Anchorage Digital

Founded Year

2017Stage

Series D | AliveTotal Raised

$487MValuation

$0000Last Raised

$350M | 3 yrs agoAbout Anchorage Digital

Anchorage Digital is a financial technology company that provides access to the digital asset ecosystem for institutions. Its services include custody, staking, trading, governance, and settlement of digital assets. Anchorage Digital serves the financial sector, including registered investment advisors, venture capital firms, asset managers, and ETF issuers. It was founded in 2017 and is based in San Francisco, California.

Loading...

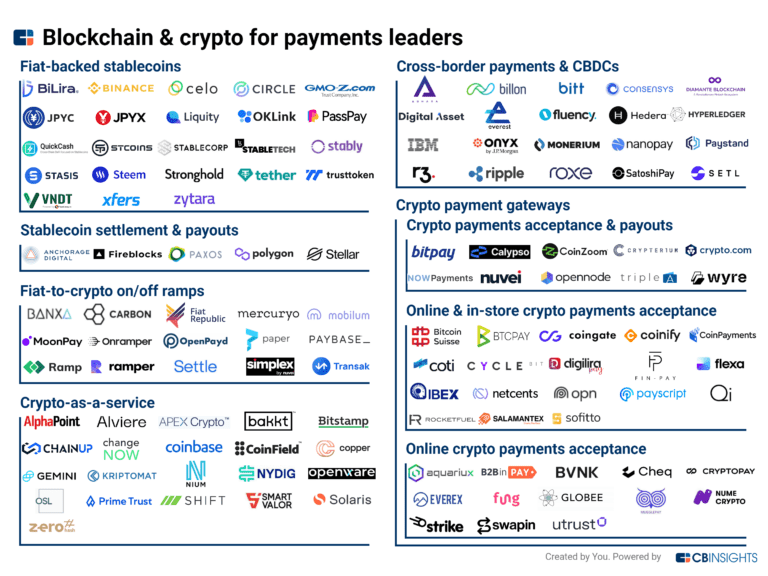

ESPs containing Anchorage Digital

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional decentralized finance (DeFi) market refers to the use of decentralized finance protocols and platforms by institutional investors, such as hedge funds, asset managers, and corporations, to access DeFi services and generate returns. Technology vendors in this market offer end-to-end software solutions. These solutions provide secure access to top distributed networks, offering sec…

Anchorage Digital named as Challenger among 15 other companies, including Circle, BitGo, and Consensys.

Anchorage Digital's Products & Differentiators

Custody

Safekeeping of over 60 digital assets

Loading...

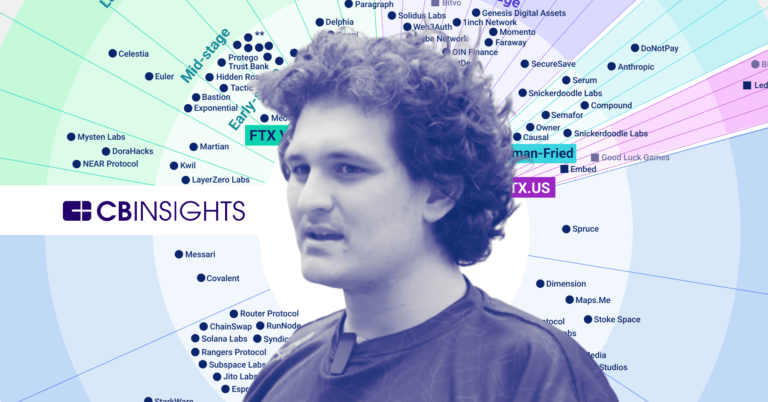

Research containing Anchorage Digital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Anchorage Digital in 7 CB Insights research briefs, most recently on Feb 23, 2023.

Oct 15, 2022

What is institutional staking?

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Anchorage Digital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Anchorage Digital is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Blockchain

8,885 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Capital Markets Tech

1,151 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Anchorage Digital News

