Investments

1211Portfolio Exits

252Funds

32Partners & Customers

9Service Providers

1About Index Ventures

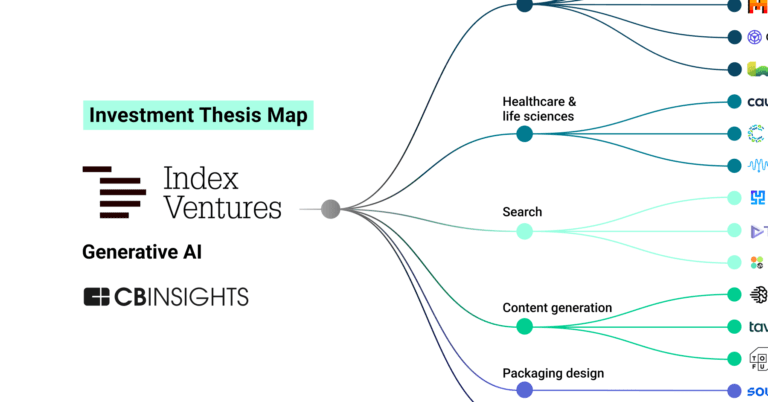

Index Ventures operates as a global venture capital firm. It invests in the commercial services, media, retail, and information technology sectors. It was founded in 1996 and is based in London, United Kingdom.

Expert Collections containing Index Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Index Ventures in 8 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

CB Insights Smart Money Investors

25 items

Research containing Index Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Index Ventures in 8 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Feb 27, 2024

