EBANX

Founded Year

2012Stage

Series C | AliveTotal Raised

$460MLast Raised

$430M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+11 points in the past 30 days

About EBANX

EBANX specializes in cross-border payment solutions within the financial technology (fintech) industry, providing payment services for companies looking to operate in rising markets. The company offers a platform for processing online purchases, managing funds from pay-ins to payouts, and facilitating transactions in various currencies and payment methods, including alternative options. It serves e-commerce, gaming, and digital advertising sectors, helping businesses operate in Latin America, Africa, and India. It was founded in 2012 and is based in Curitiba, Brazil.

Loading...

ESPs containing EBANX

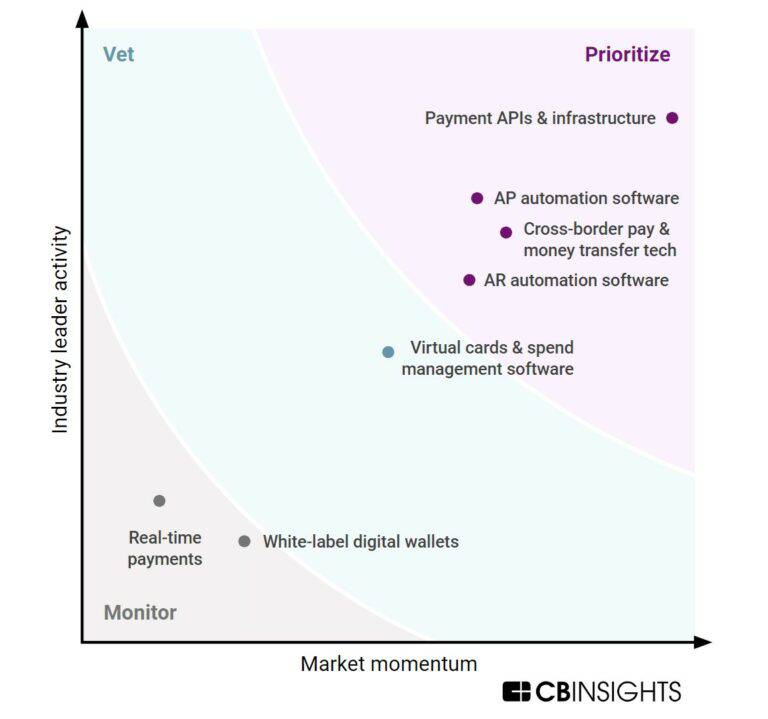

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

EBANX named as Challenger among 15 other companies, including FIS, Nium, and Checkout.com.

Loading...

Research containing EBANX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EBANX in 9 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

Nov 28, 2022

The Transcript from Yardstiq: Feel the churn

Sep 21, 2022 report

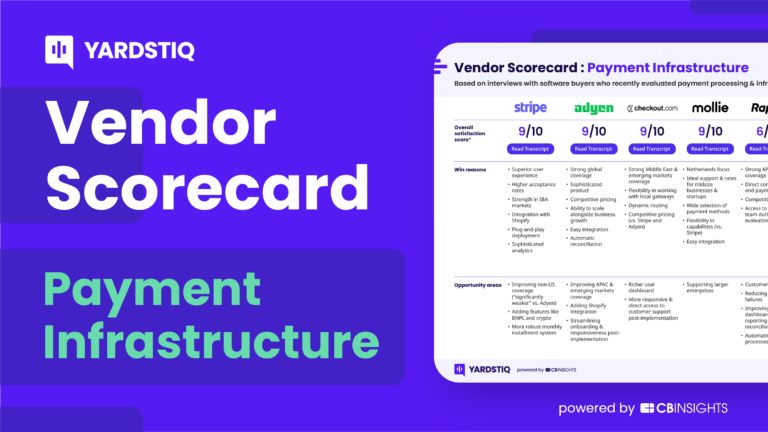

Top payment infrastructure companies — and why customers chose themExpert Collections containing EBANX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EBANX is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,359 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,257 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest EBANX News

