Devoted Health

Founded Year

2017Stage

Series E - II | AliveTotal Raised

$2.256BLast Raised

$112M | 7 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+29 points in the past 30 days

About Devoted Health

Devoted Health is a healthcare company. The company offers a range of services, including dental, vision, and prescription drug coverage, as well as fitness and wellness programs, primarily to older Americans. Devoted Health's Medicare Advantage plans are designed to provide comprehensive benefits and savings to its members. Devoted Health was formerly known as Orinoco Health. It was founded in 2017 and is based in Waltham, Massachusetts.

Loading...

ESPs containing Devoted Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Devoted Health named as Highflier among 12 other companies, including Oscar, Clover Health, and Acko.

Devoted Health's Products & Differentiators

Devoted Health Plans

Devoted Health built its Medicare Advantage health insurance plans from scratch. Its plan is purpose-built and optimized from inception to deliver and scale value-based payment and care, creating a better healthcare experience for seniors and their providers.

Loading...

Research containing Devoted Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Devoted Health in 8 CB Insights research briefs, most recently on Nov 14, 2024.

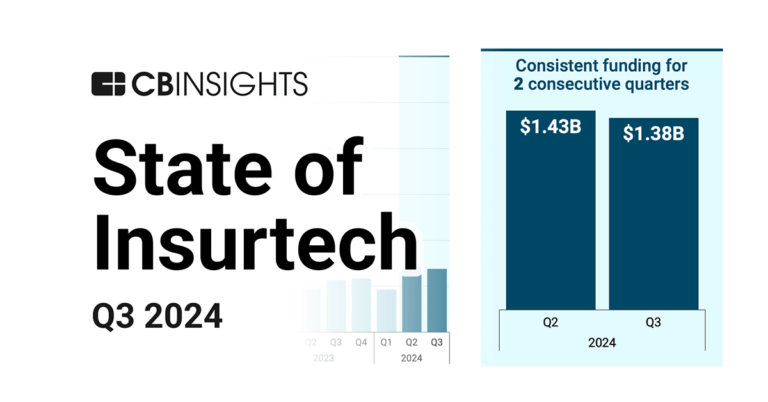

Nov 14, 2024 report

State of Insurtech Q3’24 Report

Feb 23, 2024

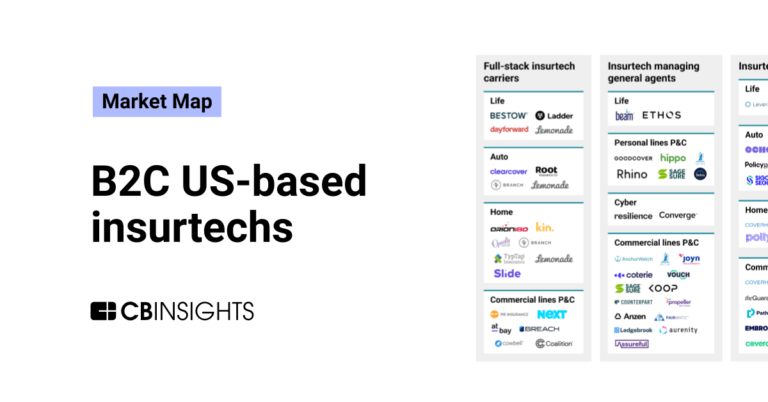

The B2C US insurtech market map

Feb 9, 2024 report

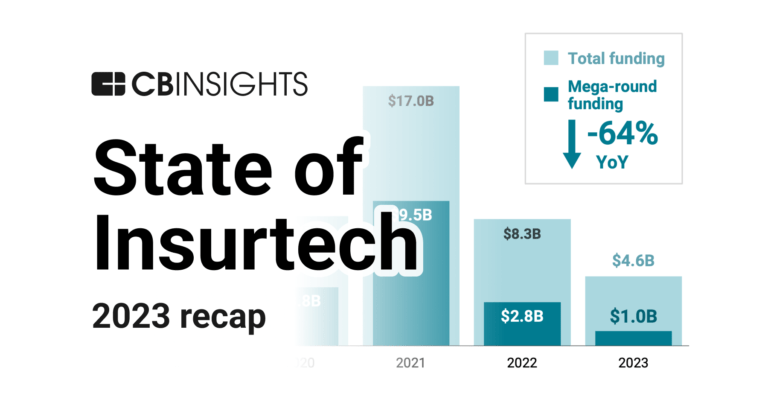

State of Insurtech 2023 Report

Jan 25, 2024 report

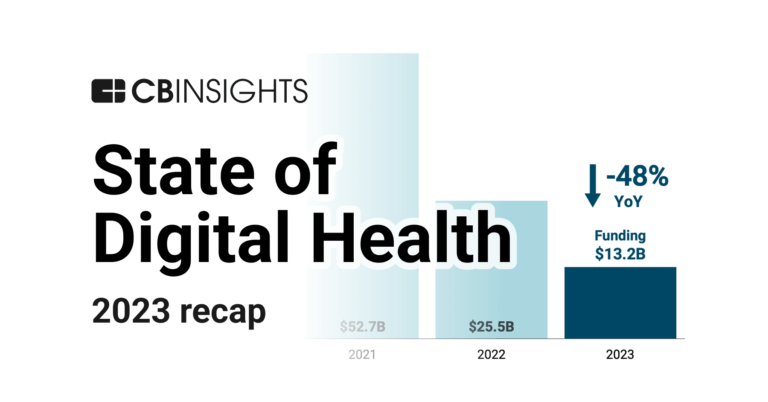

State of Digital Health 2023 Report

Expert Collections containing Devoted Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Devoted Health is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Insurtech

3,243 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Value-Based Care & Population Health

892 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Health

11,251 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Latest Devoted Health News

