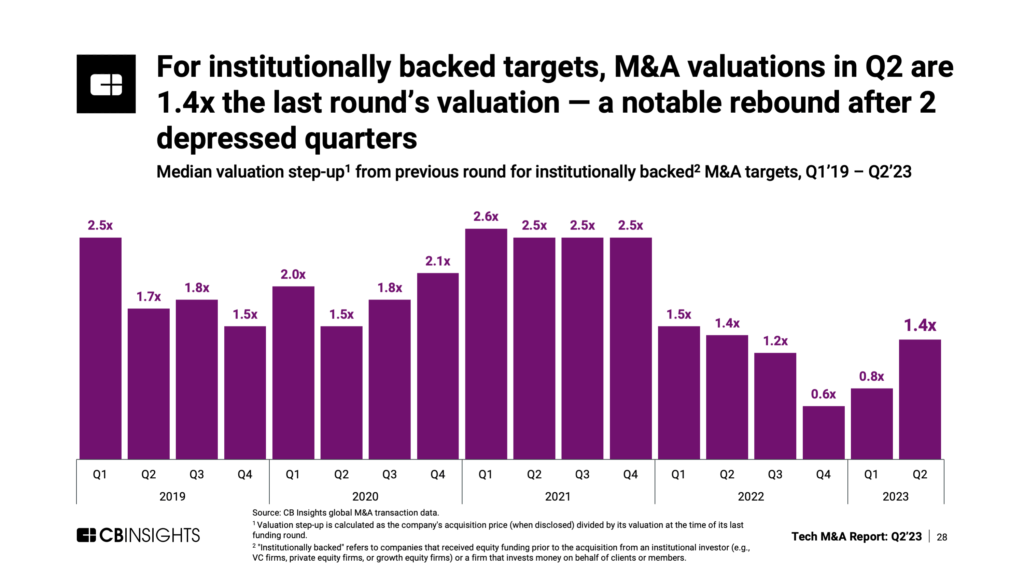

After 2 quarters in the red, institutionally backed M&A targets are now exiting at stronger prices than their previous valuations.

Institutional investors like VCs and PE firms hope their portfolio companies will not only reach an exit but also appreciate in value along the way. However, that’s not a given.

After the boom times of 2021 and early 2022, valuations had a long way to fall when the market turned sour. By Q4’22, the median M&A valuation for institutionally backed companies was just 0.6x the valuation of their previous round. This rebounded slightly in Q1’23 to 0.8x — still a discount vs. the prior round and a potential loss for any later-stage investors.

Institutional investors likely breathed a sigh of relief in Q2’23, when M&A targets saw a median valuation step-up of 1.4x over their previous round, according to the CB Insights Tech M&A Q2’23 Report.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from global M&A deal volume to big tech buying trends — in our full Tech M&A Q2’23 Report.

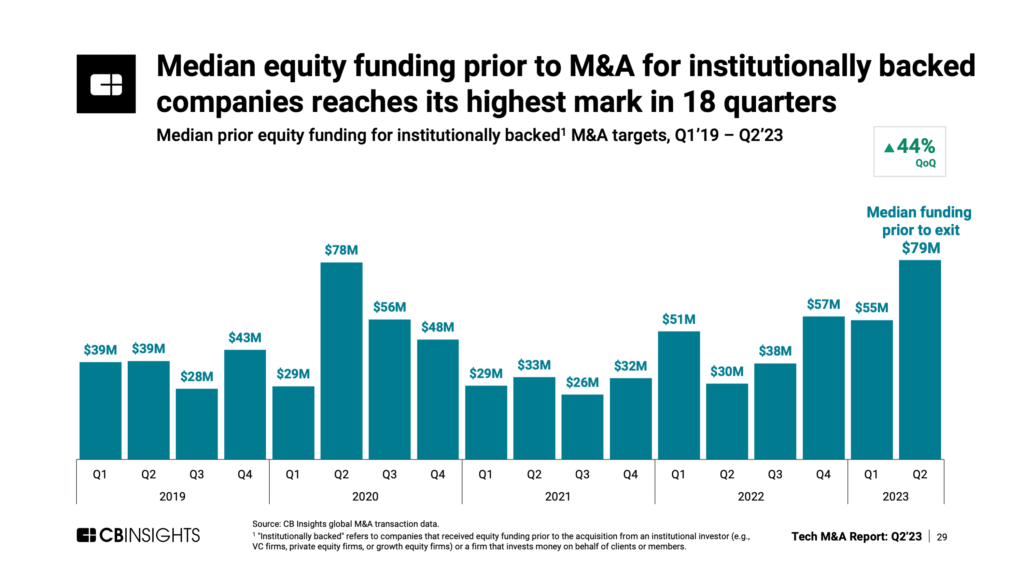

Meanwhile, the amount of equity funding that institutionally backed companies raised prior to M&A grew 44% quarter-over-quarter to reach $79M in Q2’23 — its highest level in over 4 years.

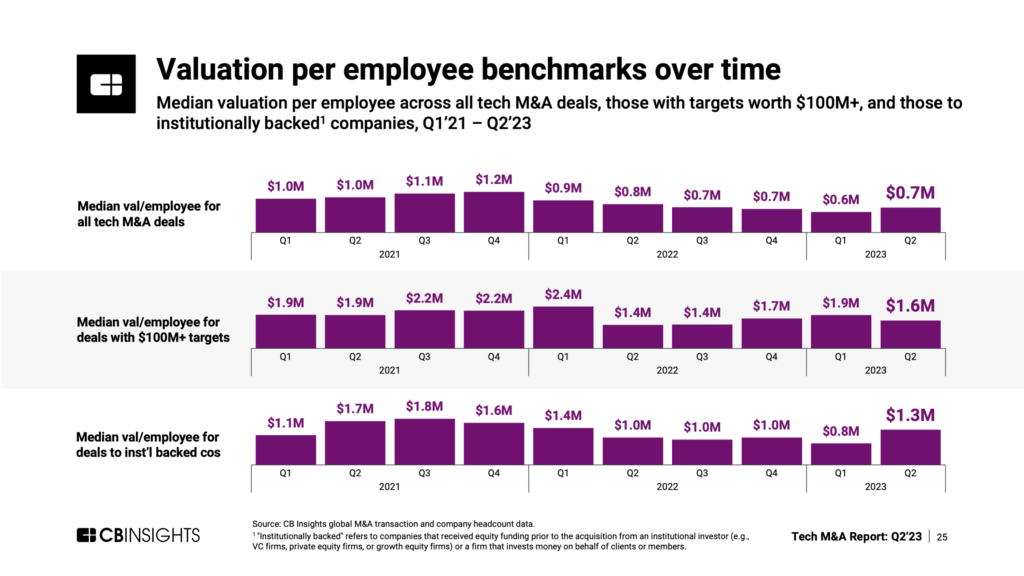

Further, the valuation per employee for institutionally backed M&A targets is increasing.

After trending down for 6 consecutive quarters, the median valuation per employee surged to $1.3M in Q2’23 — another positive shift for these targets’ prior institutional investors.

To dig into more global tech M&A trends, including a breakdown of strategic vs. financial buyers, download the entire Tech M&A Q2’23 Report here.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.