Chime

Founded Year

2012Stage

Series G - II | AliveTotal Raised

$2.599BLast Raised

$355M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+23 points in the past 30 days

About Chime

Chime is a financial technology company. The company offers banking services such as checking and savings accounts, credit building, and fee-free overdrafts, all aimed at making financial management easy and accessible for everyday people. Its primary customer base includes everyday Americans who are not well-served by traditional banks. The company was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Chime

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The alternative credit scoring market addresses the issue of creditworthiness assessment for individuals with thin-files or no file with credit reference agencies. This market provides solutions that allow lenders to accept more applicants by taking into account additional data sources, such as rent or utilities payments, online activity, employment history, or online purchase behaviors. Some prov…

Chime named as Leader among 15 other companies, including Equifax, Experian, and TransUnion.

Chime's Products & Differentiators

SpotMe

Fee free overdraft alternative

Loading...

Research containing Chime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chime in 4 CB Insights research briefs, most recently on May 2, 2023.

Expert Collections containing Chime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chime is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

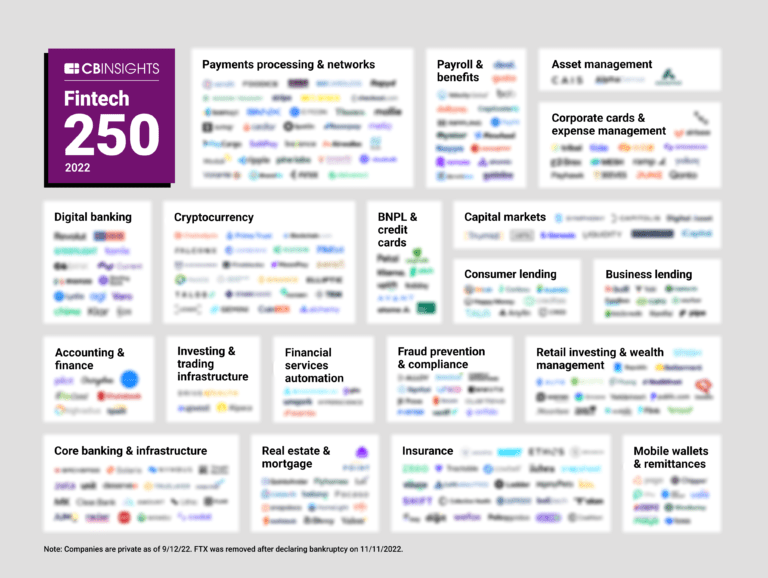

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,059 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Chime News

