Advanced Micro Devices

Founded Year

1969Stage

PIPE | IPOMarket Cap

179.61BStock Price

110.84Revenue

$0000About Advanced Micro Devices

Advanced Micro Devices operates within the technology sector, developing and selling products like processors and accelerators for data centers, artificial intelligence applications, personal computers, gaming systems, and embedded technologies. It was founded in 1969 and is based in Santa Clara, California.

Loading...

ESPs containing Advanced Micro Devices

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI accelerator modules market focuses on specialized hardware optimized for AI and machine learning tasks. As AI technology expands into new applications and fields, AI accelerators are crucial for processing the large data volumes needed for scalable AI applications. These accelerators significantly speed up deep learning, making breakthroughs like generative AI more feasible and cost-effecti…

Advanced Micro Devices named as Leader among 15 other companies, including IBM, Samsung, and NVIDIA.

Loading...

Research containing Advanced Micro Devices

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Advanced Micro Devices in 17 CB Insights research briefs, most recently on Jan 30, 2025.

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

Oct 29, 2024 report

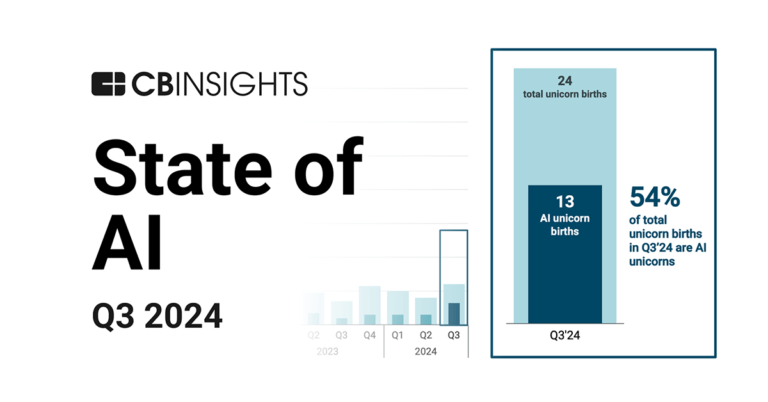

State of AI Q3’24 ReportSep 23, 2024

The semiconductor manufacturing market map

Sep 13, 2024

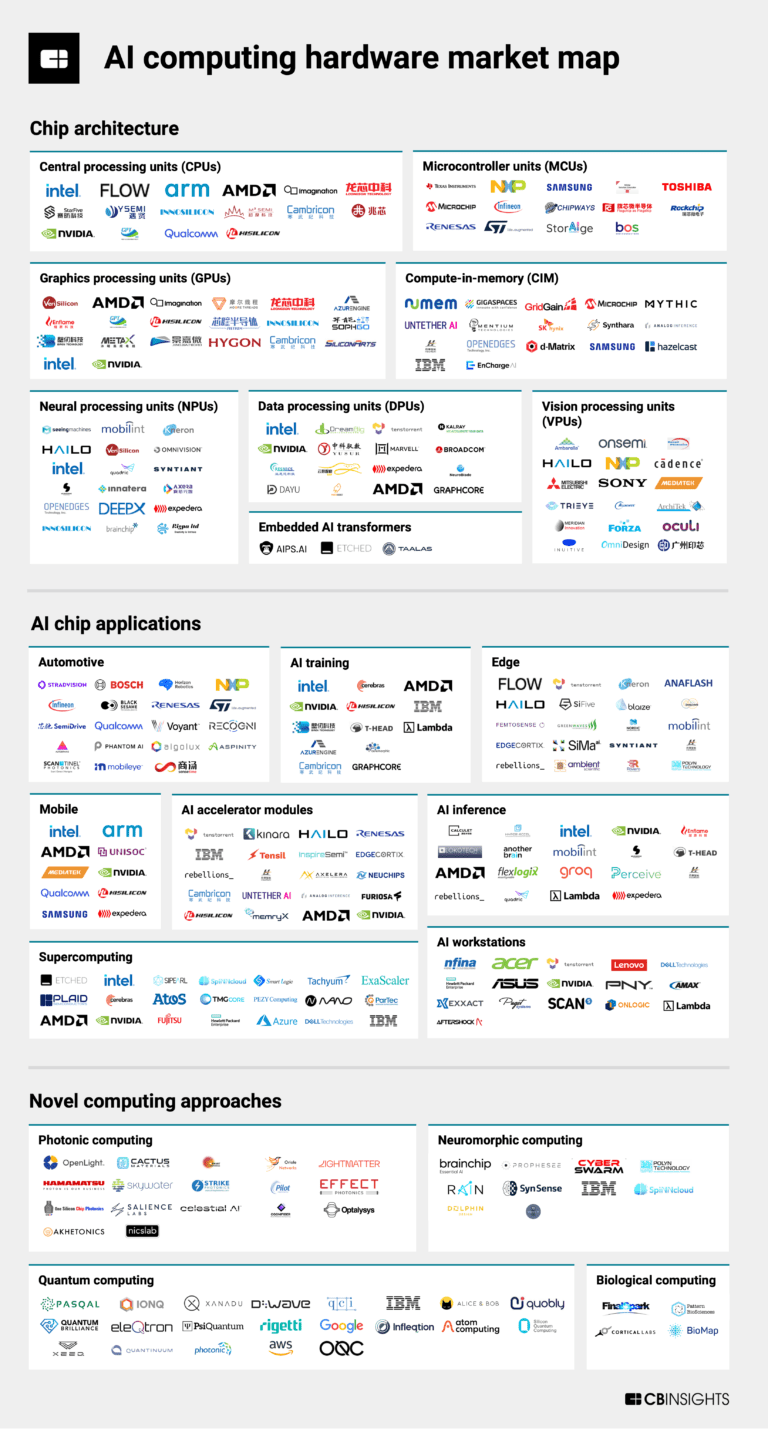

The AI computing hardware market mapExpert Collections containing Advanced Micro Devices

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Advanced Micro Devices is included in 5 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Semiconductors, Chips, and Advanced Electronics

7,308 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

Future of the Factory (2024)

436 items

This collection contains companies in the key markets highlighted in the Future of the Factory 2024 report. Companies are not exclusive to the categories listed.

NRF Big Show 2025: Exhibitors

959 items

Advanced Micro Devices Patents

Advanced Micro Devices has filed 4315 patents.

The 3 most popular patent topics include:

- computer memory

- parallel computing

- instruction processing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/28/2021 | 12/3/2024 | Electronic design automation, Integrated circuits, Clock signal, Logic gates, Electronic design | Grant |

Application Date | 12/28/2021 |

|---|---|

Grant Date | 12/3/2024 |

Title | |

Related Topics | Electronic design automation, Integrated circuits, Clock signal, Logic gates, Electronic design |

Status | Grant |

Latest Advanced Micro Devices News

Feb 22, 2025

high as $115.55 and last traded at $114.42. 12,662,058 shares changed hands during trading, a decline of 69% from the average session volume of 41,004,348 shares. The stock had previously closed at $113.10. AMD has been the topic of several research reports. Evercore ISI increased their price target on shares of Advanced Micro Devices from $193.00 to $198.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. The Goldman Sachs Group cut shares of Advanced Micro Devices from a "buy" rating to a "neutral" rating and decreased their price target for the company from $175.00 to $129.00 in a research report on Friday, January 10th. Stifel Nicolaus dropped their price target on shares of Advanced Micro Devices from $200.00 to $162.00 and set a "buy" rating for the company in a research note on Wednesday, February 5th. Loop Capital initiated coverage on Advanced Micro Devices in a research note on Tuesday, January 14th. They issued a "buy" rating and a $175.00 