Circle

Founded Year

2013Stage

Corporate Minority | AliveTotal Raised

$1.199BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-58 points in the past 30 days

About Circle

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

Loading...

ESPs containing Circle

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

Circle named as Leader among 15 other companies, including FIS, Nium, and Checkout.com.

Circle's Products & Differentiators

Circle Account

The Circle Account is a full stack solution that replaces a fractured system for business banking. Securely custody funds, send and receive payments globally and streamline treasury operations all connected through USD Coin (USDC) and integrated with a suite of APIs.

Loading...

Research containing Circle

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Circle in 13 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Expert Collections containing Circle

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Circle is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Blockchain

13,038 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

286 items

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Circle Patents

Circle has filed 50 patents.

The 3 most popular patent topics include:

- alternative currencies

- blockchains

- cryptocurrencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/22/2023 | 11/19/2024 | Cryptocurrencies, Blockchains, Alternative currencies, Payment systems, Bitcoin | Grant |

Application Date | 11/22/2023 |

|---|---|

Grant Date | 11/19/2024 |

Title | |

Related Topics | Cryptocurrencies, Blockchains, Alternative currencies, Payment systems, Bitcoin |

Status | Grant |

Latest Circle News

Jan 22, 2025

Circle announced on Jan. 21 the acquisition of the tokenization firm Hashnote, the issuer of the USYC token. Additionally, the company closed a partnership with the market maker DRW Cumberland to drive USYC and USD Coin ( USDC ) in crypto and traditional markets. According to rwa.xyz data , Hashnote’s tokenized money fund Hashnote Short Duration Yield Coin is the largest in the world, with over $1.2 billion worth of tokens USYC issued on multiple blockchain networks, including Ethereum . Circle aims to fully integrate USYC with its USDC stablecoin to enhance accessibility between tokenized money market fund collateral and the stablecoin market. The goal is to make USYC the preferred yield-bearing collateral on exchanges, custodians, and prime brokers. Jeremy Allaire, CEO and Chairman of Circle, stated: “As cash and yield-bearing short-duration treasury bill assets become fungible and convertible at blockchain speeds, this development unlocks significant opportunities for institutional adoption and sets a new standard for financial market structures.” Circle also partnered with DRW, a major institutional crypto trader, via its subsidiary Cumberland to enhance USDC and USYC liquidity. USDC on Canton In addition to the Hashnote announcement, Circle revealed the issuance of native USDC on the layer-1 blockchain Canton. Circle stated that Canton has issued over $3.6 trillion in tokenized real-world assets (RWA), as its infrastructure is already “used and supported by major traditional banks, trading firms, asset managers, and exchanges.” Notably, Circle has been trying to make USDC catch up with Tether USD ( USDT ), the largest stablecoin in the market. In December, the USDC issuer partnered with Binance to make its stablecoin an essential part of the exchange’s corporate treasury asset. Additionally, Circle recently published a report revealing that USDC surpassed $20 trillion in all-time transaction volume and a 78% year-over-year growth in circulation supply. However, USDC still has a lot of ground to cover. USDT dominates the stablecoin market with a nearly $141 billion supply, equivalent to 69% of the market. It amounts to over 3x the current USDC supply of $44.6 billion, based on Artemis data . Mentioned in this article

Circle Frequently Asked Questions (FAQ)

When was Circle founded?

Circle was founded in 2013.

Where is Circle's headquarters?

Circle's headquarters is located at 99 High Street, Boston.

What is Circle's latest funding round?

Circle's latest funding round is Corporate Minority.

How much did Circle raise?

Circle raised a total of $1.199B.

Who are the investors of Circle?

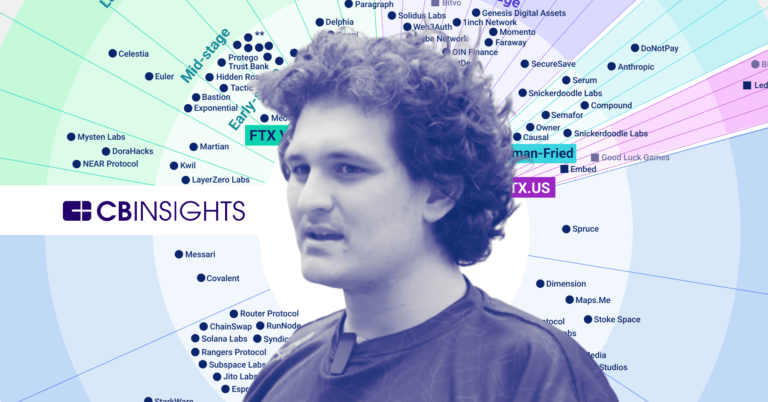

Investors of Circle include Coinbase, Marshall Wace Asset Management, Fidelity Investments, BlackRock, Fin Capital and 34 more.

Who are Circle's competitors?

Competitors of Circle include Zepz, BitGo, Bitstamp, Kraken, bitFlyer and 7 more.

What products does Circle offer?

Circle's products include Circle Account and 3 more.

Who are Circle's customers?

Customers of Circle include FTX and CMS.

Loading...

Compare Circle to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

Abra offers a mobile application platform for buying, selling, trading, storing, and borrowing cryptocurrency. Its platform enables users to store digital cash on smartphones and send it to other users. The company was founded in 2014 and is based in Mountain View, California.

Loading...