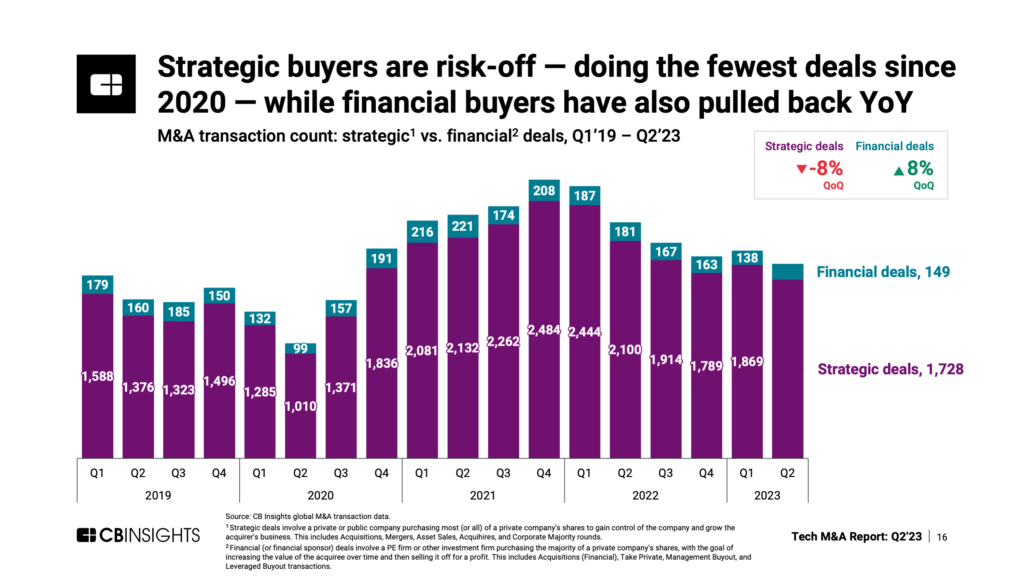

Strategic tech M&A deals have tumbled by 30% since peaking in Q4’21. However, acquisitions by strategic buyers still account for more than 90% of M&A transaction activity.

Corporations scooped up a record-breaking 2,484 tech companies in a single quarter during the height of the pandemic-driven tech boom, but transaction activity has fallen 30% from this high seen less than 2 years ago.

The CB Insights Tech M&A Q2’23 Report highlights that the number of M&A transactions by corporations has eroded in the quarters since — hitting just 1,728 in Q2’23 as economic uncertainty and rising interest rates have driven corporations to become firmly risk-off when it comes to tech M&A.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from valuation per employee to cross-border M&A activity — in our full Tech M&A Q2’23 Report.

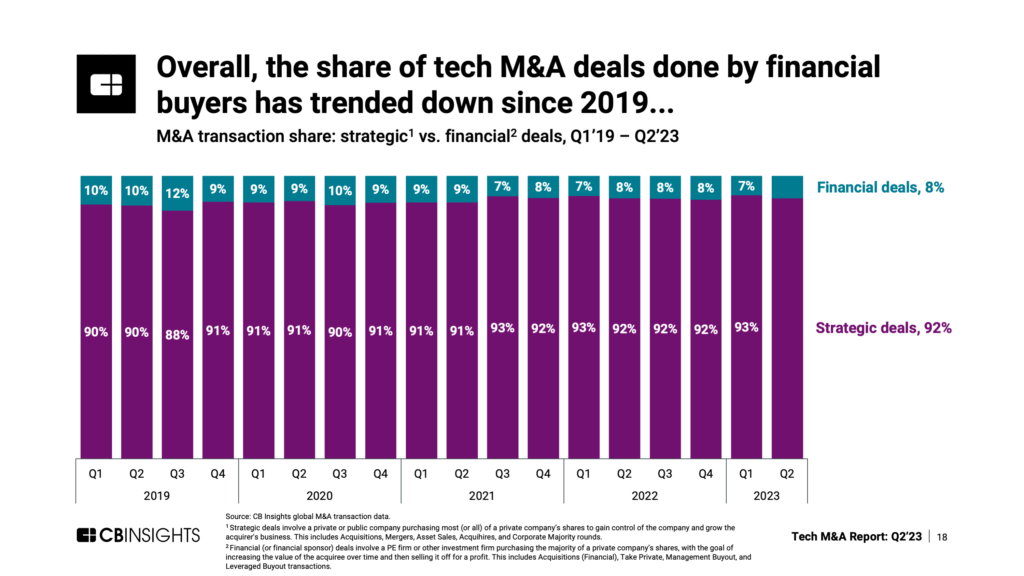

Despite the overall decline, the proportion of tech M&A deals done by strategic buyers vs. financial sponsors (private equity) has actually climbed since 2019. In Q2’23, 92% of all tech M&A transactions were done by strategic buyers.

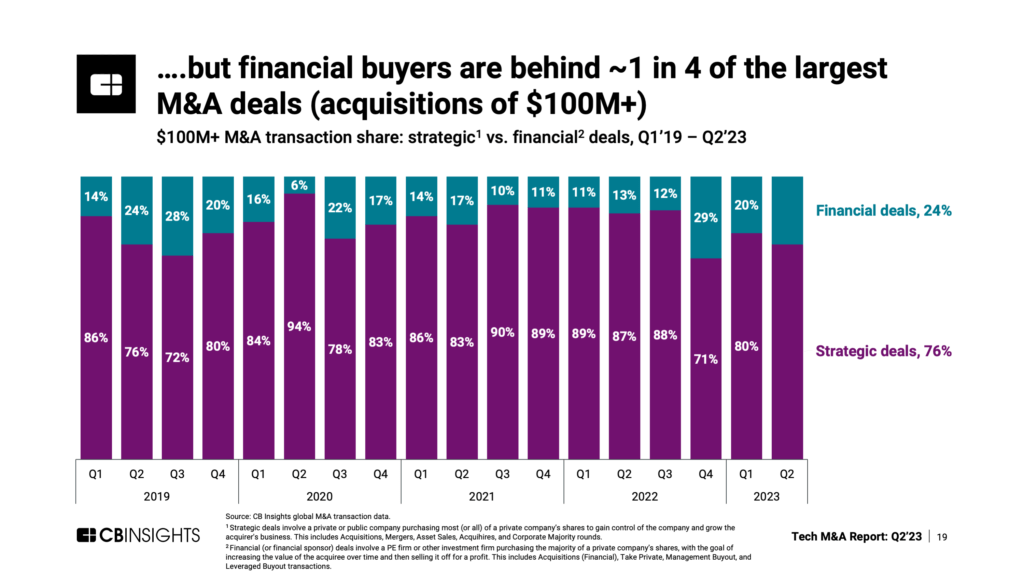

However, while strategic buyers comprise a growing share of total M&A activity, financial sponsors are behind nearly 1 in 4 tech M&A deals worth $100M+.

To dig into financial sponsor and strategic M&A trends and data, download the entire Tech M&A Q2’23 Report.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.