Chipper Cash

Founded Year

2018Stage

Debt | AliveTotal Raised

$341.58MValuation

$0000Last Raised

$3.98M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+8 points in the past 30 days

About Chipper Cash

Chipper Cash is a financial technology company that specializes in enabling cross-border payments and financial inclusivity in Africa. The company offers services such as mobile money transfers, digital payment cards, personal and business investment platforms, and artificial intelligence-led identity verification. It was founded in 2018 and is based in San Francisco, California.

Loading...

Loading...

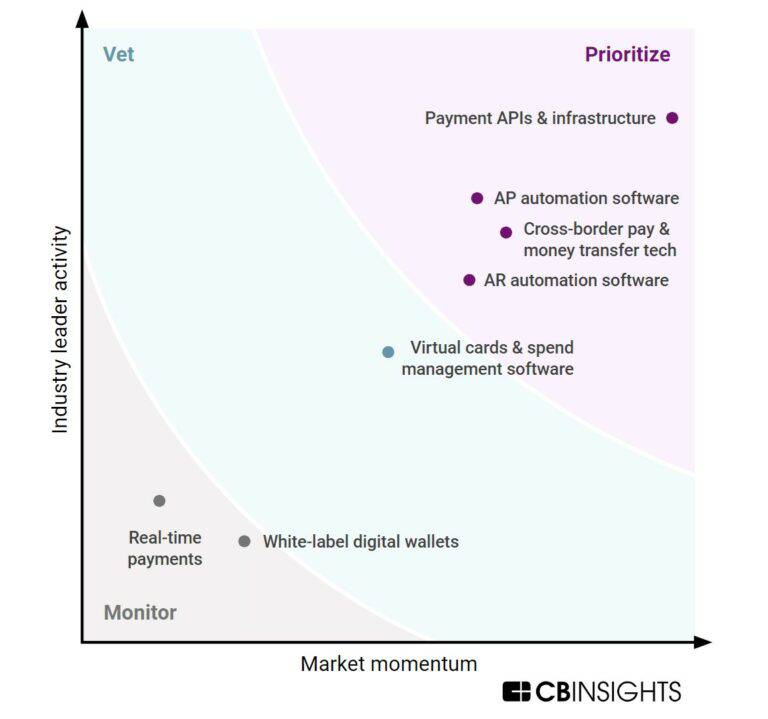

Research containing Chipper Cash

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chipper Cash in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Chipper Cash

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chipper Cash is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

E-Commerce

217 items

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Chipper Cash News

Jan 17, 2025

TechBullion Africa is witnessing rapid growth in the financial technology sector, providing unparalleled opportunities for neobanks and cash apps to emerge and flourish. This growth is largely driven by the continent’s increasing mobile penetration, an unbanked population, and a burgeoning interest in alternative financial solutions that cater to diverse demographics and needs. The Rise of Neobanks in Africa Neobanks operate without traditional physical branches, instead utilizing mobile applications to offer banking services. This model addresses key barriers faced in traditional banking, such as geographical limitations and high operational costs of physical infrastructure. As more Africans gain access to smartphones and high-speed internet, digital banking becomes increasingly viable. Here, we explore some of the top neobanks and cash apps making significant strides in Africa: Valuation: $10 billion Overview: Founded in 2018, Chipper Cash has become one of the foremost cross-border payment platforms in Africa. It allows users to send and receive money across borders without any fees, facilitating transactions between countries like Nigeria, Ghana, Kenya, Tanzania, and Uganda. Chipper Cash primarily appeals to mobile money users who frequently transfer funds across borders. Its success can be attributed to a user-friendly interface, minimal fees, and partnerships with various financial institutions. As a pioneer in the African fintech scene, Chipper Cash is also expanding its offerings to include equity investments and savings tools to foster a more inclusive financial ecosystem. Valuation: Estimated at $1 billion Overview: Launched in 2019, PalmPay is tailored to meet the needs of Nigerian consumers. Beyond just money transfers, PalmPay enables users to pay bills, purchase airtime, and access a range of merchant services conveniently. PalmPay integrates a rewards system where users earn points for transactions, redeemable for cash or discounts, creating a highly engaging and gamified experience. The platform is rapidly making inroads in the Nigerian market with aggressive marketing campaigns and partnerships with local merchants to expand its offering and enhance customer interaction. Valuation: Approximately $900 million Overview: Dubbed “the bank of the free,” Kuda Bank offers zero-fee banking services tailored specifically for young adults in Nigeria. It covers a range of services, including savings accounts, debit cards, and personal loans. Kuda Bank targets the unbanked population by providing a fully digital banking experience where users can open accounts via mobile apps with minimal paperwork. Their seamless onboarding process, commitment to transparency, and dedication to improving financial literacy have made them a popular choice among the youth. Valuation: Estimated at $10 billion Overview: Operating in 190 countries and leveraging the African Express Card network covering 24 nations, MoneyPoolsCash offers a variety of financial services catering to both personal and business users. Its platform emphasizes an intuitive user experience, featuring peer-to-peer payment solutions, cash agents, Blockchain technology, and various card options including Visa, MasterCard, and MoneyPoolsCash cards, African Express, Arabian Express, Gold backed payments. Investment options and an extensive banking suite are also part of its offerings. The strength of MoneyPoolsCash lies in its versatility to accept anyone, regardless of their banking history. It provides a holistic solution that combines modern technology with traditional banking practices, enhancing its user base’s capability to manage their finances effectively. With initiatives aimed at both urban and rural populations, MoneyPoolsCash is committed to fostering financial inclusivity. Valuation: Early-stage startup, estimated around $900 million Overview: Fola focuses on providing financial services to the agricultural sector in Africa. This niche strategy aims to improve the livelihoods of farmers by offering loans, insurance, and savings options tailored to their unique needs . With its focus on agriculture, Fola not only provides financial services but also works on initiatives to enhance food security and sustainable farming practices. By educating farmers on financial management and best practices, Fola contributes to empowering one of the most vital sectors in many African economies. Zabo Valuation: Estimated at $500 million Overview: Zabo is committed to creating financial solutions for the unbanked and underbanked segments in Africa. It includes features such as savings accounts, loans, and educational resources for financial literacy. By prioritizing education and transparency, Zabo aims to empower users with knowledge that enables better financial decisions. Their initiatives include workshops and webinars that focus on budgeting, saving, and investment strategies, thereby increasing the financial literacy of their user base. Challenges and Opportunities Despite the positive landscape, several challenges remain for neobanks and cash apps operating in Africa. These include regulatory hurdles, cybersecurity concerns, and the need for financial literacy among the target audiences. However, these challenges also present significant opportunities for growth and innovation. For instance, platforms that invest in cybersecurity measures will likely gain consumer trust, while those that emphasize education will facilitate mindful spending and saving habits. Conclusion The financial landscape in Africa is rapidly evolving, with neobanks and cash apps addressing the needs and challenges of the population. With significant investment and continuous innovation, companies in Africa stand poised to make an even greater impact, enhancing financial inclusion and accessibility across the continent. As the sector continues to grow, the collaboration between fintech companies, traditional banks, and government entities will be vital in creating a robust financial ecosystem that serves everyone, regardless of their socioeconomic status. The future is bright for Africa’s digital banking scene, and platforms like those listed are set to lead the charge in transforming the financial landscape.

