Walmart’s divestment of the D2C brand cements the retailer’s priorities in B2B tech.

Walmart is out of the direct-to-consumer business.

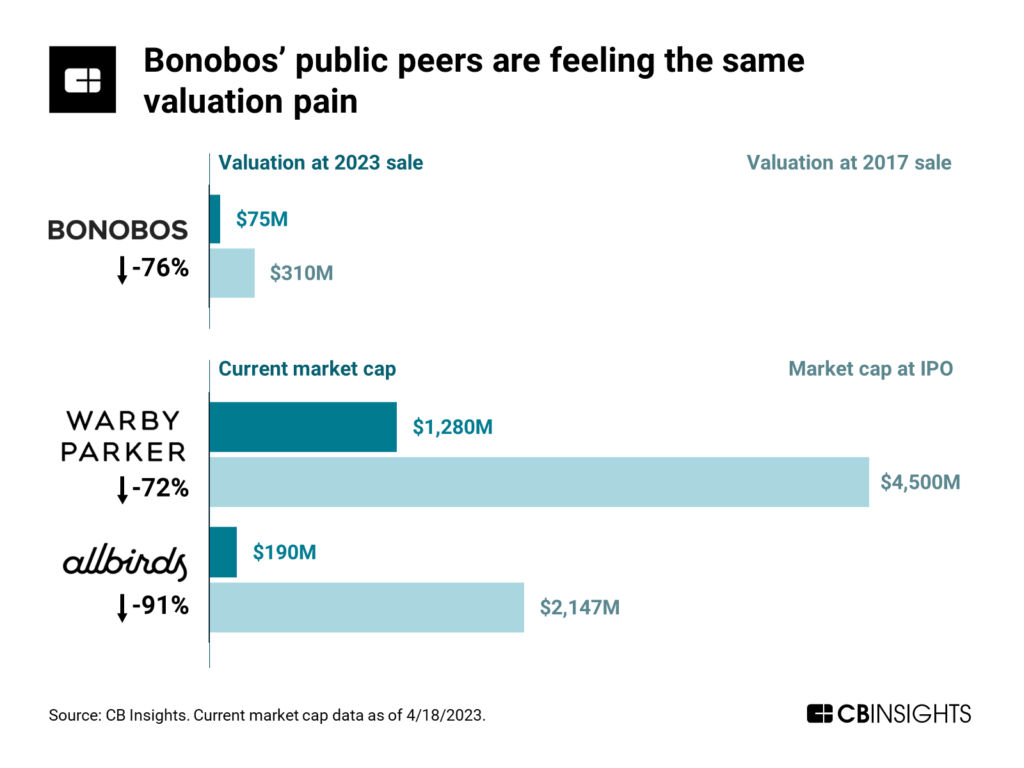

Last week, the retail giant sold Bonobos for $75M, a 76% markdown from the $310M Walmart paid for the men’s fashion brand in 2017.

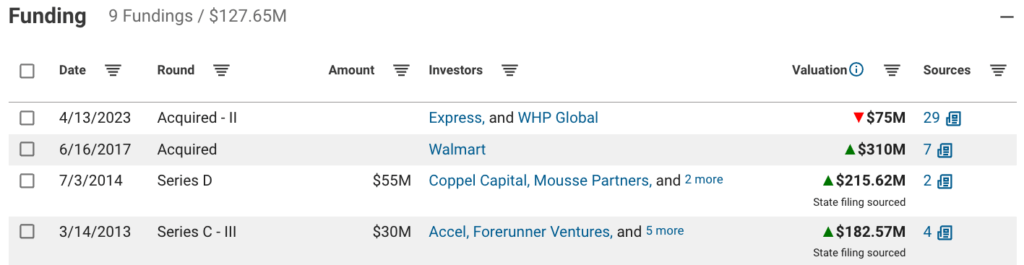

Track Bonobos’ funding and valuation history on its profile on the CB Insights platform.

The divestment marks the end of an era for Walmart.

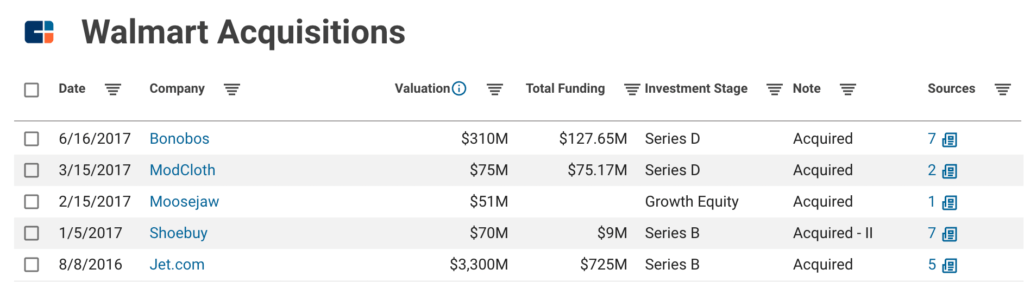

Bonobos was the last company standing from a series of 5 e-commerce acquisitions that Walmart made from late 2016 to mid-2017 as it overhauled its online operations and business.

See all of Walmart’s M&A activity on its profile on the CB Insights platform.

At the time, Walmart said that, by acquiring these online category specialists and digitally native brands, it would gain expertise in online commerce as well as the products themselves.

Then, starting in 2019, the retailer sold them all off.

Financial terms were not disclosed for the sales of ModCloth, Shoes.com (the domain Shoebuy took on in 2017), and Moosejaw, which Dick’s Sporting Goods just bought in February 2023. Meanwhile, Walmart wound down Jet.com in 2020. (Walmart has also shed 2 of its 2018 online brand acquisitions: It sold Bare Necessities in August 2020 and ELOQUII in April 2023.)

For Bonobos, its reduced price reflects broader valuation pain sweeping across the private and public markets.

For instance, the market caps for Allbirds and Warby Parker — two fellow D2C fashion brands that went public in 2021 — show the same dramatic decline. Since their IPOs, Allbirds’ and Warby Parker’s market caps have fallen 91% and 72%, respectively.

So, why is Walmart willing to take that loss?

Like many retailers, Walmart has allocated resources to the fastest-growing and most profitable parts of its business over the last few years.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.