Hokodo

Founded Year

2018Stage

Line of Credit - II | AliveTotal Raised

$165.19MLast Raised

$108.28M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-146 points in the past 30 days

About Hokodo

Hokodo specializes in B2B (business-to-business) payment solutions, offering a digital platform for trade credit and financing services within various industries. The company provides credit terms to businesses, enabling a frictionless checkout experience and real-time credit decision-making. Hokodo's solutions cater to sectors such as B2B marketplaces, food and beverages, agriculture, industrial supplies, construction and building materials, freight and logistics, freelance and workplace management, and corporate travel. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Hokodo's Product Videos

ESPs containing Hokodo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

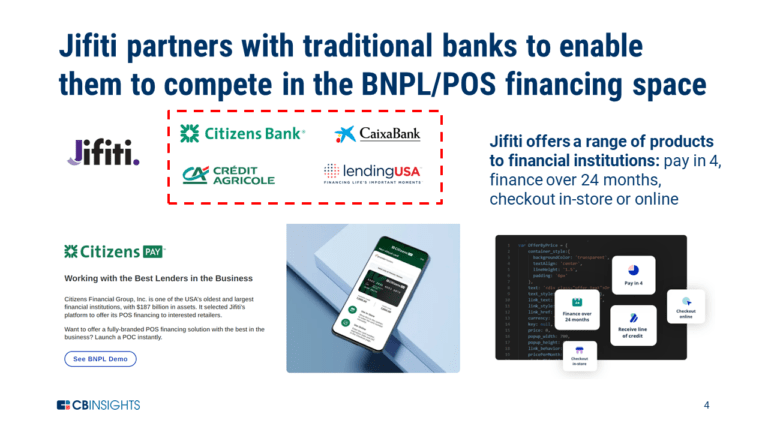

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Hokodo named as Leader among 15 other companies, including PayPal, Slope, and Amount.

Hokodo's Products & Differentiators

Payment terms

Enables buyers to defer payment by an agreed period (usually 14, 30, 60 or 90 days, but can be up to 120)

Loading...

Research containing Hokodo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hokodo in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Hokodo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hokodo is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,142 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,559 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Latest Hokodo News

