Amperity

Founded Year

2016Stage

Incubator/Accelerator | AliveTotal Raised

$217.3MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-51 points in the past 30 days

About Amperity

Amperity is a customer data platform (CDP) that focuses on identity resolution and data normalization within the marketing technology sector. The company provides tools to unify, analyze, and optimize customer data for marketing campaigns and customer experiences. Amperity's solutions assist brands in understanding their customers, facilitating engagement and privacy compliance. It was founded in 2016 and is based in Seattle, Washington.

Loading...

ESPs containing Amperity

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

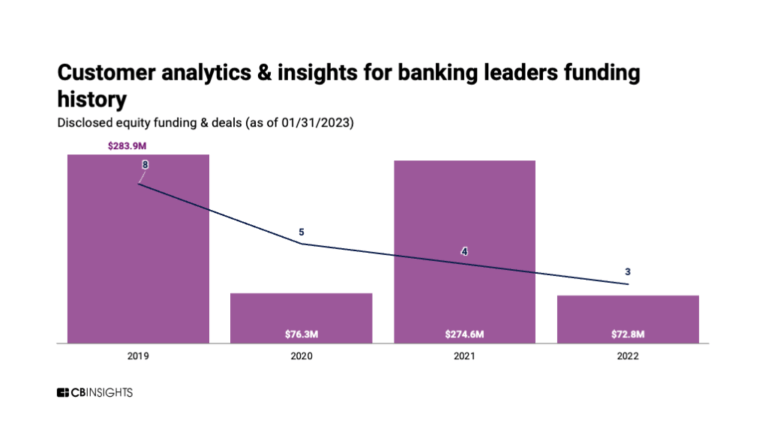

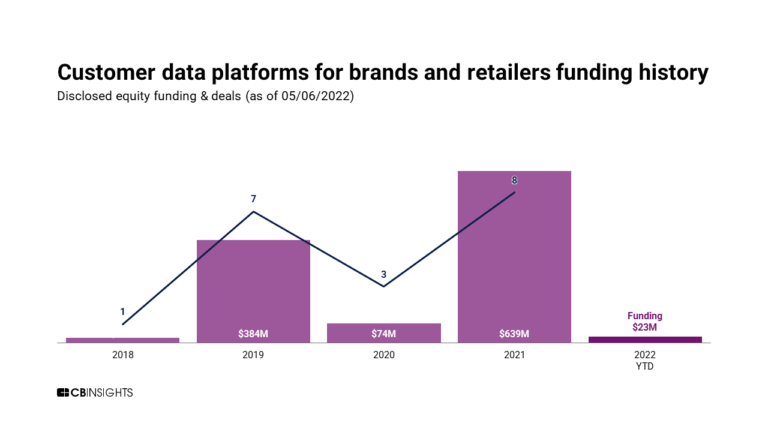

The customer data platforms (CDP) market is focused on providing a single view of the customer. CDP vendors offer solutions that unify customer data, segment profiles into actionable groups, activate segments across martech and adtech ecosystems, and provide real-time interaction management. This enables companies to offer personalized experiences across the entire customer journey. It also addres…

Amperity named as Outperformer among 15 other companies, including Oracle, Adobe, and Tealium.

Amperity's Products & Differentiators

Datagrid

DataGrid is the multi-patented infrastructure that powers all the products in Amperity's Comprehensive Enterprise CDP.

Loading...

Research containing Amperity

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amperity in 5 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024

