HealthSnap

Founded Year

2015Stage

Series B | AliveTotal Raised

$46MLast Raised

$25M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+40 points in the past 30 days

About HealthSnap

HealthSnap focuses on patient outcomes and healthcare efficiency through its integrated virtual care management platform within the healthcare technology sector. The company offers remote patient monitoring (RPM) and chronic care management (CCM) services, which enable healthcare providers to manage chronic conditions remotely. It was formerly known as HealthSnap Solutions. It was founded in 2015 and is based in Miami, Florida.

Loading...

ESPs containing HealthSnap

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The chronic care management platforms market consists of tech-enabled solutions that help healthcare providers manage and coordinate care for patients with chronic conditions. These solutions include patient engagement tools, remote patient monitoring (RPM), care planning, and/or advanced analytics to improve clinical outcomes and reduce costs. Companies in this space leverage AI and other technol…

HealthSnap named as Leader among 11 other companies, including ThoroughCare, Vironix Health, and Clinii.

HealthSnap's Products & Differentiators

HealthSnap Remote Patient Monitoring

HealthSnap helps healthcare organizations proactively monitor patients with chronic conditions, reduce readmissions, and generate additional revenue with EHR-integrated Remote Patient Monitoring (RPM) programs.

Loading...

Research containing HealthSnap

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HealthSnap in 3 CB Insights research briefs, most recently on Dec 5, 2023.

Aug 10, 2023

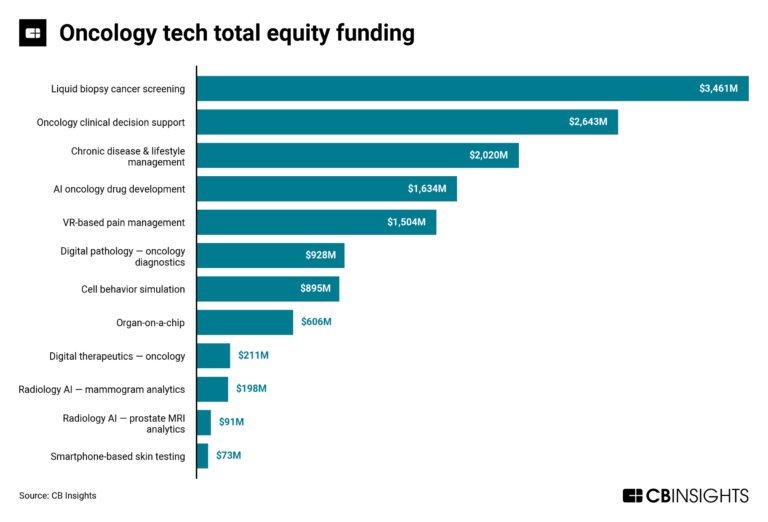

The oncology tech market mapExpert Collections containing HealthSnap

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HealthSnap is included in 6 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Value-Based Care & Population Health

1,068 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,328 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Digital Health 50

50 items

Artificial Intelligence

7,222 items

HealthSnap Patents

HealthSnap has filed 4 patents.

The 3 most popular patent topics include:

- graphical control elements

- graphical user interface elements

- graphical user interfaces

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/31/2020 | 3/26/2024 | Data management, Network protocols, Computer networking, Wireless networking, Diagrams | Grant |

Application Date | 12/31/2020 |

|---|---|

Grant Date | 3/26/2024 |

Title | |

Related Topics | Data management, Network protocols, Computer networking, Wireless networking, Diagrams |

