Augury

Founded Year

2011Stage

Series E | AliveTotal Raised

$294MValuation

$0000Last Raised

$180M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-23 points in the past 30 days

About Augury

Augury provides predictive and prescriptive artificial intelligence (AI) solutions. The company offers AI-enabled insights into machines, processes, and operations to help businesses improve outcomes, maintain their workforce, and achieve sustainable production. It primarily serves sectors such as food and beverage, consumer packaged goods, forest products, pulp and paper, glass, metals and mining, chemicals, building materials and cement, pharmaceuticals, steel, plastics, commercial services, and energy. It was founded in 2011 and is based in New York, New York.

Loading...

Augury's Product Videos

ESPs containing Augury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The predictive maintenance platforms market provides software solutions using AI and IoT technologies to provide real-time machine insights. This enables manufacturers to move from reactive to proactive maintenance programs, preventing process-driven production losses, reducing over-maintenance, extending asset lifetime, and optimizing manufacturing equipment controls. It also helps them eliminate…

Augury named as Outperformer among 15 other companies, including IBM, Oracle, and Siemens.

Augury's Products & Differentiators

Machine Health

An industrial AI solution, Machine Health uses the Internet of Things (IoT) and purpose-built Artificial Intelligence (AI) to help people manage industrial assets and optimize their performance. Augury’s full-stack Machine Health Solutions use sensors that capture vibration, temperature and magnetic data from machines, then leverages advanced AI diagnostics and human reliability expertise to deliver real-time visibility and actionable insights into the full range of rotating equipment. With insights aggregated into a centralized platform and additional interoperability capabilities, manufacturing companies can eliminate data silos and work collaboratively to reduce inefficiencies generated by malfunctioning equipment.

Loading...

Research containing Augury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Augury in 12 CB Insights research briefs, most recently on Dec 23, 2024.

