Insitro

Founded Year

2018Stage

Series C | AliveTotal Raised

$643MLast Raised

$400M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-8 points in the past 30 days

About Insitro

Insitro focuses on drug discovery and development. The company's main services involve the use of machine learning and throughput biology to predict successful paths for medicine creation. It aims to avoid costly failures in pharmaceutical research and development. Insitro primarily sells to the healthcare industry. It was founded in 2018 and is based in South San Francisco, California.

Loading...

Insitro's Products & Differentiators

Statistical genetics

ML-enabled statistical genetics to discover targets and patient segments

Loading...

Research containing Insitro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Insitro in 4 CB Insights research briefs, most recently on Jul 14, 2023.

Expert Collections containing Insitro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Insitro is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

AI 100

200 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,329 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Drug Discovery Tech Market Map

221 items

This CB Insights Tech Market Map highlights 220 drug discovery companies that are addressing 12 distinct technology priorities that pharmaceutical companies face.

Artificial Intelligence

7,222 items

Insitro Patents

Insitro has filed 21 patents.

The 3 most popular patent topics include:

- biotechnology

- molecular biology

- bioinformatics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/11/2023 | 7/23/2024 | Transcription factors, Stem cells, Developmental biology, Induced stem cells, Biotechnology | Grant |

Application Date | 8/11/2023 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Transcription factors, Stem cells, Developmental biology, Induced stem cells, Biotechnology |

