Bringg

Founded Year

2013Stage

Series E | AliveTotal Raised

$184.5MValuation

$0000Last Raised

$100M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-74 points in the past 30 days

About Bringg

Bringg provides delivery management in the logistics and supply chain. It offers a platform that provides services such as fleet and resource management, multi-carrier delivery management, route optimization, auto dispatch, delivery tracking, and returns management. The company primarily serves sectors such as the grocery, furniture, appliances, and white glove carriers industries. It was founded in 2013 and is based in Tel Aviv, Israel.

Loading...

Bringg's Product Videos

ESPs containing Bringg

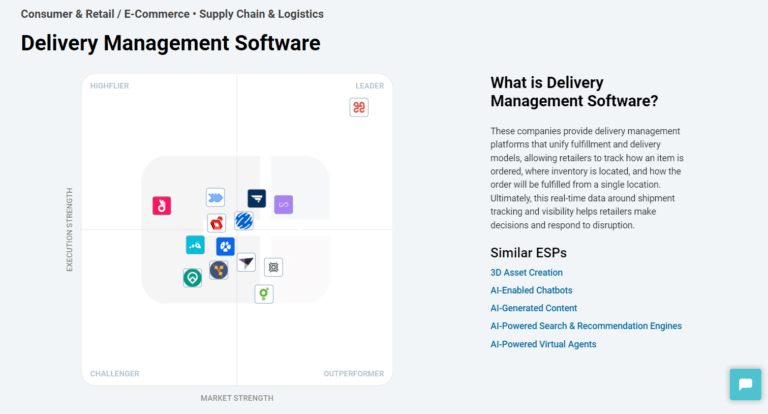

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The last-mile fleet management & operations market streamlines the management and coordination of vehicles and drivers for last-mile deliveries. This market focuses on the final stage of the delivery process, from the transportation hub to the end customer. Providers in this category provide software solutions to track and manage vehicles, dispatch drivers, and increase energy efficiency. Some las…

Bringg named as Leader among 15 other companies, including Google Cloud Platform, Samsara, and Motive.

Bringg's Products & Differentiators

Own Delivery

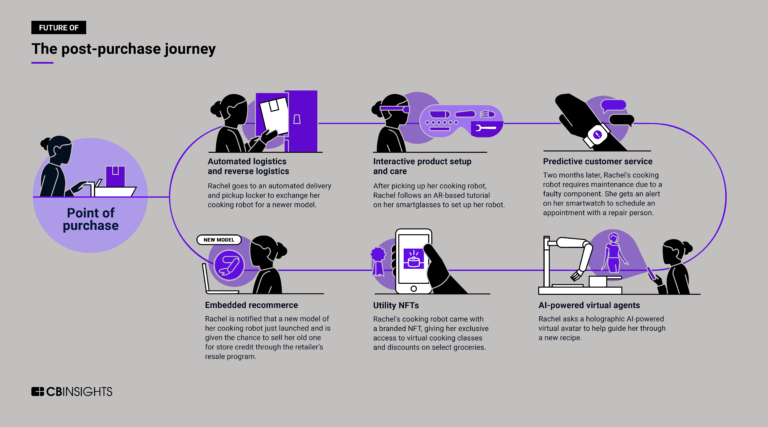

Bringg’s data-led platform digitizes and connects the existing supply chain systems, and orchestrates fulfillment models based on machine learning, industry best practices and your company’s business goals. Using automation and data analytics, Bringg’s solution engineers cost-efficient, convenient and fast last mile operations on the front end while improving efficiencies and removing complexities in the backend. For logistics providers and retailers with internal fleets our platform offers rich features around vehicle routing and scheduling, fleet and driver management, driver mobile app, control tower and visibility, reverse logistics, and customer experience all with real time tracking and communications, plus a post purchase experience.

Loading...

Research containing Bringg

Get data-driven expert analysis from the CB Insights Intelligence Unit.