Dec 23, 2024

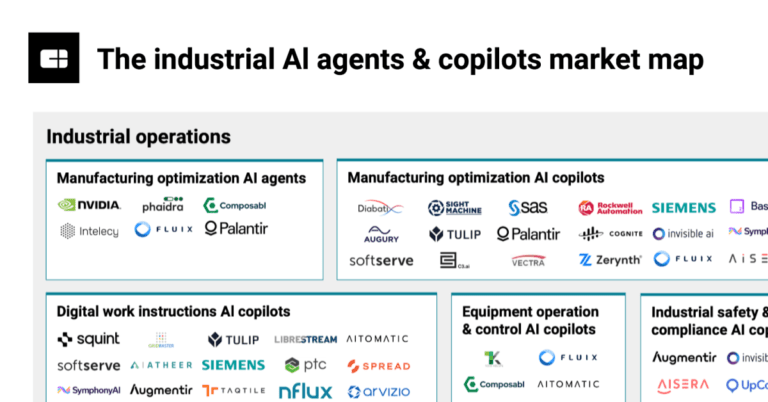

The industrial AI agents & copilots market mapSep 23, 2024

The semiconductor manufacturing market map

Sep 28, 2023

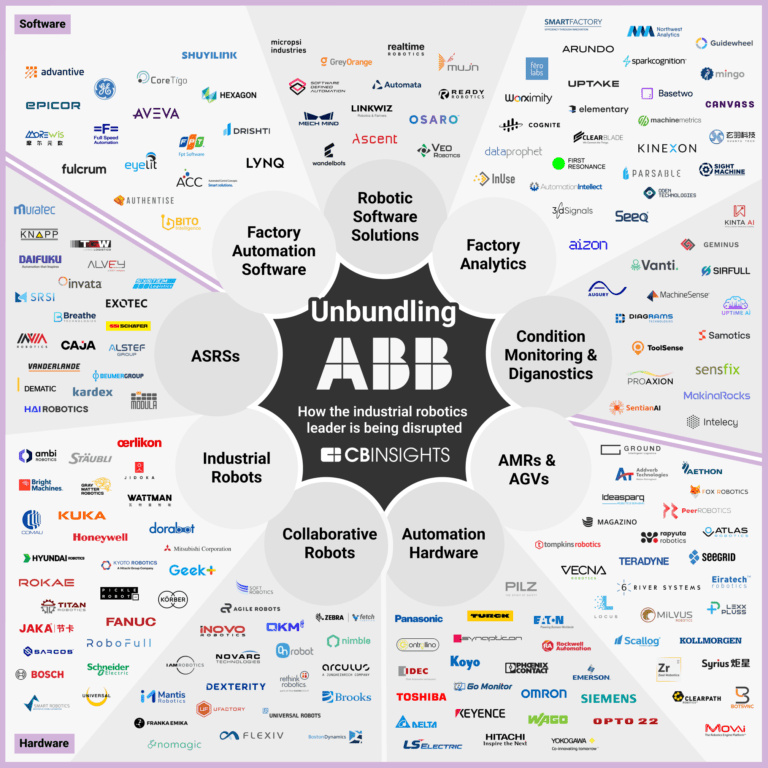

The automation in advanced manufacturing market map

Aug 16, 2023

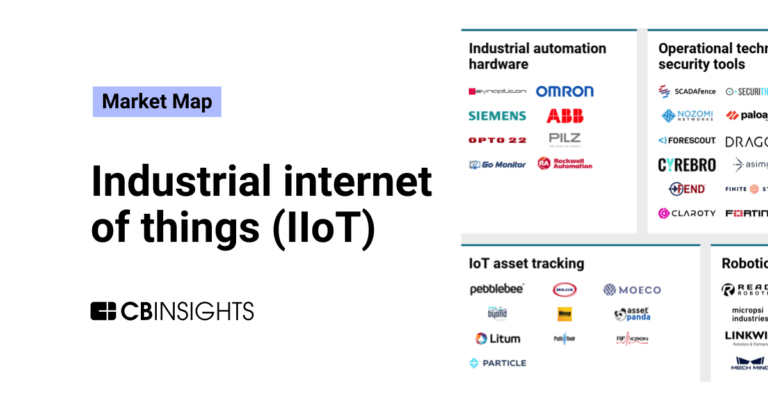

The industrial internet of things (IIoT) market mapExpert Collections containing Augury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Augury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

Oil & Gas Tech

4,980 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Insurtech

4,419 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Advanced Manufacturing

6,521 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Future of the Factory (2024)

436 items

This collection contains companies in the key markets highlighted in the Future of the Factory 2024 report. Companies are not exclusive to the categories listed.

Artificial Intelligence

7,222 items

Augury Patents

Augury has filed 16 patents.

The 3 most popular patent topics include:

- maintenance

- acoustics

- nondestructive testing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/4/2023 | 5/7/2024 | Semiconductor device fabrication, Acoustics, Nondestructive testing, Thin film deposition, Plasma processing | Grant |

Application Date | 5/4/2023 |

|---|---|

Grant Date | 5/7/2024 |

Title | |

Related Topics | Semiconductor device fabrication, Acoustics, Nondestructive testing, Thin film deposition, Plasma processing |

