Cover Genius

Founded Year

2014Stage

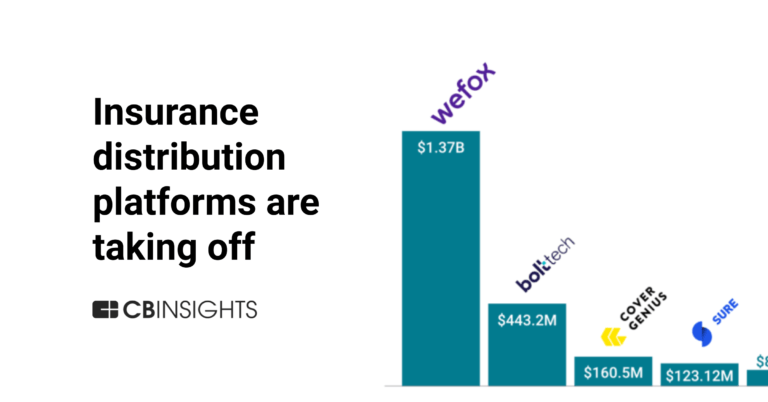

Series E | AliveTotal Raised

$240.5MLast Raised

$80M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+5 points in the past 30 days

About Cover Genius

Cover Genius is the insurtech company that specializes in embedded protection for various industries. Its main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serves sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Loading...

ESPs containing Cover Genius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The tech-enabled product warranty market includes tech-enabled startups that provide consumer product protection warranties. This market includes direct warranty providers and intermediaries, including platforms that offer warranties at embedded points of sale. Warranties offered by companies in this market typically focus on consumer products, like mobile phones, and may fall under extended prote…

Cover Genius named as Leader among 5 other companies, including Extend, Mulberry, and SureBright.

Cover Genius's Products & Differentiators

XCover

XCover is Cover Genius’ award-winning global distribution platform. It protects the customers of the world’s largest digital companies with seamless, end-to-end experiences. Licensed or authorized in over 60 countries and all 50 US States, XCover enables merchants to embed and sell multiple lines of insurance and other types of protection, backed by an industry-leading post-claims Net Promoter Score (NPS).

Loading...

Research containing Cover Genius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cover Genius in 7 CB Insights research briefs, most recently on Aug 28, 2024.

