Wefox

Founded Year

2015Stage

Private Equity | AliveTotal Raised

$1.629BLast Raised

$83M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+16 points in the past 30 days

About Wefox

Wefox is an insurtech company that provides a platform connecting insurance companies, brokers, businesses, and customers for digital insurance solutions. The company offers a comprehensive ecosystem that facilitates the launch of new insurance products, enhances broker advisory capabilities, and integrates insurance services into business offerings. Wefox also focuses on ensuring customer safety and support through its platform. It was founded in 2015 and is based in Berlin, Germany.

Loading...

ESPs containing Wefox

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — home market comprises insurtech agents, brokers, distributors, and other intermediaries that provide homeowners and renters insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

Wefox named as Leader among 11 other companies, including PolicyGenius, Insurify, and The Zebra.

Wefox's Products & Differentiators

Insurance product builder

Drag and drop tool to configure and launch digital products to market. Product can be connected to any external distribution channel via APIS and allow 100% digital quote and bind processes with dynamic customer journeys.

Loading...

Research containing Wefox

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wefox in 5 CB Insights research briefs, most recently on Aug 7, 2023.

Expert Collections containing Wefox

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wefox is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,559 items

Excludes US-based companies

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Wefox News

Jan 17, 2025

Deal covers motor, liability, and property business in Germany, Italy, and Switzerland Share DARAG Group, a legacy acquisition specialist focused on the European and UK markets, and wefox Insurance AG, the Liechtenstein-based insurance carrier of the wefox Group, have announced the transfer of a run-off portfolio. The transaction includes motor damage and third-party liability, private liability, and property business across Germany, Italy, and Switzerland. The portfolio transfer is connected to the previously disclosed sale of wefox Insurance AG to a consortium of Swiss companies led by BERAG. Claims services for all existing policyholders will continue without disruption. The agreement also involves an initial loss portfolio transfer (LPT), followed by the full transfer of all European Economic Area (EEA) domiciled business, pending regulatory approval. Tom Booth (pictured above), CEO of DARAG, said that this transaction marks a significant start to 2025, coinciding with DARAG's 15th year as a run-off consolidator in Europe. “It is further evidence of DARAG’s premier position in offering legacy solutions to the European market with our well capitalized German based carrier and local claims management expertise. Our track record in providing legal finality is unparalleled in the European market,” Booth said. Peter Huber, CEO of wefox Insurance AG, expressed confidence in DARAG as a partner for managing the portfolio. “We now are very confident that we will be able to successfully complete the announced sale of wefox Insurance AG in the first half of 2025. This is a further step towards our future focus on the Swiss short- and long-term absence market,” Huber said. In December , DARAG also announced that it has finalized the sale of its North American and Bermuda operations to RiverStone Group. “We are pleased to complete this transaction, which simplifies DARAG’s operations. It allows the group to focus on its core European business, and brings additional capital to execute a strong pipeline of European transactions, several of which are in advanced stages of negotiation,” Booth said. What are your thoughts on this story? Please feel free to share your comments below.

Wefox Frequently Asked Questions (FAQ)

When was Wefox founded?

Wefox was founded in 2015.

Where is Wefox's headquarters?

Wefox's headquarters is located at Am Karlsbad 16, Berlin.

What is Wefox's latest funding round?

Wefox's latest funding round is Private Equity.

How much did Wefox raise?

Wefox raised a total of $1.629B.

Who are the investors of Wefox?

Investors of Wefox include Searchlight Capital Partners, Chrysalis Capital, Target Global, Chrysalis Investments, Deutsche Bank and 46 more.

Who are Wefox's competitors?

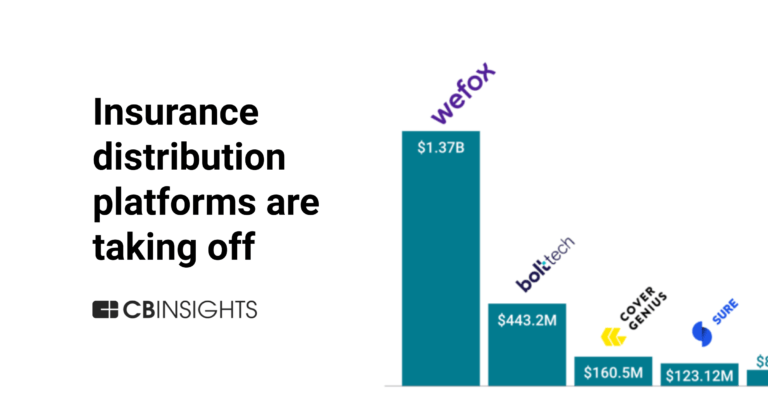

Competitors of Wefox include Bolttech, Feather, ELEMENT, Insly, TONI Digital and 7 more.

What products does Wefox offer?

Wefox's products include Insurance product builder and 4 more.

Loading...

Compare Wefox to Competitors

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform as a service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

GetSafe operates in the insurance industry. It offers a range of insurance services, including personal liability, contents, and income protection insurance, all managed through a dedicated app. Its primary customer base includes individuals seeking easy-to-manage, flexible insurance solutions. The company was founded in 2015 and is based in Heidelberg, Germany.

TONI Digital is a company that focuses on innovating in the insurance industry. The company offers a white-label solution that allows insurers, brokers, and distribution partners to create and offer tailored insurance products to their customers. These products cover a range of areas including car, building, travel, life, and household insurance. It was founded in 2017 and is based in Zurich, Switzerland.

Allianz is a company that focuses on providing insurance services in various sectors. The company offers a wide range of insurance products, including auto, home, life, and business insurance, as well as digital services such as claims management and assistance. It primarily serves individuals and businesses seeking insurance coverage. It is based in Munich, Germany.

eBaoTech is a technology solution provider for the global insurance industry, focusing on digital insurance software and platform services. The company offers products including a middleware platform (InsureMO) that supports the development and integration of insurance applications, and SaaS solutions for insurers, brokers, and other ecosystem participants. eBaoTech serves the insurance sector, offering tools for core system modernization, product development, and distribution management. It was founded in 2000 and is based in Shanghai, Shanghai.

Cover Genius is the insurtech company that specializes in embedded protection for various industries. Its main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serves sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Loading...