Dec 20, 2024

Installment payments boost revenue of global companies in Brazil by 40%, reveals EBANX EBANX PTE. Ltd. Share: In one of the most benefited sectors, Asian gaming companies are raising the order value from Brazilian customers CURITIBA, Brazil, Dec. 20, 2024 /PRNewswire/ -- In Brazil, global companies offering installments as a payment solution experience an average weekly revenue growth of 40%, as revealed by internal data from EBANX , a global technology platform specializing in payment services for rising markets. This trend is particularly pronounced in the gaming sector, where the Average Order Value (AOV) with installments increases by 98% compared to single-payment transactions. Eduardo de Abreu, Vice President of Product at EBANX, at EBANX Payments Summit in Bangkok Eduardo de Abreu, Vice President of Product at EBANX, explained that installments are a cultural phenomenon in Brazil, rooted in the country's history of high inflation in the 1980s and early 1990s. "Over time, installments have become deeply ingrained in Brazilian and all Latin American cultures, providing consumers with a convenient and accessible way to make purchases, especially for higher-ticket values," de Abreu added. Latin America has emerged as the next frontier for the international expansion of gaming companies. The industry revenue in the region is projected to grow by 6.2% in 2024, surpassing Asia-Pacific's growth rate of 1.5% and North America's 0.6%, according to market research firm Newzoo . The latest data from EBANX on installments outlines a strategy for international companies to access Latin America's growing gaming market. Offering installment payments has already proven to be a key growth strategy for Asian merchants in Brazil. For instance, after introducing this payment solution, a Chinese gaming platform processing transactions through EBANX saw a 169% increase in AOV over the course of one year. Based in Japan, another gaming company experienced a 14% weekly revenue boost after adding installments as an option for customers. "This merchant was even able to reconnect with its clients because of this feature," said de Abreu. After the Japanese company began offering installments, 30% of Brazilian customers who hadn't purchased in one month returned to make higher-value payments. Today, nearly half of this merchant's transaction volume in Brazil is driven by installments. The VP of Product pointed out that "understanding how customers behave in different markets is essential to unlocking greater opportunities." De Abreu explained that by providing tailored solutions with traditional and alternative payment methods for Latin American gamers, Asian companies can navigate the region's unique market dynamics, ensuring seamless transactions and boosting user engagement. ABOUT EBANX EBANX is the leading payment platform connecting global companies with customers from the fastest-growing digital markets in the world. The company was founded in 2012 in Brazil with the mission of giving people access to buy in international digital commerce. With powerful proprietary technology and infrastructure, combined with in-depth knowledge of the markets where it operates, EBANX enables global businesses to connect with hundreds of payment methods in different countries in Latin America, Africa, and Asia. EBANX goes beyond payments, increasing sales, and fostering seamless purchase experiences for businesses and clients. For further information, please visit:

EBANX Frequently Asked Questions (FAQ)

When was EBANX founded?

EBANX was founded in 2012.

Where is EBANX's headquarters?

EBANX's headquarters is located at Marechal Deodoro, 630, Curitiba.

What is EBANX's latest funding round?

EBANX's latest funding round is Series C.

How much did EBANX raise?

EBANX raised a total of $460M.

Who are the investors of EBANX?

Investors of EBANX include Advent International, Endeavor, FTV Capital and Bossa Invest.

Who are EBANX's competitors?

Competitors of EBANX include CloudWalk, Pismo, Klasha, Payall, HedgeWiz and 7 more.

Loading...

Compare EBANX to Competitors

Rapyd is a fintech company. It specializes in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors, including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, United Kingdom.

Stripe is a financial infrastructure platform that provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interface (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as ecommerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Nium specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. Nium primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. Nium was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Checkout.com allows companies to accept payments around the world through one application program interface. It facilitates an integrated payment processing platform allowing the processing of payments in real-time, sending payouts, issuing, processing, and managing card payments. It also offers fraud prevention and secure authentication. The company was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

LATIPAY is a financial technology company that provides payment solutions for enterprise-level clients. The company has a platform that allows Chinese payers to make payments in CNY while businesses in New Zealand and Australia receive the payment in their local currency. LATIPAY offers an online invoicing platform for invoicing, goods tracking, and funds management, along with an online payment API that integrates with e-commerce platforms. It is based in Auckland, New Zealand.

Loading...