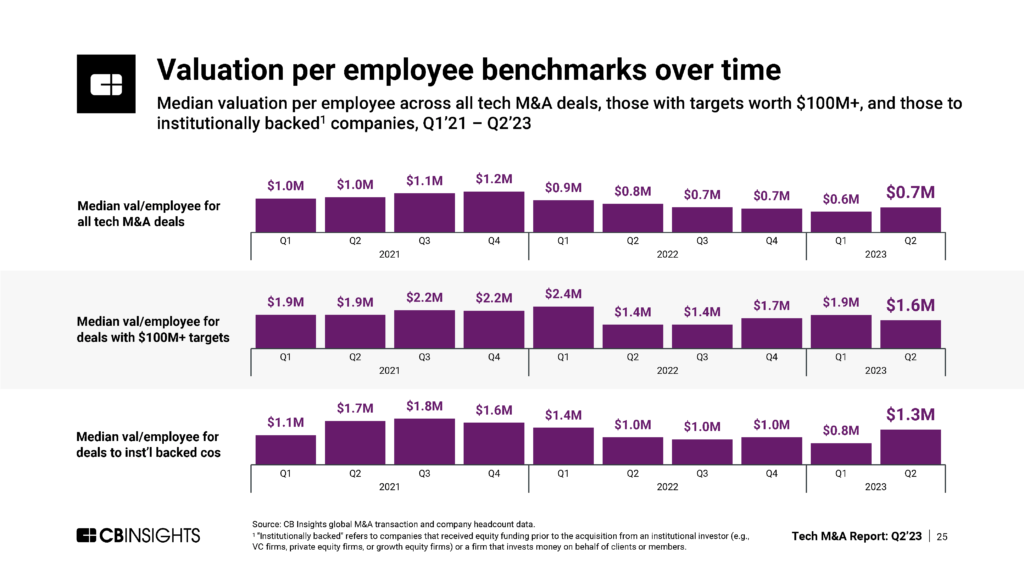

After an extended drop, buyers started to pay more per employee in tech M&A deals in Q2’23. However, they are still paying significantly less than they did in 2021.

During the boom times of 2021, the median value of tech M&A deals soared to the point that buyers were paying $1M+ for each employee at the target company.

However, the median valuation per employee for tech M&A deals started to fall as the sector watched private-market valuations deflate across stages. That figure eventually bottomed out at just under $600K in Q1’23.

Notably, in Q2’23, it rose for the first time since Q4’21 — jumping by around $120K quarter-over-quarter (QoQ) to surpass $700K, per the CB Insights Tech M&A Q2’23 Report.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from big tech dealmaking to cross-border M&A activity — in our full Tech M&A Q2’23 Report.

A similar trend played out in Q2’23 for institutionally backed M&A target companies (those that received equity funding prior to the acquisition from an institutional investor like a VC firm). These targets garnered $1.3M per employee last quarter — up 63% QoQ.

However, target companies acquired for $100M+ have had a different experience. The cost per employee for these companies actually dropped in Q2’23 after trending up for several quarters.

Regardless of how you slice it, median valuations per employee are down from their peaks in 2021 and early 2022, reflecting today’s more conservative and sober buying environment.

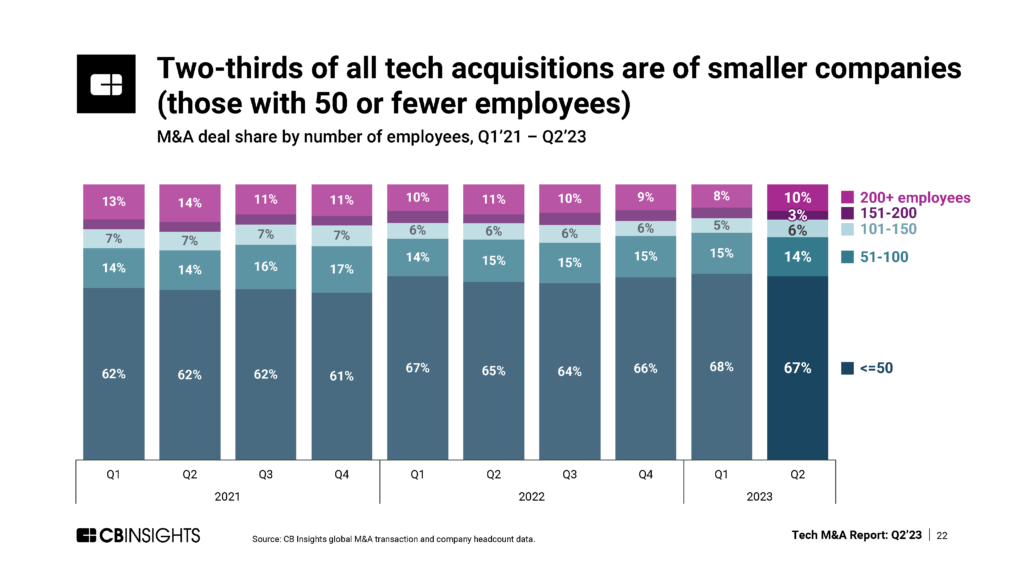

Compared to 2021, tech buyers have also been targeting companies with fewer employees. In Q2’23, 67% of tech M&A deals were of companies with 50 or fewer employees — up from the average of 62% across 2021.

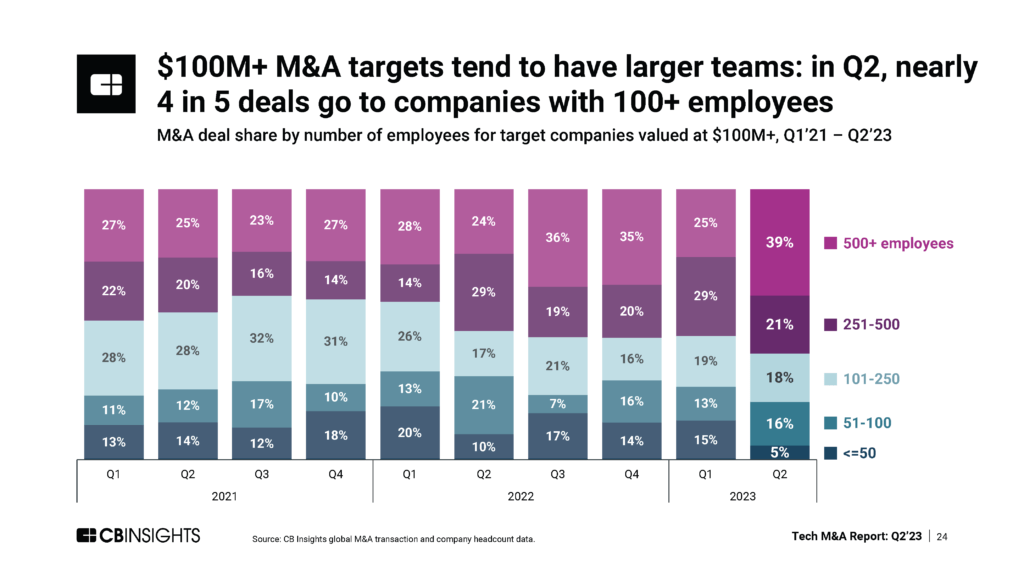

Meanwhile, while they are involved in far fewer M&A deals, companies with over 100 employees consistently serve as the most valuable M&A targets (those worth $100M+).

These companies have accounted for at least two-thirds of $100M+ M&A deals since Q1’21 — with this share reaching a recent high of 78% in Q2’23.

To dig into more global tech M&A trends, including a breakdown of strategic vs. financial buyer trends, download the entire Tech M&A Q2’23 Report here.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.