Investments

753Portfolio Exits

35Funds

1Partners & Customers

2About Gaingels

Gaingels operates a group of accredited investors that provides mentorships, supports, and invests in companies founded by lesbian, gay, bisexual, and transgender identifying individuals. The company was founded in 2014 and is based in Burlington, Vermont.

Research containing Gaingels

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gaingels in 4 CB Insights research briefs, most recently on Jan 4, 2024.

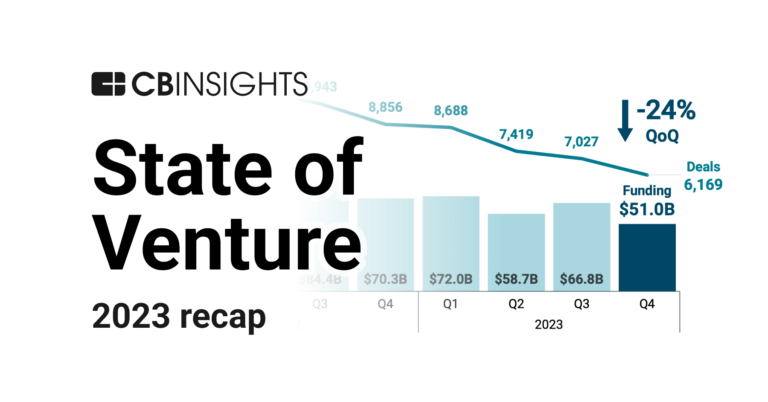

Jan 4, 2024 report

State of Venture 2023 Report

Dec 22, 2022 report

The top 50 angel investing groups

Oct 11, 2022 report

State of Venture Q3’22 ReportLatest Gaingels News

Feb 7, 2025

There’s a new leader on Crain’s list of largest venture capital firms in the New York area. Burlington, Vermont-based Gaingels took the No. 1 spot with 69 investments in metro area startups last year, more than double its local investments in 2023, according to PitchBook data.The firm, which invests in companies across the technology, B2B, health care and consumer sectors, notably funded Hudson Square-based startup ByHeart, an infant formula company, and Chelsea-based Talkiatry, a mental health practice that offers telehealth services, last year.The 25 VC firms on Crain’s latest list, which is ranked by number of 2024 investments in New York area startups, saw additional shakeups in rankings.Flatiron-based FJ Labs and Manchester, New Hampshire-based Alumni Ventures, which were tied for No. 1 on Crain’s list last year with 40 local investments each, made fewer deals in 2024. FJ Labs fell to No. 3 with 36 investments while Alumni Ventures dropped to No. 6 with 30.Meanwhile, Menlo Park, California-based Sequoia Capital jumped an impressive 12 spots on the list to No. 2 with 39 investments made last year. The firm only made 15 deals with local startups in 2023. Last year, the firm helped fund two companies that rank high on Crain’s list of largest tech unicorns in New York: Wiz, the cybersecurity startup that reigns No. 1 with a valuation of $23 billion, and Grafana Labs, a productivity software valued at $6.6 billion.And Sunnyvale, California-based Plug and Play Tech Center fell nine spots to No. 17. The firm, which funded 21 local startups in 2023, only invested in 14 last year.Combined, these 25 firms made 605 investments in New York area startups last year.Access the full lists in our Data Center. The Data Center requires an All Access subscription. If you'd like to change your subscription, please contact our customer service at 877-824-9373 or customerservice@crainsnewyork.com.

Gaingels Investments

753 Investments

Gaingels has made 753 investments. Their latest investment was in Ignota Labs as part of their Seed VC - III on February 26, 2025.

Gaingels Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/26/2025 | Seed VC - III | Ignota Labs | $6.9M | Yes | 2 | |

2/25/2025 | Seed VC - III | Afynia | $5M | No | 1 | |

2/25/2025 | Series A | Malga | $5.55M | Yes | 2 | |

2/19/2025 | Pre-Seed | |||||

2/11/2025 | Series B |

Date | 2/26/2025 | 2/25/2025 | 2/25/2025 | 2/19/2025 | 2/11/2025 |

|---|---|---|---|---|---|

Round | Seed VC - III | Seed VC - III | Series A | Pre-Seed | Series B |

Company | Ignota Labs | Afynia | Malga | ||

Amount | $6.9M | $5M | $5.55M | ||

New? | Yes | No | Yes | ||

Co-Investors | |||||

Sources | 2 | 1 | 2 |

Gaingels Portfolio Exits

35 Portfolio Exits

Gaingels has 35 portfolio exits. Their latest portfolio exit was Aura Bora on February 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/18/2025 | Acq - Fin | 2 | |||