Status | Grant |

Latest Augury News

Jan 16, 2025

Qumra Capital’s Erez Shachar joined CTech to discuss regulatory shifts and AI policy changes under the new U.S. administration and offer both challenges and opportunities for Israel's entrepreneurs. “The impact of new American leadership on the global high-tech industry is still unfolding. However, there are a few key areas we should pay attention to, such as the new administration’s approach to regulating emerging technologies like AI,” said Erez Shachar, Managing Partner and Co-founder at Qumra Capital. “Setting the balance between regulation and innovation will shape global competition, especially with countries like China, which heavily invests in AI and other advanced technologies.” The upcoming change in leadership is set to shake up the tech world in Israel, America, and also other regions like Europe and China. Shachar joined CTech for its 2025 VC Survey to share insights and predictions on how it might all play out. (Photo: Qumra Capital) “The transition team of the new administration has many leading tech figures, and fostering innovation and US competitiveness will be front and center in the new administration,” he added. You can read the entire interview below. Fund IDName of fund/funds: Qumra CapitalTotal sum of the fund: $1BPartners: Sivan Shamri Dahan, Erez Shachar, Boaz Dinte, Sharon Barzik CohenNotable/select portfolio companies (active): Connecteam, Augury, Simply, Agora Real, Appsflyer, Minute Media, At-BayNotable exits: JFrog, Fiverr, Riskified 2024 is over. How can you summarize it in terms of the Israeli high-tech industry? If I could sum up 2024 for the Israeli tech industry, I’d call it a year of remarkable resilience. With so many founders and employees in active military reserves, and many dealing with personal loss, the challenges were unimaginable. Despite this, the industry kept moving forward. Startups adapted quickly, with many shifting focus to support national needs while continuing to innovate. Venture funding, while slower, remained steady, and exits topped $10 billion. Israeli tech proved once again that no matter the obstacles, it remains a pillar of strength, creativity, and resilience. Looking ahead to 2025 - What challenges and opportunities await the Israeli high-tech sector in the coming year, and how are you, as investors, preparing for them? Looking ahead to 2025, I’m hopeful we’re nearing a recovery period. I hope the war will soon end and the hostages will be returned. The opportunities in sectors like AI, cybersecurity, digital health, digital transformations of traditional industries, and more, remain vast with Israeli startups well-positioned to lead. At the same time, Israel stands at a critical juncture. For "Startup Nation" to continue thriving, our government must invest more in education, ensuring that future generations have the skills to innovate and drive the tech sector forward. We must provide the tools for young talent to continue Israel’s legacy as a global tech leader. With the market beginning to reopen, we’ll see a resurgence in IPOs as confidence returns, and a growth in M&A activity, with the expected easing of regulatory barriers. As late-stage VCs, we are focused on finding the companies of tomorrow - not just the innovators, but also those who could execute at scale. The last decade was the decade of scale-ups in Israel. For the first time, we experienced the emergence of $10B+ market leaders coming out of Israel, like Monday and Wix. The next step for the Israeli tech market is to build the 100B+ companies that will lead the way forward. How will new American leadership affect the global high-tech industry or economy? And where does this place Israel and its entrepreneurs? The impact of new American leadership on the global high-tech industry is still unfolding. However, there are a few key areas we should pay attention to, such as the new administration’s approach to regulating emerging technologies like AI. Setting the balance between regulation and innovation will shape global competition, especially with countries like China, which heavily invests in AI and other advanced technologies. The transition team of the new administration has many leading tech figures, and fostering innovation and US competitiveness will be front and center in the new administration. On the regulatory front, we will see an easing of the anti-trust regulatory framework, which will encourage M&As that slowed down significantly as a result of regulatory concerns. What are the most important things the Israeli government should do today to accelerate the high-tech engine in the coming year? Following the turbulent last two years, the biggest threat to Israeli high-tech is the migration of Israeli tech companies to other jurisdictions, registering companies (and IP) outside of Israel, and the brain drain of top talent in the most mobile population and industry. The second threat is that foreign investors will gradually shy away from Israeli investments if the political and geo-political instability is prolonged. To tackle these issues, in the immediate term, the government should do the following: Lift the unnecessary barriers to investment in Israeli tech. The adverse incentives for Israeli institutional investors, and the uncertainty for foreign investors regarding the tax treatment. Create strong incentives for entrepreneurs to register companies in Israel, rather than in Delaware. With the current instability in Israel, there is no incentive to register new startups in Israel – a dramatically lower tax rate for long-term capital gains for entrepreneurs and early investors, could entice entrepreneurs to register in Israel and mitigate the risks associated, and net-net will benefit dramatically Israeli tax income. Help resolve the transportation crisis to and from Israel, by assisting foreign airlines to return to Israel. Lifting the “Tibi” law for a period of one year, and potentially providing insurance premium subsidies, will lift a lot of the barriers for international carriers. Increased funding and investment in early-stage startups should also be a priority, particularly for deep tech sectors like AI, cybersecurity, and biotech, helping entrepreneurs overcome early challenges. Finally, allocating more resources to innovation and research is essential to ensuring that Israel maintains its competitive edge in the global tech market. A regulatory environment that balances innovation with risk management will support sustainable growth and help Israeli startups scale internationally. By focusing on these areas—equality, education, supporting early-stage innovation, and investing in research and resources—Israel can create a dynamic and inclusive high-tech ecosystem. Are there new sectors you see as relevant? Are there any fields you anticipate will weaken significantly in the coming year? AI, cybersecurity, and defensetech expect significant growth. AI