Chipper Cash Frequently Asked Questions (FAQ)

When was Chipper Cash founded?

Chipper Cash was founded in 2018.

Where is Chipper Cash's headquarters?

Chipper Cash's headquarters is located at 180 Montgomery Street, San Francisco.

What is Chipper Cash's latest funding round?

Chipper Cash's latest funding round is Debt.

How much did Chipper Cash raise?

Chipper Cash raised a total of $341.58M.

Who are the investors of Chipper Cash?

Investors of Chipper Cash include FTX, Deciens Capital, Ribbit Capital, Bezos Expeditions, SVB Capital and 16 more.

Who are Chipper Cash's competitors?

Competitors of Chipper Cash include LemFi, Yellow Card, Zepz, Eversend, FairMoney and 7 more.

Loading...

Compare Chipper Cash to Competitors

Kuda operates in the financial services sector. The company offers a range of services, including money transfers, savings and investment options, and credit facilities such as overdrafts and term loans. Kuda primarily serves individuals and businesses, providing solutions for personal finance management and business operations. Kuda was formerly known as Kudimoney Bank. It was founded in 2018 and is based in Lagos, Nigeria.

Opay is a digital payment platform that provides financial services. The company allows fund transfers, cashback on airtime and data top-ups, and has a savings account with daily interest. Opay provides a debit card that can be used for online transactions and offers customer service support. It was founded in 2018 and is based in Lagos, Nigeria.

Eversend operates as a financial technology company. The company offers a multi-currency application that allows users to exchange, send, and receive money, as well as create virtual United States Dollar cards. It primarily serves the financial services sector. The company was founded in 2019 and is based in London, United Kingdom.

Interswitch is a company that operates in the electronic payment and digital commerce solutions sector. The company provides services including payment processing and transaction switching, as well as digital payment products for individuals, SMEs, and large corporations. Interswitch's solutions are used across different industries to facilitate transactions and business operations. It was founded in 2002 and is based in Lagos, Nigeria.

Flutterwave operates as a financial technology company. It provides a variety of payment solutions, including online payment acceptance, cross-border payouts and transfers, currency swaps, and point-of-sale (POS) systems. It primarily serves businesses, individuals, and startups, particularly in emerging markets. The company was founded in 2016 and is based in San Francisco, California.

PalmPay develops a secure, digital payment experience in an effort to promote financial inclusion and enhance consumer experiences. The company improves its users' digital payment experiences by offering financial account creation, money transfers, bill payments, and instant access to credit services. It was founded in 2019 and is based in Lagos, Nigeria.

Loading...