Hozon Auto

Founded Year

2014Stage

Series E | AliveTotal Raised

$4.525BLast Raised

$961.9M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-32 points in the past 30 days

About Hozon Auto

Hozon Auto specializes in the development and manufacturing of electric vehicles within the automotive industry. The company offers a range of electric cars that feature driving assistance systems, extended-range capabilities, and smart cockpit technologies. Hozon Auto primarily caters to the electric vehicle market by providing transportation solutions. It was founded in 2014 and is based in Putuo, China.

Loading...

Loading...

Research containing Hozon Auto

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hozon Auto in 1 CB Insights research brief, most recently on Mar 12, 2024.

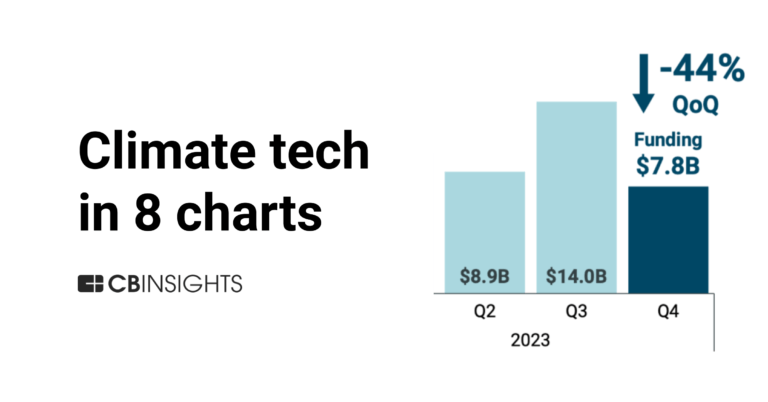

Mar 12, 2024

Climate tech in 8 charts: 2023Expert Collections containing Hozon Auto

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hozon Auto is included in 3 Expert Collections, including Auto Tech.

Auto Tech

3,977 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,261 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Hozon Auto News

Jan 2, 2025

全文6740字 As the NEV industry enters its second decade, we may witness the same transformative cycle experienced by Germany’s automotive sector in the 1960s—through consolidation and mergers, China’s NEV market could emerge stronger and more efficient, paving the way for a new era of innovation and growth. AsianFin -- The Chinese new-energy vehicle (NEV) industry, once a playground for innovation and fierce competition, is now entering a critical phase. The industry resembles a game of musical chairs—while the music still plays, the end is drawing near, and when it stops, some will be left without a chair. In 2018, over 487 EV manufacturers were active in China, according to the Wall Street Journal. By 2023, however, He Xiaopeng, CEO of XPeng Motors, noted that only around 50 startups remained in operation. The number continues to shrink in 2024, with brands such as HiPhi, Hozon, Voyah, and Jiayue edging closer to the exit. Neta Motors is also on the brink, facing plant shutdowns, store closures, and the departure of CEO Zhang Yong. As of June 2024, NEVs in China reached a market penetration rate of over 50%, signaling that the industry has transitioned into the "second half" of its growth. Competition has intensified, with price wars dominating the market. Traditional automakers are slashing prices, while domestic and startup brands strive to keep pace with frequent new model launches. The fight for survival has become more intense as market conditions tighten, and the future of many players, particularly those without strong products and brand recognition, is increasingly uncertain. The “End of the First Half” for NEVs In 2018, BYD's Chairman Wang Chuanfu first introduced the concept of the "two halves" of the NEV market: the first half focused on electrification, while the second half would shift toward smart technologies. Six years later, China’s NEV sector has gone from niche to mainstream. By June 2024, for every two passenger cars sold in China, one was an NEV. In November 2024, China's annual NEV production exceeded 10 million units. This rapid market penetration has led to heightened consumer expectations regarding NEV performance, user experience, and cost of ownership. While this signals a positive shift for the industry, it also means increased market concentration, with opportunities for mid- and smaller-tier manufacturers becoming increasingly limited. In November 2024, the top ten automakers accounted for nearly half of the market share. BYD alone sold 500,000 units in a single month, marking a significant milestone in the NEV race. This growing market concentration has led to a massive price war. After BYD launched its Qin Plus Honor Edition for as low as ¥79,800, companies like Tesla and Geely followed suit with aggressive price cuts. In fact, nine NEV manufacturers dropped prices on the same day, a rare event in the industry. However, this price competition has put tremendous pressure on profit margins. According to the China Passenger Car Association, from January to October 2024, the automotive industry saw a 2% increase in revenue to ¥8.33 trillion, but profits fell by 3.2% to ¥375.8 billion, with a profit margin of only 4.5%. While established automakers may have the resources to endure price wars, new entrants facing financial and sales disadvantages risk being driven out of the market. Struggling to Find "A Seat" The “first half” of the NEV era is nearing its end, and with it, an accelerated phase of industry consolidation. Several key players are now facing financial distress, particularly those with insufficient sales figures. In February 2024, HiPhi Motors announced a six-month production halt. Though the company briefly received positive news in May, with a $1 billion investment pledge from its parent company, Huaren Yuntong, production has yet to resume. By July, the company filed for pre-reorganization proceedings, signaling a potential restructuring in the face of mounting debt. Similarly, Hozon Auto and Voyah Motors have both faced financial crises. Hozon’s shares were frozen in September 2024, and the company has been involved in several lawsuits due to outstanding debts. Meanwhile, Voyah Motors struggled with employee layoffs, delayed salaries, and a lack of funds to continue operations. Neta Motors has also been plagued with poor sales figures and mounting debts. As of November 2024, the company stopped publishing its monthly sales reports, and multiple reports emerged about unpaid supplier bills and delayed wages for employees. The company also underwent a leadership change, with founder Fang Yunzhu taking over as CEO after Zhang Yong’s resignation. For these companies, poor sales are at the core of their financial woes. In 2023, HiPhi sold only 4,265 units, averaging just 355 cars per month. Hozon sold fewer than 5,000 units in the first ten months of 2024, and Voyah, with its monthly sales below 700 units, is barely holding on. The Endgame: Profitability or Exit In the early stages of the NEV market, consumers were more willing to embrace new brands due to limited choices. Capital markets were also highly optimistic, providing startups with valuable opportunities. However, as the industry matures, the focus has shifted. As Zhang Wei, Chairman of Jishike Capital, noted, the question is no longer about whether a company can build a car, but whether it can achieve sustainable growth, reduce production costs, and maintain profitability. According to statistics from GAC Research, there are currently 50 brands in China with monthly sales of fewer than 3,000 units. At the other end, only 43 brands have sales over 10,000 units per month, with BYD and Tesla dominating the top spots. Startups such as Nio and XPeng, despite achieving monthly sales of around 20,000 units, are still struggling to turn a profit. In contrast, established players with deep pockets and advanced technology are better positioned for the next phase of the market. Looking ahead, Zhang Wei predicts a “dual hegemony” in the NEV market, with the winners being traditional automakers that have made a successful transition to electric vehicles, and tech giants like Baidu and Geely with strong consumer insights and innovation capabilities. However, there is hope for the future. As the industry consolidates, the survival of those who can manage to stabilize their sales and improve their financial health will be critical. Companies such as XPeng and Leap Motor have reported narrowing losses in the third quarter of 2024, and with strategic efforts, including new models and technological innovations, they may still have a shot at recovery. As the NEV industry enters its second decade, we may witness the same transformative cycle experienced by Germany’s automotive sector in the 1960s—through consolidation and mergers, China’s NEV market could emerge stronger and more efficient, paving the way for a new era of innovation and growth.