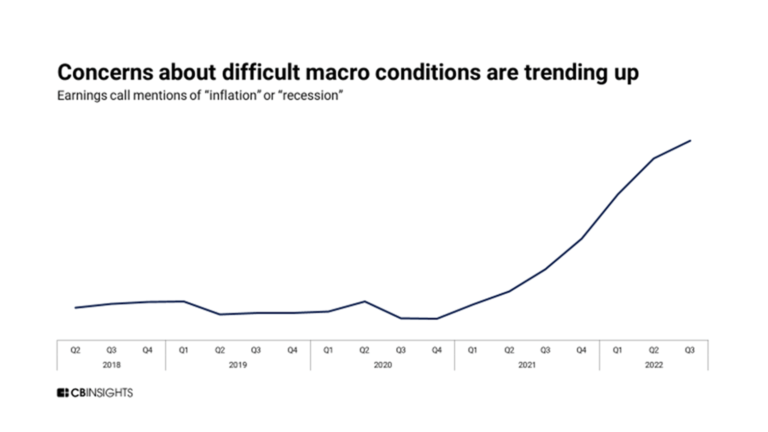

CB Insights Intelligence Analysts have mentioned Bringg in 5 CB Insights research briefs, most recently on Oct 3, 2022.

Expert Collections containing Bringg

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bringg is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

6,018 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,257 items

Grocery Retail Tech

831 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Conference Exhibitors

5,302 items

Retail Tech 100

200 items

The most promising B2B tech startups transforming the retail industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Bringg Patents

Bringg has filed 4 patents.

The 3 most popular patent topics include:

- artificial neural networks

- computational phylogenetics

- industries

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/12/2018 | 6/14/2022 | Computer memory, Wireless networking, Computer network security, Computer buses, Parallel computing | Grant |

Application Date | 11/12/2018 |

|---|---|

Grant Date | 6/14/2022 |

Title | |

Related Topics | Computer memory, Wireless networking, Computer network security, Computer buses, Parallel computing |