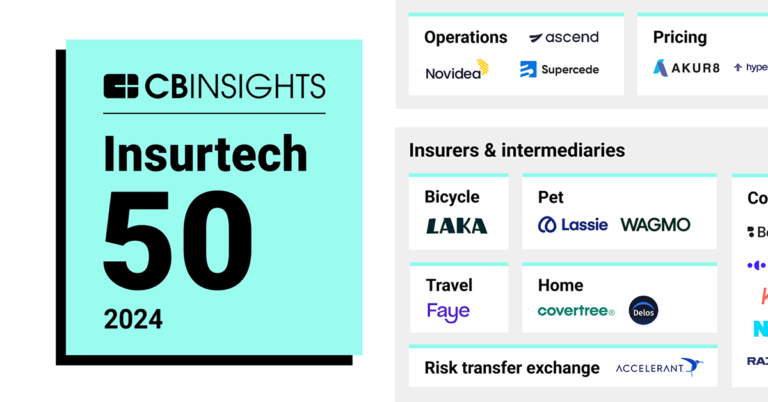

Aug 28, 2024 report

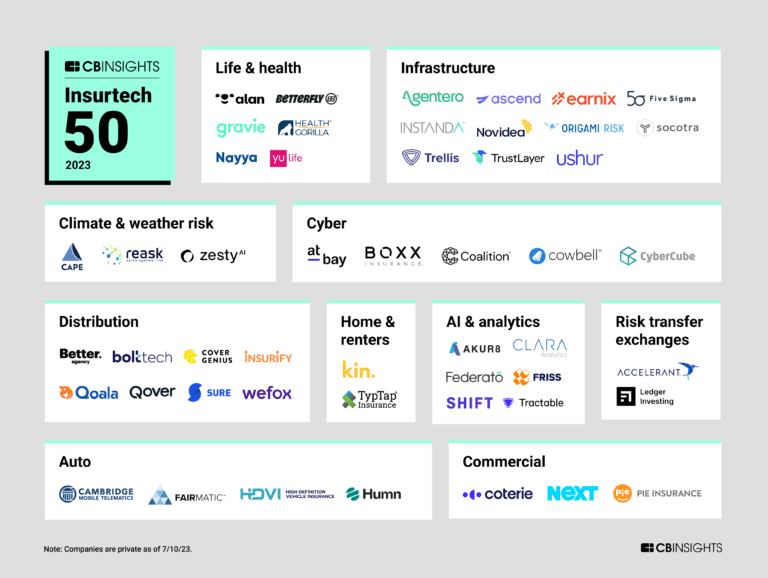

Insurtech 50: The most promising insurtech startups of 2024

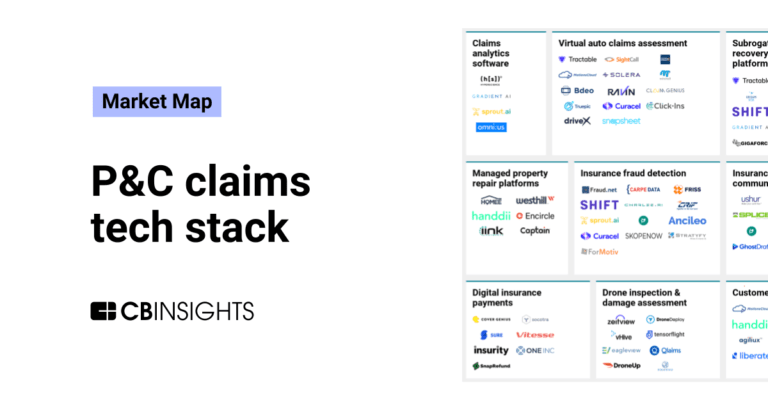

Dec 18, 2023

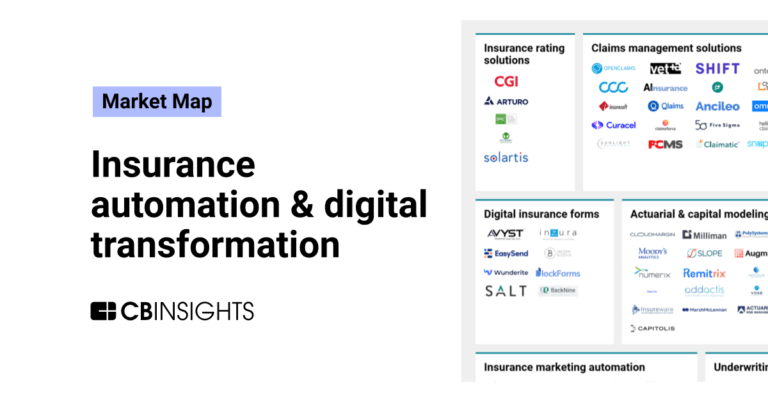

The P&C claims tech stack market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Cover Genius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cover Genius is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,139 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Cover Genius Patents

Cover Genius has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/15/2016 | Social networking services, User interfaces, Usability, Virtual communities, Pricing | Application |

Application Date | 7/15/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Social networking services, User interfaces, Usability, Virtual communities, Pricing |

Status | Application |

Latest Cover Genius News

Dec 4, 2024

Cover Genius, a global insurance distribution platform, has teamed up with Airpaz, a leading online travel agency, to offer comprehensive travel insurance for customers in Malaysia, Vietnam, Indonesia, Thailand, and the Philippines. Follow us: This partnership aims to provide travelers with peace of mind during a busy holiday season by offering coverage for unexpected disruptions, including emergency medical expenses, flight delays, and cancellations due to illness or jury duty. The collaboration comes as global tourism rebounds strongly in 2024, with international arrivals up by 16% compared to 2023. The Asia-Pacific region is leading this growth with a remarkable 33% increase in arrivals. However, this surge in travel also brings challenges such as delays, cancellations, and lost luggage, highlighting the importance of accessible and reliable travel insurance. “This exciting partnership for the APAC region is an example of our global reach that can help provide customised protection solutions to multiple markets with a seamless customer experience,” said William Snell, Vice President of Strategic Partnerships – APAC at Cover Genius. “Our technology was swiftly integrated with Airpaz’s online platform and can offer their 3+ million customers a convenient, digital experience for claims on unexpected hiccups during their travel.” By integrating Cover Genius’s platform into its booking process, Airpaz enhances its offerings, giving its customers easy access to insurance at the point of purchase. “For millions of passengers traveling during this busy season in the region, we’re thrilled to be able to provide some peace of mind for Airpaz customers and their families,” Snell added. As travelers across the Asia-Pacific region gear up for the holiday season, this partnership ensures that they can embark on their journeys with greater confidence and security. Share this article: APPLY TO SPONSOR Gain access to the most senior audience of insurance executives, entrepreneurs, and investors. We offer a wide range of opportunities for you to engage with our attendees from networking to thought leadership. Sponsorship packages provide a wide range of opportunities developed for almost any budget and are designed to help achieve your branding, networking, and/or thought leadership goals. Don’t Stop Here