Status | Grant |

Latest HealthSnap News

Nov 19, 2024

New York, Nov. 19, 2024 (GLOBE NEWSWIRE) -- Overview The Chronic Disease Management Market size is expected to reach USD 5.7 billion by 2024 and is further anticipated to reach USD 18.4 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 13.9% from 2024 to 2033. Chronic disease management providers make the patient knowledgeable about the available payment scenario and support them with Medicare and Medicaid guidance, which in turn, support patients to get their respective allowances. If the patients are looking for chronic disease management, there is a major possibility that patients get the appropriate treatments at low prices and also get the benefit of allocated reimbursement. Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/chronic-disease-management-market/request-sample/ The US Overview The Chronic Disease Management Market in the US is projected to reach USD 2.3 billion in 2024 at a compound annual growth rate of 13.0% over its forecast period. The US chronic disease management market is expanding, driven by telehealth advancements that enable remote monitoring and better access to care. Improved health data analytics helps personalized treatment plans, while government initiatives promote innovative solutions. However, high implementation costs and concerns about data privacy and security are significant barriers that may hinder broad adoption and integration of these technologies. Important Insights The Chronic Disease Management Market is expected to grow by USD 18.4 billion by 2033 from 2025 with a CAGR of 13.9%. The solution segment is expected to get the majority share of the Chronic Disease Management Market in 2024. In terms of disease type, diabetes segment is expected to be leading the market in 2024. The providers segment is set to get the biggest revenue share in 2024 in the Chronic Disease Management Market. North America is predicted to have a 45.4% share of revenue share in the Global Chronic Disease Management Market in 2024. Global Chronic Disease Management Market: Trends Telehealth Integration: The large integration of telehealth services into chronic disease management programs enables constant remote monitoring and better patient-provider communication, improving care accessibility. Artificial Intelligence and Machine Learning: The utilization of AI and machine learning in data analysis is growing, enabling more accurate predictions of disease progression & personalized treatment recommendations based on patient data. Patient-Centric Approaches: There’s an increase in the focus on patient engagement and empowerment through digital platforms that support self-management, education, and assistance for chronic disease patients. Focus on Mental Health: Recognizing the link between chronic diseases and mental health, many management programs are now using mental health support services to provide complete care for patients. Chronic Disease Management Market: Competitive Landscape The chronic disease management market is growing quickly as healthcare providers prioritize enhancing patient outcomes and cutting costs. Key players provide solutions like remote monitoring devices, digital health platforms, and data analytics for personalized care. Growing competition stems from technological advancements, telehealth growth, and demand for self-management tools, with companies collaborating to develop integrated care models for managing chronic conditions like diabetes and heart disease. Some of the major players in the market include Pegasystems Inc, Trizetto Corp, Koninklijke Philips NV, EXL Healthcare, AxisPoint Health and more. Some of the prominent market players: Pegasystems Inc Global Chronic Disease Management Market: Driver Telehealth Expansion: Higher adoption of telehealth services facilitates remote patient monitoring, improving access to care, and allowing timely interventions for chronic conditions. Health Data Analytics: Advanced data analytics tools allow healthcare providers to develop personalized treatment plans, enhancing patient outcomes and optimizing resource use. Government Initiatives: Supportive government policies and funding for innovative healthcare solutions promoting the development and integration of chronic disease management systems. Focus on Preventive Care: The increase in focus on preventive care and lifestyle management fosters the need for effective chronic disease management solutions, helping to reduce health issues before they escalate. Global Chronic Disease Management Market: Restraints High Implementation Costs: The major expenses linked with deploying advanced chronic disease management systems can be a barrier for healthcare providers, mainly smaller practices. Data Privacy and Security Concerns: The growth of apprehensions about data privacy and security issues can impact the adoption of digital health technologies, impacting trust among patients and providers. Integration Challenges: The challenge in integrating new technologies with current healthcare systems can complicate implementation, casuing inefficiencies and resistance among healthcare providers. Regulatory Hurdles: Complex regulatory needs and approval processes for new healthcare technologies may slow down innovation and market entry for chronic disease management solutions. Global Chronic Disease