Hozon Auto Frequently Asked Questions (FAQ)

When was Hozon Auto founded?

Hozon Auto was founded in 2014.

Where is Hozon Auto's headquarters?

Hozon Auto's headquarters is located at No. 588 Daduhe Road, Putuo.

What is Hozon Auto's latest funding round?

Hozon Auto's latest funding round is Series E.

How much did Hozon Auto raise?

Hozon Auto raised a total of $4.525B.

Who are the investors of Hozon Auto?

Investors of Hozon Auto include Dayone Capital, CRRC Corporation, Shenzhen Capital Group, Bank of Shanghai, Qihoo 360 and 14 more.

Who are Hozon Auto's competitors?

Competitors of Hozon Auto include WM Motor and 1 more.

Loading...

Compare Hozon Auto to Competitors

Geely Holding Group is an automotive group that operates in vehicle manufacturing and technology. The company produces various vehicles, including new energy vehicles, and participates in the development of vehicle networking and autonomous driving technologies. Geely Holding Group serves the automotive market with a focus on sustainable development. It was founded in 1986 and is based in Hangzhou, China.

Li Auto (HKSE: 2015.HK) is an electric vehicle manufacturer. The company mainly builds electric vehicles that use range extenders for a power supply. It also offers services including car maintenance, repairs, and more. Lixiang Automotive was formerly known as Chehejia. It was founded in 2015 and is based in Beijing, China.

WM Motor is engaged in the design and manufacturing of electric vehicles. It provides two vehicle platforms software-defined vehicles (STD) and PL. The company was founded in 2016 and is based in Shanghai, China. In October 2023, WM Motor filed for bankruptcy.

NIO (NYSE: NIO) is an automobile manufacturing company that designs and develops smart electric vehicles. It researches, develops, and manufactures technologies in autonomous driving, digital technologies, electric powertrains, and batteries. The company was founded in 2014 and is based in Jiading, China.

Xpeng (HKSE: 9868.HK) operates as a technology company that focuses on the future of transportation within the automotive industry. The company offers a range of electric vehicles designed to provide a more convenient and enjoyable travel experience. Xpeng's products cater to the electric vehicle market with smart features and sustainable energy solutions. It was founded in 2014 and is based in Guangzhou, China.

Shanghai New Power Automobile Technology specializes in the manufacture and sale of diesel engines within the automotive and industrial sectors. The company's diesel engines are designed for use in commercial vehicles, construction machinery, small and medium-sized ships, and electrical generator sets. Shanghai New Power Automobile Technology was formerly known as Shanghai Diesel Engine. It was founded in 1947 and is based in Shanghai, China.

Loading...