Dapper Labs

Founded Year

2018Stage

Unattributed - III | AliveTotal Raised

$676.96MLast Raised

$5.06M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-142 points in the past 30 days

About Dapper Labs

Dapper Labs provides a blockchain-based collectibles and non-fungible token (NFT) platform. Its platform uses blockchain-enabled applications to bring its customers closer to the brands. It enables users to access new forms of digital engagement and track ownership. The company was founded in 2018 and is based in Vancouver, Canada.

Loading...

ESPs containing Dapper Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The game development solutions market offers a range of technology solutions for game creators, studios, and publishers to develop and enhance their games. These solutions include game engines, development tools, middleware, and platforms that enable the creation of engaging and immersive gaming experiences. The market also caters to the growing demand for user-generated content (UGC) with platfor…

Dapper Labs named as Highflier among 10 other companies, including Epic Games, Immutable, and Niantic.

Loading...

Research containing Dapper Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dapper Labs in 6 CB Insights research briefs, most recently on Dec 20, 2022.

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Dapper Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dapper Labs is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Blockchain

12,856 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Luxury Tech

419 items

Tech-enabled companies launching new luxury brands, as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners.

Gaming

5,682 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Influencer & Content Creator Tech

339 items

Companies that serve independent creators who want to monetize their own work, from content creation tools to administrative back-end platforms to financing solutions.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Dapper Labs Patents

Dapper Labs has filed 29 patents.

The 3 most popular patent topics include:

- digital collectible card games

- 3d imaging

- container formats

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/31/2022 | 5/14/2024 | Cryptocurrencies, Blockchains, Identifiers, Alternative currencies, Ethereum | Grant |

Application Date | 10/31/2022 |

|---|---|

Grant Date | 5/14/2024 |

Title | |

Related Topics | Cryptocurrencies, Blockchains, Identifiers, Alternative currencies, Ethereum |