Dec 23, 2024

Investors are watching for a pickup in healthcare M&A deals in 2025. Foto: Nudphon Phuengsuwan/Getty Images Investors are watching for a pickup in healthcare M&A deals in 2025.Nudphon Phuengsuwan/Getty Images After a slower-than-anticipated year for healthcare funding, investors expect sunnier skies in 2025. 13 VCs from firms like ICONIQ Growth and AlleyCorp share their predictions for digital healthcare next year. They expect more M&A, funding for AI agents and clinical decision support, and Medicare shake-ups. The healthtech sector will see more private-equity-backed M&A and a fierce battle between AI-scribing startups next year, according to thirteen investors in the healthcare VC market. At the beginning of the year, healthcare venture capital appeared poised for a rebound. Investors hoping to do deals again after a two-year funding drought watched as healthcare startups flooded back to the market to grab more cash. Those VCs raced to break out their checkbooks for hot new AI startups in the first quarter, from scribing startups like Abridge to automated prior authorization players like Cohere Health . A confluence of macroeconomic factors — from still-high interest rates to fundraising struggles for venture firms to the uncertainty of a looming presidential election — dampened the anticipated resurgence. 2024's funding appears to be, at best, on pace with 2023 levels, with $8.2 billion raised by US digital health startups in the first three quarters of this year compared to $8.6 billion through Q3 2023, per Rock Health. Now, with interest rates expected to drop and a new administration on the way , VCs are anticipating sunnier skies in 2025. A pickup in healthcare M&A and IPOs After a slow year for healthcare M&A, investors want to see more deals in 2025. With interest rates expected to come down — and investors facing pressure to deploy capital — private equity buyers should be more active in 2025, said .406 Ventures managing director Liam Donohue. And Flare Capital Partners' Parth Desai said he's already seeing private-equity-backed healthcare companies looking to buy smaller startups. Their goal, as he understands it, is to make tuck-in acquisitions in 2025 that improve their growth stories as they look ahead to potential IPOs in 2026. "Maybe they're not phenomenal outcomes, but at the end of the day, they'll create some liquidity," Desai said of those acquisitions. "I expect that to be one of the first exit windows starting to manifest in 2025." Investors were hopeful but unsure that the IPO window would meaningfully reopen for digital health startups in 2025, despite startups like Hinge Health and Omada Health signaling their intentions to test the public markets. Venrock partner Bryan Roberts said he expects the healthcare IPO market to remain relatively quiet. LRV Health managing partner Keith Figlioli suggested we won't see IPO activity kick off until the second half of the year after other exit windows open. VCs said they're mostly looking for smaller deals next year, from mergers of equals to asset sales. Figlioli and Foreground Capital partner Alice Zheng said we'll see even more consolidation and shutdowns in digital health next year as startups run out of cash. "Investors will have to make tough decisions on their portfolio companies," Zheng said. "We want to support all of them, but we can't indefinitely." Alice Zheng, a partner at Foreground Capital, expects to see more consolidation and shutdowns as investors make tough decisions about their digital health portfolios.Foreground Capital Healthcare AI competition will get fierce Healthcare startups using AI for administrative tasks were easily the hottest area of healthcare AI investment in 2024. Investors think the crop of well-funded competitors will face increasing pressures next year to expand their product lines. ICONIQ Growth principal Sruthi Ramaswami said she expects the group of AI scribing startups that landed big funding rounds this year, from Abridge to Ambience Healthcare to Suki , to scale significantly next year using the fresh cash as hospitals scramble for solutions to the healthcare staffing shortage. As these startups scale, however, they'll face pressure to expand beyond ambient scribing into other product lines, like using AI for medical coding and billing, said Kindred Ventures managing partner Kanyi Maqubela. Scribing technology could become a commodity sooner than later, with many providers trying free off-the-shelf scribing software rather than contracting with startups, Maqubela said. "It'll be a race to who can start to build other services and build more of an ecosystem for their provider customers," he said. Kindred Ventures general partner Kanyi Maqubela thinks medical scribe startups will have to race to find new product lines against commoditization.Kindred Ventures Some AI startups, like Abridge, have already been vocal about their plans to expand into areas like coding or clinical decision support . The best-funded AI scribing startups may be able to acquire smaller startups to add those capabilities, but other scribing companies will be more likely to get bought out, Maqubela said. Flare Capital Partners' Desai suggested that healthcare companies already focused on RCM will try to pick up scribing solutions as the tech becomes a must-have for hospitals. He pointed to Commure 's $139 million take-private acquisition of Augmedix in July. Ramaswami