The core banking automation market map

Aug 14, 2023

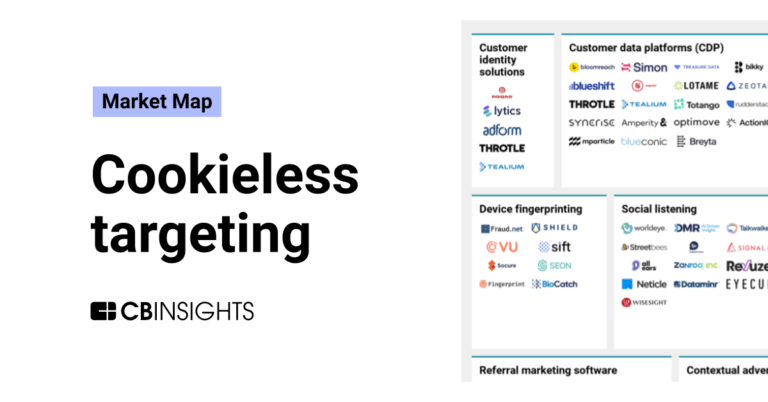

The cookieless targeting market map

Aug 4, 2023

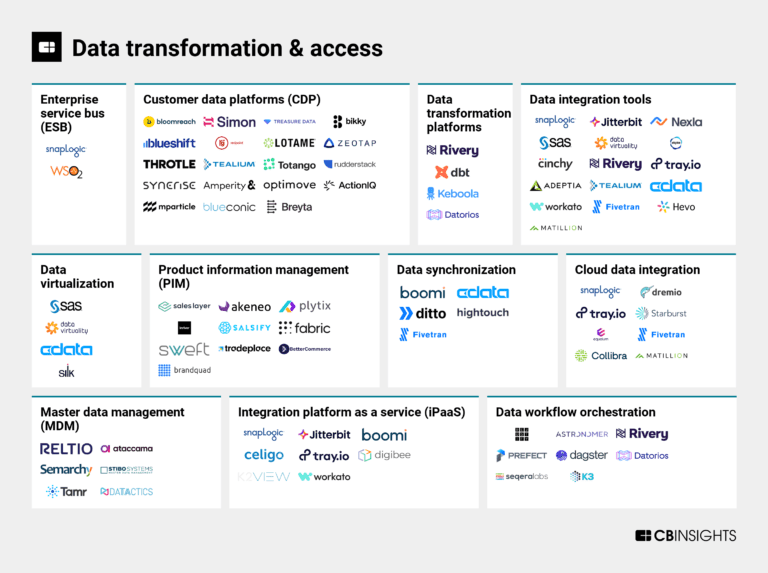

The data transformation & access market mapExpert Collections containing Amperity

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amperity is included in 10 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Tech IPO Pipeline

568 items

Ad Tech

4,236 items

Companies offering tech-enabled marketing and advertising services.

Conference Exhibitors

5,302 items

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Targeted Marketing Tech

659 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Amperity Patents

Amperity has filed 26 patents.

The 3 most popular patent topics include:

- data management

- data modeling

- database management systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/8/2023 | 6/18/2024 | Cluster analysis algorithms, Machine learning, Diagrams, Data management, Classification algorithms | Grant |

Application Date | 5/8/2023 |

|---|---|

Grant Date | 6/18/2024 |

Title | |

Related Topics | Cluster analysis algorithms, Machine learning, Diagrams, Data management, Classification algorithms |

Status | Grant |

Latest Amperity News

Jan 16, 2025

Introduction As businesses prepare for 2025, industry experts are forecasting significant shifts in how companies will handle and utilise customer data . These changes span across multiple domains, from data infrastructure to artificial intelligence, with implications for businesses of all sizes. To understand these emerging trends, Amperity’s industry leaders shared their insights on what lies ahead. The Evolution of Data Infrastructure At the foundation of these changes lies the transformation of data infrastructure itself. In this space, significant consolidation appears to be on the horizon. Caleb Benningfield, Field CTO at Amperity, sees major changes coming to the Customer Data Platform (CDP) market. “There has been no clear winner and investors will want to see action and CDPs will begin to merge or be acquired,” he explains. Benningfield also predicts that companies will increasingly position themselves as alternatives to Salesforce Data Cloud while emphasising vendor independence. Additionally, he notes that “zero-copy” architectures will become essential for competitive CDPs. AI Transformation and Business Impact While data infrastructure provides the foundation, artificial intelligence is poised to be the driving force of innovation in 2025. The AI landscape is set for dramatic evolution, according to Joyce Gordon, Amperity’s Head of Generative AI . She emphasises that AI adoption will create a clear divide between companies that thrive and those that struggle. “These successful companies will make better decisions because their teams can easily access and understand data, deliver more personalised customer experiences using generative AI, and run more efficiently by using AI for tasks like drafting creative briefs and handling initial customer service responses,” Gordon explains. “Brands that aren’t adopting AI with a cohesive strategy will fall behind.” The Path to AI Success However, implementing AI successfully requires more than just adopting the technology. Gordon particularly emphasises the importance of proper AI implementation. “Companies will move beyond segmented AI-driven content, closer to one-to-one personalisation,” she says. “This shift is possible now because AI models are becoming smaller, cheaper, and more capable, and because companies are getting better at using them.” However, Gordon cautions that success requires clean, well-organised customer data as a foundation. Media Networks and Advertising Evolution As businesses grapple with these technological changes, the media and advertising landscape is undergoing its own transformation. Related Posts In the media and monetisation sphere, Peter Ibarra, Head of Media and Adtech Solutions at Amperity, predicts significant changes in retail media networks (RMNs). “The explosion of retail media networks over the past few years means we’re close to a tipping point,” he notes. Ibarra explains that success will require these networks to mature their offerings and provide truly differentiated targeting and measurement capabilities. The Future of Digital Advertising This evolution in media networks is closely tied to broader changes in digital advertising. Despite Google’s extension of third-party cookies, Ibarra believes advertisers won’t slow their investments in alternative technologies. “Brands will need to maximise the quality of their first-party signals as opposed to relying on the volume of their data,” he states. He also predicts that television advertising budgets will continue shifting from traditional linear TV to connected TV (CTV), with programmatic exchanges emerging as the winners. Transforming Customer Data Management These changes in advertising and media naturally lead to questions about how businesses will manage their customer data going forward. Looking at the broader customer data landscape, Amperity CTO and co-founder Derek Slager sees fundamental changes ahead. “The CDP category will continue to fragment, with vendors more explicitly aligning their positioning to their strengths rather than claiming to solve things entirely,” he predicts. Slager believes that rather than seeking single-platform solutions, companies will increasingly adopt multiple specialised tools to address their customer data challenges. Analytics and Real-Time Capabilities This transformation in data management will be accompanied by significant changes in how businesses analyse and act on their data. Slager is particularly bullish on AI’s role in transforming analytics . “Dashboards are dead,” he declares. “Generative AI powered tools offering the ability to answer the questions that matter on-the-fly will be the new surface for analytics and decision making.” Slager also predicts a resurgence in real-time capabilities across the entire data stack , driven by competition in the Cloud Data Warehouse market. The Rise of Low-Code Solutions Looking to the future, perhaps the most transformative change will come from democratising access to these powerful technologies. Slager foresees the emergence of a new generation of AI-powered low-code and no-code tools that will quickly compete for enterprise use cases. This development could dramatically change how businesses approach their data infrastructure and analytics needs in the coming year, making sophisticated data operations accessible to a broader range of organisations and users. [To share your insights with us as part of editorial or sponsored content, please write to psen@itechseries.com ]

