Carta

Founded Year

2012Stage

Valuation Change | AliveTotal Raised

$1.158BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-33 points in the past 30 days

About Carta

Carta focuses on ownership and equity management solutions. The company offers a range of services, including equity management, compensation management, and venture capital solutions, which help businesses manage their equity, build their businesses, and invest in future companies. It primarily serves sectors such as investment funds, law firms, and companies in various stages of growth. It was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Carta

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

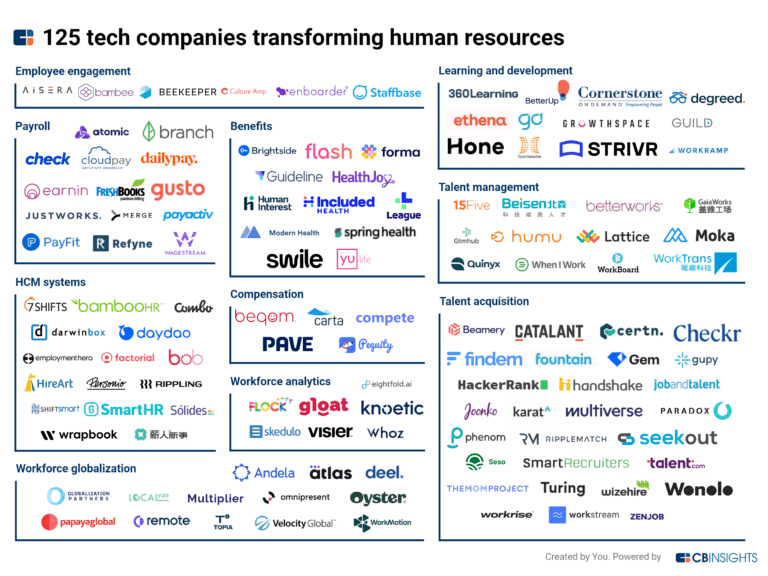

The compensation management and planning market provides solutions that enable employers to efficiently manage their total compensation packages for employees. These software platforms offer analytics, benchmarking, and planning tools to assist companies in navigating various geographies, roles, and levels, while ensuring equitable practices. Many vendors offer comprehensive end-to-end compensatio…

Carta named as Leader among 15 other companies, including Automatic Data Processing, Pave, and Syndio.

Loading...

Research containing Carta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Carta in 3 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Rippling acquires Pulley

Dec 22, 2022 report

The top 50 angel investing groupsExpert Collections containing Carta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Carta is included in 8 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,261 items

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,151 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

SMB Fintech

1,231 items

Tech IPO Pipeline

568 items

Carta Patents

Carta has filed 2 patents.

The 3 most popular patent topics include:

- 3d computer graphics

- 3d imaging

- automotive safety technologies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/5/2021 | 2/20/2024 | 3D imaging, Geodesy, Computer vision, Stereophotogrammetry, 3D computer graphics | Grant |

Application Date | 3/5/2021 |

|---|---|

Grant Date | 2/20/2024 |

Title | |

Related Topics | 3D imaging, Geodesy, Computer vision, Stereophotogrammetry, 3D computer graphics |

Status | Grant |

Latest Carta News

Mar 1, 2025

That a lot of unicorns that hit $1B+ valuations in 2020-2021 … probably aren’t really unicorns anymore. How many? Over 60% haven’t raised funding since 2021 and likely never achieved the scale to do so, or have seen growth slow: Per Carta, a𝘀 𝗼𝗳 𝗝𝗮𝗻 𝟭, 𝟮𝟬𝟮𝟱: 374 of the original 616 pool had not raised any subsequent rounds. 83 have raised a flat or up round (13.5%). 67 have raised a down round (10.9%, but nearly half of those that have raised anything). 78 have exited through IPO or M&A (12.7%). 14 have shut down (2.3%, may be a little undercount). This is what it is. In venture, we hope it all keeps going up. But the reality is, these are private companies. We often don’t talk about the ones that stop going up … unless they truly go under. Most of the time, if they don’t, we just stop talking. Some of these unicorns never made any sense. But some today are at $100m+ ARR, but have seen growth slow to less than 20%. A lot of them, in fact. That’s tough, but you still have scale and often, the burn rate is low or in many cases these centicorns are cash-flow positive. Just slow-growing now. Vs. hypergrowth a few years back., What if this is you? What if you raised at $1B+ or more in 2021, or even in 2025? And you don’t end up being worth that much? Look it’s not great but in the end, just keep growing as fast as practical and don’t run out of money. Private Equity won’t buy all of the almost 400 unicorns that didn’t raise another round. But they and others may buy a bunch. IF … if … they aren’t burning anything, still have some growth, and haven’t raised too much. Get to $100m+ ARR, with at least some growth, 100% NRR, and no burn, and you’ll have something or real value. Maybe not as much as the last round, but it is what it is. Related Posts