price objective on the stock. Finally, HSBC reaffirmed a "reduce" rating and issued a $110.00 price target (down previously from $200.00) on shares of Advanced Micro Devices in a research report on Wednesday, January 8th. Two investment analysts have rated the stock with a sell rating, ten have given a hold rating, eighteen have given a buy rating and three have given a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $158.70. View Our Latest Stock Analysis on Advanced Micro Devices The stock's 50-day moving average is $119.49 and its 200 day moving average is $138.27. The stock has a market cap of $185.01 billion, a price-to-earnings ratio of 115.32, a P/E/G ratio of 1.15 and a beta of 1.65. The company has a debt-to-equity ratio of 0.03, a current ratio of 2.62 and a quick ratio of 1.83. Advanced Micro Devices ( NASDAQ:AMD Get Free Report ) last posted its quarterly earnings results on Tuesday, February 4th. The semiconductor manufacturer reported $1.07 earnings per share for the quarter, meeting analysts' consensus estimates of $1.07. Advanced Micro Devices had a return on equity of 7.42% and a net margin of 6.36%. As a group, analysts predict that Advanced Micro Devices, Inc. will post 3.87 earnings per share for the current fiscal year. In other news, CEO Lisa T. Su sold 76,496 shares of the firm's stock in a transaction on Wednesday, December 4th. The stock was sold at an average price of $142.66, for a total value of $10,912,919.36. Following the completion of the transaction, the chief executive officer now owns 3,566,762 shares in the company, valued at $508,834,266.92. This trade represents a 2.10 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website . Also, EVP Philip Guido acquired 4,645 shares of the firm's stock in a transaction that occurred on Friday, February 7th. The stock was acquired at an average price of $107.56 per share, for a total transaction of $499,616.20. Following the completion of the transaction, the executive vice president now directly owns 33,522 shares in the company, valued at approximately $3,605,626.32. This represents a 16.09 % increase in their ownership of the stock. The disclosure for this purchase can be found here . Corporate insiders own 0.73% of the company's stock. Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Creative Capital Management Investments LLC raised its holdings in shares of Advanced Micro Devices by 124.6% in the third quarter. Creative Capital Management Investments LLC now owns 155 shares of the semiconductor manufacturer's stock worth $25,000 after acquiring an additional 86 shares during the last quarter. Bear Mountain Capital Inc. acquired a new position in Advanced Micro Devices in the 4th quarter valued at about $25,000. Global Wealth Strategies & Associates purchased a new position in Advanced Micro Devices in the 4th quarter valued at about $26,000. Greenline Partners LLC acquired a new stake in shares of Advanced Micro Devices during the 4th quarter worth about $28,000. Finally, Halbert Hargrove Global Advisors LLC purchased a new stake in shares of Advanced Micro Devices during the fourth quarter worth about $29,000. Institutional investors and hedge funds own 71.34% of the company's stock. Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products. This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com. Before you consider Advanced Micro Devices, you'll want to hear this. MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list. While Advanced Micro Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys. View The Five Stocks Here MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Advanced Micro Devices Frequently Asked Questions (FAQ)