Status | Grant |

Latest Bringg News

Dec 27, 2024

Retailers and delivery providers adjust and adapt as consumers increasingly demand a seamless “Uber-like” delivery experience, with real-time tracking and the option to make changes on the fly. Photo courtesy of J.B. Hunt Gary Frantz Gary Frantz is a contributing editor for DC Velocity and its sister publication, Supply Chain Xchange. He is a veteran communications executive with more than 30 years of experience in the transportation and logistics industries. He's served as communications director and strategic media relations counselor for companies including XPO Logistics, Con-way, Menlo Logistics, GT Nexus, Circle International Group, and Consolidated Freightways. Gary is currently principal of GNF Communications LLC, a consultancy providing freelance writing, editorial and media strategy services. He's a proud graduate of the Journalism program at California State University–Chico. The pandemic drove a huge shift in consumer buying behavior that continues to shape the last-mile delivery market today. Consumers across all demographics became far more comfortable with e-commerce and soon began buying anything and everything online, from meals to exercise equipment to furniture, appliances, and electronics. Entering 2025, that demand has been satiated for some products—in-home exercise equipment, for example. Yet consumers who flocked online are not going back to stores. If anything, they’ve embraced e-commerce more fully, becoming more sophisticated, discerning, and vocal in the services they want and the experience they expect. That’s especially true in the so-called “big and bulky” space, where goods like appliances, electronics, and furniture are delivered, assembled, and set up by a team of driver/installers in the home. “What we are hearing from customers is that while price is always a factor, more and more discussions are happening around the delivery experience provided, the data flow, [and] the information and communication around that,” notes Brian Bourke, global chief commercial officer for Seko Logistics, a major player in the last-mile delivery space. “This is quickly becoming a mobile-first, digital brand experience, especially when it comes to scheduling and notifications,” he says. He quips that, “It’s nice to know that the six pairs of socks you ordered are on the way.” But when it’s a big and bulky purchase, like a 60-inch TV or a couch, “people plan their day around that delivery … it’s now a game of who is on time and provides and maintains the best delivery experience,” he says. Consumers want an Uber-like experience, where they can see their goods on the way in real time. “You are engaging the consumer as an extension of your client’s brand,” Bourke says. “Your job is to provide a great experience with that delivery, and then give the client immediate feedback into how that experience went and what can be improved.” And while the pandemic supercharged e-commerce, it continues to reset consumer expectations—and the demands and challenges last-mile delivery providers must meet and overcome. “People click ‘purchase’ based on the promise date. That date is critical,” adds Bourke. “It’s not enough to just provide a date and time. They want the transaction and the delivery to be simple, painless, and on time, with options to adjust in real time if their circumstances change. We are now in the customer experience business.” A SENSE OF URGENCY Guy Bloch, chief executive officer of e-commerce and last-mile delivery technology developer Bringg, says retailers now understand the imperative of having a solid platform for e-commerce and online operations. It’s not a “nice to have” side business. It has become front and center. “You need to move now,” he emphasizes to the CEOs, CTOs, and supply chain heads he speaks with. Bringg’s software platform and tools are utilized today by some 800 retailers and online brands, who use them for both package and bulky goods deliveries, he says. “You are digitizing and connecting a physical world, and you are orchestrating people, products, plans, facilities, delivery assets and drivers, and consumers.” All that takes time, and waiting just puts a business further behind the curve, he observes, adding that customers typically look for last-mile solutions that are able to automate about 90% of deliveries. In his view, Bringg’s role is about unlocking value. To get there, “you have to have an urgency, a priority to do this—to adopt a product platform [and] do the process re-engineering, training, and change management. We ask the client, ‘What is the goal for the business, what problems are we trying to solve?’” he says. “Once we boil it down, figure out the business priority, and set the metrics, we can apply a solution, and you see a major shift in the business from before.” He notes that in 2023, online purchases represented about 23% of retail. By 2030, Bringg expects that to grow to 29%, and represent half of retail sales by 2040. Bloch adds that retailers also should understand another sobering point: the impact of Walmart and Amazon. According to industry reports, Walmart is expected to grow its online business by 22% this year. Amazon is expected to grow by 10%. However, the overall online market is expected to grow by only 8.8%. Playing out that trendline, Bloch estimates that by 2027, “60% of online retail will be owned by Walmart and Amazon, with the other 40% shared in the market. That has got to be a disturbing statistic for any CEO,” he adds. For retailers and online brands, the big questions, Bloch says, are: “How do I compete? How do I get the customer to come and search for the product from me? How do I keep them engaged, and how do I keep them coming back?” Therein lies the challenge. According to studies Bringg has reviewed, 72% of consumers abandon their online shopping carts before checkout because the delivery is too expensive. Some 61% of consumers leave their shopping cart because the wait time for the delivery is too long. “It’s about the customer experience with the delivery,” Bloch stresses. “Look at all the ways they can receive [their purchase]. All the options need to be personalized to that person on that site at that moment in time. You want to be in control [of] the customer experience. If you don’t do that well, they will leave and go somewhere else.” MATCHING THE SHOWROOM EXPERIENCE Even with online sales expanding for big and bulky items, there is still value to the experience a consumer has visiting a showroom and engaging with the actual product onsite. Since most big and bulky items are a major purchase, it’s not uncommon for consumers to do research online and then visit a showroom before making a final decision. “What we see is customers asking to match the showroom experience” and have the home delivery and install live up to their expectations of the product they saw in the store, says Joel Eigege, vice president of Ryder Last Mile. That’s one area where Eigege believes that good delivery providers can excel—across the network. “Customers want consistency in that experience,” regardless of where the end-consumer is, he says. “It’s not good enough to be strong in Chicago, Atlanta, and Dallas. You have to be just as