AgentSync

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$161.1MLast Raised

$50M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+34 points in the past 30 days

About AgentSync

AgentSync specializes in insurance compliance software within the insurance industry. Its main offerings include automating producer management, ensuring compliance, and optimizing distribution management through modern application programming interface (API) integrations and data solutions. It primarily serves insurance carriers, agencies, and managing general agents (MGAs) with compliance and producer management needs. AgentSync was founded in 2018 and is based in Denver, Colorado.

Loading...

ESPs containing AgentSync

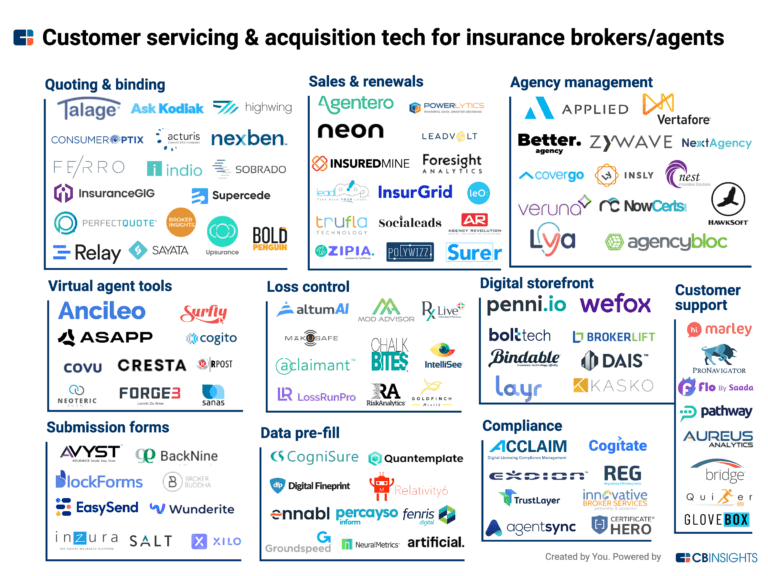

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance lead management market refers to the software solutions that help insurance companies manage their leads and sales processes. These solutions typically include lead tracking, customer relationship management (CRM), marketing automation, and analytics tools. The market is driven by the need for insurers to streamline their sales processes, improve customer engagement, and increase rev…

AgentSync named as Leader among 9 other companies, including Better Agency, Applied, and Bridge.

AgentSync's Products & Differentiators

AgentSync Manage

Our core solution, AgentSync Manage, is a powerful platform that effortlessly enforces state producer licensing and appointment regulatory requirements through an integration with the National Insurance Producer Registry (NIPR). Manage minimizes compliance costs and prevents regulatory violations before they occur by automating the administrative paper chase required to verify that agents have the necessary appointments and state licenses to sell. By simplifying the complexity of selling insurance, you can drastically reduce costs and compliance risks associated with manually managing these tasks via spreadsheets and disparate legacy systems.

Loading...

Research containing AgentSync

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AgentSync in 1 CB Insights research brief, most recently on Sep 30, 2022.

Expert Collections containing AgentSync

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AgentSync is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Insurtech