Carta Frequently Asked Questions (FAQ)

When was Carta founded?

Carta was founded in 2012.

Where is Carta's headquarters?

Carta's headquarters is located at 333 Bush Street, San Francisco.

What is Carta's latest funding round?

Carta's latest funding round is Valuation Change.

How much did Carta raise?

Carta raised a total of $1.158B.

Who are the investors of Carta?

Investors of Carta include Silver Lake, Alumni Ventures, Fabrica Ventures, Premji Invest, SierraMaya360 and 34 more.

Who are Carta's competitors?

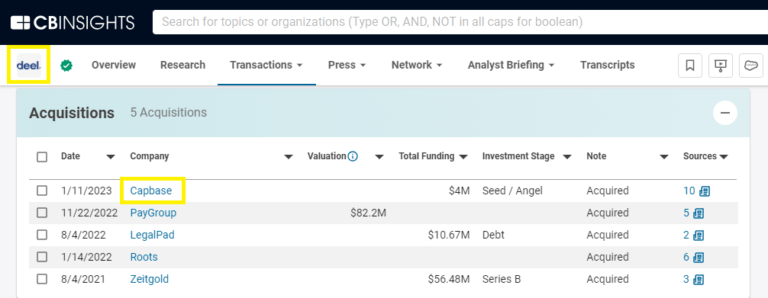

Competitors of Carta include Qapita, Aption, Nasdaq Private Market, Capbase, Shoobx and 7 more.

Loading...

Compare Carta to Competitors

Shareworks is a company that focuses on providing workplace financial solutions, operating within the financial services industry. The company offers a range of services including equity plan administration, retirement readiness programs, deferred compensation plan services, and executive services, all designed to help employees achieve their financial goals and companies to grow. The company primarily serves sectors such as private companies, public companies, and strategic partners. It was founded in 1999 and is based in New York, New York.

Pulley operates as an equity management platform for fundraising. The company offers solutions including cap table management, fundraising modeling, crypto and tokens, a communications hub, and more. It primarily serves the financial services sector. The company was founded in 2019 and is based in Oakland, California.

Upstock specializes in equity management solutions within the financial technology sector. It offers RSU-based equity plans and a platform for real-time tracking and management of worker equity, designed to empower founders and team members to align and achieve collective success. Upstock primarily serves startups, legal experts, contractors, and companies looking to integrate equity into their compensation and culture. It was founded in 2019 and is based in Wilmington, Delaware.

Ledgy is an equity management platform that specializes in streamlining equity-related processes for businesses. The company offers solutions for cap table management, equity plan automation, and financial reporting, designed to simplify workflows, ensure compliance, and enhance employee engagement through intuitive dashboards. Ledgy's platform is tailored to serve various sectors, including HR and compensation, finance and accounting, and legal and operations. It was founded in 2017 and is based in Zurich, Switzerland.

Aption specializes in equity pooling solutions within the financial services sector. The company offers services that allow individuals to leverage their equity positions to access investment opportunities in other startups. Aption was formerly known as Apeiros. It was founded in 2022 and is based in Scottsdale, Arizona.

EquityZen develops an investment platform. It connects shareholders of private companies with investors seeking alternative investments. It enables clients to provide the opportunity to invest in large private firms and address liquidity and risk concerns. It was founded in 2013 and is based in New York, New York.

Loading...