Management Market: Opportunities Digital Health Innovations: The development of the latest digital health technologies, such as mobile health apps and wearable devices, provides opportunities to improve patient engagement and self-management of chronic conditions. Personalized Treatment Solutions: The increase in the demand for customized healthcare solutions allows companies to create customized treatment plans using advanced analytics and patient data to enhance outcomes. Partnerships and Collaborations: Opportunities for partnerships between healthcare providers, technology companies, and insurers can develop the creation of integrated care models that enhance chronic disease management efficiency. Global Market Expansion: The rising awareness of chronic disease management in emerging markets presents opportunities for businesses to introduce innovative solutions and expand their services to underserved populations. Click to Request Sample Report and Drive Impactful Decisions at https://dimensionmarketresearch.com/report/chronic-disease-management-market/request-sample/ Regional Analysis North America is anticipated to dominate the chronic disease management market, capturing 45.4% of the share in 2024, which is due to favorable government policies promoting innovative healthcare services, major advancements in healthcare infrastructure, and increased funding for research initiatives. These factors develop a supportive environment for the adoption of advanced chronic disease management solutions. Further, the Asia Pacific region is projected to experience the fastest growth, driven by its expanding healthcare industry and population, mainly in China, India, and Japan. By Region Recent Developments in the Chronic Disease Management Market September 2024: The Government of Tripura announced a collaboration with the AIIMS New Delhi, and the Centre for Chronic Disease Control (CCDC), launching the STAR-NCD program, aimed on improving the prevention, diagnosis, and management of Non-Communicable diseases (NCDs) across the state. June 2024: Mount Sinai Medical Center introduced a partnership with the virtual care management platform HealthSnap to help in chronic disease management programs, which began in March 2024 with Remote Patient Monitoring (RPM) and is presently operational at three Mount Sinai locations in South Florida, with further plans to extend the service to 13 locations by the end of the year. April 2024: the US FDA (Food and Drug Administration) launched a new initiative, Home as a Health Care Hub, to help reimagine the home environment as an integral part of the health care system, to advance health equity for everyone in the country. February 2024: HealthSnap, and Chronic Care Management (CCM) solution for healthcare providers, launched its Series B funding of USD 25 million, which was caused by Sands Capital, with new investments from Comcast Ventures, Acronym Venture Capital, and Florida Opportunity Fund. January 2024: Amazon Health unveiled its latest push to enhance care for chronic conditions of “Health Condition Programs", which enables customers to discover digital health benefits to help in managing chronic conditions like pre-diabetes, diabetes, hypertension, etc. Browse More Related Reports The Global 3D Printing in Healthcare Market is projected to reach USD 10.7 billion in 2024 and grow at a compound annual growth rate of 19.2% from there until 2033 to reach a value of USD 51.7 billion. The Global Cell and Gene Therapy Market is projected to reach USD 22.8 billion in 2024 and grow at a compound annual growth rate of 19.3% from there until 2033 to reach a value of USD 111.4 billion. The Global Chronic Disease Management Market is projected to reach USD 5.7 billion in 2024 and grow at a compound annual growth rate of 13.9% from there until 2033 to reach a value of USD 18.4 billion. The Global Post Anaesthesia Care Unit Device (PACU) Market is projected to reach USD 13.7 billion in 2024 and grow at a compound annual growth rate of 8.1% from there until 2033 to reach a value of USD 27.5 billion. The Global Postoperative Management Market is projected to reach USD 42.5 billion in 2024 and grow at a compound annual growth rate of 5.4% from there until 2033 to reach a value of USD 68.3 billion. The Global Senolytic Drugs Market is projected to reach USD 42.5 million in 2024 and grow at a compound annual growth rate of 35.8% from there until 2033 to reach a value of USD 667.6 million. The U.S. Fertility Market size is expected to reach a value of USD 5.6 billion in 2024, and it is further anticipated to reach a market value of USD 8.7 billion by 2033 at a CAGR of 5.1%. The Global Stem Cell Therapy Market size is expected to reach a value of USD 18.9 billion in 2024, and it is further anticipated to reach a market value of USD 54.7 billion by 2033 at a CAGR of 12.6%. The Global Pulmonary Arterial Hypertension Market size is expected to reach a value of USD 8.1 billion in 2024, and it is further anticipated to reach a market value of USD 13.2 billion by 2033 at a CAGR of 5.6%. The Global Prescription Lens Market size is expected to reach a value of USD 54.0 billion in 2024, and it is further anticipated to reach a market value of USD 88.0 billion by 2033 at a CAGR of 5.6%. About Dimension Market Research (DMR): Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.