3,243 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest AgentSync News

Jan 8, 2025

Another year has come and gone. How’d your organization fare over the last 365 days? In many ways, 2024 was a difficult year for the insurance industry. Between the thousands of regulatory changes, increased fraud, and widespread P&C sector strain, the industry and the millions of professionals working within it faced some pretty significant challenges this year. But where there’s challenge, there’s also opportunity. So before you lock 2024 in a box and throw away the key, consider how your organization responded to the pressures and how you might rethink your distribution strategy to better navigate whatever 2025 has in store. Conducting a year-end insurance operations review At this point in the year, it’s well past time to begin assessing your 2024 performance. The most successful insurance organizations are continuously evaluating the efficiency and effectiveness of their strategy in search of areas for improvement. But everyone has to start somewhere, so whether you’ve already nailed down your 2025 plan and you clicked on this article to see where your strategy aligns, or the year got ahead of you and you’re just starting to evaluate your 2024 performance, we’ve got you covered. Learn where to start when it comes to evaluating your distribution channel management strategy and how optimizing certain areas now could set you up for success in 2025. First things first: Know where your current strategy stands To get where you want to go, you first need to know where you are. As you review your business operations, take note of any gaps in your current strategy. When building a deep understanding of your current distribution channel strategy, it’s important to understand where you’re performing across five key dimensions: Process automation Scalability Operational agility and resilience Scoring your business across these five areas can help you better understand your organization’s current strengths, along with any areas of your strategy that could benefit from improvement. Use AgentSync’s complimentary Distribution Channel Managment Assessment to see how your current strategy stacks up and to help define your priorities going into the new year. Three insurance industry predictions for 2025 There are dozens, if not hundreds, of predictions for what’s in store for the insurance industry in 2025, and you’ll get a different list of the most important trends depending on who you ask. But, for the sake of everyone’s time, here are three things that came up time and time again in our research: 1. More regulatory changes will test the efficiency of organizations’ compliance operations The world of insurance compliance regulation is ever-changing, so if there’s one thing we can absolutely guarantee the insurance sector will face in the coming year, it’s an abundance of regulatory updates . At the time of writing this, AgentSync has tracked 302 relevant changes to licensing, appointments, CE rules, and more in 2024 alone (all of which can be found in our Compliance Library ). That’s a new change every 1.2 days that insurance organizations need to identify and address for each producer in their distribution force to ensure they’re operating in compliance! Think about how your organization handled the evolving regulatory environment over the last 365 days. Did keeping up with compliance prove difficult or add unnecessary expenses to your bottom line? Did it create significant holdups that kept new producers from selling? To avoid the same fate next year, organizations with inefficient compliance management practices should consider partnering with a vendor that can help them assess and mitigate compliance risks more effectively. With the right partner, compliance management can evolve from a time-consuming, retroactively handled, cost-center to a seamless, fully proactive, growth-driver for your business. Equip your current team with the ability to meet 2025’s regulatory changes head-on, without having to hire additional administrative help, even as you scale up your distribution force. 2.Increased M&A activity will open up new opportunities and challenges Experts predict 2025 will be a big year for mergers and acquisitions (M&A) in the insurance industry. Improved economic conditions mean businesses can expect a more dynamic environment for M&A in the year ahead, with digital transformation poised to be a key driver of many major deals. Successfully navigating the evolving M&A landscape will depend heavily on how prepared your organization’s people, processes, and data are to handle change. Remember earlier when you scored your organization’s level of maturity and agility across those five key dimensions? Take another look at your scores for dimensions four (Scalability) and five (Operational Agility and Resilience). Are you confident that your current systems can effectively navigate a merger or acquisition without becoming a source of frustration, wasted time and money, and greater data security risks? Would acquiring an agency mean spending time and energy onboarding each new producer line by line all by hand? If not, now’s the time to consider partnering with a distribution channel management technology that’ll enable you adapt to new opportunities, like M&A deals, quickly and efficiently with automated workflows for bulk transacting across multiple producers who are licensed across multiple LOAs and in multiple states. For greater insight into the latest trends shaping M&A in the insurance sector, including tips and best practices for navigating transitions, check out our webinar in partnership with PropertyCasualty360: The Future of Insurance Industry Mergers & Acquisitions. 3. Organization-wide access to real-time data will give early adopters the upper hand Heading into 2025, the insurance sector will continue to be influenced by rapid technological advances and digital transformation. As insurance organizations continue to move away from antiquated producer lifecycle management systems in favor of more modern distribution channel management solutions ( particularly those that allow them to consolidate their tech stack ), industry experts and thought leaders predict a broader adoption of real-time decision support systems , like those powered by application programming interfaces (APIs) . Consider the current state of your producer and agency data. Do you have a high degree of confidence in its accuracy at any given moment? Can teams across your organization surface that data when and where they need it to make more informed business decisions? APIs elevate your data quality by synchronizing your existing systems with industry sources of truth to ensure your producer and agency data is perpetually up to date and useful. For example, imagine the benefit of accessing accurate producer data in your commission payment system or attaching line of authority data to the information in your policy admin system. Partnering with a distribution channel management solution that incorporates API technology at its core can result in wins as simple as ensuring 100 percent compliance on every policy sold and as complex as directing you to untapped lines of business. Get ahead and stay ahead by improving your insurance distribution channel strategy now If your current approach to distribution channel management is taking too much time, costing too much money, or otherwise hindering your growth, now is the time to make a change. Don’t wait until it’s too late to identify and remedy any bottlenecks and inefficiencies in your current strategy. Remember that while optimizing your operations sooner rather than later will help you successfully navigate these 2025 predictions, it’ll also put your organization in a better position to handle any unforeseeable challenges and opportunities the next year might have in store. The AgentSync platform, and our team of experts, is currently being used by hundreds of leading insurance organizations to scale and optimize their distribution networks to ensure future success. To learn more about how AgentSync can unlock your distribution channel potential, or for a personalized review of your current distribution channel management strategy, talk to one of our experts today. About AgentSync AgentSync builds modern insurance infrastructure that connects carriers, agencies, MGAs, and producers. With customer-centric design, seamless APIs, automation, and unparalleled service, AgentSync’s solutions provide data intelligence and streamlined onboarding and compliance management processes that reduce costs, increase efficiency, and get producers ready to sell in hours instead of weeks. Founded in 2018 by Niranjan “Niji” Sabharwal and Jenn Knight, and headquartered in Denver, CO, AgentSync has been recognized as one of Denver’s Best Places to Work, a Forbes Magazine Cloud 100 Rising Star, and as an Insurtech Insights Future 50 winner, and was ranked 65 in Forbes – America’s Best Startup Employers 2023. To learn more, visit https://agentsync.io/ Share this