will continue transforming industries, particularly in healthcare, finance, and autonomous systems, with Israeli startups well-positioned to lead in applied AI and automation. Cybersecurity will remain a top priority as digital threats intensify, and Israel’s expertise in this area ensures sustained demand. Finally, rising geopolitical tensions will demand innovative defensetech solutions to address evolving security challenges. Is Israel missing out on the AI revolution in the global arms race? If not, what should the local industry focus on to join the global race? As the competition in the global AI race heats up, Israeli entrepreneurs are embracing this challenge, working to broaden our imagination around the potential of Gen AI to enhance existing solutions and create groundbreaking products. Israel’s talent pool continues to attract multinational companies to establish R&D centers focused on AI-based solutions, with notable examples such as Nvidia, Google, and many others. Nvidia, in particular, remains deeply invested in Israel, acquiring startups like Deci.AI and Run:AI (now cleared by regulators) for $1 billion, following its landmark $6.9 billion acquisition of Mellanox. Another significant vote of confidence comes from entrepreneurs like Ilya Sutskever, Co-Founder of OpenAI, who recently founded a new AI company, Safe Superintelligent (SSI). SSI announced plans to base operations in both California and Israel, aiming to recruit top talent—a testament to the belief in Israel’s innovation ecosystem. However, despite these encouraging developments, Israel faces challenges, particularly a potential talent shortage in the AI sector. This could limit the country’s ability to fully capitalize on AI’s transformative potential. Even so, I believe Israel’s strong foundation for innovation positions us well for success. Our vibrant startup ecosystem, focused on cutting-edge AI applications, can thrive further with strategic investments in education, infrastructure, and talent development. The key will be fostering the next generation of AI leaders, building infrastructure for large-scale AI models, and cultivating an environment where our entrepreneurs can continue to innovate and excel. With the right focus and resources, I am confident that Israel will remain a pivotal player in the global AI revolution. Could the global IPO drought end in the coming year? The global IPO drought could very well end in the coming year. After a period of market uncertainty, inflation, and tightening monetary policies, conditions are starting to stabilize, particularly as inflation rates ease and investor sentiment improves. As global economies adjust to new realities, many companies that have delayed going public in recent years may seize the opportunity to tap into the market once again. However, the bar for going public is higher than ever and only companies with best-in-class metrics are entering the public markets first. From an investor's perspective: will the coming year be better for early-stage startups or more mature companies? The coming year will likely present better opportunities for growth companies. While the past year has been challenging, we see signs of recovery and renewed optimism. Growth companies that have already proven their product-market fit and established a solid customer base are in an ideal position to scale. With increasing demand for innovative solutions in automation, sustainability, and cybersecurity, these companies have the potential to expand rapidly as the market stabilizes and investor confidence returns. The current environment suggests that growth companies—which can demonstrate scalability and strong market presence—will likely see more investor interest and capital in 2025. This makes the coming year a promising period for growth-stage companies well-positioned to capitalize on market opportunities and expand in a recovering economy. Did you raise fund money in 2024 for an existing fund or a new one? What are your expectations regarding this matter for 2025? We closed our fourth Fund in January 2024 and will not raise a new fund during 2025. How many investments did you make in 2024, and how does it compare to previous years? We have made three investments during 2024; we see an exciting deal-flow and entrepreneurs gearing up to build the next generation of scale-up companies. Provide an example of an intriguing investment you made in 2024. What sets this company apart, or what is distinctive about its sector? Agora, a Proptech/Fintech SaaS company with offices in New York City and Tel Aviv, is revolutionizing real estate investment management with its advanced platform. By automating back-office processes, enhancing investor satisfaction, and providing advanced tools for operational efficiency, Agora is empowering real estate firms to raise and preserve more capital. Agora serves a large market currently underserved by existing solutions, and we believe the company has an opportunity to become the leading player in this space as it has proven a robust product market fit, and has demonstrated strong growth. Two notable companies that you think will thrive in 2025. These can be from your portfolio or not. Company Name: AugurySector + description of the product/service: Augury developed an end-to-end solution to provide manufacturers with early, actionable, and comprehensive insights into machine health and performance. The company’s solution includes smart sensors for continuous monitoring and a diagnostic engine based on AI algorithms to identify malfunctions, provide alerts, and issue recommendations.Founding Year: 2011Reasoning why this is their year: The company has firmly established itself as the category leader in machine health, positioning itself for continued success in the rapidly growing Industry 4.0 market. Augury has demonstrated exceptional operational and strategic execution, building a highly experienced executive team to drive the company’s growth. Company Name: Hello SimplySector + description of the product/service: Simply brings creativity and fun into our homes by developing innovative learning apps that teach piano, guitar, singing, and drawing in a joyful, interactive way. The company’s vision is to make hobby learning accessible to everyone, empowering millions to pursue their passions. Simply aims to be the go-to platform for hobby learning in every household, offering a seamless and engaging experience for all ages and skill levels.Founding Year: 2010Reasoning why this is their year: As we enter 2025, the market for mobile, self-paced learning continues to grow, and Simply is uniquely positioned to become a leader in this field. The new Vision Pro app, launched in early December of 2024, showcases the company’s latest advancements in immersive learning. By leveraging emerging technology, Simply brings music education, performance, and creative expression to life in ways we couldn’t have imagined. TAGS

