Dune Analytics

Founded Year

2018Stage

Series B | AliveTotal Raised

$79.42MValuation

$0000Last Raised

$69.42M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+46 points in the past 30 days

About Dune Analytics

Dune Analytics focuses on product analytics, specifically within the domain of decentralized applications (dApps) on the Ethereum blockchain. The company's main service involves providing analytics for these dApps, allowing users to understand and interpret data related to their products. It was founded in 2018 and is based in Oslo, Norway.

Loading...

ESPs containing Dune Analytics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

Dune Analytics named as Challenger among 14 other companies, including TradingView, Coin Metrics, and Nansen.

Loading...

Research containing Dune Analytics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dune Analytics in 5 CB Insights research briefs, most recently on Feb 23, 2023.

Dec 14, 2022

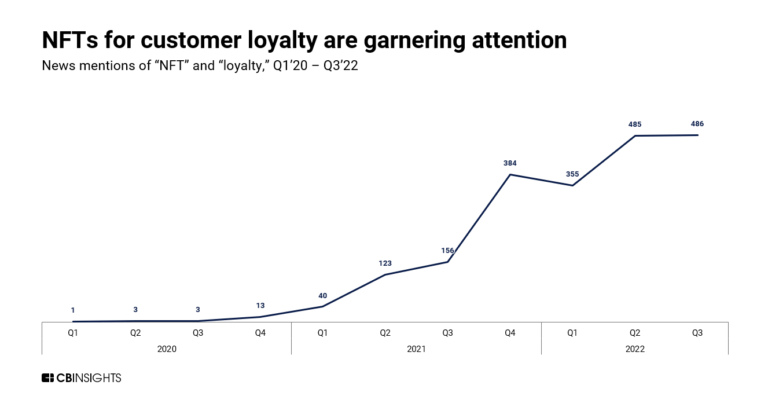

What L’Oréal, Nike, and LVMH are doing in Web3Expert Collections containing Dune Analytics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