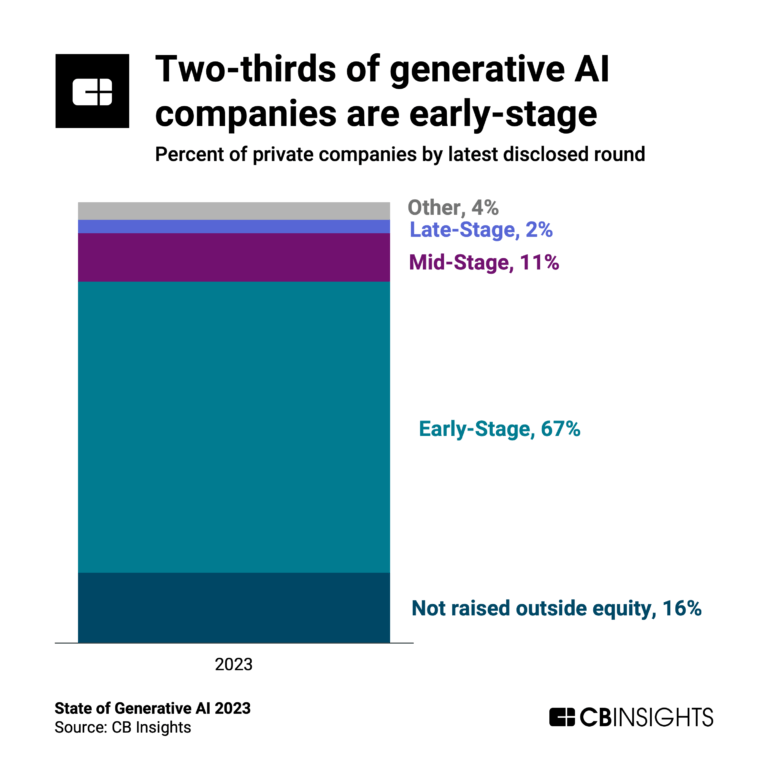

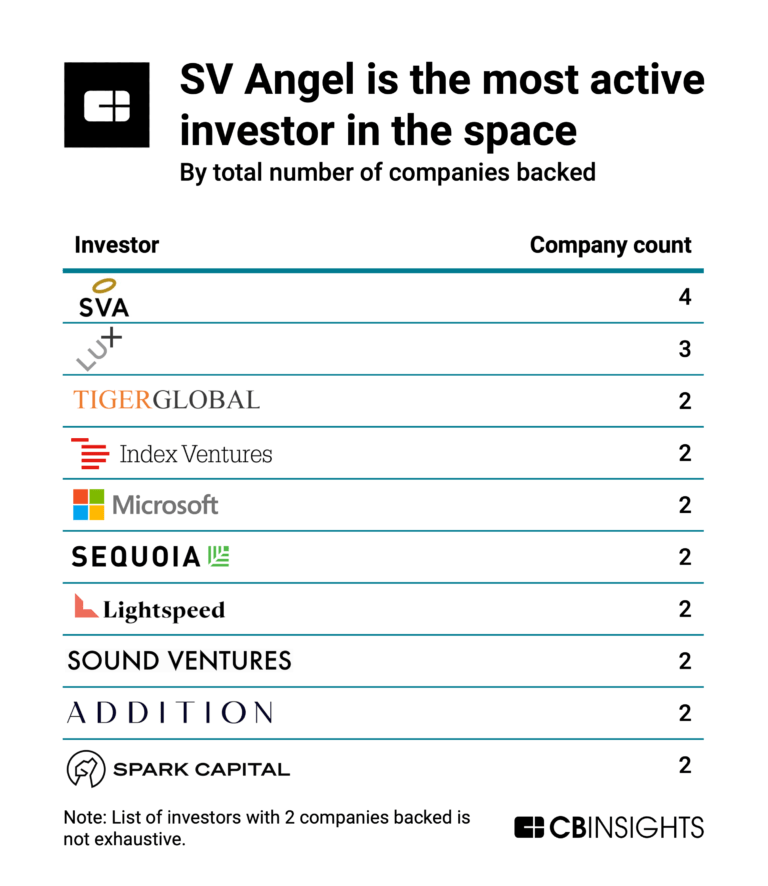

The generative AI boom in 6 charts

Jul 14, 2023

The state of LLM developers in 6 charts

Latest Index Ventures News

Jan 26, 2025

Next-generation monetization platform HYPERLINE announced it has raised $10 million in a seed extension round led by Index Ventures to help small and medium-sized businesses transform revenue management. The subscription economy has changed significantly as businesses adopt hybrid revenue models to create diversified income. And pricing and billing have become complex for modern companies. This trend towards more flexible pricing models clashed with the status quo in billing software. This has created a new market opportunity for Hyperline to step in with a new kind of platform, providing the simplicity buyers now expect. Scaling a business demands a strategic pricing approach, precise customer intent anticipation, and frictionless payments. Their customers lack flexibility on pricing models and have to work around outdated integrations and struggle to ensure data consistency across teams. Achieving this now depends on a billing platform that delivers effortless pricing, seamless workflows, powerful automation, and a comprehensive ecosystem of integrations. With this seed investment, Hyperline can now scale distribution to respond to millions more businesses and help them manage the entire revenue process with a single, automated platform. Hyperline has seen early product market fit by delivering an end-to-end monetization solution that covers everything from contracts and quotes through to invoicing, subscriptions, payments reconciliation, and analytics while providing unlimited flexibility on pricing. This enables businesses to effortlessly manage established models while adopting significant trends such as AI features, usage-based models, and outcome-based pricing. Hyperline’s success is driven by its exceptional product quality and swift implementation process. Even though competitors often require months for integration, Hyperline consistently onboard new customers within a week, transforming a complex and time-consuming process into a smooth and hassle-free experience. This funding round brings Hyperline’s total seed funding led by Index Ventures, followed by Adelie Capital, to over $14 million. And the company received its first tranche of seed investment ($4.4 million) in June 2023. In the 18 months since, the company’s client base has expanded by over 20 times, from a handful of early adopters to more than 150 small and medium-sized software and technology businesses, such as Infinit, Veesion, Gladia, Qobra, Ocus, and ScorePlay. The company now serves customers generating up to $100m ARR, offering compatibility with every currency and business model and the ability to bill customers worldwide. Hyperline was launched in Paris in 2022 by Lucas Bédout and Clément Garbay, who previously worked together as VP of Engineering and Engineering Manager at Spendesk. At Spendesk, they witnessed firsthand the challenges and frustrations of integrating a billing system for a fast-growing SaaS company with complex pricing structures. At Hyperline, they have built a senior, seasoned team that includes fintech, engineering, and invoicing industry experts from companies including Pigment, Payhawk, and Payfit. KEY QUOTES: “The market is crying out for a new kind of monetization platform. Our team and product are in place and the feedback from customers is beyond expectations, so we’re excited to scale our distribution engine and extend our reach beyond the early adopters. Demand for a more flexible, automated revenue management solution is growing fast – especially as people realize the gains of our platform within just a few weeks.” Lucas Bédout, CEO of Hyperline “As a customer for 18 months, I’ve watched Hyperline evolve, and its value proposition has only grown stronger. Hyperline has a very short integration process and succeeded in removing the billing burden I experienced in my previous experiences. It was an obvious decision for us – one of my best decisions as a founder.” Jean-Louis Quéguiner, Founder of Gladia and Hyperline “Lucas is a special founder who is building Hyperline with an infectious sense of urgency and ambition. Together with Clément, he has formed a world-class team of fintech specialists whose combined track record of building products for small and medium businesses speaks for itself. This team is moving fast and responding to a real pain point faced everyday by these businesses. We’re excited to support them as they dig deeper into the market opportunity where the transaction volumes are in the trillions and growing.” Julia Andre, Partner at Index Ventures Pulse 2.0 focuses on business news, profiles, and deal flow coverage.

