Investments

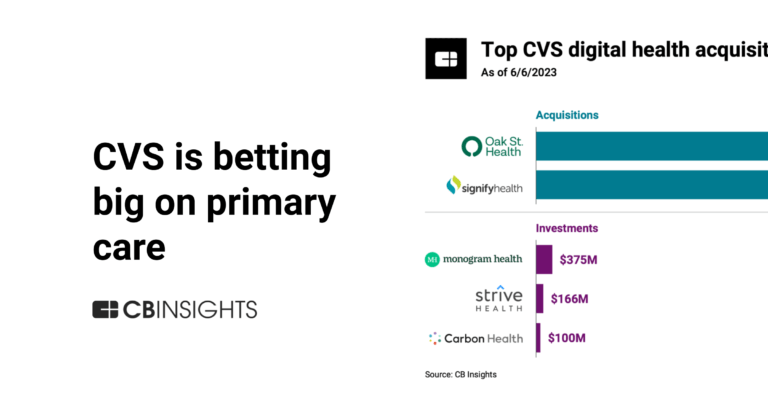

29About CVS Health Ventures

CVS Health Ventures is a dedicated corporate venture capital fund that invests in and partners with high-potential, early-stage companies that strive to make health care more accessible, affordable, and better.

Research containing CVS Health Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CVS Health Ventures in 4 CB Insights research briefs, most recently on Sep 13, 2024.

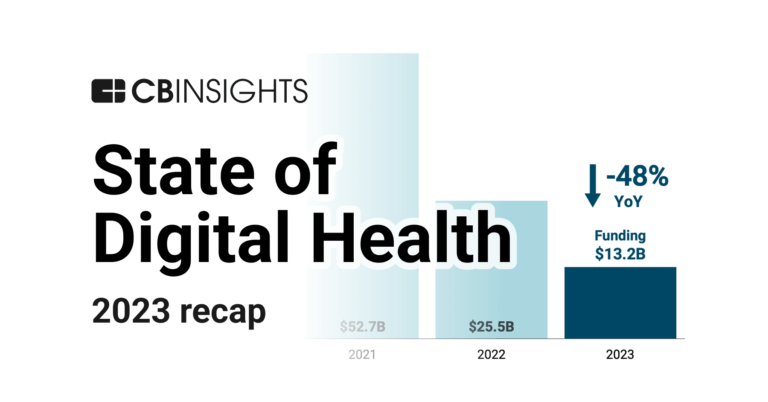

Jan 25, 2024 report

State of Digital Health 2023 ReportLatest CVS Health Ventures News

Jan 27, 2025

Reviewing Guardian Pharmacy Services (NYSE:GRDN) & CVS Health (NYSE:CVS) Posted by MarketBeat News on Jan 27th, 2025 Guardian Pharmacy Services ( NYSE:GRDN – Get Free Report ) and CVS Health ( NYSE:CVS – Get Free Report ) are both medical companies, but which is the superior investment? We will compare the two businesses based on the strength of their analyst recommendations, earnings, institutional ownership, dividends, profitability, risk and valuation. Insider and Institutional Ownership 80.7% of CVS Health shares are held by institutional investors. 0.2% of CVS Health shares are held by insiders. Strong institutional ownership is an indication that hedge funds, endowments and large money managers believe a company will outperform the market over the long term. Get Guardian Pharmacy Services alerts: Earnings & Valuation This table compares Guardian Pharmacy Services and CVS Health”s top-line revenue, earnings per share and valuation. Gross Revenue Analyst Ratings This is a summary of current recommendations for Guardian Pharmacy Services and CVS Health, as reported by MarketBeat.com. Sell Ratings 2.68 Guardian Pharmacy Services presently has a consensus target price of $22.00, indicating a potential upside of 2.31%. CVS Health has a consensus target price of $68.71, indicating a potential upside of 25.59%. Given CVS Health’s higher possible upside, analysts clearly believe CVS Health is more favorable than Guardian Pharmacy Services. Profitability This table compares Guardian Pharmacy Services and CVS Health’s net margins, return on equity and return on assets. Net Margins Summary CVS Health beats Guardian Pharmacy Services on 8 of the 10 factors compared between the two stocks. About Guardian Pharmacy Services Guardian Pharmacy Services, Inc., a pharmacy service company, provides a suite of technology-enabled services designed to help residents of long-term health care facilities (LTCFs) in the United States. Its individualized clinical, drug dispensing, and administration capabilities are used to serve the needs of residents in lower acuity LTCFs, such as assisted living facilities and behavioral health facilities and group homes. The company’s Guardian Compass includes dashboards created using data from its data warehouse to help its local pharmacies plan, track, and optimize their business operations; and GuardianShield Programs for LTCFs. The company was founded in 2003 and is based in Atlanta, Georgia. About CVS Health CVS Health Corporation provides health solutions in the United States. It operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. The Health Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, specialty and mail order pharmacy, clinical, disease management, and medical spend management services. It serves employers, insurance companies, unions, government employee groups, health plans, prescription drug plans, Medicaid managed care plans, CMS, plans offered on public health insurance, and other sponsors of health benefit plans. The Pharmacy & Consumer Wellness segment sells prescription and over-the-counter drugs, consumer health and beauty products, and personal care products. This segment also distributes prescription drugs; and provides related pharmacy consulting and other ancillary services to care facilities and other care settings. It operates online retail pharmacy websites, LTC pharmacies and on-site pharmacies, retail specialty pharmacy stores, compounding pharmacies and branches for infusion and enteral nutrition services. The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was incorporated in 1996 and is headquartered in Woonsocket, Rhode Island. Receive News & Ratings for Guardian Pharmacy Services Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for Guardian Pharmacy Services and related companies with MarketBeat.com's FREE daily email newsletter .

CVS Health Ventures Investments

29 Investments

CVS Health Ventures has made 29 investments. Their latest investment was in Nema Health as part of their Series A on November 01, 2024.

CVS Health Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/1/2024 | Series A | Nema Health | $14.5M | Yes | 2 | |

10/16/2024 | Series C | Oshi Health | $60M | No | 3 | |

9/24/2024 | Series A | Synapticure | $25M | Yes | 3 | |

5/28/2024 | Series C | |||||

4/19/2024 | Series D - II |

Date | 11/1/2024 | 10/16/2024 | 9/24/2024 | 5/28/2024 | 4/19/2024 |

|---|---|---|---|---|---|

Round | Series A | Series C | Series A | Series C | Series D - II |

Company | Nema Health | Oshi Health | Synapticure | ||

Amount | $14.5M | $60M | $25M | ||

New? | Yes | No | Yes | ||

Co-Investors | |||||

Sources | 2 | 3 | 3 |

CVS Health Ventures Team

241 Team Members

CVS Health Ventures has 241 team members, including current Founder, Managing Partner, Vijay Jun Patel.

Name | Work History | Title | Status |

|---|---|---|---|

Vijay Jun Patel | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | Founder, Managing Partner | Current |

Name | Vijay Jun Patel | ||||

|---|---|---|---|---|---|

Work History | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | ||||

Title | Founder, Managing Partner | ||||

Status | Current |

Loading...