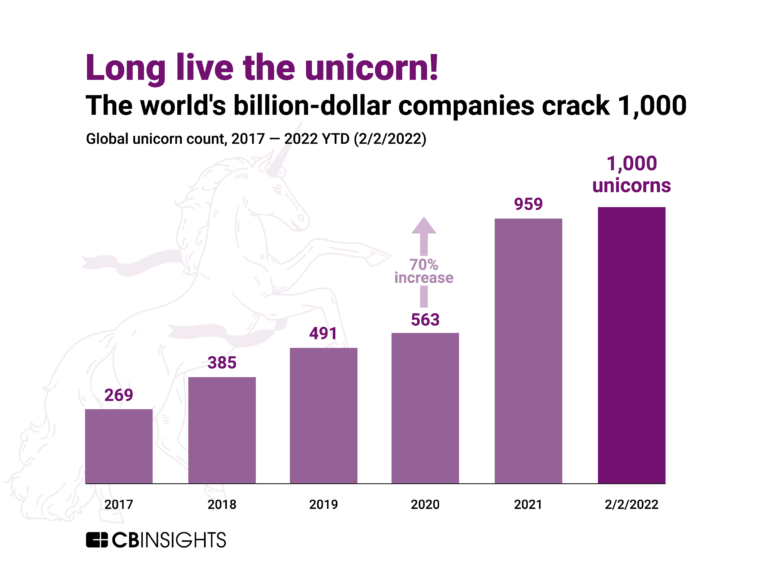

Dune Analytics is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Blockchain

12,298 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Blockchain 50

50 items

Latest Dune Analytics News

Dec 19, 2024

Link copied The Open Network, a blockchain originally developed by Telegram, is now integrated with Dune Analytics, a platform for on-chain data exploration. This integration allows developers, analysts, and blockchain enthusiasts to access and study TON’s ecosystem activity through custom dashboards and visual tools. According to a press note shared with crypto.news, Dune’s integration provides insights into TON’s growing ecosystem, according to a press note shared with crypto.news. TON ( TON ) is a Layer-1 blockchain designed for scalability and ease of use. It employs a sharding mechanism that divides the network into smaller parts to handle transactions efficiently. A Proof-of-Stake consensus mechanism ensures network security while supporting a high volume of transactions. TON’s integration with Telegram also enables users to interact with blockchain features directly within the app. Dune Analytics can now analyze TON’s activity Dune’s integration offers insights into TON’s ecosystem, including applications like decentralized storage, financial tools, and games. TON Storage, for example, provides a decentralized alternative to cloud storage, while the STON.fi decentralized exchange leads the network in trading volumes and token availability. STON.fi now has a dedicated dashboard on Dune, showcasing key metrics such as Total Value Locked and trading activity. “By making our metrics more transparent and easier to explore, we’re helping everyone—from curious newcomers to seasoned pros—feel confident about the future of cross-chain DeFi,” said Martin Masser, Chief Business Development Officer at STON.fi. With TON data available on Dune, users can analyze transaction patterns, wallet activity, and ecosystem growth. The integration also allows tracking of cross-chain activities , making it easier to understand how TON connects with other blockchain networks.

Dune Analytics Frequently Asked Questions (FAQ)

When was Dune Analytics founded?

Dune Analytics was founded in 2018.

Where is Dune Analytics's headquarters?

Dune Analytics's headquarters is located at C/o Epicenter Edvard Storms gate 2, Oslo.

What is Dune Analytics's latest funding round?

Dune Analytics's latest funding round is Series B.

How much did Dune Analytics raise?

Dune Analytics raised a total of $79.42M.

Who are the investors of Dune Analytics?

Investors of Dune Analytics include Multicoin Capital, Dragonfly, Coatue, Union Square Ventures, Redpoint Ventures and 10 more.

Who are Dune Analytics's competitors?

Competitors of Dune Analytics include Plato Blockchain and 8 more.

Loading...

Compare Dune Analytics to Competitors

Artemis is a company that provides an institutional data platform for digital assets within the financial technology sector. Its offerings include tools for analyzing on-chain activity, such as a terminal for analytics, a spreadsheet plugin for data integration, and services for data sharing and API access. Artemis serves the financial and investment sectors, providing resources for crypto analysts and institutional investors. It is based in New York, New York.

Chainalysis is a blockchain data platform that offers blockchain intelligence to assist in detecting crypto crime, ensuring regulatory compliance, and supporting financial institutions. The company serves law enforcement agencies, regulators, and centralized exchanges. It was founded in 2014 and is based in New York, New York.

Whalemap provides on-chain data for Bitcoin trading within the cryptocurrency market. The company offers tools to track whale activity, identify support and resistance levels, and analyze market trends for trading decisions. Whalemap's services cater to individuals and institutions looking to gain insights into Bitcoin's market movements based on whale transactions. It was founded in 2020 and is based in London, England.

Riskbloq is a company focused on providing professional risk analysis and scoring for digital assets within the cryptocurrency sector. Their main services include generating comprehensive risk profiles for over 3000 crypto assets by combining on-chain and off-chain data, aimed at aiding investors in making informed crypto investment decisions. The company primarily caters to individual and institutional investors looking for data-driven insights into the cryptocurrency market. It was founded in 2022 and is based in Johannesburg, South Africa.

Nansen is a blockchain analytics platform that focuses on providing insights for crypto investors and teams. The company offers services such as enrichment of on-chain data with wallet labels, real-time dashboards for tracking assets, and smart alerts for market movements. Nansen primarily serves sectors such as crypto investors, venture capital, exchanges, and DeFi protocols. It was founded in 2020 and is based in Singapore.

DeepDAO lists, ranks, and analyzes top DAOs across multiple metrics, such as membership and assets under management (AUM). Its mission is to provide comprehensive discoverability for decentralized governance systems, analytics, and information gathering.

Loading...