Dot

Founded Year

2019Stage

Series C | AliveTotal Raised

$89.2MLast Raised

$58M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-34 points in the past 30 days

About Dot

Dot is a company that provides digital commerce tools for various industries. It offers tools for point of sale, online storefronts, QR code-based ordering, payment processing, delivery management, and inventory management. These tools are applicable to the food and beverage, retail, and service sectors, enabling businesses to operate online and offline. Dot was formerly known as DotPe. It was founded in 2019 and is based in Gurugram, India.

Loading...

Loading...

Research containing Dot

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dot in 1 CB Insights research brief, most recently on Mar 14, 2023.

Mar 14, 2023 report

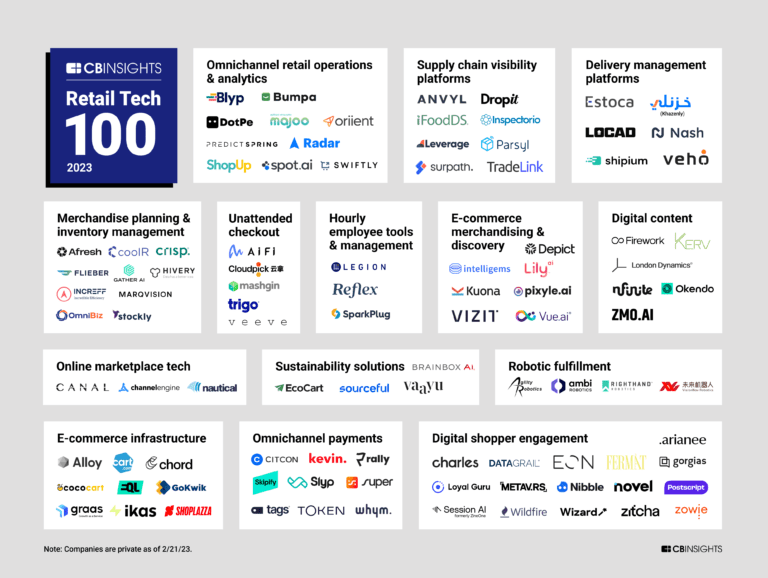

Retail Tech 100: The most promising retail tech startups of 2023Expert Collections containing Dot

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dot is included in 4 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,823 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Dot News

Dec 31, 2024

Link copied Polkadot price was the top laggard large-cap cryptocurrency in 2024, but a rare chart pattern points to a strong rebound in 2025. Polkdaot ( DOT ) retreated by over 15% this year, while other top coins like Bitcoin ( BTC ), Solana ( SOL ), and Binance Coin ( BNB ) soared to their all-time highs. The coin’s underperformance occurred even as its network saw successful ecosystem launches. For instance, Hydration, a leading decentralized exchange within the Polkadot ecosystem, handled a record-high volume of over $124 million in December. Polkadot’s NFL Rivals, a digital collectible card game, has gained traction among NFT traders. Meanwhile, Bifrost, a liquid staking network in Polkadot, accumulated over $15.1 million in assets, while Moonwell, a lending protocol, has nearly $200 million in total value locked. Even with Neuroweb transactions offline for the V8 upgrade this week… Polkadot network-wide monthly transactions are set to make a new All Time High. pic.twitter.com/bHCQLW011u According to The Block, Polkadot saw 8.52 million transfers in December, slightly down from 9.11 million in November. However, transfers in the fourth quarter reached an all-time high, signaling robust activity on the network. Similar growth was observed in the relay chain, where both active addresses and transfers increased. Polkadot also offers one of the highest staking yields among major cryptocurrencies, with a yield of 12% and a staking ratio of 25.13%. These strong fundamentals may support a price rebound in the coming months. Polkadot price has formed a falling wedge DOT price chart | Source: crypto.news The daily chart indicates that DOT price has pulled back over the past few weeks, falling from this month’s high of $11.70 to the current $6.8. Polkadot has remained above the 100-day and 200-day Exponential Moving Averages, signaling positivity. It has also formed a cup and handle chart pattern, with the ongoing retreat representing the handle. Additionally, a falling wedge pattern, a well-known bullish reversal indicator, has emerged. As the two lines of the wedge approach their confluence, the price is likely to experience a bullish breakout. This could propel DOT to the year-to-date high of $11.68, approximately 72% above its current level.

Dot Frequently Asked Questions (FAQ)

When was Dot founded?

Dot was founded in 2019.

Where is Dot's headquarters?

Dot's headquarters is located at Golf Course Road, Sector 54, Gurugram.

What is Dot's latest funding round?

Dot's latest funding round is Series C.

How much did Dot raise?

Dot raised a total of $89.2M.

Who are the investors of Dot?

Investors of Dot include PayU, Bank of Tokyo-Mitsubishi UFJ, IE Ventures, Temasek, Naya Capital and 13 more.

Who are Dot's competitors?

Competitors of Dot include Swiggy, Awayco, Listerr, WINDO, Pine Labs and 7 more.

Loading...

Compare Dot to Competitors

Dukaan operates as an online marketplace platform and global commerce partner. It helps users and offline merchants create online stores, and catalogs, and sell to customers through an application. It was founded in 2020 and is based in Bengaluru, India.

Bikayi is a comprehensive e-commerce enabler that specializes in providing a platform for businesses to create and manage their online stores. The company offers a suite of services including customizable store themes, integrated payment gateways, multi-vendor support, and delivery partner integration, as well as advanced features for digital marketing, SEO, and social media engagement. Bikayi's solutions cater to a wide range of sectors, including food and beverages, jewelry, fashion, electronics, and groceries, enabling entrepreneurs and startups to scale their online presence and sales. It was founded in 2019 and is based in Gachibowli, India.

Shopistan is a digital marketing and e-commerce agency focusing on technology-driven solutions. The company offers a range of services including digital media strategy, real-time data analytics, reporting, and search engine optimization to enhance online presence and drive business growth. Shopistan primarily caters to small and medium-sized enterprises as well as high-end brands seeking to improve their e-commerce capabilities. It was founded in 2012 and is based in Pakistan.

Rappi operates as a tech company that focuses on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

Rebel Foods focuses on operating a global chain of internet restaurants and a multi-brand cloud kitchen model. The company offers a proprietary operating system for building and scaling a diverse portfolio of own and partner food brands, leveraging culinary craft and technology infrastructure. Rebel Foods primarily serves the food delivery industry with a variety of cuisine offerings, to cater to different consumer food patterns. Rebel Foods was formerly known as Faasos. It was founded in 2011 and is based in Mumbai, India.

GoCardless specializes in online payment processing solutions. The company offers services to facilitate direct bank payments, including instant one-off payments, automated recurring payments, and access to bank account data for businesses. GoCardless primarily serves businesses looking to streamline their payment collection and reconciliation processes. It was founded in 2011 and is based in London, United Kingdom.

Loading...