Status | Grant |

Latest Dapper Labs News

Jan 6, 2025

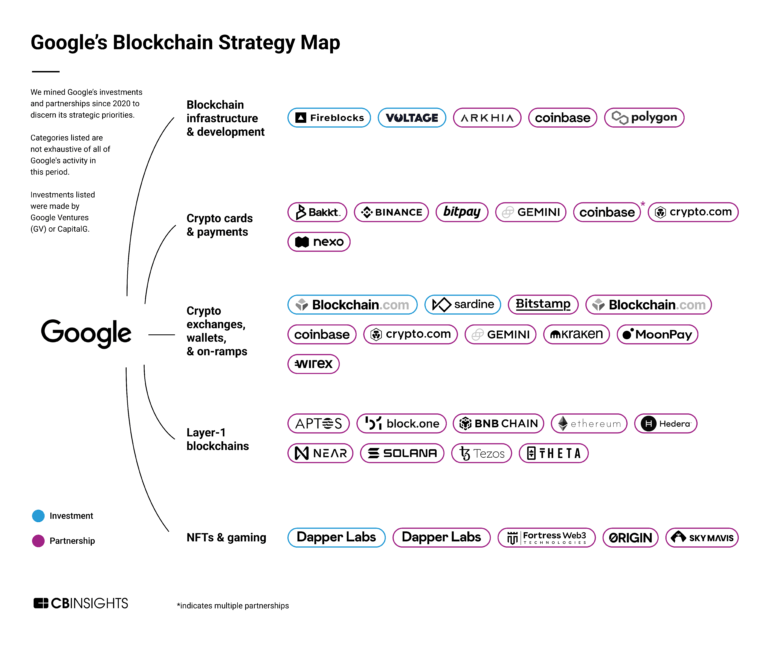

Fintech Trends and Insights Influencing Alpha, Gen Z, Millennails, Gen X, and Boomers As you can imagine, attitudes and behaviours around tech and money are constantly evolving! Attention spans have dropped to 8.25 seconds on average , so many companies and marketers rely on quick hits or bite-sized interactions. Meanwhile, a monstrous record of $68 trillion in wealth is being transferred to younger generations which will alter the financial landscape. Fintech platforms are now indispensable with a growing number of active adults across all generations relying on fintech apps for investment advice and financial planning, offering a range of tools and educational opportunities. This article takes a look at how financial technology trends are servicing and changing generational preferences with regards to money, and a few predictions of what lies ahead. Gen Alpha (born 2010-2024) Kids are becoming more financially aware at an earlier age with 41% already saving money for purchase goals like a car, college or even a house ( 2000 kids surveyed from 6-14 years old ). These kids are digital-first minded and tend to get their info from platforms like YouTube and TikTok. Also, parents are increasingly turning to online resources and digital tools to learn and teach their children about financial literacy. Believe it or not, a recent survey showed that 81% of children learn some financial skills from video games (think: gaming economies, currencies, and digital wallets), highlighting how tech is impacting financial habits. Gamified fintech apps like Mydoh are forging new avenues for financial education. These platforms provide interactive financial lessons on saving, spending, and budgeting to kids and teams to nurture financial independence from an early age. NCFA predicts that in 2025 -AI financial 'mentors' will be integrated into gamified apps to provide personalized guidance based on a young user's learning progress, financial habits and goals. Schools will (look to) adopt these fintech apps into curriculums to boost financial literacy as early as elementary school. Gen Z (1997-2012) In 2023, while housing affordability will always be a challenge, 26.3% of adult Gen Zers owned a home by the age of 24 which is tracking slightly ahead of Millennials (24.5%) and Gen X (23.5%) at the same age. 42% prioritize work life balance over other job perks making them a great fit for freelancing and the gig economy. The easily use micro investing platforms and budgeting apps for managing their income and payments. This generation wants on-demand financial tools. Apps like VoPay offer flexible payment solutions that align well with their need for automated financial solutions. Finliti , a wealth management platform providing personalized investment education and insights for younger investors by API. Crypto platforms like Bitbuy offer Gen Z access to legal bitcoin trading services. Sustainability fintech products are also popular among this generation. NCFA predicts that in 2025 -sustainability will finally take center stage over Gen Z's financial decisions. We expect there to be a rise of 'green credit scores' where fintech apps assess user's financial decisions based on their environmental impact, with rewards for more eco-friendly choices. We also anticipate that social investing platforms will allow Gen Z users to collaborate in new ways with peers on shared financial goals this year. Millennials (1981-1996) Millennials face a retirement savings gap—50% haven’t saved enough to meet their projected needs ( source ). Many balance caregiving responsibilities with careers, while 29% have ventured into Web3 technologies such as cryptocurrency ( source ). They value sustainability and automation in financial planning. Platforms like Neo Financial , FrontFundr , and Loop cater to Millennial priorities, offering green finance options and automated investment tools. With their growing comfort in Web3, decentralized finance (DeFi) and artificial intelligence platforms companies like Alethea.ai , offering on-chain agentic AI characters and Dapper Labs for blockchain ecosystem games. NCFA predicts that in 2025 - Millennials will make a major push and lead the adoption of decentralized autonomous organizations (DAOs) for community based investing and resource pooling to fund (sustainable) projects and new ventures. Also automated financial coaches will become standard, offering integrated and customized financial advice based on real time spending and saving transactions. Gen X (1965-1980) Although mentioned far less than younger generations, Gen X is still dominant in top leadership roles including Fortune 500 CEOs. Having said that with the rising cost of everything, and part of the sandwich generation (aging parents to look after as well as their own children), 41% of Gen X reports they are overwhelmed by their financial situation with only 16% feeling confident they will have enough time to save for retirement, expressing the need for effective long-term planning tools. AI driven tools like Conquest Planning uses predictive models to optimize financial planning for security and personalization. NCFA predicts that in 2025 - potential for Gen X to embrace collaborative financial ecosystems that share strategies and integrate pooled resources and services (i.e., co-purchase assets like real estate). Also given Gen X's caregiving responsibilities and increasing expenses, we expect to see the rise of AI powered tools to help identify cost-saving opportunities, consolidate and streamline all recurring, and agents to negotiate better rates to reduce financial burdens. Baby Boomers (1946-1964) By 2026 in Canada, approx $1 trillion will be transferred from Baby Boomers to Gen Xers and Millennials, the largest wealth transfer in the country ever. In terms of digital tools, believe it or not, smartphone ownership has grown from 25% in 2011 to almost 70% today . Estate planning tools like Willful can simplify the process of asset transfers. Hybrid AI and light touch financial advisory services can manage conservative, cash generating, portfolios to optimize returns while lowering risks to meet Boomer needs. NCFA predicts that in 2025 - a cybersecurity company will emerge dominant by providing stronger risk mitigation solutions for seniors. Baby Boomers will also increasingly rely on hybrid AI financial advisory services that help with estate planning and wealth management. A new, robust voice activated financial system for seniors will become more common place with the goal of helping tech-cautious seniors from being left behind. Outlook for 2025 Fintech has come a long way baby! It's going beyond technology in a way that bridges and connects generations with tailored financial solutions. By solving unique generational needs, fintech companies will be empowering society to achieve greater financial independence and security in ways that traditional financial institutions were not able to nor interested in providing. Fintech is set to create multi-generational products and services that will seamlessly adapt across all age brackets. The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Support NCFA by Following us on Twitter!

