AlphaSense

Founded Year

2011Stage

Biz Plan Competition | AliveTotal Raised

$1.397BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About AlphaSense

AlphaSense is a market intelligence and search platform that uses AI and NLP technology to provide insights across various sectors. The company offers tools for financial research, including access of equity research, expert call transcripts, and the ability to integrate and analyze internal content alongside public data. AlphaSense serves the financial services, asset management, consulting, and corporate sectors with its market intelligence solutions. It was founded in 2011 and is based in New York, New York.

Loading...

ESPs containing AlphaSense

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional investment analytics and insights market refers to a range of software and services that provide investment managers with tools to help them make informed investment decisions and optimize their portfolios. These solutions typically include investment research, data analysis, risk management, and performance attribution capabilities. The market for institutional investment analyt…

AlphaSense named as Leader among 9 other companies, including S&P Global, SESAMm, and Incorta.

AlphaSense's Products & Differentiators

AlphaSense Core Search (newest release: AlphaSense X)

AlphaSense is the leading market intelligence platform leveraging cutting-edge technology to continuously filter and analyze billions of fragmented pieces of information. We apply the power of AI to an extensive library of high value unstructured and structured data-sets, enabling business professionals to make critical decisions with confidence.

Loading...

Research containing AlphaSense

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AlphaSense in 7 CB Insights research briefs, most recently on Oct 15, 2024.

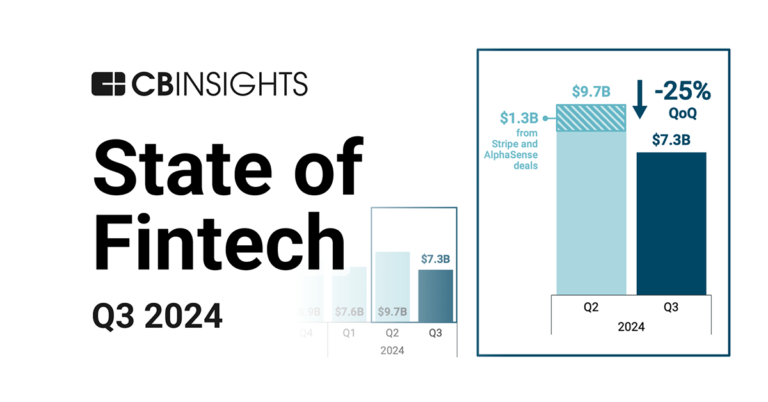

Oct 15, 2024 report

State of Fintech Q3’24 Report

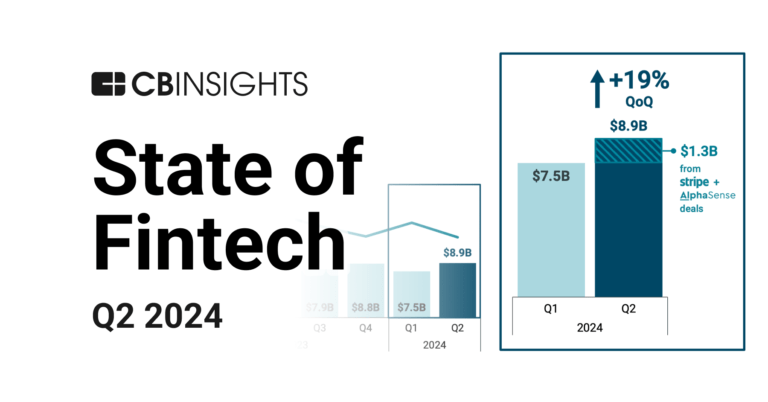

Jul 16, 2024 report

State of Fintech Q2’24 Report

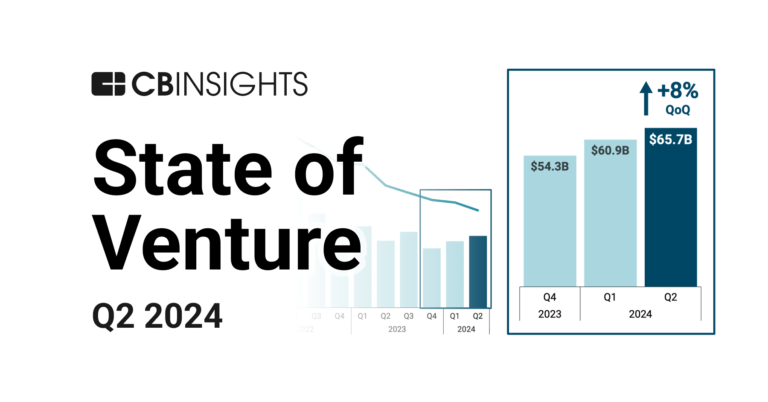

Jul 3, 2024 report

State of Venture Q2’24 Report

Oct 6, 2023

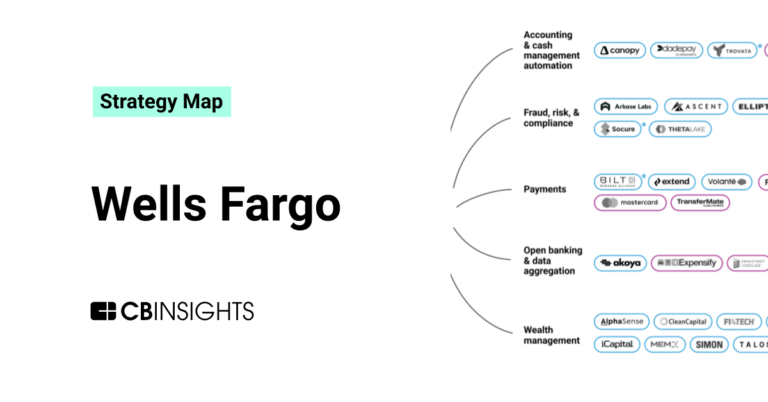

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing AlphaSense

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AlphaSense is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,030 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

