Airbnb

Founded Year

2007Stage

IPO | IPOTotal Raised

$6.626BDate of IPO

12/10/2020Market Cap

82.57BStock Price

135.12Revenue

$0000About Airbnb

Airbnb (ABNB) operates as an online hospitality marketplace. The company's platform allows people to list, discover, and book accommodations around the world. It offers a range of accommodations, including private rooms, entire homes, and more. primarily it serves the travel and tourism sector. Airbnb was formerly known as AirBed & Breakfast. The company was founded in 2007 and is based in San Francisco, California.

Loading...

Loading...

Research containing Airbnb

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Airbnb in 8 CB Insights research briefs, most recently on Feb 1, 2024.

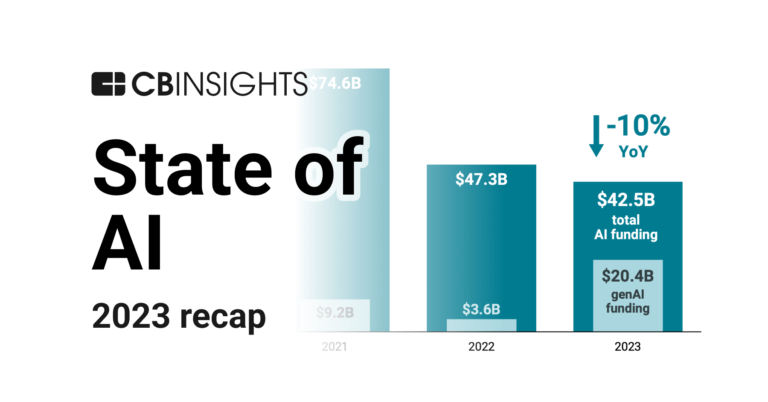

Feb 1, 2024 report

State of AI 2023 Report

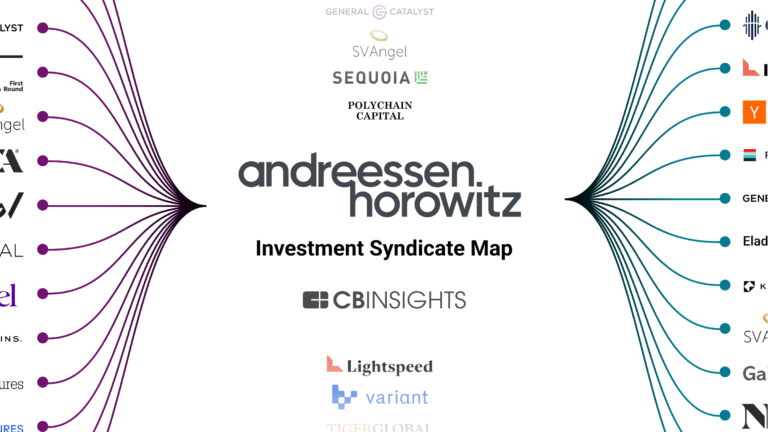

Dec 21, 2022 report

The top 50 individual angel investors

Apr 5, 2022 report

What is a SPAC?Expert Collections containing Airbnb

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Airbnb is included in 2 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Tech IPO Pipeline