When was Advanced Micro Devices founded?

Advanced Micro Devices was founded in 1969.

Where is Advanced Micro Devices's headquarters?

Advanced Micro Devices's headquarters is located at 2485 Augustine Drive, Santa Clara.

What is Advanced Micro Devices's latest funding round?

Advanced Micro Devices's latest funding round is PIPE.

Who are the investors of Advanced Micro Devices?

Investors of Advanced Micro Devices include Mubadala Investment Company.

Who are Advanced Micro Devices's competitors?

Competitors of Advanced Micro Devices include Arm, Beeline Russia, Luminous, Xilinx, Habana Labs and 7 more.

Loading...

Compare Advanced Micro Devices to Competitors

Marvell (NASDAQ: MRVL) specializes in the development of essential technology for data infrastructure. The company offers a range of products that enable the movement, processing, storage, and security of data across different platforms. Marvell's solutions are tailored to modernize and secure networks, support the software-defined vehicle evolution, and optimize data center operations for cloud and artificial intelligence (AI) applications. It was founded in 1995 and is based in Santa Clara, California.

Microchip Technology (NasdaqGS: MCHP) provides smart, connected, and secure embedded control solutions for the semiconductor industry. The company offers development tools and a comprehensive product portfolio that help customers create designs that minimize risk and reduce system cost and time to market. Microchip Technology primarily serves the industrial, automotive, consumer, aerospace and defense, communications, and computing markets with its solutions. It was founded in 1989 and is based in Chandler, Arizona.

Flow Computing specializes in enhancing CPU performance through its Parallel Processing Unit (PPU) technology within the technology sector. The company's main offering is the PPU architecture, which aims to improve CPU performance and enhance the efficiency of legacy applications with backward software compatibility. Flow Computing's solutions are applicable in sectors including AI, edge and cloud computing, multimedia processing, autonomous vehicles, and military-grade systems. It was founded in 2024 and is based in Helsinki, Finland.

Brain-CA Technologies works as a company that specializes in artificial intelligence (AI) through the development of a cellular automata-based learning system. The company's offerings include a patented innovation that addresses the Von Neumann bottleneck, allowing for AI systems that aim to improve power and efficiency. Brain-CA's technology can be implemented in software for existing technologies or in hardware for potential brain-on-a-chip applications. It was founded in 2023 and is based in Cincinnati, Ohio.

Zhongxingxin Telecom provides telecommunications services including mobile communication, legal services, and business information. It was founded in 1985 and is based in Shenzhen, Guangdong.

Ambient Scientific is a semiconductor company that specializes in AI processors for the semiconductor industry. The company offers AI microprocessors that support on-device AI applications, including voice commands and predictive maintenance, powered by battery without the need for cloud connectivity. Ambient Scientific serves sectors that require edge AI computing capabilities, such as consumer electronics, industrial automation, and smart devices. It was founded in 2017 and is based in Santa Clara, California.

Loading...