Dataminr

Founded Year

2009Stage

Secondary Market - II | AliveTotal Raised

$1.044BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Dataminr

Dataminr specializes in real-time event and risk detection, operating within the AI and public data analysis sectors. The company's AI platform processes vast amounts of public data to generate timely alerts on high-impact events and emerging risks, enabling organizations to respond effectively to crises. Dataminr's solutions cater to a diverse clientele, including global corporations, public sector agencies, newsrooms, and non-governmental organizations. Dataminr was formerly known as EBH Enterprises. It was founded in 2009 and is based in New York, New York.

Loading...

Loading...

Research containing Dataminr

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dataminr in 2 CB Insights research briefs, most recently on Aug 21, 2023.

Aug 14, 2023

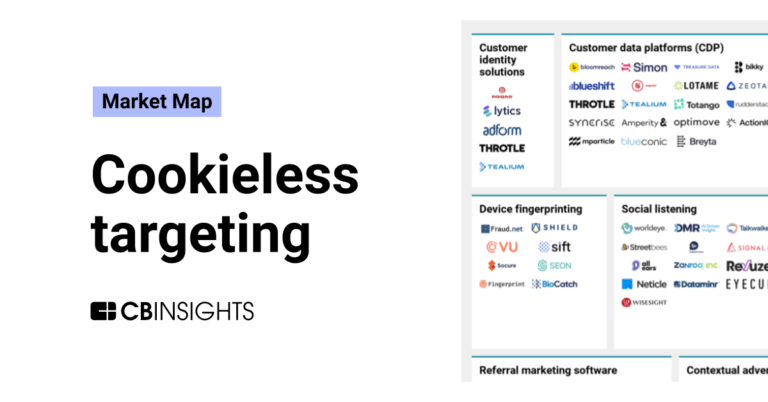

The cookieless targeting market mapExpert Collections containing Dataminr

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dataminr is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

7,146 items

Latest Dataminr News

Jan 2, 2025

The agreement will see Windward shareholders receive 215 pence per share in cash. December 26, 2024 Windward’s AI solution empowers stakeholders with predictive insights and a 360° view of the maritime ecosystem. Credit: GreenOak/Shutterstock. Octopus UK Bidco, a subsidiary of FTV VIII, has announced a recommended cash acquisition of Windward, a maritime artificial intelligence (AI) based analytics firm, in a deal valued at around £216m ($270.7m). The deal will result in Windward shareholders receiving 215 pence per share in cash. Go deeper with GlobalData Windward provides a comprehensive platform for maritime domain awareness and risk management. Its AI-driven solution enables stakeholders to make predictive, real-time decisions with a comprehensive 360° perspective of the maritime ecosystem. Recently, Windward joined forces with US-based AI company Dataminr to incorporate real-time alerting into its maritime platform, equipping customers with tools to address maritime and global events proactively. Windward CEO Ami Daniel said: “This marks an exciting next step in the evolution of Windward, providing the opportunity to build upon our first mover advantage in maritime generative AI through accelerated innovation and greater market reach. How well do you really know your competitors? Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge. Not ready to buy yet? Download a free sample We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form By GlobalData Submit Submit and download Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address. “We are incredibly proud of the growth we have achieved while on the AIM market, and our ability to adapt and incorporate evolving technology, specifically generative AI.” The acquisition process, structured as a merger in line with Israeli Companies Law, is expected to conclude by the end of the first quarter of 2025. FTV VIII managing partner Brad Bernstein said: “As global seaborne trade expands, regulatory regimes tighten and supply chain pressures mount, the need for advanced maritime intelligence and visibility has become imperative for global organisations to effectively operate and manage risk in an increasingly complex landscape. “Windward has built a best-in-class maritime AI-based analytics platform spanning use cases across risk, compliance, trading and the supply chain and delivering tangible value to its growing blue-chip customer base worldwide.” Legal advice for the acquisition is being provided by CMS Cameron McKenna Nabarro Olswang and Epstein Rosenblum Maoz for Windward, with Willkie Farr & Gallagher and Gornitzky representing the FTV VIII, Bidco, and SPV. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

Dataminr Frequently Asked Questions (FAQ)

When was Dataminr founded?

Dataminr was founded in 2009.

Where is Dataminr's headquarters?

Dataminr's headquarters is located at 6 E 32nd St, New York.

What is Dataminr's latest funding round?

Dataminr's latest funding round is Secondary Market - II.

How much did Dataminr raise?

Dataminr raised a total of $1.044B.

Who are the investors of Dataminr?

Investors of Dataminr include Fabrica Ventures, Institutional Venture Partners, Morgan Stanley, MSD Capital, Valor Equity Partners and 36 more.

Who are Dataminr's competitors?

Competitors of Dataminr include Accern, Capitolis, NYSHEX, VULCAiN Ai, Cyabra and 7 more.

Loading...

Compare Dataminr to Competitors

Q4 provides capital markets access platforms, operating within the financial technology sector. The company offers products including IR website products, virtual event solutions, engagement analytics, investor relations CRM, shareholder and market analysis, surveillance, and ESG tools, designed to facilitate efficient communication and engagement between issuers, investors, and the sell-side. Q4 primarily serves public companies across various industries seeking to enhance their investor relations and capital market activities. It was founded in 2006 and is based in Toronto, Canada.

Symphony is a technology company that provides communication infrastructure for the financial services industry. The company offers products including messaging, voice communication, directory services, and analytics tailored for market participants. Symphony's solutions facilitate standardized and automated workflows, catering to the needs of institutions and professionals. It was founded in 2014 and is based in New York, New York.

CloudMargin is a cloud-based collateral management workflow tool. The firm's Software-as-a-Service model helps financial institutions, including exchanges, brokerage firms, banks, asset management firms, and insurance companies, meet regulatory deadlines and reduce costs associated with collateral requirements that are growing. CloudMargin enables clients to experience rapid implementation and access to robust and secure collateral management workflow software. It was founded in 2014 and is based in London, United Kingdom.

Trumid operates as a financial technology company. It offers an electronic trading platform and provides corporate bond market professionals with direct access to anonymous and counterparty-disclosed liquidity. It primarily serves the financial technology sector. The company was founded in 2014 and is based in New York, New York.

NYSHEX focuses on the ocean supply chain through its digital platform in the shipping industry. The company offers services for shippers, carriers, and NVOCCs. NYSHEX primarily serves the global shipping sector, providing a system of record for all parties involved. It was founded in 2014 and is based in New York, New York.

sFOX is a full-service crypto prime dealer that operates in the financial services industry, focusing on institutional investors. The company offers a suite of services including trading, liquidity solutions, secure custody, staking, prime services, and API integration to facilitate digital asset transactions. sFOX caters primarily to institutions, asset managers, financial institutions, advisors, hedge funds, crypto exchanges, family offices, and sophisticated individual traders. sFOX was formerly known as Ox Labs Inc.. It was founded in 2014 and is based in El Segundo, California.

Loading...