good in the mid-sized to smaller cities you serve. And that takes a well-designed and well-resourced a network.” In Ryder’s case, that delivery network includes 135 last-mile warehouses, of which about 50 are dedicated customer sites. The company made roughly 2.1 million deliveries within the last 12 months. The service mix also is changing. In some cases, last-mile teams are pre-assembling products prior to delivery. They’re providing full installation services for the flat-screen TVs they deliver—unpacking and mounting them, booting up the software, and giving the consumer a tutorial on the TV’s use. They’re providing plumbing services to support appliance installations. For connected fitness equipment, the installer literally is drilling into a wall to mount an interactive video fitness screen. Another item high on the demand list, says Eigege, is integration capability coupled with real-time visibility and immediate customer feedback post-delivery. “They want us to be fully integrated into their supply chain,” which Eigege says Ryder does through its RyderView platform, which provides visibility and self-scheduling tools. He adds that customers also place a premium on being able to flex up capacity for peak demand periods. “Flex capacity for promotional periods or seasonal sales windows is critical,” he says. “The customer comes to us with a two-week product promotion or a holiday sales window. We have to be able to scale up 20%, 30%, even 100% in some cases to meet that.” Last-mile planning and execution technologies have to support “what gives convenience to the consumer, [provides] visibility and cost management for the retailer, and enables an over-the-threshold delivery and install experience that delights the customer,” Eigege says. They also have to be able to create operating plans and determine optimized delivery schedules for each delivery team and truck—which in many cases is an independent contractor. That involves planning the optimal loads to go on that truck as well as the best routes and delivery schedules to maximize those assets and people—and support a top-notch customer engagement. And it all has to happen on a smartphone. A MATTER OF TRUST John Vargo, senior vice president of final-mile services for trucker J.B. Hunt, has seen any number of shifts in the business over his 25 years at the carrier. The rise of e-commerce and its impact on the last-mile big and bulky market has reinforced, in Vargo’s view, several enduring priorities: to provide safe, reliable assets and people; to optimize assets and operations to eliminate waste in the overall transportation process (last mile can make up 50% of that overall cost); to protect the customer’s brand through well-trained, exceptional people delivering a superior experience; and to build and maintain a reputation as a service provider you can trust. “One of our foundational values is [using] people you can trust,” he notes. “We have a responsibility every time we go into a home to ensure that we [send] people that the consumer can trust, and who demonstrate that trust in how they provide the service.” J.B. Hunt Final Mile Services is focused on the big and bulky market and participates in what Vargo describes as all three segments of the delivery process: “First mile, where we pick up at a manufacturer’s or retailer’s site. Middle mile, where we deliver it to a forward stocking site or DC for staging into last mile. And then last mile, which is delivering to the consumer’s home.” He notes that J.B. Hunt handles the first and middle miles through its specialized less-than-truckload unit, which is designed for shipments that require careful handling and secure transportation to ensure product integrity while in transit. J.B. Hunt also “embeds” its own employees and expert staff within a customer’s facility and manages the delivery process for that customer directly on site. “So if the client has a market where it makes sense to have a facility, we’ll staff and operate it, whether as a local DC or a back-of-store [operation].” Among the biggest challenges Vargo sees for the industry is recruiting and keeping qualified, dedicated delivery personnel, which in many cases for last mile are independent contractors. “These are difficult jobs, and finding the right skilled labor that can support this need and fulfill these roles is a key challenge—and an opportunity for us,” he notes. “It takes a certain type of person. We have a great team that does recruitment, our “people” team. We do extensive background checks to make sure our personnel are vetted and qualified. We provide training. Then once we onboard, we focus on support, communication, and retention. Trust matters,” he says. Even with its challenges, Vargo believes the future is bright for the big and bulky last-mile market. “As consumers buy more and more [large items] online that need delivery and setup, it will be a huge opportunity.” Currently, J.B. Hunt Final Mile Services completes more than 4.6 million last-mile deliveries a year. INTEGRATING THE WAREHOUSE AND THE LAST MILE The rising cost of operating big and bulky last-mile delivery services is causing retailers and online brands to look at different models. One is purely doing the last-mile piece themselves. Increasingly, however, businesses are looking to providers who can provide both a dedicated (or multiclient) warehouse footprint, on a national or regional basis, where fast-moving SKUs (stock-keeping units) can be forward stocked; and a last-mile delivery network, fleet, and drivers. And the management technology that brings it all together. “Retailers are seeking both,” notes Sandeep Pisipati, president of RXO Last Mile, which deploys 76 RXO-owned and -operated last-mile hubs and executes 10 million last-mile deliveries each year. He says there is a case to be made for last mile to be able to leverage the same platform to submit, execute, track, and trace orders across the entire supply chain. “It’s the ability to position inventory in high-demand markets, then expedite deliveries without having to integrate across multiple platforms,” he notes, adding that RXO can leverage real estate it already has to help customers expand their reach and position product closer to the end-consumer. Customers also are seeking “self-service” platforms “that are easy to use, provide accurate information, and are cyber-secure,” he notes. Capacity remains an issue. “Everyone is looking for capacity to support their volume,” Pisipati says. “Aside from that, clients are looking for ways to leverage different modes of transportation from the same provider to help drive down costs.” In terms of growth, he sees opportunity “from the variety of outlets that consumers can purchase from today—whether it be in-store, e-commerce, or other avenues that have not been fully explored. We have to stay flexible.” Looking ahead, Pisipati shares a challenge that’s becoming an increasing concern for last-mile operators: a dwindling carrier workforce. “It’s a special skill set to be able to handle heavy appliances and commercial driving while having the customer service mindset to enter people’s homes. As more people with this skill set retire, it will only be harder [to rebuild the workforce],” he says.