Amperity Frequently Asked Questions (FAQ)

When was Amperity founded?

Amperity was founded in 2016.

Where is Amperity's headquarters?

Amperity's headquarters is located at 701 5th Avenue, Seattle.

What is Amperity's latest funding round?

Amperity's latest funding round is Incubator/Accelerator.

How much did Amperity raise?

Amperity raised a total of $217.3M.

Who are the investors of Amperity?

Investors of Amperity include Accelerate@IATA, Madrona Venture Group, Tiger Global Management, Declaration Partners, Madera Technology Partners and 16 more.

Who are Amperity's competitors?

Competitors of Amperity include mParticle, Lytics, Rivery, ActionIQ, Zeotap and 7 more.

What products does Amperity offer?

Amperity's products include Datagrid and 3 more.

Loading...

Compare Amperity to Competitors

mParticle is a customer data platform focused on data infrastructure and customer data management across various industries. The company provides services that offer insights into customers, data segmentation, analytics, and predictions to support marketing strategies and customer engagement. mParticle serves the media & entertainment, quick service restaurants, retail, travel and hospitality, and financial services sectors. It was founded in 2013 and is based in New York, New York.

Tealium operates in the field of customer data integration and management within the technology sector. The company provides a customer data platform that allows businesses to collect, unify, and use customer data in real-time, while also focusing on data quality and compliance with privacy standards. Tealium's solutions serve various sectors including marketing, data analytics, and IT. It was founded in 2011 and is based in San Diego, California.

BlueConic provides a Customer Data Operating System for businesses to utilize customer data in various industry sectors. Its solutions offer support for data integration and data sharing and are applicable in consumer goods, retail, media and publishing, telecommunications, and financial services. It was founded in 2010 and is based in Boston, Massachusetts.

Zeotap is a customer intelligence platform that operates in the data solutions and marketing technology sectors. The company offers a Customer Data Platform (CDP) for integrating and unifying customer data, as well as targeting segments for programmatic and social platforms. Zeotap also provides a universal marketing ID initiative, to address the challenges of a cookieless future. It was founded in 2014 and is based in Berlin, Germany.

Simon Data is a company that provides a Customer Data Platform (CDP) within the marketing technology sector. The company offers tools for personalization, analytics, and identity resolution, allowing marketers to unify customer data, create audiences, and personalize customer journeys across various marketing channels. Simon Data serves the retail, travel & hospitality, subscription, and marketplace industries. Simon was formerly known as Radico. It was founded in 2014 and is based in New York, New York.

Blueshift focuses on intelligent customer engagement and cross-channel marketing. The company offers a platform that uses artificial intelligence to automate marketing messages and unify customer data. Blueshift primarily sells to sectors such as retail and e-commerce, personal finance, media and publishing, and digital health. It was founded in 2014 and is based in San Francisco, California.

Loading...