Newfront

Founded Year

2017Stage

Series D | AliveTotal Raised

$300.53MValuation

$0000Last Raised

$200M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-85 points in the past 30 days

About Newfront

Newfront operates an insurance brokerage firm that specializes in business insurance and risk management services. It offers a range of products, including casualty, cyber risk, executive risk, property, workers’ compensation, and surety, as well as services such as global insurance, risk analytics, claims advocacy, and contract review. Newfront also provides employee benefits packages and retirement planning services. Newfront was formerly known as Abe Labs. The company was founded in 2017 and is based in San Francisco, California.

Loading...

Newfront's Product Videos

Newfront's Products & Differentiators

Newfront Mobility

A Benefits Experience Platform

Loading...

Research containing Newfront

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Newfront in 6 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market map

Jul 19, 2022 report

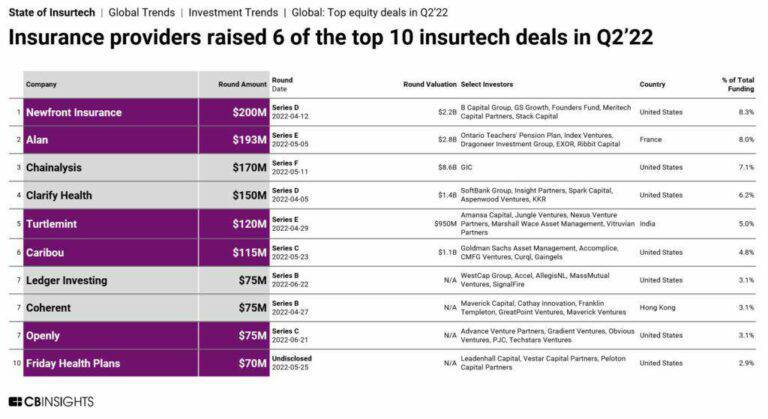

State of Fintech Q2’22 ReportExpert Collections containing Newfront

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Newfront is included in 5 Expert Collections, including Agriculture Technology (Agtech).

Agriculture Technology (Agtech)

2,275 items

Companies in the agtech space, such as equipment manufacturers, surveying drones, geospatial intelligence firms, and farm management platforms

Unicorns- Billion Dollar Startups

1,257 items

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Newfront Patents

Newfront has filed 3 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/4/2013 | 4/16/2019 | Video signal, Broadcast engineering, Computer connectors, USB, Electronic test equipment | Grant |

Application Date | 3/4/2013 |

|---|---|

Grant Date | 4/16/2019 |

Title | |

Related Topics | Video signal, Broadcast engineering, Computer connectors, USB, Electronic test equipment |

Status | Grant |

Latest Newfront News

Nov 13, 2024

against cyber incidents and cyber system failures like Crowdstrike. Jennifer Wilson, head of cyber at Newfront, an insurance brokerage, spoke with Digital Insurance in early November about the rise of MGAs offering cyber coverage, the ways the terms of coverage are changing and how Newfront brokers terms for coverage with insurers. This is the second of two parts. This article is excerpts from the interview, edited for clarity. What’s the risk of carriers pulling back on provisions of policies? Jennifer Wilson, head of cyber at Newfront. If a new type of cyberattack hits, or a new exposure is exposed, insurance companies will say, we're not prepared for that. Or they'll get hit with a ton of claims in a specific area, and they'll limit exposure for that type of event by pulling coverage back or adding exclusions. Brokers then shift to carriers that will give us what we're looking for. When these carriers realize they're losing a ton of premiums, they have to add that coverage back on. Because of the Change Healthcare and the Crowdstrike events, dependent business interruption is a big exposure for the markets, and they're paying a lot of money related to that. So a lot of carriers are limiting their coverage for dependent business interruption. If terms can be changed every few months, are policies still written for one-year terms? Policies are typically written for a year. We've been successful in negotiating renewal guarantees where we reserve that policy form for two years, but it's generally 12 months. Even if that carrier changes their policy form within that 12-month period, that policy does not change. We just know at renewal we'll be getting the new, revised version, so the policy does not change during that 12-month period for that particular client. But if you have a renewal, once there's a change, you're stuck with being revised. Do carriers have the appropriate coverage for different risks coming along? The markets are still trying to figure out their comfort level with coverage. Again, that's driven by claims. AI is adding a wrench in this, in that AI is creating some new exposures that were not contemplated before, and are not affirmatively covered in policies. There are some that are coming out with new policy terms specific to AI. It's just happening right now. AI risk is going to change how policies are written. This is going to be an exposure we're going to see with all these tech-centered companies, and we need a solution for them. How much of a factor is AI in cyberattacks? It's a consideration. The biggest concerns with AI are copyright infringement and bias. AI is certainly giving unskilled hackers the ability to pull off sophisticated attacks like the Where is the cyber insurance specialty market headed? We're going to learn from these claims. The claims will continue to evolve, but cybersecurity is also going to continue to evolve. We will get to a place where we're not always behind the threat actors, and maybe we're in lockstep with them, and hopefully, at some point, get ahead of them so we can prevent more, rather than react. The problem the good guys face is that we have to deal with regulators, and we have to deal with lawyers who are making sure the policy language is appropriate and all of that. And the threat actors are just wheeling and dealing and moving fast as lightning. How long may it be for these various gaps to be sorted out? Will there be a year or two for insurers to decide what they’ll cover? Most of the seasoned brokers are negotiating a mandatory language, and they're saying, 'hey, carrier, look, you want to write this business and you understand their operations, their business model. We need to cover this exposure, and your policy doesn't currently do that. Here's language we recommend.' They give that to their lawyers, and they eventually will amend the policy language to cover that particular risk. That's already happening. Eventually, this language will be incorporated by the carriers. That is going to happen a lot slower than the one-offs. Cyber policies vary by insurer, and coverage can vary based on the endorsements added to the policy. There are some key coverages that are currently excluded by many insurers. A few examples are wrongful collection, pixel tracking, and biometrics. An insurer will look for a significant premium to remove the exclusions or offer the coverage. Larger companies are willing to pay for that coverage. Some smaller companies might be in a minimum premium range and not worth the risk for the insurer. Meaning the insurer is paying out more than they are taking in. The potential loss ratio equation might not make sense.