568 items

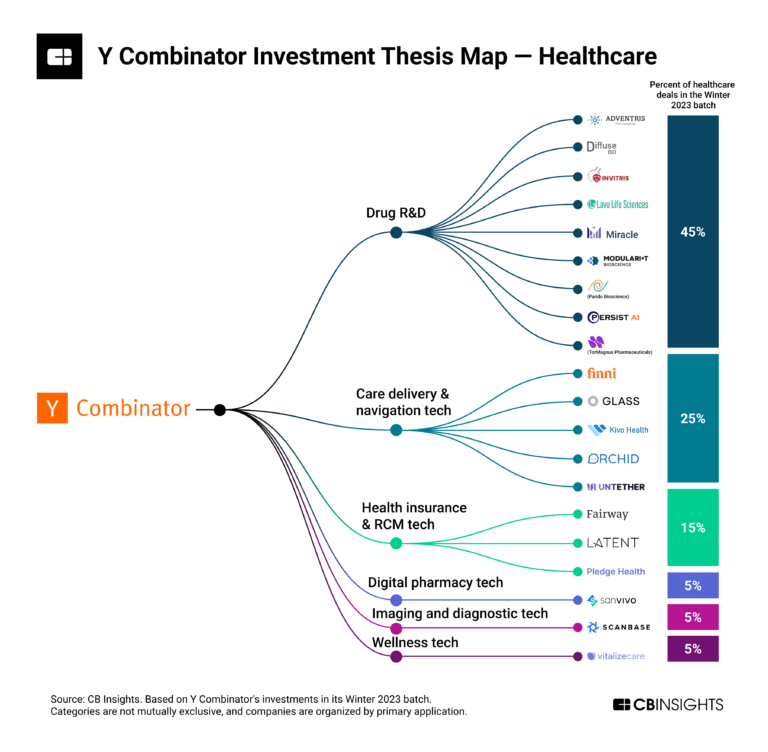

Airbnb Patents

Airbnb has filed 212 patents.

The 3 most popular patent topics include:

- social networking services

- graphical control elements

- graphical user interface elements

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/16/2022 | 10/8/2024 | Grant |

Application Date | 11/16/2022 |

|---|---|

Grant Date | 10/8/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Airbnb News

Jan 20, 2025

Short Interest in Airbnb, Inc. (NASDAQ:ABNB) Drops By 5.3% Posted by MarketBeat News on Jan 20th, 2025 Airbnb, Inc. ( NASDAQ:ABNB – Get Free Report ) was the target of a significant decrease in short interest in the month of December. As of December 31st, there was short interest totalling 14,360,000 shares, a decrease of 5.3% from the December 15th total of 15,160,000 shares. Based on an average daily volume of 4,440,000 shares, the short-interest ratio is presently 3.2 days. Airbnb Trading Up 2.2 % Shares of ABNB stock opened at $135.12 on Monday. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.62 and a quick ratio of 1.62. The business has a 50-day moving average of $134.16 and a 200 day moving average of $131.95. The stock has a market capitalization of $85.66 billion, a PE ratio of 47.41, a P/E/G ratio of 1.63 and a beta of 1.13. Airbnb has a 1-year low of $110.38 and a 1-year high of $170.10. Get Airbnb alerts: Airbnb ( NASDAQ:ABNB – Get Free Report ) last issued its earnings results on Thursday, November 7th. The company reported $2.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.17 by ($0.04). Airbnb had a return on equity of 32.88% and a net margin of 16.96%. The firm had revenue of $3.73 billion during the quarter, compared to the consensus estimate of $3.72 billion. During the same quarter in the prior year, the business posted $2.39 EPS. As a group, sell-side analysts anticipate that Airbnb will post 3.99 earnings per share for the current year. Insider Buying and Selling at Airbnb Want More Great Investing Ideas? In other Airbnb news, CAO David C. Bernstein sold 1,000 shares of the company’s stock in a transaction dated Monday, December 9th. The shares were sold at an average price of $137.00, for a total transaction of $137,000.00. Following the sale, the chief accounting officer now directly owns 40,581 shares of the company’s stock, valued at $5,559,597. This represents a 2.40 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link . Also, CEO Brian Chesky sold 76,923 shares of Airbnb stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $139.94, for a total transaction of $10,764,604.62. Following the completion of the transaction, the chief executive officer now owns 12,616,300 shares of the company’s stock, valued at $1,765,525,022. The trade was a 0.61 % decrease in their position. The disclosure for this sale can be found here . Over the last ninety days, insiders sold 1,130,982 shares of company stock valued at $150,523,585. Company insiders own 27.83% of the company’s stock. Hedge Funds Weigh In On Airbnb A number of hedge funds have recently modified their holdings of ABNB. Pacer Advisors Inc. boosted its holdings in shares of Airbnb by 6,085.6% during the third quarter. Pacer Advisors Inc. now owns 4,241,557 shares of the company’s stock worth $537,872,000 after purchasing an additional 4,172,985 shares during the period. Meritage Group LP purchased a new stake in Airbnb in the 3rd quarter worth approximately $160,985,000. Edgewood Management LLC grew its position in shares of Airbnb by 9.2% in the 3rd quarter. Edgewood Management LLC now owns 13,582,433 shares of the company’s stock worth $1,722,388,000 after buying an additional 1,143,464 shares during the last quarter. International Assets Investment Management LLC grew its position in shares of Airbnb by 19,430.3% in the 3rd quarter. International Assets Investment Management LLC now owns 1,119,479 shares of the company’s stock worth $1,419,610,000 after buying an additional 1,113,747 shares during the last quarter. Finally, Temasek Holdings Private Ltd increased its stake in shares of Airbnb by 91.3% during the third quarter. Temasek Holdings Private Ltd now owns 2,324,151 shares of the company’s stock valued at $294,726,000 after buying an additional 1,109,076 shares during the period. Hedge funds and other institutional investors own 80.76% of the company’s stock. Analyst Upgrades and Downgrades A number of equities analysts have recently commented on ABNB shares. Raymond James assumed coverage on Airbnb in a report on Friday, September 27th. They issued a “market perform” rating and a $134.00 price target for the company. UBS Group raised their target price on Airbnb from $134.00 to $144.00 and gave the stock a “neutral” rating in a research note on Wednesday, October 23rd. Jefferies Financial Group lifted their target price on Airbnb from $120.00 to $135.00 and gave the company a “hold” rating in a report on Tuesday, October 22nd. Robert W. Baird increased their price target on shares of Airbnb from $120.00 to $140.00 and gave the stock a “neutral” rating in a report on Friday, November 8th. Finally, Bank of America boosted their price objective on shares of Airbnb from $154.00 to $159.00 and gave the company a “neutral” rating in a research note on Wednesday, December 18th. Six analysts have rated the stock with a sell rating, twenty have given a hold rating and eight have given a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of “Hold” and a consensus price target of $139.63.