Nov 25, 2024

Over to you Louis – my questions are in bold: Who are you and what’s your background? My name is Louis Carbonnier and I’m the President and one of the Co-founders of Hokodo , Europe’s leading provider of digital trade credit solutions. I attended a French business school called ESSEC where I studied Finance and also Sorbonne University where I studied Philosophy. This is also where I met Sami Ben Hatit , who would eventually become one of my Hokodo Co-founders. We bonded over maths and video games – both of which Sami was much better at than I. So much so, in fact, that he ended up becoming a professional StarCraft player. I suspect he decided to do a PhD just so he would have 3 more years to play! I started off my career in consulting, working in the financial services practice at Oliver Wyman . During my 8 year tenure, I had the opportunity to work with 40+ banks and insurers that I really looked up to including BNP, Allianz, HSBC and more. I quickly learned that many of these companies were trapped in the past because of bureaucracy and inadequate tech that they couldn’t migrate away from. It gave me encouragement to find out the bar was so low and that the area was ripe with opportunity. Consulting is excellent for building good generalist skills due to the nature of frequently moving on to new assignments, but this comes with a key drawback: one never gets the chance to sit behind the steering wheel. It’s like designing the journey and helping build the car but never driving it. I knew that one day I wanted to have a shot at running a business of my own. During all that time, I saw that there was a large financing gap that financial services incumbents were not tackling. When I joined Euler Hermes (Allianz Trade), it became obvious that there was an opportunity around bringing trade credit online and making it accessible to SMEs. At this stage, my mindset moved from ‘I want to build a business some day’ to ‘I’ve spotted a real opportunity to build a business.’ In 2018, I founded Hokodo alongside my co-founders Richard Thornton and the aforementioned Sami, with the goal to make trade credit simple, fair, and accessible to sellers and buyers alike. What is your job title and what are your general responsibilities? My role is largely focused on the commercial and product side of Hokodo, while Richard oversees operations, finance and legal and risk, and Sami leads the engineering teams. I work closely with the product team on the vision and strategy for Hokodo’s solutions, while my work with the sales, customer success and marketing teams involves advising on important deals, ensuring key customers are satisfied and being the spokesperson for the business. I’m also closely involved in managing relationships with our key partners like Citibank, BNP Paribas and Mirakl, and with investors too. As Founders of a relatively young and quickly scaling fintech, we’re still very much “hands on” with day to day tasks. I’m particularly proud of the open-door and non-hierarchical environment we’ve developed. Can you give us an overview of your business? OK, here we go! Hokodo offers a scalable, all-in-one payment solution for B2B, complete with trade credit and up front payment options. We enable European merchants, marketplaces and other suppliers to achieve their growth goals without being hindered by operational inefficiencies, outdated payment processes or working capital constraints. Our proprietary underwriting platform doesn’t rely on any third party suppliers, which means we’re able to offer superior offer rates and unrivalled uptime to our supplier partners. Buyers receive real-time credit decisions, even on their first purchase, leading to higher customer satisfaction and 24% more purchases per month. Meanwhile, suppliers are paid up front and in full. The digital-first nature of Hokodo’s end-to-end credit management solution means that we’re able to support B2B businesses with the full order-to-cash cycle as they expand into new markets, regions or industries. Hokodo handles credit scoring, fraud detection, payments, collections, financing and credit insurance, so there’s no need to integrate with any other providers. Our geographic footprint enables us to reach buyers across Europe. Hokodo finances the buyer’s purchase so that the supplier can receive payment up front and in full, stimulating positive cash flow for both parties. We handle collections with tact to preserve the commercial relationships of our supplier partners, and provide 100% protection against all credit and fraud risks. Even if the buyer is unable or unwilling to pay, the supplier keeps their money. To date, Hokodo’s solutions have been adopted by marketplaces, merchants and other suppliers in verticals ranging from freight to food and beverages, construction to clothing and textiles. Suppliers that integrate with Hokodo – including Ankorstore , MONIN and @Maison & Objet – see, on average, a 40% increase in revenue. Tell us how you are funded? Hokodo is a Series B VC funded business. Our most recent funding round was a €100 million debt facility from global credit investment manager Viola Credit . That money will help facilitate more than €1.5 billion of B2B transactions across Europe over the next 18 months. Before that, in April last year, we announced a Series B extension round which came from Citibank roughly 10 months after our initial Series B announcement. It was a great vote of confidence for Citi to invest in Hokodo, which is only compounded by the fact that they also chose to partner with us for enterprise clients that want a digital trade credit solution. We were fortunate to be in a position to raise our Series B during the enlightened period of 2022, compared to the relative dark ages that we are currently experiencing! We count ourselves lucky that there is still healthy interest among investors for Hokodo’s Series C fundraise, but the conversations are still significantly more challenging than before. What’s the origin story? Why did you start the company? To solve what problems? My role at Euler Hermes allowed me to see the major shortcomings in trade credit, in particular when it comes to accessibility. I realised that credit terms are readily available to corporations while SMEs who truly need them the most can’t access it. I also found that trade credit was designed for the offline world, rather than the digital world we live in. Over 60% of B2B trade takes place on payment terms, with trade credit representing the largest source of business financing in advanced economies. Yet current processes for offering trade credit are outdated and not fit for the digital age. These realisations got me thinking about creating a new product. After my initial enthusiasm for this opportunity, Sami joined me to prototype some BNPL APIs. Then I caught up with Richard, who was growing tired of corporate life and couldn’t believe the gap in the market that Hokodo could fill. After days of searching through Google to see if anything like this had been invented already, we concluded that we would be first. With Sami and Richard on board, the Hokodo team took its shape. Hokodo’s full payment stack solves this issue by offering smaller suppliers a powerful set of solutions to manage their pay now and pay later functions. With payments taken care of, businesses have the resources and confidence they need to compete on a level playing field. Despite the fact that B2B e-commerce is booming, there has been no good solution today to offer credit terms online. We solve that problem. And while the problem we solve is obvious, it takes a lot of infrastructure to deliver reliable instant credit decisions. That’s why we invested enormously in our data and risk platform right from the very start of the business. We’ve rebuilt the end-to-end credit management tech stack, including data mining, credit decisions, fraud detection, collections, insurance against bad debt, and financing. Because that’s what will give the business agility, control, and scalability. And the ability to deliver the best payment method for B2B trade while managing risk. Who are your target customers? What’s your revenue model? Our target customers are B2B merchants or marketplaces. When we started out, we had e-commerce in mind, but over time our offering has become omnichannel and we are now able to work with merchants selling over the phone, via email, in store and, of course, online. Wherever they sell, we want to work with digital-first businesses, and those who already have a book of customers that expect to be offered payment terms or a trade account at the checkout. As for the revenue model, we take a small percentage of each transaction. This usually comes from the merchant and the exact amount depends on various factors such as risk and length of payment terms. Most of the time, buyers are not charged any fees or interest for using trade credit with Hokodo. If you had a magic wand, what one thing would you change in the banking and/or FinTech sector? If I had a magic wand I would create a greater number of innovation sandboxes and grant licences more easily. We’re past that stage now at Hokodo but going over these entry barriers was a massive hassle for us and I know it impacts lots of our peers too. This protects oligopolies in the short term, but doesn’t benefit anyone in the long term and ends up stifling innovation. Yes, it protects incumbents and consumers, but you end up with a world that’s super inefficient and Europe ends up lagging behind the US and China when it comes to innovation. Ultimately, this opening gap doesn’t benefit consumers. My magic spell would open the taps of regulation so that different levels of scrutiny could be applied according to the size of the risk. Ultimately, this is all about proportionality and pragmatism. I believe this would increase innovation, competition and consumer benefits – everyone wins! What is your message for the larger players in the Financial Services marketplace? There’s a huge amount of pressure on CEOs at global banks to deliver results for the next quarter or two. Also, a typical tenure for high ranking executives is around 3 to 4 years. So, naturally, most banking execs focus on short term decisions with immediate impact, while neglecting the bigger picture. The large, audacious projects that could help reform the industry rarely get off the ground because the focus is on the cash cow. However, all these banks evolve with huge legacy in their systems and are at real risk of becoming outdated monsters. When you think about everything that’s happening in the world right now, with AI, genetics, etc – all the innovative creations are happening outside of banking. If current banks still want to be at the top in ten years, CEOs and other executives need to broaden their thinking and stop fighting yesterday’s war. Fill the people and competency gaps before it’s too late! Where do you get your Financial Services/FinTech industry news from? I read The Economist , and a little bit of Les Echos (French newspaper) and FT (when I’m in the Eurostar lounge!) But what I read first and foremost is a newspaper called L’EQUIPE , which provides all the sports news that a decent gentleman should know. Can you list 3 people you rate from the FinTech and/or Financial Services sector that we should be following on LinkedIn, and why? What FinTech services (and/or apps) do you personally use? Online banking What’s the best new FinTech product or service you’ve seen recently? Pennylane . They’re currently only operating in France but I believe they’re the Xero of the future. Quickbooks has just announced that they are leaving the French market and my interpretation is that Pennylane is winning the war. I expect a form of convergence between accounting and banking in the SME world and Pennylane is at the bleeding edge of this new paradigm. Small companies don’t need two apps and there are lots of synergies when combining the two. I suspect Pennylane will even take on banking apps like Qonto and Revolut in the not so distant future. Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector? Of course, I could talk about AI or the blockchain here, but do you really want to hear that again? Trade finance is the unsung hero of B2B commerce. Each year, €700 million of business-to-business transactions are facilitated by this special type of credit – that’s compared to €60m in factoring and €200m worth of business loans. In recent years, the fintech world has slowly come to realise that payment terms are the lifeblood of the economy, hence the founding of businesses like Hokodo. But things are changing. Trade finance is now converging with payments, all facilitated by the API economy. You hear the phrase “B2B Buy Now, Pay Later” thrown around a lot and, while it goes some way to explaining fintech trade finance solutions, it’s actually a bit of an understatement. Of course, companies have been paying on terms forever. B2B BNPL means nothing more than that. So, how is the trend going to develop in the next few years? Trade credit will become more accessible and more frictionless, creating a huge unlock for the economy. Due to cash flow restrictions and risk factors, trade credit is traditionally reserved only for top customers, but thanks to businesses like ours, merchants can offer payment terms to anyone that’s eligible. In real terms, that means 80% of buyers instead of 20%. In this scenario, the SMEs that need financing options the most but currently struggle to access it have a much easier time finding a supplier that will let them defer payment by 30 days, 60 days or even longer. It solves a huge accessibility issue which has plagued B2B ever since e-commerce began to become popular and is one of the most effective ways to bridge the financing gap. Thank you so much for taking the time to participate Louis. You can read more about Louis Carbonnier on LinkedIn and read more about his company Hokodo at https://www.hokodo.co/ .