Newfront Frequently Asked Questions (FAQ)

When was Newfront founded?

Newfront was founded in 2017.

Where is Newfront's headquarters?

Newfront's headquarters is located at 450 Sansome Street, San Francisco.

What is Newfront's latest funding round?

Newfront's latest funding round is Series D.

How much did Newfront raise?

Newfront raised a total of $300.53M.

Who are the investors of Newfront?

Investors of Newfront include Meritech Capital Partners, Founders Fund, GS Growth, B Capital, Stack Capital and 18 more.

Who are Newfront's competitors?

Competitors of Newfront include Brit Insurance, AssuredPartners, McGriff Insurance Services, NFP, Risk Strategies and 7 more.

What products does Newfront offer?

Newfront's products include Newfront Mobility and 2 more.

Who are Newfront's customers?

Customers of Newfront include Twitter, AirBnB, Golden State Warriors, Coinbase and Zillow.

Loading...

Compare Newfront to Competitors

USI operates as an insurance brokerage and consulting firm. The company offers a range of services including property and casualty insurance, employee benefits, personal risk management, and retirement consulting solutions. USI primarily serves large risk management clients, middle market companies, smaller firms, and individuals with customized, actionable solutions. It was founded in 1994 and is based in Valhalla, New York.

INSURICA operates as an insurance agency with a focus on providing insurance and risk management solutions. The company offers a range of services including commercial insurance, employee benefits, personal insurance, and specialized programs for risk management, claims handling, and loss control. It caters to sectors such as construction, education, energy, healthcare, and many others, delivering industry-specific expertise and global insurance reach. It was founded in 1959 and is based in Oklahoma City, Oklahoma.

BMS Group operates as an independent specialist brokerage. It focuses on providing solutions in the fields of reinsurance, wholesale, and direct insurance. The company offers a range of services including reinsurance solutions, wholesale insurance, direct insurance services, and capital advisory. BMS Group caters to various sectors including marine, energy, financial institutions, and construction, among others. It was founded in 1980 and is based in London, United Kingdom.

Alliant Insurance Services focuses on insurance, risk management, employee benefits, and consulting. The company offers a range of services, including claims assistance, disaster preparedness and recovery, risk management solutions, and employee benefits. The company primarily serves sectors such as agribusiness, aviation, construction, cyber, energy and marine, financial institutions, healthcare, and real estate and hospitality, among others. It was founded in 1925 and is based in Irvine, California.

Lockton is an independent insurance brokerage with a focus on providing customized solutions in the risk management, benefits, and retirement sectors. The company offers a range of services including assessing and planning for employee benefits, and retirement needs, and delivering industry-specific risk management solutions. Lockton's private ownership model and dedication to client-focused advisory set it apart in the insurance industry. It was founded in 1966 and is based in Kansas City, Missouri.

Amwins specializes in the distribution of specialty insurance products. The company offers a broad range of services such as excess and surplus lines brokerage, professional lines insurance, alternative risk solutions, and group benefits programs. It serves a diverse clientele, including sectors such as construction, energy, healthcare, and transportation. Amwins was formerly known as American Wholesale Insurance. It was founded in 1998 and is based in Charlotte, North Carolina.

Loading...