CoinDCX

Founded Year

2018Stage

Series D | AliveTotal Raised

$244.4MValuation

$0000Last Raised

$135M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-4 points in the past 30 days

About CoinDCX

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Loading...

ESPs containing CoinDCX

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The centralized crypto exchanges market refers to a segment of the cryptocurrency industry that involves trading digital assets through a centralized platform. These exchanges are owned and operated by a central authority, which manages the exchange's infrastructure, order book, and user funds. Centralized exchanges typically charge fees for trading, deposits, and withdrawals, and require users to…

CoinDCX named as Challenger among 15 other companies, including Coinbase, Binance, and HTX.

Loading...

Research containing CoinDCX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CoinDCX in 4 CB Insights research briefs, most recently on Sep 10, 2022.

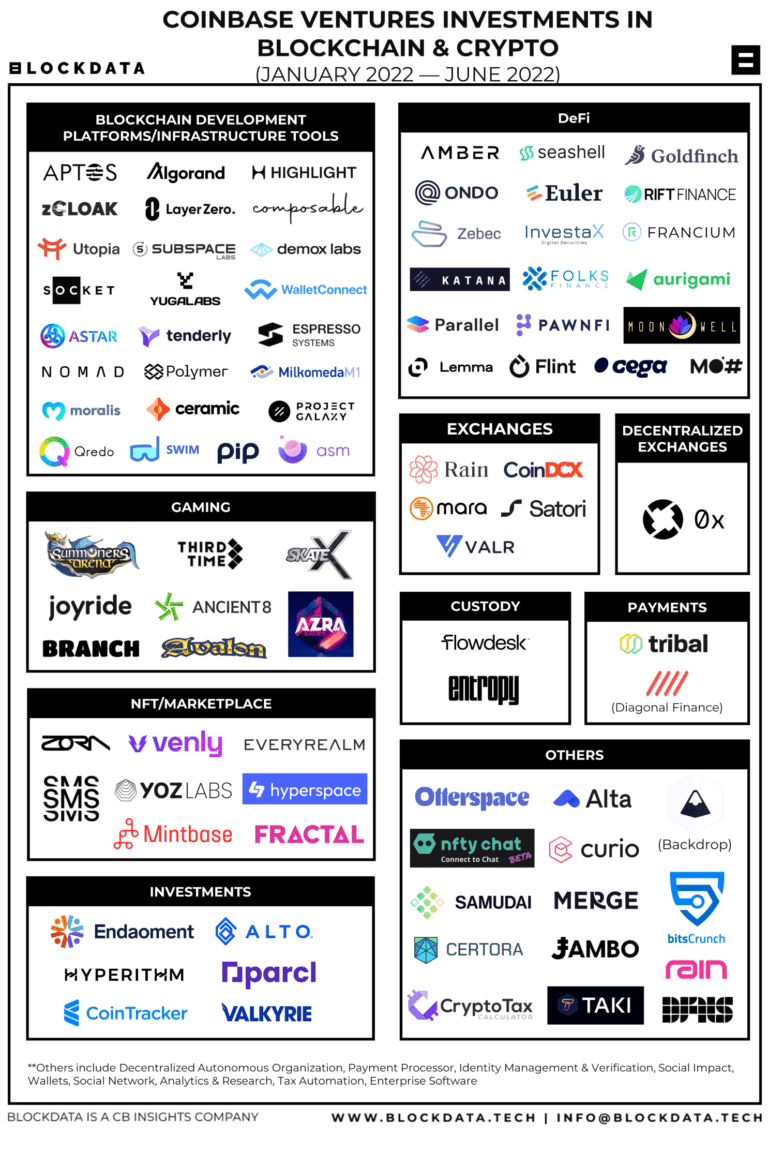

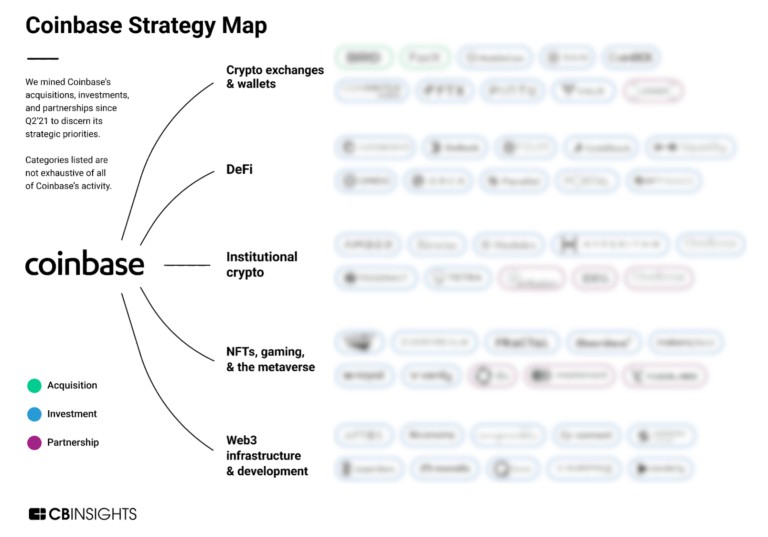

Sep 10, 2022

Where Coinbase Ventures is investing

Expert Collections containing CoinDCX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoinDCX is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Blockchain

9,276 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest CoinDCX News

Jan 5, 2025

Author Writer by choice, CryptoCurrency Writer, and Researcher by chance. Currently, focusing on financial news and analysis, as well as cryptocurrency news and data. One may not call me a crypto “Enthusiast” but trust me I'm getting there. Jan 05, 2025 08:14 UTC 1 minute read CoinDCX Users Slam Exchange Over Withdrawal Restrictions and Delayed Support Indian cryptocurrency exchange CoinDCX is facing criticism on social media due to restrictions on crypto withdrawals. Many users have reported issues such as failed INR withdrawals and delays in resolving their support tickets, with some claiming their withdrawal requests have been pending for weeks. This has led to growing frustration among users. The confusion surrounding CoinDCX’s withdrawal policies has raised questions about the platform’s Know Your Customer (KYC) procedures. Users are concerned about inconsistent rules, with some speculating that the sudden changes to withdrawal processes could indicate potential issues with the exchange’s regulatory compliance. As the complaints continue to mount, CoinDCX faces increasing scrutiny over its handling of user funds and policies. As reported by Analytical Insights, CoinDCX co-founder Sumit Gupta addressed the ongoing withdrawal