Cambridge Mobile Telematics

Founded Year

2010Stage

Corporate Minority | AliveTotal Raised

$502.5MLast Raised

$500M | 6 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+2 points in the past 30 days

About Cambridge Mobile Telematics

Cambridge Mobile Telematics specializes in the telematics and analytics sector, focusing on road safety and driver behavior. The company offers a platform that collects and analyzes data from IoT devices to improve vehicle and driver safety and provides insights for risk assessment and driver improvement programs. Its services cater to auto insurers, automakers, commercial mobility companies, and the public sector. It was founded in 2010 and is based in Cambridge, Massachusetts.

Loading...

ESPs containing Cambridge Mobile Telematics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

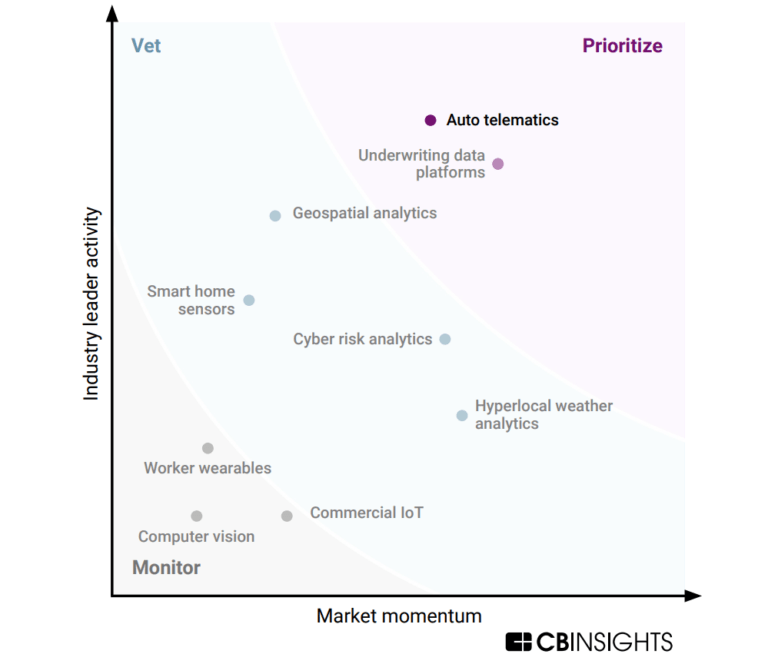

The auto telematics platforms market comprises solutions that gather driver behavior and usage data. Telematics technology is typically installed in the vehicle and can collect data such as driving speed, braking patterns, and distance traveled. Insurance companies can use the data gathered through auto telematics to better assess the risk associated with a policyholder and to determine more accur…

Cambridge Mobile Telematics named as Leader among 14 other companies, including INRIX, CCC Intelligent Solutions, and Earnix.

Loading...

Research containing Cambridge Mobile Telematics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cambridge Mobile Telematics in 6 CB Insights research briefs, most recently on Mar 21, 2024.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

May 19, 2022 report

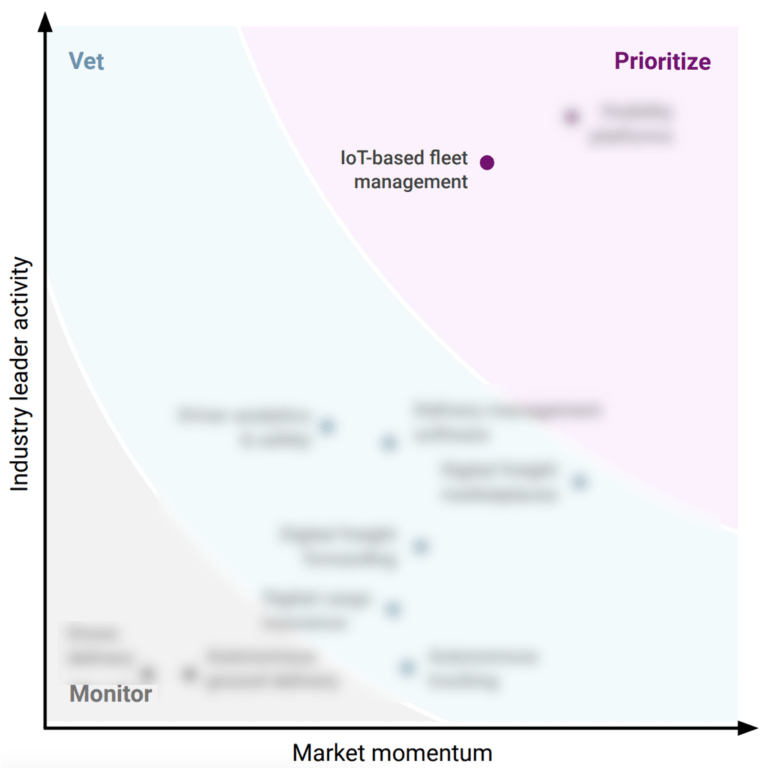

Why P&C insurers are prioritizing auto telematics

Apr 21, 2022 report

Why retailers are prioritizing IoT-based fleet managementExpert Collections containing Cambridge Mobile Telematics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cambridge Mobile Telematics is included in 8 Expert Collections, including Auto Tech.