AgentSync Frequently Asked Questions (FAQ)

When was AgentSync founded?

AgentSync was founded in 2018.

Where is AgentSync's headquarters?

AgentSync's headquarters is located at 3601 Walnut Street, Denver.

What is AgentSync's latest funding round?

AgentSync's latest funding round is Series B - II.

How much did AgentSync raise?

AgentSync raised a total of $161.1M.

Who are the investors of AgentSync?

Investors of AgentSync include Craft Ventures, Valor Equity Partners, Tiger Global Management, Anthemis, Atreides Management and 9 more.

Who are AgentSync's competitors?

Competitors of AgentSync include RegEd and 5 more.

What products does AgentSync offer?

AgentSync's products include AgentSync Manage and 1 more.

Who are AgentSync's customers?

Customers of AgentSync include Senior Life and Online Medicare Distributor.

Loading...

Compare AgentSync to Competitors

RegEd operates as a market-leading provider of Regulatory Technology solutions within the financial services industry. The company offers a suite of enterprise solutions that include workflow-directed processes, regulatory intelligence, automated validations, and compliance dashboards to facilitate operational efficiency and regulatory compliance. RegEd primarily serves the financial services sector, with a focus on compliance and risk management for enterprise clients. It was founded in 2000 and is based in Morrisville, North Carolina.

Spyder specializes in data management, cyber compliance, and secure document storage for the financial services and insurance domains. The company offers a platform that helps in data management and compliance with cyber regulations and document storage needs, tailored specifically for insurance agents and financial service providers. Its solutions are designed to support licensed individuals and home office firms in managing licensing renewals, continuing education, and cyber security certifications. The company was founded in 2021 and is based in Fort Scott, Kansas.

Egnyte specializes in content governance and smart content collaboration and operates within the cloud computing and data governance sectors. The company offers a unified, artificial intelligence (AI) enabled platform designed to manage, secure, and govern digital content for businesses, facilitating collaboration in the cloud or on-premises. Egnyte's platform provides sensitive content classification, ransomware detection and recovery, and data access governance, among other services. It was founded in 2007 and is based in Mountain View, California.

Advocate provides a software platform to replace manual insurance review processes with automated solutions for lenders in the financial services industry. The platform aims to improve pre-closing and servicing functions. Advocate serves commercial real estate lenders and other financial institutions involved in loan programs. It was founded in 2020 and is based in New York, New York.

CaseWare specializes in cloud-enabled audit, financial reporting, and data analytics solutions for various sectors within the accounting industry. The company provides tools that automate and streamline financial reporting, tax engagements, practice management, and audit processes to enhance efficiency and insights. It was founded in 1988 and is based in Toronto, Canada.

EverCheck is a company that focuses on healthcare compliance, operating within the healthcare and software industries. The company offers automated compliance software that provides services such as license verification, sanction and exclusion management, and continuing education tracking for healthcare professionals. The primary sectors EverCheck caters to are the healthcare and human resources industries. It was founded in 2012 and is based in Jacksonville, Florida.

Loading...