectors including electronic commerce, healthcare, and construction supplies. It was founded in 2014 and is based in Atlanta, Georgia. In September 2021, Roadie was acquired by United Parcel Service.

Gopuff is a commerce platform operating in the retail sector. The company offers various products including groceries, alcohol, home essentials, cleaning products, medication, pet care, office supplies, beauty and wellness items, baby products, food, drinks, and local brands, all available for delivery. It was founded in 2013 and is based in Philadelphia, Pennsylvania.

Ninja Van is a tech-enabled logistics company that specializes in e-commerce express logistics. The company offers a suite of solutions for parcel delivery, including digital and full-funnel marketing services to enhance shippers' sales. Ninja Van's network extends to various sectors, including e-commerce and business-to-business inventory restocking. It was founded in 2014 and is based in Singapore.

Huolala is an internet logistics platform. It provides same-city and cross-city freight transportation, enterprise logistics services, less-than-truckload (LTL) transportation, car rental and after-sales services, and more. It was formerly known as EasyVan. The company was founded in 2013 and is based in Guangzhou, China.

Loading...