Auto Tech

2,607 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

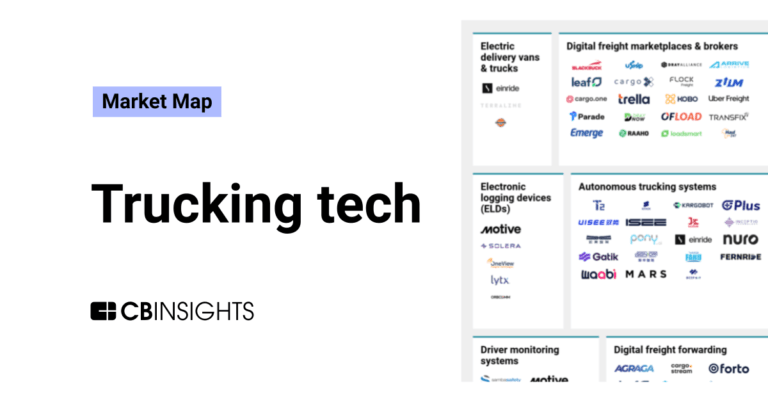

Supply Chain & Logistics Tech

4,484 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,258 items

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Cambridge Mobile Telematics Patents

Cambridge Mobile Telematics has filed 93 patents.

The 3 most popular patent topics include:

- global positioning system

- geolocation

- wireless locating

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/28/2023 | 10/29/2024 | Spruance-class destroyers, Classification algorithms, Ships sunk as targets, Statistical classification, Lithics | Grant |

Application Date | 11/28/2023 |

|---|---|

Grant Date | 10/29/2024 |

Title | |

Related Topics | Spruance-class destroyers, Classification algorithms, Ships sunk as targets, Statistical classification, Lithics |

Status | Grant |

Latest Cambridge Mobile Telematics News

Jan 23, 2025

World First: Good Drivers Get Cheaper Car Finance via DriveScore Share this post: DriveScore , the free app which helps good drivers save money on their car insurance through telematics technology, has launched the world’s first car finance deals discounted for good drivers. The loans, provided by Zopa Bank, Admiral, AA Car Finance, and My Car Credit, offer discounts of £170* for a typical borrower with a good driving score. DriveScore harnesses world-class technology through a partnership with Cambridge Mobile Telematics to give users a driving score, with a score of 750 or above (out of 1000) indicating good driving behaviour. DriveScore users can choose to share this score with DriveScore’s panel of insurers, to receive discounted motor insurance premiums based on how well they drive. Today’s launch extends those benefits of being a safer driver further, to include car finance as well. DriveScore, part of The ClearScore Group, has been able to create these savings due to its unique relationship with sister brand ClearScore, the UK’s leading data-driven financial marketplace. DriveScore’s analysis across hundreds of thousands of users shows that good drivers were significantly less likely to be behind on repayments across credit cards, loans, and car finance**. Three quarters of DriveScore users go on to achieve a ‘good’ score, with resources and tools available on the app to help users improve their score over time. Andrew Hooks, Managing Director at DriveScore, said: “At a time when our users are actively searching for better deals to save money, we are bringing a completely new concept to market – namely that being a safer driver can save you money on your car finance as well as on your car insurance. This is about empowering people to leverage their personalised driving data to bring tangible financial benefits. “Until recently, industry telematics technology has been focussed largely on the highest-risk young drivers – meaning most consumers have remained disengaged and neither insurers nor good drivers have truly felt the benefits. DriveScore is a unique proposition which aims to bring telematics into the mainstream by putting drivers in charge of their data.” Three quarters of a million people have downloaded DriveScore, and more than two billion miles of driving has been logged by the app. DriveScore offers a huge opportunity for insurers, and now lenders as well, enabling them to more accurately and competitively price quotes and therefore drive profitable new customer acquisition. People In This Post Insurtech News News Fintech Funding

Cambridge Mobile Telematics Frequently Asked Questions (FAQ)

When was Cambridge Mobile Telematics founded?

Cambridge Mobile Telematics was founded in 2010.

Where is Cambridge Mobile Telematics's headquarters?