Index Ventures Investments

1,211 Investments

Index Ventures has made 1,211 investments. Their latest investment was in Instabase as part of their Series D on January 17, 2025.

Index Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

1/17/2025 | Series D | Instabase | $100M | No | 4 | |

1/16/2025 | Seed VC - II | Hyperline | $10M | No | 5 | |

1/15/2025 | Series A | Nexos.ai | $8M | Yes | Avishai Abrahami, Creandum, Dig Ventures, Ilkka Paananen, Olivier Pomel, Sebastian Siemiatkowski, and Undisclosed Angel Investors | 2 |

12/12/2024 | Series B | |||||

12/12/2024 | Series A |

Date | 1/17/2025 | 1/16/2025 | 1/15/2025 | 12/12/2024 | 12/12/2024 |

|---|---|---|---|---|---|

Round | Series D | Seed VC - II | Series A | Series B | Series A |

Company | Instabase | Hyperline | Nexos.ai | ||

Amount | $100M | $10M | $8M | ||

New? | No | No | Yes | ||

Co-Investors | Avishai Abrahami, Creandum, Dig Ventures, Ilkka Paananen, Olivier Pomel, Sebastian Siemiatkowski, and Undisclosed Angel Investors | ||||

Sources | 4 | 5 | 2 |

Index Ventures Portfolio Exits

252 Portfolio Exits

Index Ventures has 252 portfolio exits. Their latest portfolio exit was ServiceTitan on December 12, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

12/12/2024 | IPO | Public | 7 | ||

11/21/2024 | Acquired | 3 | |||

11/5/2024 | Merger | 4 | |||

Date | 12/12/2024 | 11/21/2024 | 11/5/2024 | ||

|---|---|---|---|---|---|

Exit | IPO | Acquired | Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 7 | 3 | 4 |

Index Ventures Acquisitions

1 Acquisition

Index Ventures acquired 1 company. Their latest acquisition was Dubsmash on April 15, 2019.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

4/15/2019 | Seed / Angel | $22.25M | Acq - Fin | 2 |

Date | 4/15/2019 |

|---|---|

Investment Stage | Seed / Angel |

Companies | |

Valuation | |

Total Funding | $22.25M |

Note | Acq - Fin |

Sources | 2 |

Index Ventures Fund History

32 Fund Histories

Index Ventures has 32 funds, including Index Origin.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/26/2021 | Index Origin | $200M | 3 | ||

7/26/2021 | Index Ventures Growth VI | $2,000M | 1 | ||

7/26/2021 | Index Ventures XI | $900M | 1 | ||

5/19/2020 | Index Ventures X (Jersey) | ||||

5/19/2020 | Index Ventures Growth V (Jersey) |

Closing Date | 7/26/2021 | 7/26/2021 | 7/26/2021 | 5/19/2020 | 5/19/2020 |

|---|---|---|---|---|---|

Fund | Index Origin | Index Ventures Growth VI | Index Ventures XI | Index Ventures X (Jersey) | Index Ventures Growth V (Jersey) |

Fund Type | |||||

Status | |||||

Amount | $200M | $2,000M | $900M | ||

Sources | 3 | 1 | 1 |

Index Ventures Partners & Customers

9 Partners and customers

Index Ventures has 9 strategic partners and customers. Index Ventures recently partnered with Latham & Watkins on September 9, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

9/26/2022 | Vendor | United States | 1 | ||

6/9/2022 | Vendor | ||||

4/26/2017 | Partner | ||||

1/9/2014 | Partner | ||||

1/9/2014 | Vendor |

Date | 9/26/2022 | 6/9/2022 | 4/26/2017 | 1/9/2014 | 1/9/2014 |

|---|---|---|---|---|---|

Type | Vendor | Vendor | Partner | Partner | Vendor |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 1 |

Index Ventures Service Providers

1 Service Provider

Index Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Index Ventures Team

17 Team Members

Index Ventures has 17 team members, including current Founder, General Partner, Neil Rimer.

Name | Work History | Title | Status |

|---|---|---|---|

Neil Rimer | Founder, General Partner | Current | |

Name | Neil Rimer | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, General Partner | ||||

Status | Current |

Compare Index Ventures to Competitors

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm operating across sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

General Catalyst works as a venture capital firm focused on early-stage and transformational investments within the technology and market-leading business sectors. The firm supports exceptional entrepreneurs building innovative technology companies, offering funding and strategic guidance to help them grow. General Catalyst primarily sells to sectors such as fintech, health assurance, consumer, and enterprise industries. It was founded in 2000 and is based in San Francisco, California.

Loading...