1/9/2025 | Acquired | 6 | |||

12/4/2024 | Acquired | 4 | |||

Date | 2/18/2025 | 1/9/2025 | 12/4/2024 | ||

|---|---|---|---|---|---|

Exit | Acq - Fin | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 6 | 4 |

Gaingels Fund History

1 Fund History

Gaingels has 1 fund, including UB Gaingels Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

UB Gaingels Fund I | $0.47M | 1 |

Closing Date | |

|---|---|

Fund | UB Gaingels Fund I |

Fund Type | |

Status | |

Amount | $0.47M |

Sources | 1 |

Gaingels Partners & Customers

2 Partners and customers

Gaingels has 2 strategic partners and customers. Gaingels recently partnered with The University of Pennsylvania School of Nursing on February 2, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/13/2023 | Partner | United States | `` The partnership between Eidos and Gaingels responds to the National Academies recommendation as a first-of-its-kind effort to magnify the reach and impact of discoveries and high-impact solutions . | 1 | |

6/30/2020 | Partner |

Date | 2/13/2023 | 6/30/2020 |

|---|---|---|

Type | Partner | Partner |

Business Partner | ||

Country | United States | |

News Snippet | `` The partnership between Eidos and Gaingels responds to the National Academies recommendation as a first-of-its-kind effort to magnify the reach and impact of discoveries and high-impact solutions . | |

Sources | 1 |

Gaingels Team

6 Team Members

Gaingels has 6 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Paul Grossinger | A-Level Capital, and INE Ventures | Founder | Current |

Name | Paul Grossinger | ||||

|---|---|---|---|---|---|

Work History | A-Level Capital, and INE Ventures | ||||

Title | Founder | ||||

Status | Current |

Compare Gaingels to Competitors

Seed to Harvest Ventures is a venture capital firm focusing on early-stage investments in the technology sector, specifically targeting companies built by and for women of color. The firm offers strategic product development advice, education, resources, and networking opportunities to help these companies scale. Seed to Harvest Ventures positions itself as a partner to founders, providing expertise in product and design to set early-stage companies up for long-term success. It was founded in 2022 and is based in Oakland, California.

Backstage Capital offers a venture capital fund that invests in startups led by underrepresented founders, including women, people of color, and LGBTQ individuals. The company provides funding and support to early-stage companies. It was founded in 2015 and is based in Los Angeles, California.

SoGal is a nonprofit organization focused on closing the diversity gap in entrepreneurship within the venture capital and startup ecosystem. It provides a global platform for diverse entrepreneurs and investors, offering resources such as networking events, educational programs, and funding opportunities. The organization primarily serves diverse founders and funders in the entrepreneurial and venture capital sectors. It is based in New York, New York.

Included VC is a fellowship program aimed at diversifying the venture capital industry by providing education and mentorship to individuals from underrepresented communities. The program offers a fully-funded, comprehensive curriculum that includes masterclasses, mentorship, investment committee simulations, and in-person retreats, designed to equip participants with the knowledge and skills needed to succeed in venture capital. Included VC's mission is to create multi-generational change by increasing the representation of diverse backgrounds within the venture capital sector, supported by a consortium of international venture capital partners and sponsors. It is based in London, England.

Diversity VC is a non-profit organization that aims to increase diversity and inclusion within the venture capital industry. The organization provides guidance, toolkits, and data analysis to venture capital funds and related organizations to understand the state of diversity across the ecosystem. Diversity VC also offers internship programs for underrepresented talent to gain experience in the venture capital field. It was founded in 2016 and is based in London, England.

Black Capital is an early-stage fund that focuses on investing in underrepresented founders, particularly in the venture capital sector. The company provides financial support to startups, with a special interest in the Sports Tech, EdTech, and GovTech industries. The primary customers of Black Capital are US-based companies seeking early-stage funding. It is based in Sacramento, California.

Loading...