Cambridge Mobile Telematics's headquarters is located at 314 Main Street, Cambridge.

What is Cambridge Mobile Telematics's latest funding round?

Cambridge Mobile Telematics's latest funding round is Corporate Minority.

How much did Cambridge Mobile Telematics raise?

Cambridge Mobile Telematics raised a total of $502.5M.

Who are the investors of Cambridge Mobile Telematics?

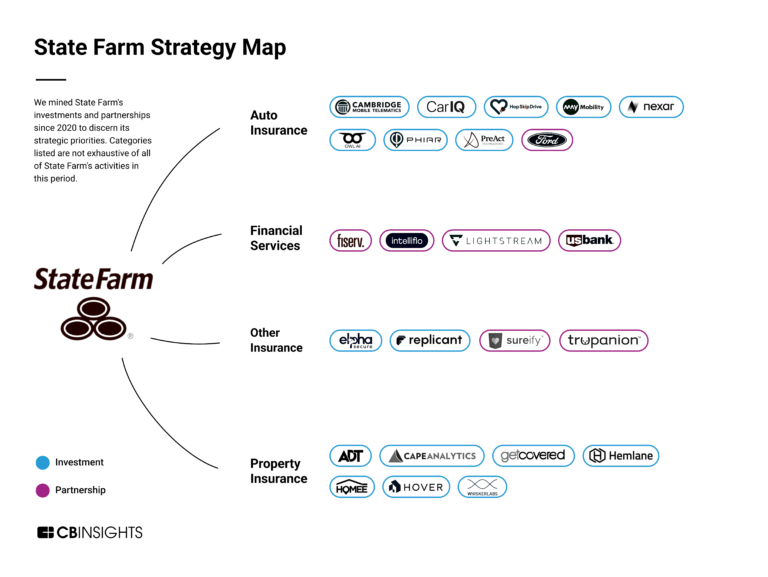

Investors of Cambridge Mobile Telematics include SoftBank, MIT Csail and State Farm Ventures.

Who are Cambridge Mobile Telematics's competitors?

Competitors of Cambridge Mobile Telematics include The Floow, Zendrive, Driver Technologies, Artificient Mobility Intelligence, Amodo and 7 more.

Loading...

Compare Cambridge Mobile Telematics to Competitors

OSeven is a company specializing in telematics and driving behavior analytics within the insurance and automotive sectors. The company offers a platform that analyzes driving data to help improve driver safety and promote eco-friendly driving habits. OSeven's solutions cater to various industries, including insurance, banking and fintech, telecommunications, rental and leasing, fleet management, and ridesharing. It was founded in 2015 and is based in London, England.

Sentiance specializes in motion insights and focuses on driver behavior to enhance road safety within the technology sector. The company offers AI-powered solutions that analyze driving behavior, detect crashes, and provide insights into mobility and lifestyle patterns, all processed on-device in a privacy-centric manner. Sentiance primarily serves industries such as motor insurance, the gig economy, sustainable mobility, transport authorities, and automotive OEMs. Sentiance was formerly known as Argus Labs. It was founded in 2015 and is based in Antwerp, Belgium.

Octo specializes in insurance telematics and smart mobility solutions within the connected vehicle and Internet of Things (IoT) sectors. The company offers a range of services including risk scoring, crash and claim management, and safety and security features for drivers. Octo's solutions cater to various sectors such as insurance, automotive, fleet management, and smart cities. It was founded in 2002 and is based in Rome, Italy. Octo operates as a subsidiary of Renova Group.

Reviver specializes in digital license plate technology and operates within the automotive tech industry. The company offers a platform that transforms traditional license plates into digital, smartphone-controlled devices that facilitate vehicle registration renewal, personalization, and integrated telematics for safety. Reviver's products cater to both individual consumers and commercial fleet operators, providing a suite of management tools and services. Reviver was formerly known as Smart Plate, Inc. It was founded in 2009 and is based in Granite Bay, California.

The Floow specializes in telematics data management and predictive analytics within the motor insurance and automotive sectors. The company offers solutions that leverage smartphone sensor technology and contextual analysis to provide insights into driver behavior, aiming to enhance safety and customer engagement. It was founded in 2012 and is based in Sheffield, United Kingdom.

Accuscore (fka Acculitx) is working with many of the major insurance companies to redefine usage-based insurance (UBI) to create a more relevant identification of driver behavior and risk called RBI - Risk Based Insurance. The key differentiator of accuscore is in using continuous vehicle motion data to generate a relevant predictor for driver risk with very strong correlation to actuary data. Because accuscoreSM is not 'event' based, it results in being the most comprehensive and accurate identifier of driver risk and behavior assessment.

Loading...