Airbnb Frequently Asked Questions (FAQ)

When was Airbnb founded?

Airbnb was founded in 2007.

Where is Airbnb's headquarters?

Airbnb's headquarters is located at 888 Brannan Street, San Francisco.

What is Airbnb's latest funding round?

Airbnb's latest funding round is IPO.

How much did Airbnb raise?

Airbnb raised a total of $6.626B.

Who are the investors of Airbnb?

Investors of Airbnb include Silver Lake, Sixth Street Partners, T. Rowe Price, Glade Brook Capital, Fidelity Investments and 59 more.

Who are Airbnb's competitors?

Competitors of Airbnb include Mondee, OYO, reAlpha, Nestpick, Love Home Swap and 7 more.

Loading...

Compare Airbnb to Competitors

CouchSurfing is a social travel platform that facilitates cultural exchange by connecting travelers with local hosts around the world. The service allows members to stay with locals and share authentic travel experiences, fostering mutual respect and cultural understanding. It primarily serves the global travel and tourism industry, connecting individuals who wish to explore new places with a unique and personal perspective. It was founded in 2004 and is based in San Francisco, California.

UpNext is a company specializing in travel technology solutions within the travel and tourism industry. The company offers a platform that leverages micro-segmentation to provide personalized travel experiences, connecting travelers with bespoke opportunities in short term rentals and hotel accommodations. UpNext primarily serves the travel industry, focusing on enhancing the travel experience for individuals. It was founded in 2015 and is based in Pitt Meadows, British Columbia.

9flats is a company focused on providing a marketplace for vacation rentals and alternative lodging options in various sectors of the travel and hospitality industry. The company offers a platform for individuals to rent out their private accommodations, such as apartments, guest houses, and unique stays, to travelers seeking a more personal experience than traditional hotels. 9flats primarily serves the travel and tourism sector, offering diverse lodging options to both leisure and business travelers around the world. It was founded in 2011 and is based in Hamburg, Germany.

Accor is a hotel operator in Europe and is present in 92 countries with more than 3,700 hotels and 480,000 rooms. Accor provides an extensive offer including complementary brands - from luxury to economy - that are recognized and appreciated around the world for service quality: Sofitel, Pullman, MGallery, Novotel, Suite Novotel, Mercure, ibis, ibis Styles, ibis budget, hotelF1 as well as Thalassa sea and spa.

Sykes Cottages provides self-catering holiday rentals in the UK and Ireland. The company has various cottages for rent, including dog-friendly and luxury options, as well as properties with features such as hot tubs or proximity to the sea. Sykes Cottages also has services for property owners who want to leave their holiday homes and provides information on holiday home purchases and mortgages. It was founded in 1991 and is based in Cheshire, United Kingdom.

Best Western International operates in the hotel industry, offering travel and accommodation services through its portfolio of hotel brands. The company serves the hospitality sector with a focus on options for travelers and developers. It was founded in 1946 and is based in Phoenix, Arizona.

Loading...