Cover Genius Frequently Asked Questions (FAQ)

When was Cover Genius founded?

Cover Genius was founded in 2014.

Where is Cover Genius's headquarters?

Cover Genius's headquarters is located at 11 West 42nd Street, New York.

What is Cover Genius's latest funding round?

Cover Genius's latest funding round is Series E.

How much did Cover Genius raise?

Cover Genius raised a total of $240.5M.

Who are the investors of Cover Genius?

Investors of Cover Genius include King River Capital, G Squared, Dawn Capital, Spark Capital, Atlas Merchant Capital and 8 more.

Who are Cover Genius's competitors?

Competitors of Cover Genius include Bolttech, Insuritas, Boost, AIG Kenya Insurance, Curacel and 7 more.

What products does Cover Genius offer?

Cover Genius's products include XCover and 4 more.

Who are Cover Genius's customers?

Customers of Cover Genius include https://www.priceline.com.

Loading...

Compare Cover Genius to Competitors

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform as a service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

Bolttec focuses on ecosystems for protection and insurance. The company provides an embedded insurance platform that includes a distribution engine, product configurator, and sales and servicing solutions. Bolttech serves the insurance and protection product industries, connecting insurers, distributors, and customers. Bolttech was formerly known as EdirectInsure Group. It was founded in 2020 and is based in Singapore.

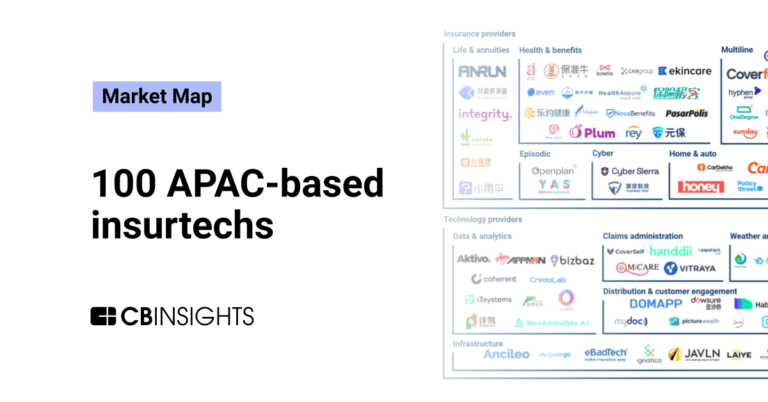

Ancileo is a provider of insurance technology solutions, specializing in the digital distribution of insurance products and services. The company offers a suite of enterprise solutions including API integration, white label services, agent portal management, AI-driven claims automation, policy management, and localized premium billing, all designed to enhance the operations of insurers, re-insurers, brokers, and affinity partners. Ancileo's technology is tailored to support the insurance industry, with a focus on travel insurance portfolios. It was founded in 2016 and is based in Singapore, Singapore.

Boost focuses on providing digital insurance solutions in the insurance technology sector. It offers a digital insurance platform that provides compliance, capital, and technology infrastructure for insurance technology companies, MGAs, and embedded insurance. It primarily sells to the insurance technology industry, as well as to MGAs, brokers, agents, and embedded insurance platforms. The company was founded in 2017 and is based in New York, New York.

Root specializes in low-code, API-first insurance technology within the insurtech sector. The company offers an end-to-end insurance platform that enables clients to build, launch, and manage digital and embedded insurance products with ease. Root's platform serves a diverse range of clients, including large brands, retailers, insurance providers, and captives, primarily in the insurance industry. It was founded in 2016 and is based in Cape Town, South Africa.

Loading...