Status | Grant |

Latest Insitro News

Feb 10, 2025

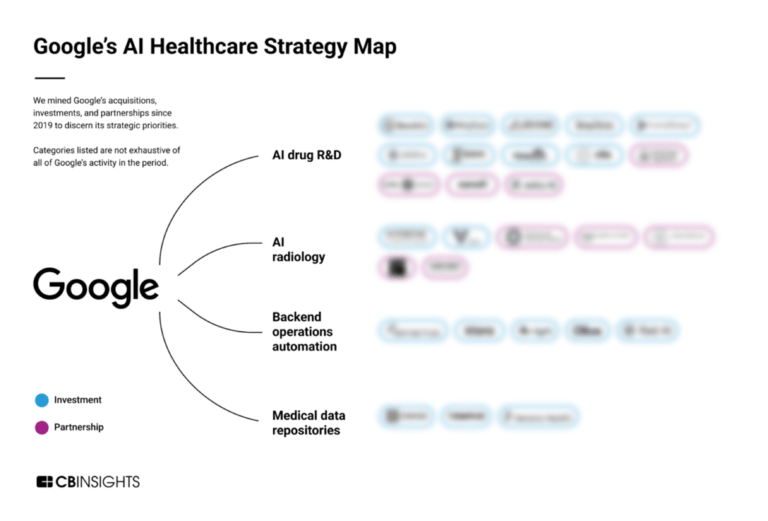

Share The use of artificial intelligence (AI) is burgeoning in the drug discovery space as pharma and biotech companies battle to reduce research costs. These five AI players aim to crack the code. Computing speeds have exponentially improved over the past few decades and labs worldwide are increasingly equipped with tools such as DNA sequencing and genetic engineering. Conversely, the years-long drug development process is becoming slower and more expensive as financial risks grow, the standard of care improves, and regulations become tighter. AI has swept through the industry as excitement builds around its potential to predict which drug compounds are most likely to fail and succeed. Much of this excitement involves growing numbers of pharmaceutical companies harnessing third-party AI and cloud computing collaborations to guide drug development. This demand is expected to drive growth in the global market for AI in drug discovery, from $3.5 billion in 2023 to $7.9 billion by 2030, reflecting an annual growth rate of 12.2%. Many tech giants, including Microsoft, IBM, and Alphabet, are helping clients employ AI for a multitude of drug development applications. But other drug discovery-focused AI companies are now emerging into the limelight as their offerings and pipelines begin to mature. See below for our take on the top AI companies, both private and public, to keep an eye on in the coming years. Market cap: $758 million BioAge Labs aspires to extend the duration for which people stay healthy as they age, known as the human healthspan. To achieve this, the company is researching molecular pathways that contribute to aging with the help of a systems biology- and AI-driven platform. The platform collects and harnesses molecular and clinical data from thousands of patients with more than 50 years of follow up. BioAge’s lead candidate for obesity treatment, azelaprag, showed promising efficacy and safety in a Phase Ib trial before moving to a Phase II trial last year. The Phase II trial, the results of which are expected this year, is part of a collaboration with Eli Lilly to speed up weight loss by combining azelaprag with Lilly’s tirzepatide (Mounjaro/Zepbound). BioAge’s second small molecule, an inflammasome inhibitor, is designed to clamp down on diseases caused by neuroinflammation and is in preparations to enter clinical testing. To finance the development of its pipeline, BioAge secured $170 million in a Series D funding round earlier this year, led by Sofinnova Investments. The firm quickly followed up with an initial public offering on the NASDAQ Global Select Market and private placement, bagging a grand total of $238.3 million. Since then, the stock price has been buoyed by booming industry interests in obesity treatments. BioAge expects a cash runway all the way up to 2029. Total funding raised: $643 million insitro was set up by the co-founder and co-CEO of the online course company Coursera with the aim of addressing the huge complexity of human biology and “abysmally low” success rate of therapeutic R&D. To do this, the company blends clinical, genomic, and cellular data generated from automated labs. It then feeds the data into its machine learning and generative AI tools to model diseases and identify treatment options with custom-designed drug molecules. Some of insitro’s big pharma partners are Bristol Myers Squibb, which sealed a $2.1 billion deal to discover treatments for neurodegenerative conditions in 2020, and Eli Lilly, which established multiple agreements last year to co-develop metabolic disease treatments based on targets identified by insitro’s AI platform. Although the company is not yet public, its estimated valuation is around $2.4 billion. The company acquired the AI-fuelled drug discovery firm Haystack Sciences in 2020 to snap up the latter’s vast chemical libraries encoded by DNA. Insitro also bagged $400 million in a Series C round in 2021 led by the Canada Pension Plan Investment Board. Another program in insitro’s pipeline involves analyzing histopathology images with AI to profile solid tumors, develop novel biomarkers, and predict the most effective treatments for patients. Market cap: $2 billion A self-proclaimed “techbio” company, Recursion was set up to change the way drug compounds are conceived. The company aims to move from a reductionist and hypothesis-driven outlook to a less biased approach that blends multiple disciplines across tech and biology. Recursion’s eponymous operating system platform is designed to cause biological and chemical “perturbations” to a digital molecule and use deep learning to tease out the relationship between parts of the molecule. The company’s most advanced pipeline program is a small molecule treatment for the rare disease cerebral cavernous malformation (CCM) that can lead to seizures, headaches, progressive neurological deficits, and potentially deadly internal bleeds. The candidate blazed through a Phase II trial last year and the company plans to discuss its next steps with the U.S. FDA. To finance its progress, Recursion bagged $239 million in an oversubscribed Series D financing round in 2020, led by Bayer’s impact investment arm Leaps by Bayer. This was followed by an impressive $501.8 million initial public offering as it debuted on the NASDAQ in 2021, with an additional $200 million public offering this year. Recursion has been on an acquisition spree in the last few years, absorbing the Canadian firms Cyclica and Valence in 2023 to access their digital chemistry and deep learning know-how.In 2024, Recursion followed up by acquiring its AI-based drug discovery peer Exscientia in a $688 million deal that is due to close this year. Market cap: $11.4 billion Tempus AI was established after the founder’s wife was diagnosed with breast cancer, with a mission to deploy technology and AI to enhance cancer care. The company later branched out to provide services in other therapeutic areas like disorders of the central nervous system and cardiology. Tempus’ tools are designed to support the discovery and 0development of novel drugs in addition to helping clients provide personalized patient care by identifying optimal treatment options. These tools are based on collecting, structuring, and analyzing vast amounts of real-world clinical and molecular data, and crafting AI-based algorithms to guide drug development. Large pharma and biotech companies flocking to Tempus for drug discovery assistance include GSK, which sealed an agreement in 2022, and BioNTech, which teamed up with Tempus this year to support its drug discovery efforts with multimodal data that could shed light on biological mechanisms in oncology. Tempus raised over $1.4 billion in private funding rounds, followed by an initial public offering on the NASDAQ worth $410.7 million last year. The company’s 2023 revenue stood at $531.8 million, up from $320.7 million in 2022. Tempus also acquired the cancer screening firm Ambry Genetics for $600 million last year to access the latter’s genetic testing expertise and expand its services into new therapeutic areas. Market cap: HKD 22.7 billion ($2.9 billion) Also known as QuantumPharm, XtalPi was founded by three physicists from the Massachusetts Institute of Technology (MIT) and has many of its research operations in China. The company blends quantum physics, AI, computational chemistry, and automated laboratory processes to assist the R&D efforts of clients across multiple industries, including pharmaceuticals. XtalPi’s Inclusive Digital Drug Discovery and Development (ID4) platform uses AI and physics-based algorithms to predict the properties of small molecules to deliver new candidates faster and with more diversity than current drug discovery methods. The firm’s recent Ailux division also predicts protein structures to improve the design of new biologic drugs. XtalPi raised more than $700 million across multiple private financing rounds, including a $400 million Series D round led by OrbiMed and RRJ Capital in 2021. The firm went public last year, bagging $126.8 million in an initial public offering on the Hong Kong Stock Exchange. XtalPi launched strategic collaborations with big pharma firms like Pfizer in 2018, Johnson & Johnson in 2022, and Eli Lilly in a $250 million pact in 2023. The firm’s revenue grew from 133.4 million yuan ($19 million) in 2022 to 174.4 million yuan ($24 million) in 2023, though the company currently considers itself pre-commercial. Jonathan Smith is a freelance science journalist based in the U.K. and Spain. He previously worked in Berlin as reporter and news editor at Labiotech, a website covering the biotech industry. Prior to this, he completed a PhD in behavioral neurobiology at the University of Leicester and freelanced for the U.K. organizations Research Media and Society of Experimental Biology. He has also written for medwireNews, Biopharma Reporter, and Outsourcing Pharma.