Jan 24, 2025

Say Goodbye to Overdraft Fees With These Banks Don't let unnecessary charges chip away at your hard-earned money. David McMillin David McMillin writes about credit cards, mortgages, banking, taxes and travel. Based in Chicago, he writes with one objective in mind: Help readers figure out how to save more and stress less. He is also a musician, which means he has spent a lot of time worrying about money. He applies the lessons he's learned from that financial balancing act to offer practical advice for personal spending decisions. 5 min read ProfessionalStudioImages/Getty Images One bad day with your finances can cost you big time if your bank charges overdraft fees. At some banks, an overdraft fee can set you back around $35, and if you aren't monitoring your account, you might wind up paying multiple fees in one day. Who wants to pay their bank an extra $100 or more? While Bankrate research shows that 94% of accounts have overdraft fees, there are banks that have completely done away with them. No fine print, no hoops to jump through, nothing. If you're looking to wave goodbye to overdraft fees once and for all, look for a checking account at one of these institutions. Citibank Big banks may be known for fees, but you won't find overdraft charges at Citibank. And if you've struggled in the past to monitor your account balances, Citi allows you to link a savings account for automatic transfers to cover a potential overdraft. Some customers can also apply for the ability to transfer funds from a line of credit to cover the charges. Capital One Capital One Capital One's 360 Checking account makes our list of the best checking accounts for several reasons, one of which is its lack of overdraft fees. In some cases, the bank will even cover the payment with a service called No-Fee Overdraft Protection. You must immediately deposit money to pay for the transaction, however. If you don't, the bank may not approve additional transactions, and your account may be closed Discover Discover You won't pay any overdraft fees with Discover's checking account. You can also score some rewards with the bank's cash-back debit program, which pays 1% back on up to $3,000 of purchases each month. If you're worried about overdrawing your account, consider opening a money market or savings account at the bank too, both of which pay competitive savings rates and can be linked to cover charges if your checking account balance drops to zero. Chime Chime Chime isn't actually a bank; it's a financial technology company, and its bank accounts are FDIC-insured via a partner program. No matter what you want to call the company, you won't ever have to comb through your account statement to look for any overdraft fees. You can enroll in a service called SpotMe for limited overdraft coverage without any charges, provided you receive at least $200 of direct deposits per month. Note: On May 7, 2024, the Consumer Financial Protection Bureau issued an order against Chime Financial for failing to refund consumers' remaining balances within 14 days after they closed their checking and/or savings accounts. Chime was ordered to pay a $3.25 million civil money penalty and at least $1.3 million to consumers in redress. Ally There's a lot to love about Ally Bank, which is why it's on our list of the best online banks . It doesn't charge overdraft fees, and you can opt for transfer protection by linking a savings or money market account to your checking account to replenish the balance if it dips below zero. You may also be able to qualify for CoverDraft, which provides up to $250 in temporary relief for a transaction that overdraws your account. You'll get 14 days to bring your balance out of the red, with your next deposit automatically applying to the negative balance. Aspiration Aspiration Like Chime, Aspiration is an online-only financial firm, not a chartered bank, but it offers FDIC coverage via a partnership program. In addition to not charging overdraft fees, the key point of differentiation about this company is a focus on protecting the planet. Each time you swipe your debit card, you'll get the option to fund planting a tree. Truist Truist Truist Bank's Truist One Banking offers two checking accounts without overdraft fees. These accounts allow you to overdraw up to $99 without incurring a fee. If you reach a negative $100 balance, additional transactions will be declined. This overdraft feature is available to Truist customers who have made a deposit of $100 or more for two consecutive months. Be mindful of other fees, though. You'll pay a $12 monthly fee if you fail to meet direct deposit or balance requirements. Alliant Credit Union Alliant Credit Union Alliant Credit Union is one of the largest credit unions in the country, and its members don't have to worry about any overdraft fees or nonsufficient funds fees. Alliant also pays impressive rates and offers valuable membership benefits that help distinguish it as one of the best credit unions in the country . How to avoid overdraft fees Overdraft fees are avoidable. Here are four simple ways to make sure you're never stuck paying extra for letting your balance dip below zero. 1. Opt out. Talk to your credit union or bank about opting out of overdraft fees. Once you opt out, transactions that exceed your available balance will be declined. You'll want to make sure that you aren't subject to nonsufficient funds fees too. 2. Link your savings account. When you link accounts, any amount not covered by your checking account will automatically be covered by your savings account. Assuming you have money in savings, this is a far less costly option. In fact, some banks and credit unions offer this service for free. 3. Sign up for account alerts. Many banks offer low-balance alerts via email or text message. These alerts will notify you when your balance falls below a certain threshold, which can give you a heads-up before you overdraw. 4. Switch banks. As more banks and credit unions stop charging overdraft fees, it's getting easier to find a bank without them. So, shop around. FAQs How much do overdraft fees cost? Bankrate research shows that the average overdraft fee in 2024 was $27.08. In some cases, a bank might charge that fee multiple times in one day. Banks make a lot of money from these fees too. In 2023, the Consumer Financial Protection Bureau reported that banks collectively earned $5.83 billion from overdraft fees and nonsufficient funds fees. Can you get overdraft fees waived? It depends. Some banks offer 24-hour grace periods to give you extra time to make a deposit and avoid the fee. If you incur an overdraft fee, it's always worth your while to request a refund . If it's not a regular occurrence, some banks may excuse your mistake. Which banks make the most off overdraft fees? According to figures from the Consumer Financial Protection Bureau, JPMorgan Chase and Wells Fargo raked in the most money from these fees in 2023. The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Chime Frequently Asked Questions (FAQ)

When was Chime founded?

Chime was founded in 2012.

Where is Chime's headquarters?

Chime's headquarters is located at 101 California Street, San Francisco.

What is Chime's latest funding round?

Chime's latest funding round is Series G - II.

How much did Chime raise?

Chime raised a total of $2.599B.

Who are the investors of Chime?

Investors of Chime include Crosslink Capital, Menlo Ventures, General Atlantic, Dragoneer Investment Group, Tiger Global Management and 23 more.

Who are Chime's competitors?

Competitors of Chime include Current, Brigit, ONE, Jiko, MoneyLion and 7 more.

What products does Chime offer?

Chime's products include SpotMe and 2 more.

Loading...

Compare Chime to Competitors

Varo is a digital bank that focuses on providing premium banking services through a mobile app. The company offers access to high-yield savings accounts, quicker access to funds, and automatic saving tools without the need for physical branches. Varo serves customers seeking convenient and modern banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

KikOff is a personal finance platform that offers a revolving line of credit and a secured credit card. These financial products aim to assist individuals in establishing a payment history and improving their credit scores. KikOff serves individuals interested in building or enhancing their credit profiles. It was founded in 2019 and is based in San Francisco, California.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

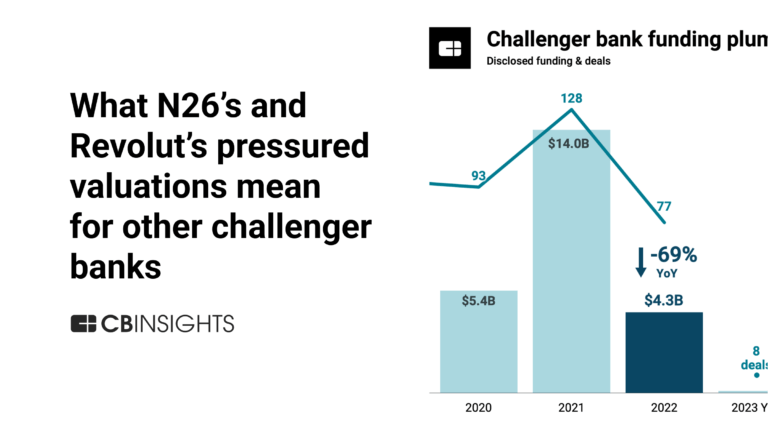

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

Loading...