said that demonstrating a high return on investment would be critical for these startups as hospitals pick their favorites among various AI pilots . Sruthi RamaswamiIconiq Growth Health insurance in flux in Trump's second term While many VCs quietly celebrated the potential for more M&A and IPOs in 2025 following Trump's election in November, the incoming administration could bring some big shake-ups for healthcare markets. Trump could move to boost private health insurers, including Medicare Advantage plans, in his second term, Venrock's Roberts said. That could be a boon for young insurers like Devoted Health and Alignment Healthcare fighting for Medicare Advantage market share, as well as startups contracting with insurers to improve healthcare payment processes . He suggested the new administration may even roll back changes made in the Center for Medicare and Medicaid Services' latest reimbursement model for Medicare, which went into effect this year and resulted in lower payments for many Medicare Advantage plans in the agency's attempt to improve payment accuracy. Brenton Fargnoli, a general partner at AlleyCorp, said he expects to see health insurers respond to these risk adjustment changes and move to control higher-than-expected medical costs over the past year by launching a bevy of new value-based care partnerships in 2025 for specialties, including oncology, cardiology, and musculoskeletal care. Brenton Fargnoli, a general partner at AlleyCorp, thinks insurers will launch a bevy of value-based care partnerships in 2025 for high-cost specialties.AlleyCorp Some healthcare experts are also concerned that the federal government could cut funding for Medicaid plans. These changes could force states to scramble for new strategies and potentially new partnerships to control healthcare costs for their Medicaid populations. "If there is a significant shift in direction at the federal level, I think you're going to see certain states do much more than they have in the past to try to continue to address health disparities," said Jason Robart, cofounder and managing partner of Seae Ventures. "As it happens, that creates opportunities for private companies to leverage their innovative solutions to address the need." Similarly, Muse Capital founding partner Rachel Springate said that while investors in reproductive health startups will be closely watching state-level regulatory changes that could impact their portfolio companies, those startups could see surges in consumer demand as founders step up to fill gaps in reproductive care access. Some of the Trump administration's proposed moves could stunt progress for health and biotech startups by stalling regulatory oversight. Robert F. Kennedy Jr. , Trump's pick to lead Health and Human Services, has said he wants to overhaul federal health agencies, including the Food and Drug Administration and the National Institutes of Health. Marissa Moore, a principal at OMERS Ventures, said the promised audits and restructuring efforts could lead to major delays in critical NIH research and FDA approvals of new drugs and medical devices. Rachel Springate, founding partner at Muse Capital, thinks reproductive health startups could see surges in consumer demand as founders step up to fill gaps in care access.Muse Capital What's hot in AI beyond scribes In 2025, AI will be an expectation in healthcare startup pitches, not an exception, said Erica Murdoch, managing director at Unseen Capital. Startups have pivoted to position AI as a tool for improved efficiency rather than as their focal point — and any digital health startups not using AI, in turn, will need a good reason for it. With that understanding, investors expect to see plenty more funding for healthcare AI in 2025. While many tools made headlines this year for their ability to automate certain parts of healthcare administration, .406 Ventures' Donohue and OMERS Ventures' Moore said they expect to see an explosion of AI agents in healthcare that can manage these processes autonomously. Investors remain largely bullish about healthcare AI for administrative tasks over other use cases, but some think startups using the tech for aspects of patient diagnosis and treatment will pick up steam next year. "We will begin to see a few true clinical decision support use cases come to light, and more pilots will begin to test the augmentation of clinicians and the support they truly need to deliver high quality, safe care," said LRV Health's Figlioli. He hinted the market will see some related funding announcements in early 2025. Moore said she's also expecting to see more investments for AI-driven mental health services beyond traditional cognitive behavioral therapy models — "for example, just today I got pitched 'the world's first AI hypnotherapist." Dan Mendelson, the CEO of JPMorgan's healthcare fund Morgan Health , said he's watching care navigation startups from Included Health to Transcarent to Morgan Health's portfolio company Personify that are now working to improve the employee experience with AI. The goal, he says, is for an employee to query the startup's wraparound solution and be directed to the right benefit via its AI, a capability he says he hasn't yet seen deployed at scale. "These companies are racing to deploy their data and train their models, and we'd love to see a viable product in this area," he said. Read the original article on Business Insider