issues, explaining that relaxing withdrawal restrictions could pose a risk to the exchange, as authorities might freeze bank accounts. Gupta clarified that crypto withdrawals on CoinDCX currently operate on an opt-in basis, with the process being carried out in stages. However, he did not provide a specific timeline for when these withdrawals would be fully available to all users. WazirX Scare Looms On July 18, a devastating hack on WazirX, India’s largest cryptocurrency exchange, resulted in the theft of $230 million, affecting 15 million users. Despite the platform’s strong security measures, cybercriminals breached one of its main trading wallets, siphoning off over 50% of the exchange’s assets, which amounted to more than $230 million. The stolen funds have led to significant financial loss for investors, with the stolen assets laundered and uncertainties surrounding the legal and financial repercussions. As a response to the breach, WazirX froze all trading and withdrawals, a measure that remains in effect as the company continues to investigate and recover from the hack. Tags

CoinDCX Frequently Asked Questions (FAQ)

When was CoinDCX founded?

CoinDCX was founded in 2018.

Where is CoinDCX's headquarters?

CoinDCX's headquarters is located at Andheri Kurla Road, Near Metal Estate, Andheri street, Marol Naka, Mumbai.

What is CoinDCX's latest funding round?

CoinDCX's latest funding round is Series D.

How much did CoinDCX raise?

CoinDCX raised a total of $244.4M.

Who are the investors of CoinDCX?

Investors of CoinDCX include Polychain Capital, Coinbase Ventures, B Capital, Kingsway Financial Services, Pantera Capital and 20 more.

Who are CoinDCX's competitors?

Competitors of CoinDCX include Bitstamp, Nomoex, Kraken, bitFlyer, Deribit and 7 more.

Loading...

Compare CoinDCX to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

OKCoin International is a cryptocurrency exchange platform in the financial technology sector. The company facilitates the buying, selling, and trading of various cryptocurrencies, including Bitcoin and Ethereum, through its online platform. OKCoin primarily serves individual and institutional clients in the cryptocurrency market. It was founded in 2013 and is based in San Francisco, California.

Bitpanda focuses on providing an investment platform. The company offers investment options including stocks, cryptocurrencies, and precious metals, serving individuals with different investment budgets. It operates in the financial technology sector. The company was founded in 2014 and is based in Vienna, Austria.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Loading...