Bringg Frequently Asked Questions (FAQ)

When was Bringg founded?

Bringg was founded in 2013.

Where is Bringg's headquarters?

Bringg's headquarters is located at 132 Derech Menachem Begin, Tel Aviv.

What is Bringg's latest funding round?

Bringg's latest funding round is Series E.

How much did Bringg raise?

Bringg raised a total of $184.5M.

Who are the investors of Bringg?

Investors of Bringg include Salesforce Ventures, Pereg Ventures, Next47, Shmuel Harlap, GLP Capital Partners and 11 more.

Who are Bringg's competitors?

Competitors of Bringg include LogiNext, Cartwheel, QDelivery, OPTIMIND, Last Mile Team and 7 more.

What products does Bringg offer?

Bringg's products include Own Delivery and 2 more.

Who are Bringg's customers?

Customers of Bringg include Hibbit Sports.

Loading...

Compare Bringg to Competitors

DispatchTrack provides last mile delivery management software within the logistics and supply chain industry. The company offers a SaaS platform that includes route optimization, scheduling and tracking, delivery execution, and customer experience management to improve delivery operations. DispatchTrack serves sectors including delivery and logistics, building materials and supplies, food and beverage, furniture and appliance, retail and consumer goods, and field services. It was founded in 2010 and is based in San Jose, California.

Locus delivers a dispatch management technology platform. The platform uses proprietary algorithms to offer logistics solutions such as route optimization, real-time tracking, insights, analytics beat optimization, efficient warehouse management, vehicle allocation, and more. It also helps companies optimize their end-to-end supply chain network with strategic consulting. The platform was founded in 2015 and is based in Milpitas, California.

OptimoRoute provides route optimization and planning for deliveries and field services within various business sectors. The company offers software solutions that assist with route planning, scheduling, and management for mobile workforces. OptimoRoute's services cater to a range of industries including logistics, retail distribution, healthcare, and field services. It was founded in 2012 and is based in Palo Alto, California.

Wise Systems specializes in autonomous dispatching and routing software for the fleet management sector. The company offers a suite of tools that enhance fleet efficiency and customer service by optimizing last-mile delivery routes in real-time using machine learning algorithms. Wise Systems primarily serves industries that require dynamic routing and delivery solutions, such as wholesale and retail distribution, as well as parcel and courier services. It was founded in 2014 and is based in Cambridge, Massachusetts.

Onfleet specializes in last-mile delivery software solutions within the logistics and transportation sector. The company offers a platform that includes route optimization, real-time tracking, automated dispatch, and delivery analytics to streamline delivery operations. Onfleet's software is designed to enhance the efficiency of delivery services for various industries such as grocery, pharmacy, and furniture. It was founded in 2012 and is based in San Francisco, California.

OPTIMIND is a company that provides solutions for the last mile of logistics through technology. Its main offering, 'Loogia', is a service that aids in creating delivery routes, improving delivery operations. The company serves businesses dealing with urban distribution challenges and aims to assist in improving delivery efficiency. It was founded in 2015 and is based in Nagoya, Japan.

Loading...