Hokodo Frequently Asked Questions (FAQ)

When was Hokodo founded?

Hokodo was founded in 2018.

Where is Hokodo's headquarters?

Hokodo's headquarters is located at 77 Leadenhall Street, London.

What is Hokodo's latest funding round?

Hokodo's latest funding round is Line of Credit - II.

How much did Hokodo raise?

Hokodo raised a total of $165.19M.

Who are the investors of Hokodo?

Investors of Hokodo include Viola Credit, Citibank, Anthemis, Mosaic Ventures, Notion Capital and 10 more.

Who are Hokodo's competitors?

Competitors of Hokodo include Defacto, Slope, Mondu, Sprinque, Optty and 7 more.

What products does Hokodo offer?

Hokodo's products include Payment terms and 2 more.

Who are Hokodo's customers?

Customers of Hokodo include Ankorstore, Monin and Rawlins Paints.

Loading...

Compare Hokodo to Competitors

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors, including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

PenTech provides digital financial solutions for businesses in the financial services sector. The company offers services including digital factoring, credit, and leasing, which provide businesses with financing options. These services cater to sectors requiring liquidity management and cash flow. It was founded in 2019 and is based in Budapest, Hungary.

Balance specializes in B2B payment technology within the fintech industry. The company offers a range of services, including digital trade credit, B2B payments, and accounts receivable management, all aimed at facilitating and managing business transactions digitally. Balance primarily serves the eCommerce industry, tech teams, and business leaders. It was founded in 2020 and is based in New York, New York.

Sprinque is a B2B crossborder payments platform that specializes in facilitating global expansion for businesses. The company offers a suite of payment solutions, including the ability for business buyers to pay by invoice with net payment terms or in installments, and provides merchants with instant payment while managing credit and fraud risks. Sprinque primarily serves businesses looking to streamline their payment processes and expand their customer base internationally. It was founded in 2021 and is based in Amsterdam, Netherlands.

Loading...