Jan 16, 2025

Transforming Access, Visualization and Sharing of Factual Information SAN FRANCISCO, October 16, 2024-- Tako, a groundbreaking AI search engine for visualizing and sharing the world's knowledge, announced today it has raised $5.75 million in a seed funding round led by Kevin Hartz at A* and Ramtin Naimi at Abstract Ventures with participation from Stanley Druckenmiller / Kevin Warsh, Gokul Rajaram, Naval Ravikant, Stan Chudnovsky, Guillermo Rauch (Vercel), Scott Belsky (Adobe), GC Lionetti (OpenAI), George Sivulka (Hebbia), Aravind Srinivas (Perplexity), Johnny Ho (Perplexity), Kanjun Qiu (Outset Ventures), Joe Montana (Liquid2 Ventures), Chase Coleman, Diogo Monica (Haun Ventures), Nathan McCauley (Anchorage Digital), Paul Yacoubian (Copy.ai) and more. With a focus on deep research, Tako delivers interactive, up-to-date and shareable knowledge cards built exclusively from the world?s most authoritative data sources, transforming how knowledge workers access, visualize and share factual information. The seed funding will be used to expand Tako's partnerships, attract top-tier talent and expand its platform?s capabilities. Co-founded by Alex Rosenberg, former Amazon leader, and Bobby Abbott, Tako has already made waves in the AI space with its innovative partnership with Perplexity. In May, Tako's advanced search and visualization tools were integrated into Perplexity?s answer engine, and last month, Tako expanded its capabilities further with a Polymarket tie-in, allowing for visual display of dynamic data like election trends. ?Tako grounds research and storytelling in reality by turning real-time, authoritative data into visual representations of knowledge,? said Alex Rosenberg, co-founder and CEO of Tako. ?We're making it easier than ever to access and share reliable information. We?ll use this funding to accelerate our plan to index all the world's authoritative data and push the boundaries of how factual information can be visualized and persuasively shared.? The funding will specifically be used to grow Tako's knowledge graph, enhance platform UX and UI, and expand its partnerships with industry leaders who share Tako?s vision of democratizing access to truthful, authoritative data. By continuing to collaborate with the world?s leading structured data providers like S&P and Stats Perform, Tako will ensure users receive reliable, factual information every time they interact with AI. Attracting top talent is essential to Tako?s mission, and this investment will enable the company to bring in the brightest minds to push the boundaries of innovation, driving Tako?s growth and impact. ?It's rare to find a team that combines as much domain expertise and ambition as Alex and Bobby,? said Kevin Hartz, Co-Founder and General Partner at A*. ?Their drive is unmatched, and their vision of transforming authoritative data into dynamic, shareable visual references for the world?s knowledge workers has the potential to transform multiple industries.? ?AI raised expectations about what software and search should do,? said Guillermo Rauch, CEO and Founder of Vercel. ?Ten blue links no longer cuts it; people want complete, succinct analysis they can creatively express. Tako?s knowledge platform makes it super easy for developers to build more rich and interactive AI-native products.? About Tako Tako is an AI search engine for visualizing and sharing the world's knowledge. Founded by Alex Rosenberg and Bobby Abbott, Tako partners with authoritative data providers to deliver knowledge cards that are up-to-date, shareable and built on a foundation of structured, reliable data. Tako transforms how knowledge workers access, visualize and share factual information, empowering them to make informed decisions based on the most accurate and comprehensive data available. Visit trytako.com to learn more. Contact:

Anchorage Digital Frequently Asked Questions (FAQ)

When was Anchorage Digital founded?

Anchorage Digital was founded in 2017.

Where is Anchorage Digital's headquarters?

Anchorage Digital's headquarters is located at One Embarcadero Street, San Francisco.

What is Anchorage Digital's latest funding round?

Anchorage Digital's latest funding round is Series D.

How much did Anchorage Digital raise?

Anchorage Digital raised a total of $487M.

Who are the investors of Anchorage Digital?

Investors of Anchorage Digital include Andreessen Horowitz, Blockchain Capital, Elad Gil, Wellington Management, GS Growth and 25 more.

Who are Anchorage Digital's competitors?

Competitors of Anchorage Digital include BitGo, Signature Bank, Fireblocks, Standard Custody & Trust Company, Finoa and 7 more.

What products does Anchorage Digital offer?

Anchorage Digital's products include Custody and 2 more.

Who are Anchorage Digital's customers?

Customers of Anchorage Digital include Visa.

Loading...

Compare Anchorage Digital to Competitors

BitGo provides solutions for the digital asset economy within the financial technology sector. Its offerings include custody, digital asset wallets, and financial services such as trading, borrowing, lending, and staking, which are used to manage digital assets. BitGo serves institutional clients, cryptocurrency exchanges, and investment platforms with services designed for the crypto space. It was founded in 2013 and is based in Palo Alto, California.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Fireblocks is an enterprise-grade platform that specializes in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors, including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

Ledger specializes in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Its products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. The company was founded in 2014 and is based in Paris, France.

Hex Trust is a fully-licensed digital asset custodian that specializes in providing secure solutions for the management and safeguarding of digital assets within the financial sector. The company offers a range of services, including institutional-grade custody, access to decentralized finance (DeFi) markets, and staking, all underpinned by rigorous security and compliance measures. Hex Trust caters primarily to financial institutions, protocols, foundations, and entities within the Web3 and metaverse ecosystems. It was founded in 2018 and is based in Hong Kong.

Cactus Custody is a financial services provider. It provides services such as mining companies, mining pools, cloud mining platforms, exchanges, funds, and OTC dealers. It also offers digitally enabled, transparent, and efficient institutional custodial services. It was founded in 2019 and is based in Hong Kong.

Loading...