7,146 items

AlphaSense Patents

AlphaSense has filed 35 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/8/2024 | 10/1/2024 | Grant |

Application Date | 3/8/2024 |

|---|---|

Grant Date | 10/1/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest AlphaSense News

Jan 15, 2025

News provided by Share this article Recognitions Highlight the Company's Momentum Heading Into 2025 NEW YORK, Jan. 15, 2025 /CNW/ -- AlphaSense , the leading market intelligence and search platform, today celebrated a landmark year of achievements in 2024, including record-breaking industry and individual award wins from prestigious organizations such as CNBC, Fast Company, Fortune, Inc., and more. The accolades underscore AlphaSense's leadership in AI-driven market intelligence and its commitment to empowering decision-makers worldwide. Trusted by 88% of the S&P 100 and 80% of the top asset management firms, AlphaSense's innovative AI search capabilities and vast content library are indispensable tools for confident and efficient decision-making. Top award wins in 2024 included: Inc.'s 2024 Best in Business list, which celebrates organizations and leaders for superior execution across all facets of entrepreneurial business Fortune's AI 50 Innovators annual list, highlighting the top companies driving the adoption of cutting-edge AI technologies Fintech Global's AI Fintech 100 , celebrating the world's most innovative AI solution providers for financial services "These recognitions are a testament to the transformative impact of AlphaSense's AI-driven search capabilities and our team's dedication to pushing the boundaries of what's possible," said Heather Zynczak, Chief Marketing Officer at AlphaSense. "2024 was a pivotal year for us, not just in terms of awards but in our ability to deliver meaningful value to our customers. As we move into 2025, these achievements inspire us to continue innovating and scaling our solutions globally." The market intelligence leader also celebrates accolades for its leadership team: Building on this momentum, AlphaSense is poised for another groundbreaking year in 2025. The company plans to further expand its content and data offerings, enhance its AI capabilities, and deepen its impact across industries and geographies, reaffirming its role as the trusted partner for AI-driven market intelligence. About AlphaSense The world's most sophisticated companies rely on AlphaSense to remove uncertainty from decision-making. With market intelligence and search built on proven AI, AlphaSense delivers insights that matter from content you can trust. Our universe of public and private content includes equity research, company filings, event transcripts, expert calls, news, trade journals, and clients' own research content. Founded in 2011, AlphaSense is headquartered in New York City with over 2,000 people across the globe and offices in the U.S., U.K., Finland, India, Singapore, Canada, and Ireland. For more information, please visit www.alpha-sense.com . Media Contact:

AlphaSense Frequently Asked Questions (FAQ)

When was AlphaSense founded?

AlphaSense was founded in 2011.

Where is AlphaSense's headquarters?

AlphaSense's headquarters is located at 24 Union Square East, New York.

What is AlphaSense's latest funding round?

AlphaSense's latest funding round is Biz Plan Competition.

How much did AlphaSense raise?

AlphaSense raised a total of $1.397B.

Who are the investors of AlphaSense?

Investors of AlphaSense include Fast Company’s Next Big Things in Tech, Viking Global Investors, CapitalG, Goldman Sachs, Blue Owl Capital and 34 more.

Who are AlphaSense's competitors?

Competitors of AlphaSense include Auquan, Hebbia, Preqin, SESAMm, Xperiti and 7 more.

What products does AlphaSense offer?

AlphaSense's products include AlphaSense Core Search (newest release: AlphaSense X) and 3 more.

Loading...

Compare AlphaSense to Competitors

YCharts operates as a financial research and proposal platform within the financial services industry. The company provides inclusive data, visualization tools, and analytics for equity, mutual fund, and exchange-traded fund (ETF) data and analysis, enabling investment professionals to improve client engagements and simplify complex financial topics. YCharts primarily serves the financial advisory and asset management sectors. It was founded in 2009 and is based in Chicago, Illinois.

Prosights specializes in providing a research platform tailored for private equity investors within the financial services domain. The company offers tools for private investment analysis, including financial data aggregation and insights into market trends. It primarily serves professionals in the private equity and investment sectors. The company was founded in 2024 and is based in San Francisco, California.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

280First is a financial services platform that analyzes unstructured data to provide insights for investment professionals. The company offers a platform that helps investment professionals identify opportunities and manage risks in financial documents. This platform supports investment professionals in managing a broader portfolio of companies. It is based in Redwood City, California.

Convergence is a data and analytics company that provides insights and consulting services for the financial services industry. The company offers support for business development, operational efficiency, and non-investment business risk management, as well as outsourced data services. Convergence serves asset managers, service providers, and institutional investors, offering analytics, research, and advisory services. It was founded in 2013 and is based in Norwalk, Connecticut.

FE fundinfo specializes in providing data and technology solutions for the fund management industry. The company offers a range of services, including fund data management, regulatory compliance support, and investment research and analysis tools. FE fund info primarily serves fund managers, distributors, and financial advisers. FE fundinfo was formerly known as Financial Express. It was founded in 1996 and is based in London, United Kingdom.

Loading...