Devoted Health Frequently Asked Questions (FAQ)

When was Devoted Health founded?

Devoted Health was founded in 2017.

Where is Devoted Health's headquarters?

Devoted Health's headquarters is located at 221 Crescent Street, Waltham.

What is Devoted Health's latest funding round?

Devoted Health's latest funding round is Series E - II.

How much did Devoted Health raise?

Devoted Health raised a total of $2.256B.

Who are the investors of Devoted Health?

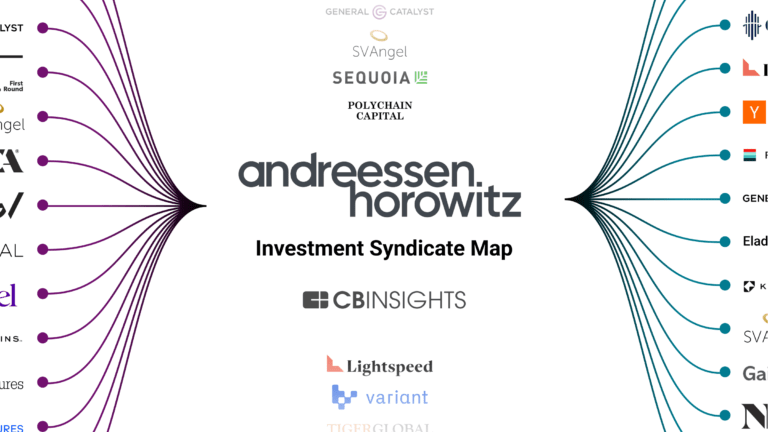

Investors of Devoted Health include The Space Between, Cox Enterprises, White Road Investments, Andreessen Horowitz, Emerson Collective and 22 more.

Who are Devoted Health's competitors?

Competitors of Devoted Health include NeueHealth and 8 more.

What products does Devoted Health offer?

Devoted Health's products include Devoted Health Plans and 2 more.

Loading...

Compare Devoted Health to Competitors

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

UnitedHealthcare is a health insurance company that offers various health plans and services, including Medicare Advantage, Medicaid, individual and family plans, dental, vision, and supplemental insurance options. UnitedHealthcare primarily sells to individuals, families, and employers seeking health insurance. UnitedHealthcare was formerly known as Bind. It was founded in 1974 and is based in Hopkins, Minnesota.

Alignment Health operates as a health insurance provider focused on offering Medicare plans. The company provides on-demand access to healthcare services, including in-person, in-home, and mobile device consultations, along with a range of all-inclusive benefits for its members. The company primarily serves the Medicare beneficiaries sector. It was founded in 2013 and is based in Orange, California.

Carelon is a healthcare services company focused on delivering whole-person care across various domains within the healthcare industry. The company offers integrated care models, digital tools, and services that address physical, mental, social, and economic health factors, aiming to simplify healthcare experiences, improve outcomes, and manage costs. Carelon's solutions are designed to support individuals with complex health conditions, provide behavioral health management, and facilitate primary and palliative care, alongside pharmacy services and medical benefits management. It was founded in 2017 and is based in Morristown, New Jersey.

Blue Cross and Blue Shield of North Carolina is a health insurance provider offering individual and family health insurance plans, Medicare, dental, and vision options, as well as plans for small and large employers. It was founded in 1933 and is based in Durham, North Carolina.

Sompo Digital Lab focuses on digital technology innovation in the customer experience and health services sectors. The company aims to enhance safety, security, and health through digital solutions, leveraging a team composed of research & development, in-house development, and data scientists. It was founded in 2015 and is based in Foster City, California.

Loading...