Augury Frequently Asked Questions (FAQ)

When was Augury founded?

Augury was founded in 2011.

Where is Augury's headquarters?

Augury's headquarters is located at 469 Fashion Avenue, New York.

What is Augury's latest funding round?

Augury's latest funding round is Series E.

How much did Augury raise?

Augury raised a total of $294M.

Who are the investors of Augury?

Investors of Augury include Lerer Hippeau, Eclipse Ventures, Munich Re Ventures, Insight Partners, Qualcomm Ventures and 10 more.

Who are Augury's competitors?

Competitors of Augury include Ndustrial, Sensemore, Neuron Soundware, Everactive, AssetWatch and 7 more.

What products does Augury offer?

Augury's products include Machine Health and 1 more.

Who are Augury's customers?

Customers of Augury include Colgate-Palmolive Company, Osem-Nestlé and ICL .

Loading...

Compare Augury to Competitors

Smartia is a company that provides industrial intelligence solutions in the manufacturing sector. Their offerings include a data and machine learning platform for industrial enterprises, as well as applications for asset performance monitoring, predictive maintenance, and quality control. Smartia serves sectors such as aerospace, defence, food & beverage, manufacturing, packaging, and utilities. It was founded in 2018 and is based in Bristol, England.

Petasense is a company focused on asset reliability and optimization within the Industrial IoT sector. They offer a suite of wireless sensors, cloud software, and machine learning analytics designed to monitor and predict the health of industrial machinery. Their solutions cater to various sectors, including rotating machines, electric panels, valves, and steam traps. It was founded in 2014 and is based in Milpitas, California.

Falkonry provides products that analyze operational data and enable condition-based actions related to reliability, quality, and sustainability. It serves the metals, defense and intelligence, chemicals, electronics and semiconductors, oil and gas, automotive, and pharmaceutical industries. It was founded in 2012 and is based in Cupertino, California. In August 2023, Falkonry was acquired by IFS.

3d Signals manufactures automation cloud solutions within the industrial sector. The company offers machine monitoring and energy efficiency solutions, utilizing non-invasive sensors and a cloud-based platform. 3d Signals serves the manufacturing industry. It was founded in 2015 and is based in Kfar Saba, Israel.

Predictronics provides AI-based predictive analytics solutions within the industrial sector. The company offers services that include predictive maintenance, predictive quality, and condition-based maintenance, facilitated by their software platform, PDX. These services monitor critical assets, reduce unplanned downtime, and improve product quality for various industries. It is based in Cincinnati, Ohio.

MPDV is a company that provides IT solutions for the manufacturing sector, focusing on Smart Factories. Their offerings include a Manufacturing Execution System, an Advanced Planning and Scheduling System, and a Manufacturing Integration Platform, which are used by manufacturing companies to improve production processes and support data evaluation in real-time. These systems help companies adapt to Industry 4.0 standards. It was founded in 1977 and is based in Mosbach, Germany.

Loading...