Dapper Labs Frequently Asked Questions (FAQ)

When was Dapper Labs founded?

Dapper Labs was founded in 2018.

Where is Dapper Labs's headquarters?

Dapper Labs's headquarters is located at 565 Great Northern Way, Vancouver.

What is Dapper Labs's latest funding round?

Dapper Labs's latest funding round is Unattributed - III.

How much did Dapper Labs raise?

Dapper Labs raised a total of $676.96M.

Who are the investors of Dapper Labs?

Investors of Dapper Labs include Delta Growth Fund, Third Point Ventures, Andreessen Horowitz, Version One Ventures, Coatue and 99 more.

Who are Dapper Labs's competitors?

Competitors of Dapper Labs include Sorare, DappRadar, Mint Songs, Candy, Patronus and 7 more.

Loading...

Compare Dapper Labs to Competitors

DappRadar is a decentralized application store. The company offers a platform for managing crypto wallets, tokens, and non-fungible tokens (NFTs), as well as providing insights into the market with smart tools. DappRadar serves as a hub for dapp discovery and a distribution channel for developers to reach consumers, while also incorporating community governance through its decentralized autonomous organization (DAO). It was founded in 2018 and is based in Klaipeda, Lithuania.

Dibbs specializes in the tokenization of physical collectibles. It operates within the blockchain and NFT sectors. It provides a platform for brands and intellectual property holders to create and manage asset-backed NFTs, offering services such as regulated custody, proprietary 3D imaging, and minting of digital tokens. Dibbs primarily serves sectors that deal with consumer products in sports, music, entertainment, toys, and luxury goods. It was founded in 2020 and is based in El Segundo, California.

Candy is a digital asset content company focused on building an innovative NFT ecosystem within the blockchain technology sector. They offer a virtual storefront for purchasing officially licensed digital collectibles and a platform for trading them on a secure secondary marketplace. Candy's blockchain architecture connects to Ethereum and is designed to be significantly more efficient than traditional Proof of Work networks. It was founded in 2021 and is based in New York, New York. Candy operates as a subsidiary of 10T Fund, ConsenSys Mesh, and Consensys.

Royal focuses on the intersection of music and crypto within the blockchain industry. The company offers a platform that enables individuals to own rights in songs using blockchain technology, allowing artists to maintain control over their work and fans to invest in music. Royal primarily serves the music industry, offering solutions that empower artists and engage fans by providing investment opportunities in music. It was founded in 2021 and is based in Austin, Texas.

Big Time Studios focuses on creating multiplayer AAA entertainment with a high level focus on player control over virtual assets in the gaming industry. The company offers a free-to-play, multiplayer action RPG that allows players to engage in fast-action combat and adventure through various eras of time and space. Big Time Studios provides a player-driven economy, procedural generation for unique gaming experiences, and the ability to customize a personal metaverse, along with the flexibility to change character classes during gameplay. It was founded in 2020 and is based in Los Angeles, California.

Rally offers a platform specializing in alternative asset investment, offering a marketplace for buying and selling equity shares in collectible assets. The company enables investors to participate in initial offerings and secondary market trading of shares representing ownership in curated collectible items. Rally primarily serves individual investors interested in diversifying their portfolios with alternative investments. It was formerly known as Rally Rd. It was founded in 2016 and is based in New York, New York.

Loading...