HealthSnap Frequently Asked Questions (FAQ)

When was HealthSnap founded?

HealthSnap was founded in 2015.

Where is HealthSnap's headquarters?

HealthSnap's headquarters is located at 1951 North West 7th Avenue, Miami.

What is HealthSnap's latest funding round?

HealthSnap's latest funding round is Series B.

How much did HealthSnap raise?

HealthSnap raised a total of $46M.

Who are the investors of HealthSnap?

Investors of HealthSnap include Florida Funders, MacDonald Ventures, Asclepius Growth Capital, Sands Capital, TGH Innoventures and 16 more.

Who are HealthSnap's competitors?

Competitors of HealthSnap include Optimize Health and 5 more.

What products does HealthSnap offer?

HealthSnap's products include HealthSnap Remote Patient Monitoring and 1 more.

Who are HealthSnap's customers?

Customers of HealthSnap include Montefiore, Mayo Clinic, Life Line Screening, Cardiology Consultants of Philadelphia and UHealth.

Loading...

Compare HealthSnap to Competitors

MedSys Health focuses on disrupting healthcare delivery through a comprehensive virtual care platform in the healthcare technology sector. The company offers a suite of services including remote patient monitoring, telemedicine, and patient engagement solutions designed to improve health outcomes and patient care. It primarily serves healthcare organizations looking to implement value-based care through technology. It was founded in 2019 and is based in Fort Lauderdale, Florida.

Veta Health specializes in AI-enabled virtual care solutions within the healthcare industry. The company offers a platform that facilitates real-time and asynchronous communication between healthcare providers and patients, remote monitoring of patient vitals, personalized engagement, and care coordination tools. Veta Health primarily serves health systems, clinicians, and patients, aiming to improve patient outcomes and healthcare delivery efficiency. It was founded in 2016 and is based in Miami, Florida.

CoachCare provides remote patient monitoring and virtual health solutions within the healthcare technology sector. The company offers software for virtual health visits, remote monitoring, and connected devices that deliver real-time health data to healthcare providers. CoachCare serves individual practices, hospitals, and health systems. CoachCare was formerly known as Selvera. It was founded in 2013 and is based in New York, New York.

Medically Home is a healthcare company that focuses on providing decentralized care for patients with serious or complex illnesses. The company's main service is a comprehensive care delivery system that enables health systems to admit patients to their own homes for acute and restorative care rather than a traditional hospital setting. Medically Home primarily serves the healthcare industry. It was founded in 2017 and is based in Boston, Massachusetts.

Life365 is a telehealth company that specializes in remote patient monitoring and care management solutions. The company offers a digital health platform that collects biometric measurements and other health data from patients at home, providing clinicians with insights for informed care and timely interventions. Life365's solutions are designed to support healthcare providers in reducing hospital readmissions, managing chronic conditions, and improving patient engagement and adherence to therapy. Life365 was formerly known as RainLife365. It was founded in 2015 and is based in Scottsdale, Arizona.

Optimize Health specializes in chronic disease management and remote patient monitoring within the healthcare sector. The company offers a platform that enables healthcare providers to monitor patient health data in real-time, engage patients more effectively, and optimize clinical workflows, while also aiming to increase healthcare revenue and improve clinical outcomes. Optimize Health primarily serves various healthcare organizations, including physician practices, hospitals, and health systems, across different specialties and chronic conditions. Optimize Health was formerly known as Pillsy. It was founded in 2015 and is based in Seattle, Washington.

Loading...