Insitro Frequently Asked Questions (FAQ)

When was Insitro founded?

Insitro was founded in 2018.

Where is Insitro's headquarters?

Insitro's headquarters is located at 279 East Grand Avenue, South San Francisco.

What is Insitro's latest funding round?

Insitro's latest funding round is Series C.

How much did Insitro raise?

Insitro raised a total of $643M.

Who are the investors of Insitro?

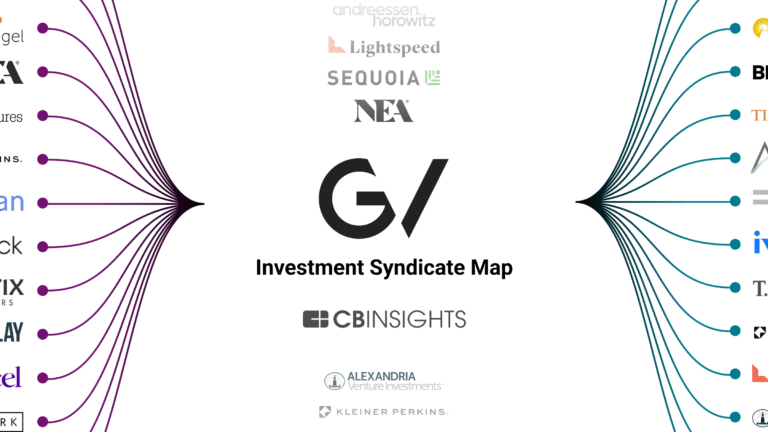

Investors of Insitro include ARCH Venture Partners, Foresite Capital, Third Rock Ventures, Two Sigma Ventures, Andreessen Horowitz and 15 more.

Who are Insitro's competitors?

Competitors of Insitro include BioSymetrics, Exscientia, Turbine, Noetik, Healx and 7 more.

What products does Insitro offer?

Insitro's products include Statistical genetics and 2 more.

Loading...

Compare Insitro to Competitors

Atomwise develops machine learning-based discovery engines and uses artificial intelligence (AI)-based neural networks to help discover new medicines. It predicts drug candidates for pharmaceutical companies, start-ups, and research institutions and designs drugs using computational drug design. It was formerly known as Chematria. The company was founded in 2012 and is based in San Francisco, California.

Healx is a technology company focused on artificial intelligence (AI) drug discovery for rare disease treatment within the pharmaceutical industry. The company specializes in using AI to identify drug-disease relationships and accelerate the development of new therapies for rare conditions. Healx's approach aims to increase the scale and success rate of rare disease treatment development by repurposing known compounds and running multiple drug discovery programs in parallel. Healx was formerly known as Healx3. It was founded in 2014 and is based in Cambridge, United Kingdom.

Aria Pharmaceuticals operates as a preclinical-stage pharmaceutical company that focuses on the discovery and development of novel, small-molecule therapies in the pharmaceutical industry. The company's main service is the development of new treatments for complex and hard-to-treat diseases using its proprietary symphony platform, which combines biomedical data and artificial intelligence to increase the success rates of drug discovery. Aria Pharmaceuticals primarily serves the healthcare sector, specifically targeting areas where new therapies are most needed. It was founded in 2014 and is based in Palo Alto, California.

Standigm specializes in AI-driven drug discovery within the pharmaceutical industry. The company provides services, including target identification, lead generation, and optimization, as well as AI SaaS solutions for drug development. Standigm primarily serves sectors engaged in pharmaceutical research and drug development. It was founded in 2015 and is based in Seoul, South Korea.

Aitia focuses on the development and application of Causal AI and Digital Twins in the pharmaceutical industry. The company's main services include the discovery of drugs for neurodegenerative disorders, oncology, and immunology by revealing hidden biological mechanisms of diseases and creating Digital Twins. It is used to discover novel therapies and accelerate research and development in various diseases such as Alzheimer’s Disease, Parkinson’s Disease, Huntington’s Disease, multiple myeloma, prostate cancer, and pancreatic cancer. It was founded in 2000 and is based in Cambridge, Massachusetts.

Insilico Medicine is a biotechnology company that focuses on artificial intelligence in drug discovery and development. The company provides AI platforms for multi-omics target discovery, deep biology analysis, automated drug design, and predicting outcomes in clinical trials. The technologies are intended to assist in the process of discovering and developing new medications for various diseases. It was founded in 2014 and is based in Pudong, China.

Loading...