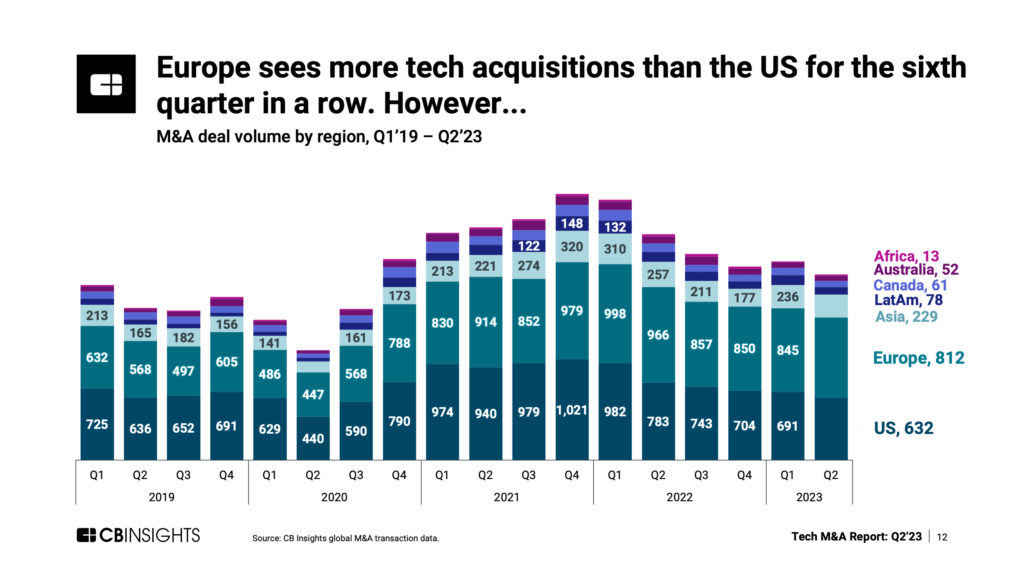

Europe has led global tech M&A since surpassing the US in Q1’22. However, the US is still the undisputed champion of M&A deals worth $100M+.

Europe’s tech market saw 812 M&A deals in Q2’23 — more than any other region globally for the sixth straight quarter, per the CB Insights Tech M&A Q2’23 Report.

While the continent’s M&A deal volume ticked down 4% quarter-over-quarter (QoQ) in Q2’23, it remains elevated compared to pre-2021 levels. For comparison, tech M&A volume in the US has slumped to levels not seen since 2020’s Covid lockdowns.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from valuation per employee to cross-border M&A activity — in our full Tech M&A Q2’23 Report.

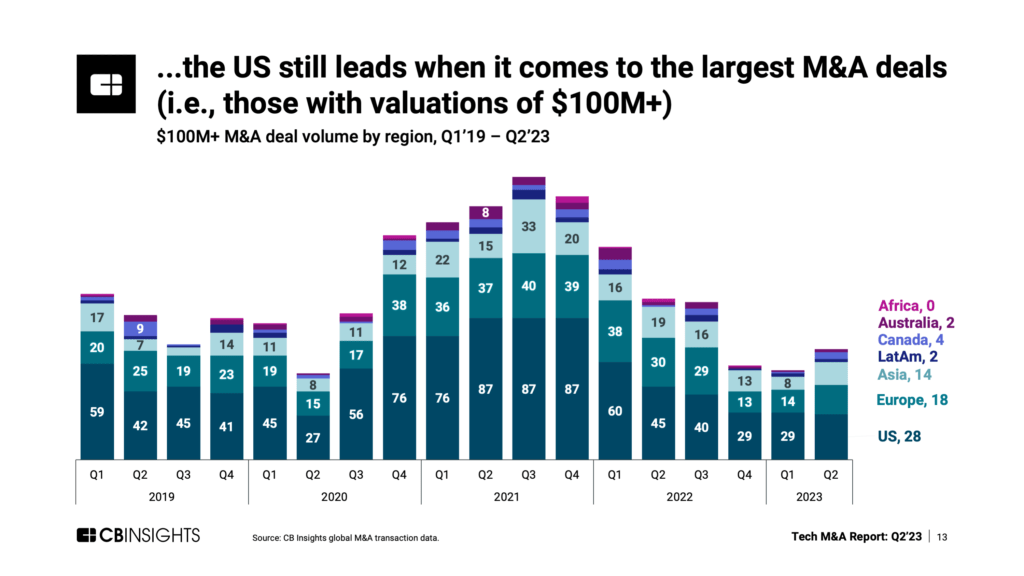

Although Europe holds the top spot across all tech M&A, the US is home to the largest proportion of M&A deals with disclosed valuations of $100M or more. In Q2’23, it saw 28 $100M+ deals, compared to 18 in Europe.

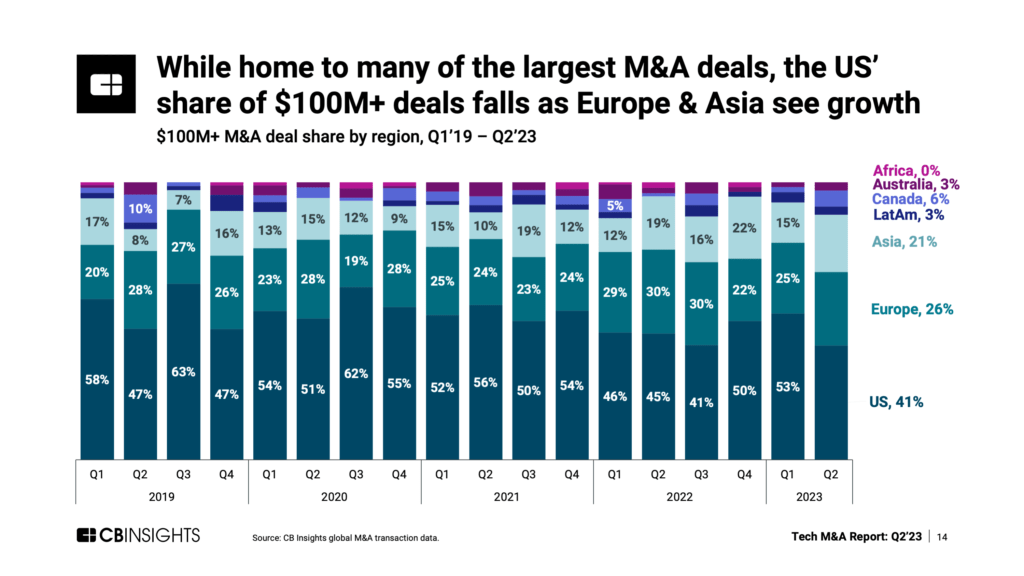

However, its share of these deals shrunk 12 percentage points QoQ in Q2’23, falling to 41%. This sits below historical levels, which typically range from 45% to 60%.

As the US’ share declined, Europe and Asia each saw growth QoQ. Notably, Asia’s share of $100M+ M&A deals reached 21% — the second-highest quarterly level since 2019.

To dig into more global tech M&A trends, including M&A data across buyer types and deal sizes, download the entire Tech M&A Q2’23 Report here.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.